Request to Pay involves a payee initiating a request for a specific transaction from a payer. The system provides a digital request that the payer can receive on their mobile device. This could arrive on a mobile banking app, or via a third-party fintech.

What You Will Learn from This Blog:

✓ Impact of Open Banking Request to Pay (RtP) solutions on utility bill payments.

✓ Key features and benefits of RtP for both consumers and utility companies.

✓ How RtP enhances flexibility, transparency, and control over financial transactions.

✓ The role of Open Banking and PSD2 in facilitating RtP.

✓ Future developments and their potential impact on the utility sector.

Introduction

In today’s fast-moving world, the way we manage our utility bill payments is undergoing a transformative change, thanks to the innovative integration of Open Banking Request to Pay solutions. This emerging technology not only simplifies the process of paying bills but also enhances transparency and control over financial transactions for both consumers and businesses alike. With utility bills forming a significant part of monthly expenditures for households across the UK, finding efficient and flexible ways to pay these—be it your water bill, electricity, or gas—has become more important than ever. Recognising this need, Open Banking has paved the way for a more accessible, secure, and user-friendly approach to manage utility bill payments online, offering a seamless experience from water meter reading to the final bill calculation.

As we delve deeper into the nuances of Open Banking Request to Pay, this guide will explore its key features, including the multitude of ways to pay, such as direct debit and online payments, and how it stands to benefit both consumers looking to calculate costs and pay their bills with ease, and utility companies aiming for streamlined bill calculation and payment collections. Furthermore, we’ll examine the user experience, highlighting how this innovation not only offers flexibility in how and when to pay bills but also fosters a more transparent relationship between consumers and service providers. From understanding the benefits for utility companies to envisaging the future of online bill payments, this comprehensive guide aims to empower readers with valuable insights into making utility bill payments effortless, marking a significant leap towards financial inclusion and efficiency.

📚 Guide to Request to Pay in 2025

What is Open Banking Request to Pay?

Request to Pay (RtP) is an innovative overlay messaging service that integrates seamlessly with existing payment infrastructures. It is designed to provide organisations the ability to incorporate it into their applications and services, offering a new level of flexibility and choice in financial management for both consumers and businesses.

Basic Definition and Background

RtP operates alongside traditional payment methods like Direct Debit, enhancing the control and options available to bill payers. It allows businesses to issue payment requests directly to consumers, who can then respond through secure channels. This system not only facilitates easier and more flexible payment management but also significantly reduces the reconciliation costs and resources typically needed to manage overdue payments.

How It Differs from Traditional Payment Methods

Unlike standard payment methods, RtP provides a real-time communication channel between billers and payers. This means payment requests can be issued and responded to instantly, which is a stark contrast to the often slower processes involved with traditional methods such as cheques or standard bank transfers. Additionally, RtP allows for more interactive and responsive communication, enabling payers to directly query or negotiate payments through the same system, fostering transparency and trust between the involved parties.

Key Features of Request to Pay

✓ Secure Messaging

Request to Pay provides a secure communication framework within existing payment applications. This feature allows billers to send payment requests directly to their customers, ensuring all data transmitted remains secure and private.

✓ Payment Flexibility Options

The system offers multiple payment responses for bill payers, enhancing flexibility. Options include:

- Pay Part: Allows partial payments, helping avoid complete non-payment scenarios.

- Pay Later: Offers the ability to defer payments, aiding in personal cash flow management without incurring late fees.

- Decline to Pay: Enables bill payers to reject unrecognized payment requests, which can initiate a direct dialogue with the biller to resolve any issues.

✓ Immediate Payment, Schedule, or Decline

Request to Pay not only supports immediate payment responses but also allows bill payers to schedule payments for a future date or decline requests. This level of control is particularly beneficial for managing budgets and financial planning.

Incorporating real-life scenarios, imagine a scenario where a user receives a Request to Pay notification via their banking app for an unexpected utility surcharge. The user can choose to pay immediately using funds available in their account, schedule the payment for after the next payday, or contact the utility provider to clarify the charge before making a payment decision. This flexibility significantly enhances the user experience and financial management.

Benefits of Request to Pay for Utility Bill Payments

Improved Cash Flow Management ✓

Request to Pay significantly enhances cash flow management for both consumers and businesses. By allowing customers the flexibility to schedule payments according to their financial situation, it ensures that payments are more predictable and manageable, reducing the risk of late payments and improving overall cash flow stability.

Better Customer Communication ✓

This system fosters better communication between utility providers and customers. Through Request to Pay, customers receive clear and timely notifications about their bill payments and can communicate directly with providers if there are any issues or queries. This immediate and interactive communication enhances customer service and satisfaction.

