Peer-to-peer (P2P) lending is transforming how people access credit and invest. Instead of relying on traditional banks, borrowers connect directly with individual investors through online platforms, streamlining the process and reducing overhead.

This model is gaining real traction: the UK’s P2P lending industry reached approximately £376.6 million in 2023, marking a 1.6% increase from the previous year. Globally, the market was valued at $139.8 billion in 2024, with projections suggesting it could reach $1.48 trillion by 2034, growing at a CAGR of 26.6%. Those numbers show P2P is no niche; it’s becoming a mainstream alternative.

Beyond the numbers, it’s the advent of Open Banking that’s accelerating change. Access to real-time financial data lets P2P platforms assess creditworthiness instantly, score borrowers more accurately, and reduce fraud, while offering faster service to both lenders and borrowers.

Keep Reading or Jump to the section you’re looking for

What Is Peer-to-Peer (P2P) Lending?

Peer-to-peer (P2P) lending is a financial model where borrowers receive money directly from individual investors, without going through a bank or traditional financial institution. Often referred to as peer to peer lending, this approach takes place on dedicated online platforms that match people who need a loan with those willing to fund it.

Rather than applying for credit through a bank, borrowers fill out a profile on a P2P lending platform. Investors can then review the application and decide whether to fund the loan, often contributing just a portion of the total amount. The result is a decentralised, often faster way to borrow or invest money.

The main appeal of P2P lending lies in its accessibility and flexibility. Borrowers may face fewer barriers than with traditional lenders, while investors get a chance to earn interest that typically outperforms standard savings accounts.

As the market grows, understanding how P2P lending works is becoming essential for anyone looking for alternative financing or investment opportunities in the UK.

