Managing business finances can be time-consuming and stressful. Keeping track of invoices, expenses, and tax obligations while ensuring everything is accurate often feels like a full-time job. Relying on spreadsheets or manual bookkeeping increases the risk of errors, which can lead to cash flow problems or compliance issues.

That’s why choosing the right accounting software is important. A good system can help businesses automate financial tasks, stay organised, and get a clear view of their cash flow. With so many options available, it can be difficult to know which one suits your needs best.

This guide explores 10 popular accounting solutions for businesses in the UK. We’ll look at the features they offer, who they’re best suited for, and how they can help you manage your finances more efficiently. Whether you’re self-employed, running a small business, or managing multiple clients, this list will help you find a system that works for you.

We will guide you through:

What to Look for in Accounting Software?

Choosing the right accounting software isn’t just about finding a tool to record income and expenses. The best solution should align with your business needs, simplify financial tasks, and ensure compliance with UK tax regulations. Before deciding on a system, consider the following factors:

1. Compliance with UK Tax Laws

In the UK, businesses must follow Making Tax Digital (MTD) regulations, which require VAT-registered businesses to keep digital records and submit tax returns electronically. A good small business accounting software should be MTD-compliant, making tax filing easier and reducing the risk of errors.

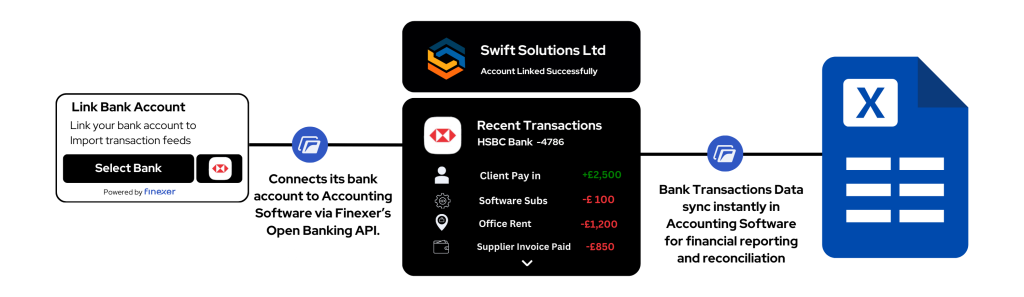

2. Bank Integration & Open Banking

A key feature to look for is whether the software connects directly to your bank account. Open Banking allows accounting software to automatically pull in transactions, eliminating the need for manual data entry. This ensures your records stay up to date and minimises reconciliation errors.

3. Ease of Use & Accessibility

If a system is too complicated, you’ll end up spending more time trying to figure it out than actually managing your finances. The best solutions have:

- A user-friendly dashboard.

- Mobile access for checking financials on the go.

- Customisable reports to track income, expenses, and profit.

4. Features That Match Your Business Needs

Every business has different accounting needs. Some software options offer advanced features that may not be necessary for freelancers or small businesses. Consider:

- Invoicing & Payment Tracking: Does the software allow you to send invoices and accept payments?

- Payroll Management: If you have employees, does it include payroll processing?

- Multi-Currency Support: Important for businesses dealing with international transactions.

5. Scalability & Pricing

Many providers offer different pricing tiers based on the size and complexity of your business. While some tools are ideal for startups and freelancers, others are better suited for growing companies that require advanced reporting and automation.

By keeping these factors in mind, you can choose an accounting software that fits your business without overpaying for features you don’t need.

10 Best Accounting Software Options for Small Businesses in the UK

1. Xero

Xero is one of the most widely used accounting software solutions for small businesses in the UK. It’s designed to help business owners keep their finances organised, automate key tasks, and stay on top of cash flow. With features that cater to freelancers, startups, and growing businesses, Xero is a solid choice for those looking for a small business accounting software that integrates with banking systems and tax authorities.

Key Features:

- Automatic Bank Feeds: Connect your bank account to Xero for real-time transaction imports, reducing manual data entry.

- Customisable Invoicing: Create and send invoices with payment links, track outstanding payments, and set up reminders.

