Small businesses today rely on accurate, real-time financial insights, not just raw data. From accounting platforms to cash flow tools, every touchpoint needs context-rich transaction data to stay compliant, reduce admin, and serve clients better.

But here’s the problem:

Many traditional data providers were built for banks and enterprises, not for the flexible, fast-moving needs of startups or SME platforms. Generic enrichment APIs often miss critical tags, fail to categorise small business expenses correctly, or leave gaps in merchant recognition.

That’s where SME-focused transaction enrichment APIs make the difference.

They’re built to understand what matters most to SMEs — recurring bills, VAT-deductible expenses, supplier references, and transaction-level metadata that makes reconciliation and advisory services easier.

Let’s see which provider offers the most value for teams building SME-ready financial tools in 2025.

Finexer

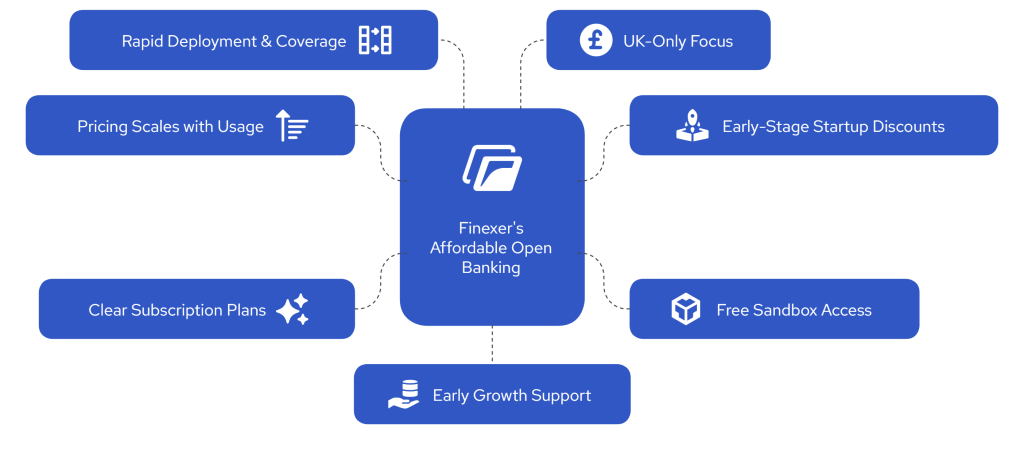

Finexer is a UK-based open banking provider offering enrichment APIs built specifically for business account data, not just consumer use. Designed with SMEs, accounting software, and fintech tools in mind, our enrichment stack helps teams deliver cleaner, more usable bank data with minimal engineering effort.

Here are four reasons to choose Finexer as your bank data enrichment partner.

1. Built for SME’s: Structured Data That Reflects Real Transactions

Most enrichment APIs are built for consumers, and while they may work for personal finance, they often miss what matters for SMEs.

Finexer’s bank data enrichment API was designed from the ground up to support business-specific use cases. That includes:

- Labeling VAT, PAYE, and recurring supplier payments

- Matching transaction descriptions to invoice numbers or PO references

- Detecting card terminal fees, SaaS subscriptions, and other common business spends

- Normalising merchant names and linking to Companies House data where available

This means you get transaction-level data that’s actually ready to use in SME workflows — from reconciliation to risk checks.

2. Fast Integration with 99% UK Bank Coverage

Finexer connects to nearly every UK bank through regulated Open Banking APIs. Our platform is fully FCA-authorised, developer-first, and supports a flexible integration approach — whether you need direct access to the enrichment API or want to start with a no-code dashboard.

Most teams are able to go live in days, not months. You’ll also get:

- Usage-based pricing with no monthly minimums

- Prebuilt sandbox environments

- Consistent JSON structures for clean developer handoff

Whether you’re building a reconciliation engine or integrating real-time income data into a lending app, Finexer gives you the bank data structure you need without the heavy lift.