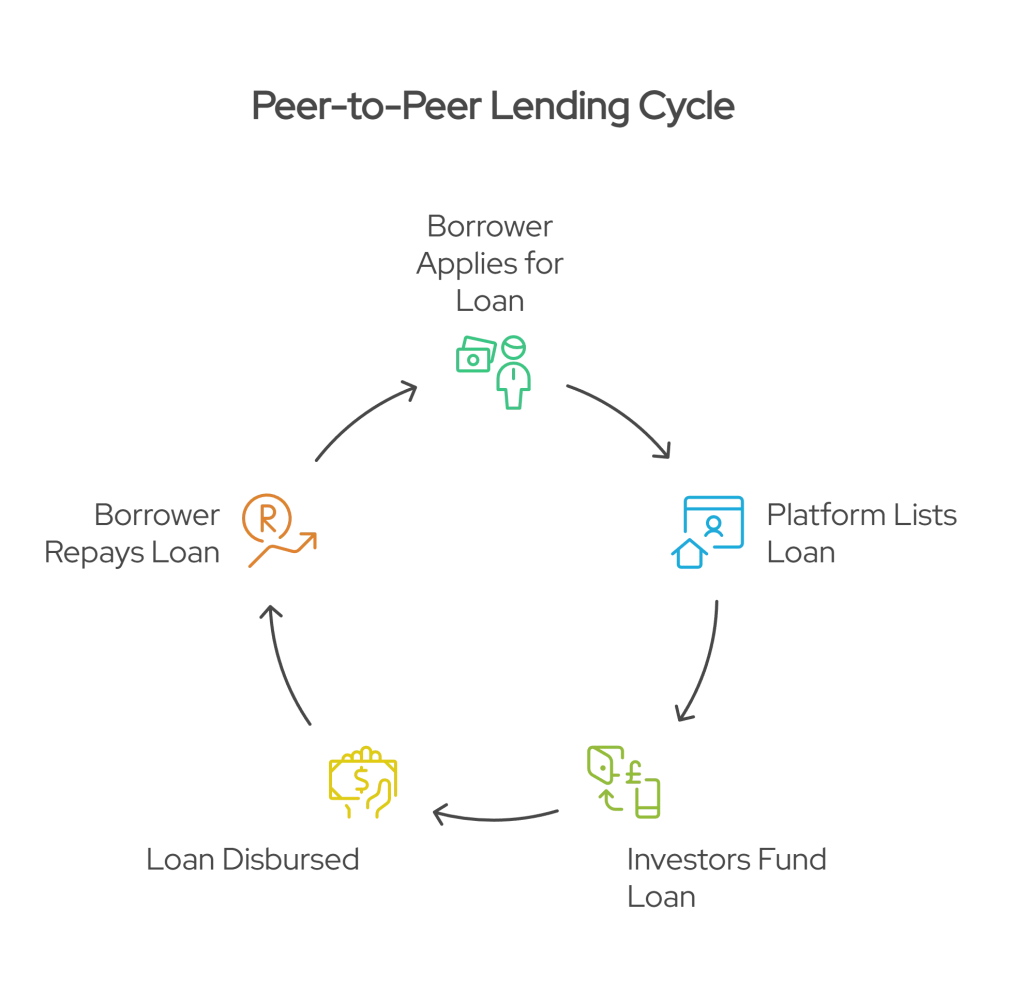

How Does P2P Lending Work?

Peer-to-peer (P2P) lending connects individual borrowers with private investors through online platforms. The process involves distinct steps for both sides, and understanding them is essential before borrowing or investing.

For Borrowers

- Application:

Borrowers visit a peer to peer lending platform and submit details such as loan amount, repayment term, income, and loan purpose. Some platforms may request access to bank data or run a credit check. - Loan Listing:

If the application is approved, the request is posted on the platform. It may be visible to all investors or matched algorithmically based on risk profile. - Funding:

One or more investors choose to fund the loan. In most cases, multiple lenders contribute smaller amounts to spread their risk. - Disbursement & Repayment:

Once fully funded, the loan is paid out. Borrowers repay the loan in fixed instalments (typically monthly), including interest, until the term ends.

For Investors

- Account Setup:

Investors register, deposit funds, and review loan opportunities listed on the platform. - Loan Selection:

They can manually choose which borrowers to fund or use automated tools that match investments based on risk appetite, term, and expected return. - Return on Investment:

As borrowers repay, investors receive principal plus interest. Some investors choose to reinvest their returns to compound earnings.

P2P lending offers direct access to credit and investment, but unlike traditional banking, the risk isn’t absorbed by an institution. Both parties interact via the platform, but the financial exposure remains between the borrower and the lender.

This model works best when borrowers are transparent and investors diversify. With the rise of Open Banking and automated risk assessment, the process is becoming faster, more data-driven, and increasingly viable at scale.

Is P2P Lending Safe?

It’s a fair question. Is P2P lending safe, especially compared to borrowing or saving through a bank? The answer depends on which side of the transaction you’re on and how well you understand the risks.

For Borrowers

Borrowers generally face fewer risks in peer to peer lending compared to lenders. The main concern is managing repayments. Since these loans are often unsecured, defaulting can damage your credit score, trigger penalty fees, or lead to third-party debt collection. However, many platforms allow borrowers to repay early or adjust terms in certain cases.

For Investors

The bigger risk lies with the investor. If a borrower defaults, there’s usually no collateral to recover losses. And unlike bank deposits, money invested in P2P loans isn’t protected by the Financial Services Compensation Scheme (FSCS). That means your capital is at risk.

To help manage this, investors often diversify funding into small portions of many loans instead of putting all their money into one. Some platforms also offer reserve funds or default protection mechanisms, though these aren’t guaranteed.

Regulatory Considerations

In the UK, many P2P lending websites are regulated by the Financial Conduct Authority (FCA), which helps provide some level of consumer protection. But regulation doesn’t eliminate risk. Both borrowers and lenders should review terms carefully before entering into any agreement.

