If you’ve ever worked with raw bank transaction data, you’ll know how messy and unhelpful it can be. Descriptions often look like random codes, merchant names are inconsistent, and there’s no easy way to tell if a payment is for rent, coffee, or cloud software. For businesses building finance-related tools or making decisions based on financial data, this creates avoidable delays, extra manual work, and inconsistent reporting.

That’s where a Transaction Enrichment API comes in. Instead of dealing with fragmented data, you can convert bank transactions into something clean and understandable—merchant names that make sense, categories that reflect spending behaviour, and insights into recurring payments

We will guide you through:

What is a Transaction enrichment API?

A transaction enrichment API takes raw banking transaction data (date, amount, merchant code) and adds clear, consistent details that make it easy to understand and act on. Instead of seeing entries like “POS DEBIT 0421,” you’ll see “Starbucks Coffee — Coffee & Snacks.” Beyond cleaning up merchant names, enrichment APIs classify each transaction into meaningful categories (for example, “Utilities,” “Payroll,” or “Office Supplies”) and flag recurring payments.

This extra layer of context matters because raw data alone can be confusing, inconsistent, and hard to use for decision‑making. Businesses that rely on financial data — such as lenders assessing creditworthiness, personal finance apps tracking spending patterns, or accounting platforms automating bookkeeping — gain faster insights, reduce manual effort, and improve accuracy.

How a Transaction Enrichment API Works

A Transaction Enrichment API takes raw bank feed entries and adds clear labels, categories, and metadata so you can use transaction data immediately — without manual cleanup.

1. Merchant Name Standardisation

Banks often return inconsistent merchant descriptions. A Transaction Enrichment API uses a reference database to convert entries like “AMZN Mktp US*XYZ123” and “AMAZON.CO.UK” into a single, human‑readable name (e.g., Amazon Marketplace). This consistency reduces support tickets and ensures reporting accuracy across different data sources.

| Raw Description | Enriched Merchant Name |

|---|---|

| AMZN Mktp US*XYZ123 | Amazon Marketplace |

| AMAZON.CO.UK | Amazon Marketplace |

| STARBUCKS STORE #541 | Starbucks Coffee |

2. Transaction Categorisation

By grouping transactions into logical buckets, a Transaction Enrichment API makes it easy to see spending trends at a glance. Common category sets include:

| Category Type | Example Labels | Accuracy Rate* |

|---|---|---|

| Consumer | Groceries, Dining Out, Subscription | 95–98% |

| Business | Office Supplies, Travel Expenses, Payroll | 92–95% |

High categorisation accuracy helps power budgeting tools, expense reports, and credit decisioning models.

3. Recurrence & Payment Method Detection

Advanced enrichment solutions flag whether a payment is recurring (salary, subscription) or one‑off (single purchase), and identify payment channels (card, direct debit, PayPal). These insights improve cash‑flow forecasting and risk assessments.

4. Data Quality Metrics

When evaluating any Transaction Enrichment API, look for published performance data:

- Merchant name match rate (target >98%)

- Category accuracy (target >95%)

- Service uptime SLA (minimum 99.9%)

By standardising merchant details, assigning precise categories, and identifying recurring payments, a Transaction Enrichment API transforms raw transaction feeds into reliable, actionable data — freeing teams from manual reconciliation and driving faster business decisions.

Who Benefits Most from a Transaction Enrichment API

A Transaction Enrichment API adds structure and clarity to banking data, making it far easier to use in real-world applications. It’s especially valuable for businesses that rely on financial information to make decisions, build user experiences, or automate internal processes. Here’s how different industries benefit:

1.Lenders and Credit Providers

For lenders, speed and accuracy are essential when assessing credit applications. A Transaction Enrichment API helps streamline this process by turning raw bank transactions into clean, categorised data. Instead of waiting for applicants to upload statements manually, lenders can pull verified transaction histories in seconds.

With standardised merchant names and clear categories, it’s easier to assess income, identify recurring expenses, and calculate available income with more precision. Automated enrichment also reduces review time and supports more consistent credit models by eliminating the inconsistencies often found in raw financial data.

