The way people move money has changed dramatically in the UK. Traditional transfers that once took days can now be completed in seconds, thanks to Faster Payments and modern banking infrastructure. Whether you’re sending money to a friend, paying a supplier, or managing company disbursements, the ability to transfer funds instantly has become a standard expectation. It’s no longer a luxury for large enterprises; individuals and small businesses alike now rely on real-time payments for everyday transactions.

With more than 5 billion Faster Payments transactions processed annually, the UK is one of the most advanced real-time payments markets in the world. This blog breaks down how instant transfers work, why they’re secure, and how businesses can use them to improve cash flow and customer experience.

What Is an Instant Bank Transfer?

An instant bank transfer allows money to move between UK bank accounts within seconds, 24 hours a day, including weekends and holidays. Unlike traditional BACS payments that can take up to three working days, or CHAPS transfers that depend on strict cut-off times, instant transfers use the Faster Payments network to settle funds almost immediately.

This payment method relies on secure, regulated banking rails rather than card networks, which helps reduce transaction fees and delays. When you transfer funds instantly using Faster Payments, the receiving account is typically credited in under 10 seconds, giving both individuals and businesses greater flexibility and certainty.

For businesses, adopting instant bank transfer capabilities enables smoother payouts, real-time settlements, and a better customer experience. It’s especially valuable for payroll teams, e-commerce platforms, lenders, and service providers that depend on timely transactions.

Why Instant Payouts Matter for UK Businesses

The ability to transfer funds instantly is reshaping how UK businesses handle disbursements, refunds, and payroll. Customers and employees no longer want to wait days for money to arrive. They expect transactions to happen in real time, and that’s exactly what instant payout solutions enable.

An instant payout allows businesses to send money directly to a recipient’s bank account within seconds. Whether it’s paying contractors, issuing refunds to customers, or topping up digital wallets, real-time transfers improve cash flow and operational efficiency. For industries like e-commerce, lending, utilities, and payroll, the difference between same-day and next-day payments can significantly impact trust and satisfaction.

When businesses adopt systems that let them transfer funds instantly, they gain better control over their financial operations. It reduces administrative delays, supports faster reconciliations, and strengthens customer relationships by delivering payments exactly when expected.

How to Transfer Funds Instantly in the UK

Understanding how to transfer funds instantly is essential for anyone looking to move money quickly and securely. The UK’s Faster Payments infrastructure makes it possible to send and receive funds in seconds, but knowing the correct steps ensures smooth and error-free transactions.

Here’s a simple breakdown of the process:

- Start the Transfer

Log in to your online banking platform or use a payment API that supports real-time transfers. Enter the recipient’s details and the amount you want to send. - Authenticate Securely

Complete Strong Customer Authentication (SCA), usually through a mobile app or one-time passcode. This step protects against unauthorised transactions. - Confirm and Send

Once confirmed, the payment travels through Faster Payments. The recipient typically receives the funds in under 10 seconds. - Track the Transaction

Most banks provide instant notifications, allowing both sender and recipient to see the transfer status immediately.

Whether you’re paying suppliers, contractors, or friends, these steps ensure you can transfer funds instantly without friction, while maintaining high levels of security and compliance.

Instant Bank Transfers vs Other Methods

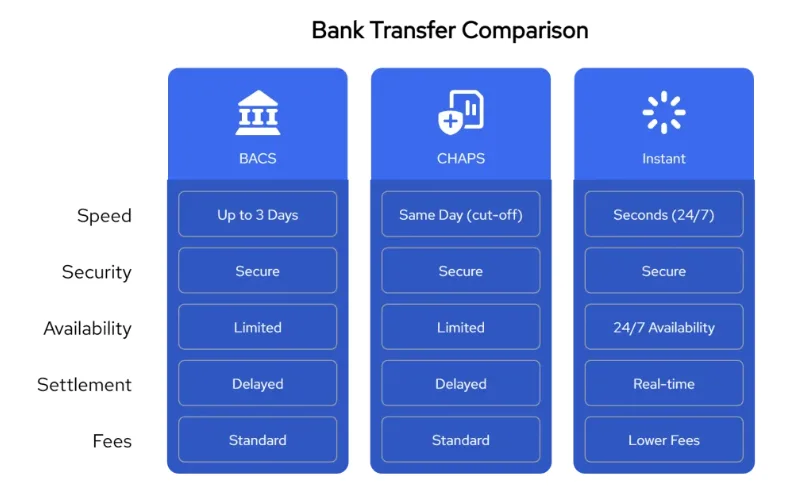

When you need to transfer funds instantly, it’s useful to understand how instant bank transfers compare to traditional payment methods such as BACS or CHAPS. Each method has its place, but real-time payments offer clear advantages for speed, availability, and cost.