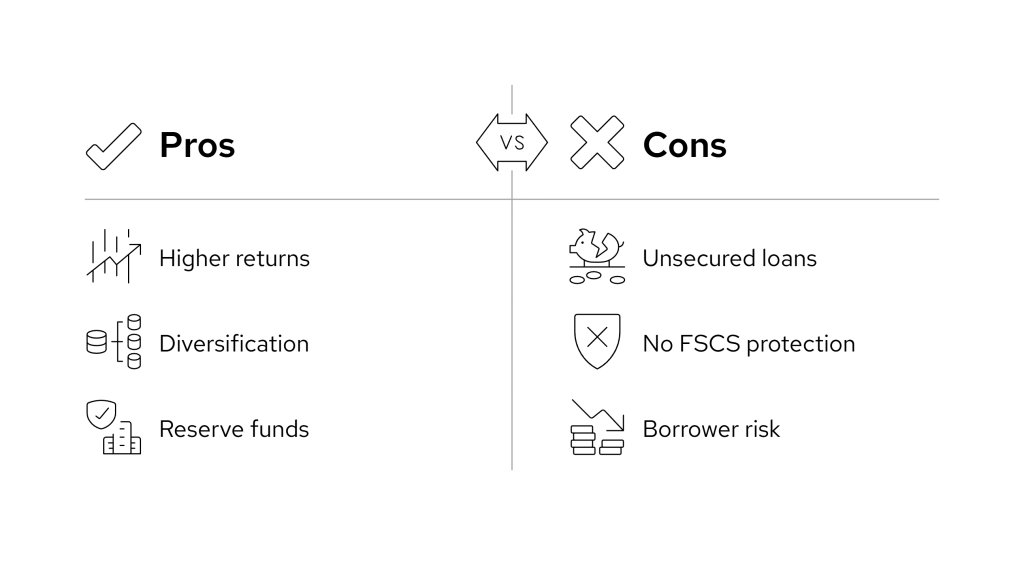

Pros and Cons of P2P Lending

Like any financial product, P2P lending comes with its advantages and trade-offs. Whether you’re borrowing money or investing it, understanding both sides of the equation is key.

Pros of P2P Lending

For Borrowers:

- Easier access to credit: If your credit history is limited or slightly damaged, peer to peer lending may offer more flexibility than a traditional bank.

- Faster turnaround: Many applications are handled digitally, which means decisions and disbursements can happen in days rather than weeks.

- Customised loan terms: Borrowers often have more choice when it comes to repayment duration, interest rates, and loan purpose.

For Investors:

- Higher return potential: Lending directly to individuals or businesses typically generates more interest than savings accounts or bonds.

- Portfolio diversification: Investors can spread small amounts across many loans, reducing exposure to individual defaults.

- Transparent borrower data: Most platforms provide detailed borrower profiles and credit insights to help inform lending decisions.

Cons of P2P Lending

For Borrowers:

- Higher interest rates for lower credit scores: Some applicants may be approved, but only at costly rates.

- Fees and charges: Beyond interest, some services charge origination, late payment, or administration fees.

- Less support: Traditional banks often offer payment holiday options or customer service for hardship, something P2P models may lack.

For Investors:

- Default risk: If a borrower fails to repay, the investor bears the loss. Many loans are unsecured and unprotected.

- No FSCS protection: Money invested in loans isn’t covered by the Financial Services Compensation Scheme.

- Platform risk: If the service provider fails or exits the market, investor funds could be tied up or lost.

Understanding these factors helps clarify how peer to peer lending works in real-world scenarios and where caution is warranted.