- VAT & MTD Compliance: File VAT returns directly with HMRC and ensure compliance with Making Tax Digital regulations.

- Expense Management: Upload receipts and categorise expenses automatically.

- Multi-Currency Support: Ideal for businesses that deal with international transactions.

Who is Xero Best For?

✅ Freelancers and small business owners who want accounting software UK that automates bookkeeping and tax filings.

✅ Growing businesses that need multi-user access and advanced reporting.

✅ Businesses working with accountants, as Xero allows direct collaboration.

Pricing

Xero offers different pricing plans based on business size and features required. It usually includes a basic plan for sole traders and freelancers, a standard plan for small businesses, and an advanced plan for larger companies needing additional tools like payroll.

Pros & Cons

| Pros | Cons |

|---|---|

| Easy-to-use interface | Learning curve for beginners |

| Strong integration with UK banks | Can become expensive as business scales |

| MTD-compliant for VAT returns | No phone support—only chat and email |

Xero stands out for its user-friendly design, automation capabilities, and seamless banking connections. For small businesses that want a comprehensive accounting software UK solution without needing an accountant for every task, Xero is a reliable choice.

2. QuickBooks Online

QuickBooks Online is another leading accounting software for UK businesses, offering a wide range of features for financial management, invoicing, and tax preparation. It’s particularly well-known for its integration with payroll services, making it a good choice for businesses with employees.

Key Features:

- Bank Reconciliation: Syncs directly with UK bank accounts for automated transaction tracking.

- Invoice Customisation & Payment Tracking: Create branded invoices and track when customers have viewed or paid them.

- Payroll & VAT Filing: Simplifies payroll management and helps with tax returns, including MTD compliance.

- Expense & Mileage Tracking: Useful for businesses with travel-related expenses.

- Multi-User Access: Allows business owners, accountants, and employees to collaborate securely.

Who is QuickBooks Best For?

✅ Small business owners who need an all-in-one accounting software with payroll management.

✅ Businesses that want detailed financial reporting and forecasting.

✅ Freelancers who need a basic plan for tracking expenses and invoicing clients.

Pricing

QuickBooks offers multiple pricing plans based on the features you need. There are options tailored for freelancers, small businesses, and enterprises.

Pros & Cons

| Pros | Cons |

|---|---|

| Wide range of accounting features | More expensive than some competitors |

| Payroll and VAT filing included | Some advanced tools require higher-tier plans |

| Mobile app for managing accounts on the go | Can be overwhelming for beginners |

QuickBooks Online is a great option for businesses looking for a full-featured small business accounting software that handles bookkeeping, payroll, and compliance in one place.

3. Sage Accounting

Sage has a long history in the UK business software market. Its Sage Accounting platform is aimed at small and medium-sized businesses that want a flexible system for everyday bookkeeping, VAT management, and optional payroll features. Below are some core elements of Sage Accounting, with details verified for accuracy.

Key Features

- Making Tax Digital (MTD) Compliance:

Sage Accounting lets you submit VAT returns to HMRC in a digital format, meeting current MTD requirements. - Bank Integrations:

Users can connect their business bank accounts for direct transaction imports. This saves time on manual uploads and reduces the chance of errors. - Invoicing & Quotes:

The software includes customisable templates for creating invoices and quotes, plus tools to track which ones are paid or outstanding. - Expense Tracking & Reporting:

With expense categories and automated summaries, Sage Accounting gives you an overview of where money is coming in and going out. - Payroll (Optional Add-On):

Sage offers integrated payroll for businesses with employees. It covers calculating wages, National Insurance, and tax deductions.

Best Suited For

- Small Business Owners:

If you need to handle daily bookkeeping and want to stay up-to-date with UK tax regulations, Sage Accounting provides a reliable framework. - Medium-Sized Firms:

Sage has scalable features, which means you can add payroll or other modules as your business requirements grow. - Businesses Seeking a Familiar Brand:

Sage’s long-standing presence in the UK market makes it a common choice among accountants and bookkeepers who prefer established solutions.

Pricing

- Sage typically offers tiered plans, such as Sage Accounting Start, Sage Accounting Standard, and Sage Accounting Plus.