Enhanced Control and Transparency ✓

Request to Pay empowers customers with greater control over their financial transactions. They can choose how and when to pay, respond to payment requests directly, and have full visibility into each transaction. This transparency builds trustand helps customers manage their spending more effectively, leading to a more informed and engaged relationship with utility providers.

How Open Banking Facilitates Request to Pay

Open Banking has significantly enhanced the functionality and accessibility of financial services, including the innovative Request to Pay (RtP) framework. This integration is primarily facilitated through the alignment with existing banking systems and the regulatory framework provided by the Payment Services Directive 2 (PSD2).

Request to Pay benefits from a seamless integration into existing banking infrastructures, allowing users to manage payments within their trusted banking environments. This integration supports various payment channels, from direct bank apps to electronic communication via email or SMS, making it versatile and user-friendly. The key advantage here is the familiar environment it offers to users, which reduces hesitation and fosters quicker adoption.

Role of PSD2 in Enabling Request to Pay

PSD2 has been a pivotal element in the advancement of Request to Pay by mandating banks to open their APIs to third-party providers. This regulation ensures that the payment initiation services (PIS) and account information services (AIS) are accessible, which is crucial for the operational functionality of RtP. By facilitating secure and direct interactions between financial institutions and third-party services, PSD2 enhances the overall efficiency and security of the payment processes involved in RtP.

This regulatory backing not only supports the technical capabilities of RtP but also boosts consumer confidence in using these services, knowing they are backed by stringent EU regulations. The combination of Open Banking and PSD2 creates a robust framework for Request to Pay, enhancing both its functionality and its adoption across various sectors, including utility bill payments.

User Experience with Request to Pay

Ease of Use for Bill Payers ✓

Request to Pay significantly simplifies the bill payment process for consumers. It integrates seamlessly with existing banking apps and services, allowing users to respond to payment requests directly within their familiar banking environment. This user-friendly approach minimises confusion and enhances the efficiency of making payments.

Real-time Notifications and Updates ✓

One of the standout features of Request to Pay is the provision of real-time notifications. Bill payers receive immediate updates when a payment request is made, which not only keeps them informed but also enables prompt action on their bills. This real-time communication ensures that both billers and payers can manage their transactions more effectively, fostering a transparent financial relationship.

Benefits for Utility Companies

Reduction in Late Payments ✓

Request to Pay (RtP) significantly reduces the incidence of late payments for utility companies. By offering multiple response options such as ‘Pay Now’, ‘Pay Later’, or ‘Decline to Pay’, customers can manage their payments more effectively. This flexibility helps in maintaining a steady cash flow and minimising the financial discrepancies caused by delayed payments.

Streamlined Reconciliation Process ✓

The implementation of RtP aids utility companies in streamlining their reconciliation processes. The secure communication channel within RtP allows for accurate and timely updates on payment statuses, reducing the administrative burden associated with tracking and reconciling payments. This not only cuts down operational costs but also enhances efficiency in financial operations.

Future of Utility Bill Payments with Request to Pay

Potential Developments

The evolution of Request to Pay (RtP) systems is poised to significantly enhance the way utility payments are managed. Anticipated developments include the integration of more sophisticated automated payment systems, which will not only streamline the process but also provide greater control and flexibility to both users and utility providers. This could involve advanced direct debit mandates that operate seamlessly within new payment infrastructures, ensuring that payments are more predictable and less prone to errors.

Impact on the Utility Sector

For the utility sector, the implications of evolving RtP systems are profound. Enhanced real-time data flow capabilities will allow for immediate communication between consumers and utility companies. This will likely lead to improved cash flow management and a reduction in the administrative burdens associated with payment delays and discrepancies. Moreover, the ability to offer tailored payment options and immediate financial adjustments will foster stronger relationships between service providers and customers, potentially increasing customer satisfaction and loyalty.