📚 Top 10 Loan management software UK

2.Personal Finance Apps

Personal finance apps depend on clarity and automation to give users control over their money. With a Transaction Enrichment API, every transaction is automatically sorted into logical categories such as groceries, subscriptions, or transport. This enables users to see real-time updates on their spending without having to label each item themselves. Dashboards become more insightful, showing trends and spending breakdowns instantly.

Apps can also apply rules to group similar items, like combining all streaming services into one view. The result is a smoother experience and fewer support requests caused by confusing or mislabelled transactions.

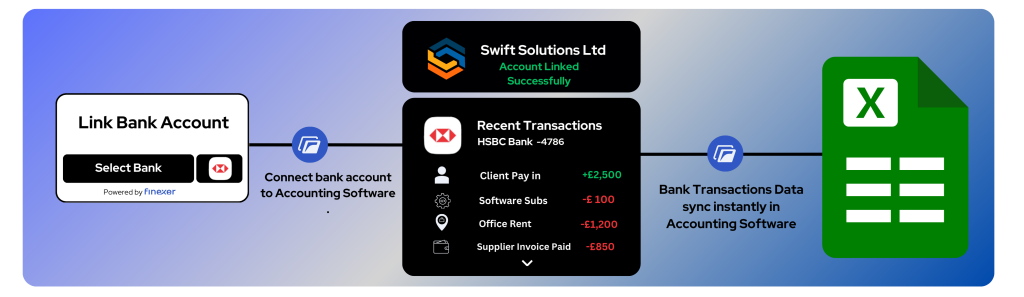

3.Accounting and Bookkeeping Platforms

Bookkeeping platforms that serve small and medium-sized businesses benefit significantly from enriched data. Instead of relying on manual expense categorisation, a Transaction Enrichment API automatically assigns labels like “Office Supplies” or “Travel” to each transaction. This speeds up monthly reconciliation and helps match transactions with receipts, invoices, or vendor names.

It also reduces the chance of human error. Recurring business expenses such as payroll or rent are identified and flagged early, improving cash flow forecasting. Detailed, export-ready reports integrate seamlessly with general ledger systems and make financial audits simpler and more transparent.

📚 Open Banking for Accountants

How to Evaluate a Transaction Enrichment API in UK

If your business operates in the UK and relies on transaction data, choosing the right Transaction Enrichment API is an important decision. Not all providers offer the same quality, coverage, or level of control. Here are four key areas to look at before committing to a provider.

1. UK Bank Coverage

Your chosen API should connect to the majority of UK banks — not just the big names.

Things to check:

- Does it support both major and challenger banks? For example, Barclays, NatWest, Lloyds, Monzo, Starling, and Revolut.

- Can it access both personal and business accounts? Many APIs only support consumer accounts — if you serve businesses, this is a dealbreaker.

- Is the account access real-time or delayed? Some APIs only fetch historical data, while others can show transactions as soon as they happen.

Look for providers with at least 95% UK coverage and transparent documentation about supported banks and account types.

2. Data Accuracy and Consistency

Transaction enrichment is only useful if it’s correct and reliable. Your API should provide:

- Standardised merchant names — for example, turning “AMZ*UK123” into “Amazon UK”

- Accurate categories — like grouping “Tesco” under “Groceries” or “HMRC” under “Tax”

- Recurring payment detection — being able to flag monthly subscriptions or salary payments

Good providers usually publish their accuracy rates. As a benchmark, look for:

- Merchant name accuracy of at least 98%

- Category classification accuracy of at least 95%

- Ability to distinguish one-off from recurring payments

Ask if the provider uses machine learning, rules-based logic, or a combination — but focus on results, not the method.

3. Reliability and Performance

If your app or platform depends on live transaction data, reliability isn’t optional.

Make sure the API offers:

- Strong uptime — ideally, 99.9% or higher

- Fast responses — average response times under 500 milliseconds

- Clear limits — like how many transactions you can process per minute or month

- Good error handling — including retry options if a request fails

You don’t want users waiting or your system breaking during peak times.

4. Security and UK Compliance

Any financial data handled in the UK must follow strict rules. Your API provider should be:

- Fully PSD2-compliant (regulated as an AISP by the FCA)

- Using strong encryption (e.g., TLS 1.2+ for data in transit and AES-256 for data at rest)

- Offering audit logs that track who accessed what data, and when

- ISO 27001 certified or equivalent — this shows they take data security seriously

Also, ask if the provider supports user consent flows that meet UK Open Banking standards. Your users should always be aware of — and agree to — what’s being shared.