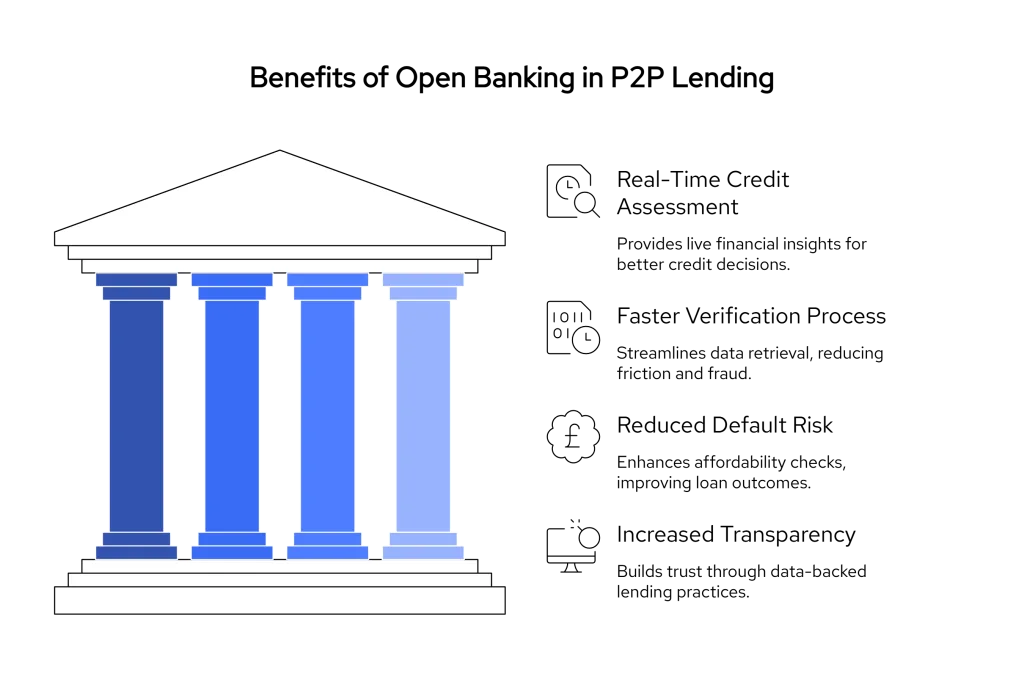

How Open Banking Improves P2P Lending

One of the most important developments in recent years is the integration of Open Banking and P2P lending. By allowing secure access to real-time bank data, Open Banking is reshaping how these platforms assess borrowers, manage risk, and build trust with investors.

1. Real-Time Credit Assessment

Traditional credit scores only reveal part of a borrower’s financial health. Open Banking enables lenders to see live transaction data, income patterns, regular expenses, and account activity. This gives a much clearer picture of someone’s ability to repay a loan, especially for borrowers with thin credit files or recent income changes.

2. Faster Verification Process

Instead of asking borrowers to upload bank statements or payslips, Open Banking APIs allow the platform to fetch verified data instantly. This reduces friction, speeds up approval, and cuts down on fraud attempts involving falsified documents.

3. Reduced Default Risk for Investors

With more accurate insights into affordability and cash flow, P2P lenders can make smarter decisions about who they approve and on what terms. This helps reduce the chances of loan defaults, protecting investor funds more effectively.

4. Increased Transparency and Trust

For both parties, the data shared via Open Banking creates a more transparent lending experience. Borrowers are judged on actual finances rather than static credit reports, and investors gain confidence in the platform’s decision-making process.

In short, the combination of Open Banking and P2P lending is not just about convenience, it’s about better risk assessment, faster onboarding, and more informed decision-making across the board.

How Finexer Helps in Lending

Finexer gives P2P lending providers a faster, more reliable way to assess borrowers, using live bank data instead of static credit scores or uploaded statements.

With a single API, Finexer lets you see how much income a borrower actually receives, how they manage their spending, and what financial commitments they already have. This makes it easier to:

- Spot affordability issues before approval

- Detect irregular income or high-risk patterns

- Reduce fraud by verifying data directly from the bank

- Avoid delays caused by missing documents or manual reviews

For UK-based lending teams, Finexer covers 99% of personal and business accounts, is fully FCA-regulated, and can be deployed in days. You keep full control of your user experience, while Finexer handles the heavy lifting on compliance, bank connectivity, and data accuracy.

By adding real-time bank insights into your approval process, you reduce default risk and improve investor confidence, all without increasing your operational burden.

Get Started

See why businesses use Finexer to Speed up loan approvals and reduce default risk.

Try NowFinal Thoughts

P2P lending has created new opportunities for both borrowers and investors, offering faster access to credit, flexible terms, and the potential for stronger returns. But it also comes with unique risks, especially around borrower assessment and investor protection.

That’s why understanding how peer to peer lending works, what to expect, and how to manage risk is essential for anyone entering the space. And as the market matures, tools like Open Banking are helping make the process safer, smarter, and more data-driven.

By leveraging real-time financial insights, P2P lending platforms can move beyond credit scores and start making decisions based on actual behaviour. Whether you’re borrowing or lending, that shift benefits everyone.

What’s the difference between secured and unsecured P2P loans?

Secured P2P loans are backed by collateral like property, while unsecured loans rely solely on the borrower’s creditworthiness, making them riskier for investors.

Can Open Banking reduce fraud in P2P lending?

Yes. Open Banking verifies account ownership and flags suspicious activity in real time, reducing fraud without needing uploaded documents.

Do P2P loans affect credit scores?

Yes. Missed or late payments on P2P loans can negatively impact your credit score, just like traditional loans.

What types of P2P loans exist?

Beyond personal loans, P2P lending also supports business loans, real estate-backed loans, and student financing.

Tired of chasing bank statements? Finexer lets you verify everything instantly through Open Banking!