A vending machine is an automated machine that dispenses items such as snacks, beverages, cigarettes, and lottery tickets to consumers after cash, a credit card, or other forms of payment are inserted into the machine

Introduction

In today’s rapidly evolving digital landscape, the integration of open banking with vending machines is paving the way towards a more efficient and cashless society. This revolutionary approach not only signifies a shift in how transactions are conducted but also showcases the potential for vending machines—ranging from coffee vending machines and snack vending machines to drinks and food vending machines—to become pivotal components in the cashless payments ecosystem. By harnessing the power of open banking, vending machine businesses are now capable of offering seamless, secure, and cost-effective payment solutions, thereby enhancing the customer experience and potentially increasing profitability.

The article delves into Finexer’s solutions using open banking, providing a comprehensive overview of cashless vending machines, the role of open banking in transforming these businesses, and the notable benefits it brings along. Key topics including practical applications, hurdles such as implementation strategies, and real-world case studies will offer insight into how vending machines UK-wide are adapting to this innovative change. Furthermore, we will explore how open banking acts as a catalyst for innovation, leading to energy-efficient operations, automated stock replenishment, and personalized customer interactions, thus setting a new standard in the vending machine business landscape.

Challenges Faced byVending Machines

1.High Transaction Costs in Vending Machines

Vending machines are convenient and widely used, but they face several challenges, particularly concerning transaction costs. Traditional payment methods in vending machines, which often include cash and outdated card systems, incur high transaction fees that significantly impact profitability. These high transaction costs arise from several factors:

- Processing Fees:

- Issue: Each transaction through traditional card systems involves fees paid to banks and payment processors.

- Impact: These fees can accumulate quickly given the typically low value of individual vending machine transactions, significantly impacting overall profitability.

- Maintenance Costs:

- Issue: Cash-based machines require regular cash collection and handling, which adds labor costs. Similarly, card payment systems need regular maintenance and updates to ensure security and functionality.

- Impact: Increased operational costs due to the need for frequent maintenance and updates, as well as the labor costs associated with handling cash

2.Maintenance and Operational Efficiency:

Maintaining vending machines can be challenging, particularly those that are older or heavily used. Mechanical failures, such as coin or bill jams, are common and can disrupt service. Additionally, ensuring that vending machines are consistently stocked and functioning efficiently requires regular monitoring and maintenance, which can be resource-intensive

Payment Processing Issues:

Vending machines, including those integrated with digital payment systems, can encounter payment processing issues. Occasionally, digital payments may not process correctly, which can lead to transaction failures. This not only results in lost revenue but can also diminish customer trust if not promptly addressed. To mitigate these issues, vending machine operators can employ robust payment systems like Finexer and provide clear instructions for reporting payment problems.

- Payment Processing Failures:

- Issue: Digital payments may not process correctly, leading to transaction failures.

- Impact: Loss of revenue and diminished customer trust.

Operational Efficiency:

- Issue: Ensuring machines are adequately stocked and operational requires significant resources.

- Impact: High operational costs and potential service downtimes.

Mechanical Failures:

- Issue: Older or heavily used vending machines are prone to mechanical issues like coin or bill jams.

- Impact: Service disruptions and increased maintenance costs.

3.Customer Experience:

The customer experience can be significantly affected by the aforementioned challenges. Delays or failures in product dispensation, caused by operational glitches, directly impact customer satisfaction. To enhance the user experience, vending machine operators can integrate advanced technologies that allow for real-time monitoring of machine status and swift troubleshooting solutions.

- Product Dispensation Delays:

- Issue: Operational glitches can delay or prevent product dispensation.

- Impact: Direct negative impact on customer satisfaction.

4.Security Concerns in Vending Machines

- Cash Handling Risks

- Theft and Vandalism: Vending machines that accept cash are prime targets for theft and vandalism. The presence of cash makes these machines attractive to thieves.

- Fraud: Cash transactions are prone to fraudulent activities such as the use of counterfeit money.