Finexer’s Request to Pay Solution for Utility Bill Payments

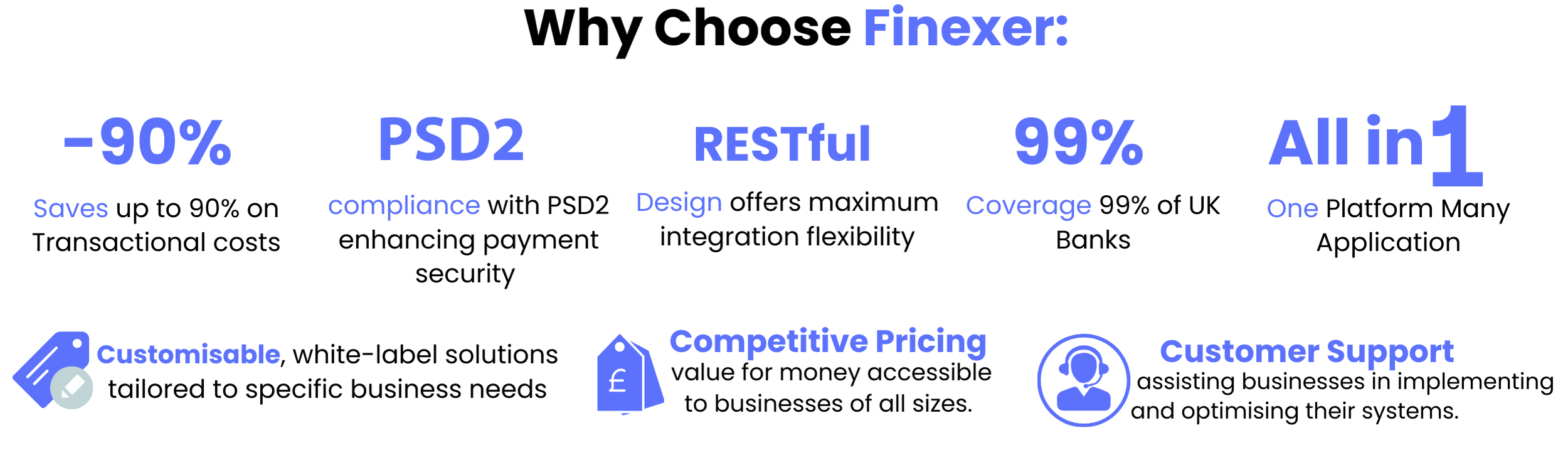

finexer offers a comprehensive open banking platform designed to facilitate seamless payments and enriched data solutions. Among its offerings, the Request to Pay (RTP) service stands out as a transformative solution for utility bill payments, addressing common challenges and enhancing the overall payment experience for consumers and utility providers alike.

Here’s how finexer ‘s RTP solution works and the benefits it brings to utility bill payments:

1.Instant Payments: ✓

Feature: Finexer enables instant account-to-account (A2A) payments through its RTP service.

Benefit: Utility providers can receive payments instantly, improving cash flow and reducing the time and resources spent on payment processing.

2.Customer Control and Flexibility: ✓

Feature: Customers receive payment requests and have the flexibility to choose when and how much to pay.

Benefit: This flexibility can improve customer satisfaction and reduce late payments as customers can align payments with their cash flow.

3.Cost Reduction: ✓

Feature: By eliminating card processing fees and reducing reliance on direct debit systems, Finexer’s RTP significantly cuts transaction costs.

Benefit: Utility providers can save up to 90% on payment processing costs.

4.Enhanced Security: ✓

Feature: Secure open banking integrations authenticate payments directly with the customer’s bank.

Benefit: This reduces the risk of fraud and eliminates issues like chargebacks, providing a more secure payment environment.

5.Seamless Integration: ✓

Feature: Finexer’s RTP integrates easily with existing billing systems via structured APIs.

Benefit: Utility companies can implement the RTP service without significant changes to their current infrastructure, ensuring a smooth transition and minimal disruption.

6.Real-time Data and Insights:✓

Feature: Finexer provides real-time transaction data and detailed insights into customer payments.

Benefit: Utility providers can gain better visibility into payment behaviors, allowing for improved financial forecasting and customer relationship management.

7.White Label Solution: ✓

Feature: Finexer offers a white label solution that allows utility providers to maintain their brand identity within the RTP service.

Benefit: This fosters trust and recognition among customers, enhancing the overall user experience.

Benefits for Utility Bill Payments

The implementation of Finexer’s RTP service brings several specific advantages to the management of utility bill payments:

- Improved Payment Timeliness:

✓- RTP allows customers to pay their bills promptly upon receiving a request, reducing the incidence of late payments and associated penalties.

- Increased Payment Efficiency:

✓- Instant payment processing ensures that utility providers receive funds faster, reducing the administrative burden associated with traditional payment methods.

- Enhanced Customer Engagement:

✓- The flexibility and control offered to customers can improve engagement and satisfaction, as they can manage their payments more effectively according to their financial situation.

- Operational Cost Savings:

✓- By lowering transaction fees and automating payment processes, utility companies can achieve significant cost savings and allocate resources more efficiently.

- Risk Mitigation:

✓- The secure authentication processes reduce the risk of fraud and errors, providing peace of mind to both providers and customers.

Conclusion

Finexer’s Request to Pay service revolutionizes the way utility bill payments are managed, offering a secure, cost-effective, and customer-friendly solution. By integrating Finexer’s RTP, utility providers can enhance operational efficiency, improve customer satisfaction, and significantly reduce payment processing costs. Emphasize Finexer in your payment infrastructure to unlock these benefits and stay ahead in the utility sector.

Discover how Finexer’s Request to Pay can revolutionise your utility bill payments today!