3. Reliable Data for Scaling Products

Finexer’s enrichment engine is designed to support platforms at every stage — from MVP to scale. That includes:

- Reconciliation-ready categorisation

- Real-time webhook updates for new or modified transactions

- Duplicate detection to maintain clean feeds

- Intelligent pattern detection for recurring entries

This allows teams to reduce their dependency on manual tagging or rigid rule sets and instead rely on a data pipeline built to serve actual business flows.

4. Customisable Consent and Branded User Flows

Whether you need a white-label consent screen or a prebuilt hosted flow, Finexer gives you options.

Our white-label toolkit allows you to fully customise branding, layout, and flow, so your customers see your brand throughout. If you need to launch quickly, we also provide hosted consent pages styled to your theme, with full compliance and re-consent logic built in.

You’ll stay fully aligned with UK Open Banking regulations while maintaining full control over the customer experience.

Choose Finexer as Your Bank Data Enrichment Provider

If your platform serves UK businesses and you’re looking to enrich transaction data at scale, with clean categorisation, invoice-level detail, and fast setup, Finexer is ready to help.

Whether you’re integrating with an accounting platform, ERP tool, or financial onboarding journey, we’ll support you with flexible pricing, dedicated technical assistance, and enrichment logic tuned for real-world business data.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Bud

Bud offers a financial data platform designed for banks, lenders, and digital finance tools. Its capabilities span aggregation, categorisation, and identity verification — used widely in credit scoring and onboarding processes. While flexible, its approach to enrichment was not originally designed for SMEs.

Bud supports teams looking to build on top of raw banking data, but platforms building SME-specific features may need to apply their own logic to get the precision Finexer offers natively through its SME-focused transaction enrichment APIs.

Best For

Lending platforms, retail finance apps, and digital banks that need structured data for affordability models, risk checks, or multi-account analysis.

Aggregation and Access

- API access to thousands of UK bank accounts

- Balance and transaction-level data via real-time sync

- Supports multi-account visibility for users across banks

Categorisation and Enrichment

Bud categorises transactions into consumer-centric groups.

- Enables basic spending breakdowns, income detection, and trend reporting

- Not natively aligned with SME workflows like VAT tagging, supplier detection, or invoice parsing

- Can be adapted for SME use, but lacks out-of-the-box support for SME-focused transaction enrichment APIs

Identity Verification

Bud allows user identity to be confirmed using bank data.

- Streamlines onboarding without requiring manual documentation

- Commonly used in financial apps where speed and verification are required

- Useful for general KYC use cases, not tailored to business-specific onboarding paths

Consent and Control

- Offers branded, hosted consent flows with support for re-consent and revocation

- Includes consent expiry alerts and permissions logging

- Built for compliance but lacks deep control features often required by SME platforms managing multiple linked users or team-based permissions

Developer Experience

Bud is well-documented and developer-friendly. APIs are consistent, and integration timelines are reasonable for most mid-size fintech teams.

Yodlee

Yodlee is one of the oldest names in financial data aggregation, with global reach and deep partnerships across banking, credit, and investment sectors. While it supports a range of data-driven use cases, its core product was not designed with UK SMEs in mind, making its utility for SME-focused enrichment APIs limited unless extensively customised.

For platforms needing broad, multi-country coverage or legacy data integrations, Yodlee offers flexibility. But when it comes to structured, context-specific enrichment for small business accounting, its model lacks the focus other providers offer out of the box.

Best For

Multinational fintechs, credit bureaus, or financial institutions operating across the US, EU, and APAC regions that require long-term data aggregation or wide-scale account connectivity.

Aggregation and Reach

- Extensive bank coverage across 45+ countries, including the UK

- Offers both Open Banking and credential-based connections

- Historical data depth spanning multiple years, depending on the institution

Categorisation and Enrichment

Yodlee supports transaction categorisation, primarily focused on consumer spending patterns.