- Outdated Payment Systems

- Card Skimming: Traditional card payment systems are vulnerable to skimming devices, which can capture card details and lead to fraud.

- Data Breaches: Outdated payment systems may not comply with the latest security standards, increasing the risk of data breaches.

- Software Vulnerabilities

- Hacking: Vending machines with outdated software can be hacked, leading to unauthorized access and potential data theft.

- Malware Attacks: Machines connected to networks without proper security measures are susceptible to malware attacks, which can disrupt operations and compromise customer data.

Finexer’s Solution

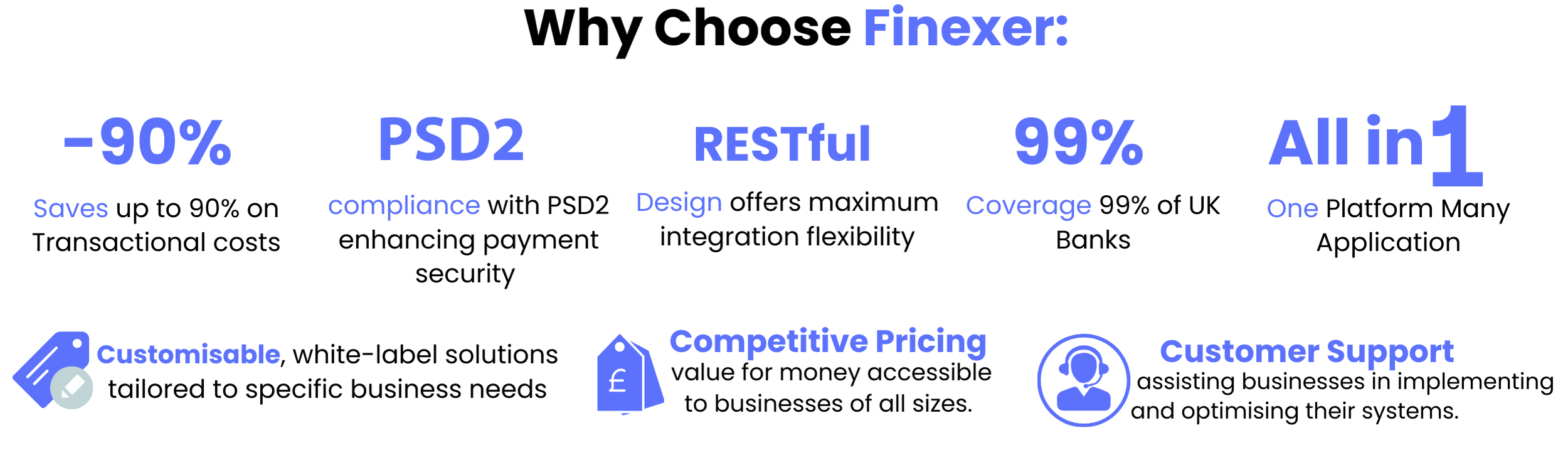

1.Reduced Transaction Cost ✔

- Reduced Transaction Fees:

- Solution: By leveraging open banking, Finexer minimizes intermediary involvement.

- Benefits: Cuts transaction costs by up to 90%, enhancing profitability for vending machine operators.

- Cost-Efficient Maintenance:

- Solution: Finexer’s technology integrates with supply chain systems to automate stock replenishment and operational monitoring.

- Benefits: Reduces labor costs associated with cash handling and maintenance, optimizing operational efficiency.

2.Improved Operational Efficiency ✔

By integrating with supply chain systems, Finexer’s technology can automate stock replenishment, ensuring that vending machines are always adequately stocked without manual intervention. This integration not only saves time but also reduces operational costs, making the management of vending machines more efficient.

- Solution: Finexer’s platform provides real-time monitoring and data access for proactive maintenance.

- Benefits: Ensures machines are always adequately stocked and operational, reducing downtime and maintenance costs.

Enhanced Payment Processing

This streamlined payment processing system supports various payment methods, including instant account-to-account transfers, which enhance the efficiency and security of transactions.

- Solution: Finexer’s open banking solutions significantly reduce transaction costs and support diverse payment methods.