Below is a quick comparison of the three most common UK payment methods:

| Feature | Instant Bank Transfer | BACS Transfer | CHAPS Transfer |

|---|---|---|---|

| Settlement Speed | Seconds (24/7) | Up to 3 business days | Same day (before cut-off) |

| Cost | Low / Usage-based | Low | Higher fees |

| Best For | Real-time payouts, refunds | Payroll batches | Large, urgent transfers |

| Availability | 24/7, 365 days | Working days only | Business hours |

Common Use Cases for Instant Transfers

The ability to transfer funds instantly has become essential across multiple industries in the UK. From payroll teams to e-commerce platforms, instant bank transfer capabilities are being used to improve speed, trust, and operational efficiency.

Here are some of the most common use cases:

- Payroll & Contractor Payments: Businesses can process salaries and contractor fees in seconds using instant payout features, ensuring employees receive funds on time without delays.

- Refunds & Insurance Payouts: Retailers, insurers, and utilities use real-time payments to issue refunds or claims instantly, enhancing customer satisfaction and reducing support queries.

- E-commerce & Marketplaces: Platforms can transfer funds instantly to sellers and partners after transactions, improving cash flow and boosting trust between buyers and sellers.

- Digital Wallet Top-ups: Fintech apps and platforms rely on instant bank transfer to enable real-time wallet funding, giving users immediate access to their money.

- Supplier & Partner Settlements: Businesses can manage large volumes of outgoing payments efficiently by scheduling same-day transfers through Faster Payments, even outside traditional banking hours.

In each of these scenarios, the ability to transfer funds instantly offers clear financial and operational advantages. It shortens payment cycles, strengthens partner relationships, and delivers a modern, real-time experience that customers now expect.

Transfer Funds Instantly with Finexer

If your business needs to transfer funds instantly across the UK, Finexer provides the infrastructure to make it happen without the long lead times or upfront costs typically associated with payment integrations.

Finexer’s FCA-authorised API infrastructure connects directly to 99% of UK banks, enabling both instant bank transfer and instant payout capabilities through a single, secure connection. Our platform is built specifically for UK businesses that need reliability, compliance, and speed.

Here’s what sets Finexer apart:

- Start Small, Scale Smart: Begin with the core services you need and expand your use cases without rebuilding from scratch.

- Deploy 2–3× Faster: Pre-built integrations and hands-on onboarding support help you go live in weeks, not months.

- Usage-Based Pricing: No setup fees or long-term contracts. You pay only for what you use.

- White-Label Options: Customise the payment experience to match your brand and workflows.

- Regulatory Peace of Mind: Operate on an FCA-regulated, PSD2-compliant platform with built-in security and consent frameworks.

With Finexer, businesses can issue refunds, settle supplier payments, or disburse wages in seconds. By integrating once, you can transfer funds instantly to customers, partners, and employees at any time securely and at scale.

How to transfer funds instantly in the UK?

To transfer funds instantly, use a bank or payment service that supports the UK’s Faster Payments network. Most transfers clear within seconds, even on weekends, giving you real-time access to funds.

Can you transfer funds instantly between any UK banks?

Yes. As long as both banks are connected to Faster Payments, you can transfer funds instantly between accounts. Nearly all major UK banks support this, covering both personal and business transactions.

Can businesses use instant payout features?

Yes. Businesses can integrate payment APIs or use online banking portals to access instant payout capabilities for payroll, refunds, and supplier settlements.

Is there a limit on instant transfers?

Most UK banks allow Faster Payments up to £250,000, though individual limits can vary depending on the bank and account type.

Enable your business to transfer funds instantly with Finexer’s FCA-authorised API and 99% UK bank coverage.