- Categories such as groceries, utilities, entertainment, and income

- Lacks specific tagging for UK SME needs (e.g. PAYE, supplier payments, invoice matching)

- Not built to support modern SME-focused enrichment APIs without significant platform-side transformation

Data Types and Outputs

- Offers access to account balances, income, transactions, assets, and liabilities

- Primarily used in lending, wealth management, and personal finance management (PFM) tools

- May include duplicate entries or inconsistent schemas, requiring additional cleansing

Consent and Security

- Consent flows available but less flexible than newer UK-first platforms

- Built-in access expiry and revocation options

- Compliance aligned with US and international standards; UK-specific flows are less refined

Compare Finexer vs Bud vs Yodlee

| Feature | Finexer | Bud | Yodlee (Envestnet) |

|---|---|---|---|

| Bank Connections (UK/EU) | 99% of UK banks | 90%+ of UK (CMA9) | Global OB coverage; UK via OB & credentials |

| AIS/PIS | Real-time AIS + PIS | AIS supported | Primarily AIS; PIS available but underutilised |

| Data Enrichment | Transaction categorisation, reconciliation,Affordability Checks, KYC | Transaction categorisation, affordability scoring | Merchant ID, analytics; lacks SME context |

| SME-Focused Enrichment APIs | Yes – built for VAT, payroll, invoice-level data | Partial – requires additional logic | No – not tailored for SME workflows |

| Supported Payment Flows | Instant pay-ins, payouts, Request to Pay | Limited one-off payments in apps | Rarely used for payments |

| VRP Support | In beta; platform-ready | Sweeping only | Not available |

| Integration Speed | Live in few days | Longer; enterprise-led | Moderate; enterprise-first |

| Developer Experience | REST API, clear docs, responsive support | Strong tools, but banking-focused | Comprehensive but legacy stack |

| Onboarding | Unlimited testing sandbox, light compliance | Sales-led only | Enterprise onboarding with sandbox |

| Pricing | Transparent, usage-based, no minimums | Enterprise-only | Enterprise-only |

| Use Case Focus | SMEs, accounting, lending, ERP tools | Banks, lenders, embedded finance | PFM, credit decisioning, data tools |

| White-Label Options | Yes – fully brandable API-first | Yes – built for white-label use | Yes – used inside bank apps |

| Support Quality | Dedicated support and developer-friendly | High-touch for enterprise | Reliable B2B with global reach |

| Compliance & Security | FCA-authorised, PSD2, GDPR, AES-256 | FCA AISP/PISP, bank-grade encryption | FCA AISP, GDPR, trusted by top banks |

| Settlement Speed | Instant via Faster Payments | Bank-to-bank, instant to account | N/A – mostly data-focused |

Choosing the Right SME-Focused Enrichment API

If you’re building a platform for UK SMEs, whether in accounting, lending, payroll, or reconciliation, your enrichment API shouldn’t be an afterthought. Generic categorisation isn’t enough. You need structured transaction data that reflects how small businesses actually operate: supplier payments, VAT charges, invoice numbers, and recurring payroll runs.

Finexer stands out as the only provider in this comparison offering SME-focused enrichment APIs purpose-built around these needs. It’s faster to deploy, easier to customise, and specifically aligned with UK compliance and banking infrastructure.

Bud and Yodlee offer broad functionality, but their focus remains on retail finance, not business flows. They may suit larger institutions or multi-market platforms, but for teams building SME tools in the UK, they require more custom logic, time, and overhead.

Whether you’re launching a new product or upgrading your data layer, choosing the right enrichment partner early will save time, reduce friction, and unlock far more value downstream.

Which provider offers the best data enrichment API for SMEs in the UK?

Finexer offers the most SME-ready enrichment APIs, with UK-specific categorisation, invoice detection, and reconciliation support built in.

How is Finexer different from Bud and Yodlee?

Unlike Bud and Yodlee, Finexer is purpose-built for UK SMEs. It focuses on transaction enrichment aligned with accounting, ERP, and reconciliation workflows.

Is Finexer suitable for startups and small teams?

Most teams go live within week. Finexer is designed for rapid integration with clean documentation, SDKs, and a ready-to-use sandbox environment.

Looking for Affordable Bank Data Enrichment? Switch to Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