- Benefits: Offers instant account-to-account transfers and enhances transaction efficiency and security, reducing the likelihood of payment processing failures.

3.Enhanced Customer Experience ✔

Finexer’s robust security measures, including advanced encryption and fraud detection systems, ensure the safety of each transaction. Additionally, the real-time access to transaction data and machine status provided by Finexer’s platform enables proactive maintenance and inventory management. This leads to a seamless customer experience, with minimal downtime and enhanced satisfaction through personalised promotions and product recommendations. Finexer’s user-friendly interfaces further enhance this experience, making it intuitive and straightforward for all users.

Enhanced Customer Experience:

- Solution: Finexer’s real-time data access and user-friendly interfaces ensure smooth transactions and quick problem resolution.

- Benefits: Improves customer satisfaction by reducing product dispensation delays and providing personalized promotions and recommendations

4.Enhanced Security Measures in Vending Machines ✔

Finexer employs state-of-the-art security measures to protect vending machine transactions and operations. Utilizing advanced encryption and robust fraud detection systems, Finexer ensures the highest level of security for every transaction. Their solutions are regularly updated to comply with the latest security standards, preventing risks such as card skimming, data breaches, and malware attacks. By integrating Finexer’s secure open banking technology, vending machine operators can safeguard against theft, vandalism, and unauthorized access, ensuring a secure and trustworthy service for their customers.

- Advanced Security Measures:

- Solution: Finexer employs advanced encryption and fraud detection systems to secure transactions.

- Benefits: Protects against theft, vandalism, and fraudulent activities, ensuring the safety of both cashless and card transactions.

- Compliance and Up-to-Date Systems:

- Solution: Finexer’s solutions comply with the latest security standards and regularly update software.

- Benefits: Prevents card skimming, data breaches, and other security threats, ensuring robust protection against cyber-attacks.

The Role of Open Banking in Vending Machines

How Open Banking Facilitates Cashless Transactions

Open banking significantly enhances the functionality of vending machines by enabling secure, cashless transactions. Through direct account-to-account (A2A) payments, open banking reduces the need for physical cash, streamlining the buying process. This system not only expedites transactions but also lowers transaction costs by up to 90%, making it a cost-effective solution for vending machine operators.

Security Measures in Open Banking for Vending Machines

To ensure the security of transactions, open banking incorporates robust measures such as encryption and fraud detection. These security protocols safeguard user data and financial information, providing a reliable and secure environment for cashless payments. This integration is crucial in maintaining trust and reliability in the use of vending machines for both operators and consumers.

Benefits Observed from Integrating Open Banking Solutions

The adoption of open banking solutions in vending machines has led to significant operational efficiencies. A notable case is a network of vending machines across multiple office buildings which reported a 90% reduction in transaction costs due to the streamlined payment process. Additionally, the integration of real-time data access has enabled proactive stock management and maintenance, thereby reducing downtime and ensuring constant availability of products to meet consumer demands.

FAQs

1. What does the future hold for open banking?

The future of open banking is promising, with the potential to democratise financial services, enhance consumer choices, and stimulate economic growth. As guardians of this transformative technology, it is our responsibility to nurture its success, adapt to evolving changes, and continue leading in innovation.

2. What constitutes a cashless banking system?

A cashless banking system involves transactions that do not require physical cash. This encompasses payments made through credit/debit cards, cheques, direct debits, NEFT, RTGS, and other online payment methods that eliminate the need for cash.

3. How does transitioning to a cashless economy benefit society?

Moving towards a cashless economy offers several benefits, including increased transparency, reduced circulation of black money, heightened convenience, and accelerated economic growth.

4. Why are banks moving towards cashless operations?

Banks are adopting cashless operations primarily due to a decrease in foot traffic and in-store transactions, coupled with a growing demand for online banking services. However, this shift has raised concerns among community leaders about the potential adverse effects on cash-dependent businesses and community organisations.

Transform your vending machines with Finexer’s secure, cashless solutions – Book a demo now 🙂