Final Tip

Request sandbox access before making a final decision. That way, you can test how the Transaction Enrichment API performs with real banking data, using accounts from UK institutions you actually work with.

This hands-on check is often the difference between choosing an API that fits your needs and one that looks good on paper but falls short in practice.

Why UK SMEs Consider Finexer for Transaction Enrichment?

Finexer is a UK-based open banking provider offering a transaction enrichment API built for modern financial products — with a focus on startups, SMEs, and lean teams. Our platform is designed to reduce complexity, simplify integration, and deliver clean, ready-to-use data from day one.

If you’re looking for a solution that works straight out of the box — and can scale as your transaction volume grows — here’s why Finexer is a strong fit.

1. A single API for enriched transaction data across UK banks

With Finexer, you gain access to enriched transaction data through a single integration that connects to 99% of UK banks. That includes personal and business accounts from both major institutions and digital-only banks.

Our enrichment process ensures that:

- Merchant names are normalised and recognisable

- Transactions are categorised clearly for both personal and business use

- Recurring payments are flagged and tracked with minimal delay

Whether your users are managing personal spending or business finances, Finexer helps you turn raw transaction data into something that makes sense — without needing to build it yourself.

2. Built for growing businesses, not just enterprises

Most enrichment platforms were designed with enterprise clients in mind. Finexer is different. We’ve built our platform around the needs of UK-based startups and SMEs — teams that need reliable infrastructure without the overhead.

- Our infrastructure supports scaling from hundreds to hundreds of thousands of transactions, without needing additional technical investment

- You can get started with consumption-based pricing and no enterprise-level commitment

- Onboarding is tailored, with built-in testing to ensure the API fits your product from day one

If you’re a smaller team building financial products, we’ve designed Finexer to get you moving faster, with fewer roadblocks.

3. Fully compliant and FCA-authorised in the UK

Finexer is authorised by the Financial Conduct Authority (FCA) as an Account Information Services Provider (AISP). We’re fully compliant with UK Open Banking regulations and PSD2 standards.

What you get:

- Secure data handling with full encryption in transit and at rest

- Audit-ready consent management

- A platform that automatically manages ongoing compliance, so you don’t have to

You can focus on building your product — we handle the regulatory side.

4. Customise the user experience with your own brand

How your users interact with data matters. With Finexer, you can launch under your own brand using our white-label capabilities. That means:

- No Finexer branding shown to your end users

- You control the flow, look, and feel of the user experience

- Customers stay inside your environment during authentication and consent

This keeps your product experience consistent, while still relying on a fully managed data backend.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Choose Finexer as your transaction enrichment partner

Finexer offers a transaction enrichment API that’s simple to integrate, compliant by design, and built for real usage — whether you’re launching a personal finance tool, an SME dashboard, or a lending platform.

How is it different from standard bank data?

Standard APIs return unlabelled data like amounts and dates. Enrichment adds context—such as readable merchant names, spending categories, and payment patterns—making the data usable without manual review.

Who should use a Transaction Enrichment API?

It’s useful for lenders, personal finance apps, and accounting platforms. Any business that needs to process or understand transaction data will benefit from having clearer, categorised, and structured bank feeds.

Why does merchant name standardisation matter?

Merchant names often appear in confusing formats. Enrichment tools clean and unify these names, helping users recognise transactions instantly and reducing errors in reporting or budgeting.

Does Finexer support business accounts?

Yes. Finexer’s API works with both consumer and business accounts. It can enrich a wide range of transactions, making it useful for budgeting, reconciliation, and reporting in different use cases.

Is Finexer regulated and secure?

Yes. Finexer is FCA-authorised as an AISP under PSD2. The platform follows UK Open Banking standards, encrypts all data, and includes built-in consent and audit tracking features.

Can I offer enrichment under my own brand?

Yes. Finexer supports full white-labelling. You can control the entire experience—from onboarding to data display—without showing any Finexer branding to your end users.

Get Easy to use Transaction Enrichment API for your Business; Schedule your free demo and get a 14 days Trial by Finexer 🙂