- Prices often begin at around £12 per month for a basic package and can increase to £30+ per month for additional features like multi-currency support or advanced reporting.

- Note: Actual pricing may vary based on promotions, contract length, or bundled offers. Always check Sage’s official site for the latest pricing details.

| Pros | Cons |

|---|---|

| Recognised and widely used in the UK | May feel complex for very small businesses |

| MTD-compliant for VAT filing | Advanced features usually require higher-tier plans |

| Optional payroll add-on for growing businesses | Interface can seem less modern compared to newer tools |

4. FreeAgent

FreeAgent, which is part of the NatWest Group, caters to freelancers, contractors, and small business owners. It aims to reduce the complexity of day-to-day bookkeeping by offering user-friendly tools for invoicing, expenses, and project-based billing. Here are some verified details about its features and pricing.

Key Features

- Tax Timeline & Deadlines:

The software provides reminders for important dates, including VAT, Self Assessment, and Corporation Tax submissions. - Automatic Bank Feeds:

Connect your UK bank accounts to pull in transactions, cutting down on manual data entry. - Invoicing & Estimates:

Create professional invoices, track when they’re viewed, and set up payment reminders for clients. - Time Tracking & Project Management:

Useful for freelancers billing by the hour or managing multiple projects with different rates. - MTD Compliance:

FreeAgent supports Making Tax Digital requirements, helping with accurate digital record-keeping.

Who It’s Best For

- Freelancers & Contractors:

Built to handle project-based billing, time tracking, and individual tax obligations. - Micro-Businesses:

Owners who need core financial management tools without advanced or enterprise-level features. - Sole Traders:

Individuals looking for a simpler approach to bookkeeping, invoicing, and tax deadlines.

Pricing

- Single Plan Approach:

FreeAgent generally offers one main subscription plan that includes the majority of its features. - Typical Monthly Cost:

The monthly fee often starts around £14–£19 (plus VAT), although promotions or bank partnerships can sometimes reduce this cost. - Free Trial:

A 30-day free trial is usually available for new users to test the platform before committing. - Bank Account Offers:

Some UK banks, especially NatWest, Royal Bank of Scotland (RBS), and Ulster Bank, provide FreeAgent free of charge to qualifying business account holders.

📚 Guide to FreeAgent Pricing for Startups

| Pros | Cons |

|---|---|

| Good for freelancers with project-based billing | Limited advanced features for larger companies |

| Helps track tax deadlines (VAT, Self Assessment) | Customisation options for reports and invoices are fewer |

| Bank connections for automatic transaction imports | Single pricing plan may not suit all budgets |

5. FreshBooks

FreshBooks is often chosen by freelancers and small businesses that place a strong emphasis on professional invoicing, payment collection, and basic accounting functions. It has gained popularity for its user-friendly design and options for tracking both expenses and billable time.

Key Features

- Invoicing & Payments

FreshBooks offers customisable invoice templates and integrates with popular payment gateways, making it easier to collect payments from clients. - Time Tracking

Users can log the hours spent on each project and generate invoices based on tracked time. - Expense Management

Record expenses by category, attach receipts, and review monthly or yearly spending. - Multi-Currency Billing

Bill clients in different currencies, which is helpful if you have international customers. - MTD Compliance

FreshBooks supports Making Tax Digital for UK users, assisting with VAT submissions when configured properly.

Who It’s Best For

- Freelancers and Consultants

If you need to track time and send invoices with minimal hassle, FreshBooks is a straightforward option. - Small Teams

Businesses with a few team members can use collaborative features like project management and expense sharing. - Service-Based Businesses

Ideal for those who bill primarily by the hour or project, rather than tracking large inventories.

Pricing

- Multiple Plans

FreshBooks generally has tiered packages (Lite, Plus, Premium), starting around £11 per month for a basic subscription and going up as you add more clients or team members. - Client Limit

Lower-tier plans have a limit on the number of billable clients; you need to upgrade for higher limits. - Free Trial

A 30-day free trial is typically available, allowing users to test core functionalities before paying.

Pros & Cons

| Pros | Cons |

|---|---|

| Simple and clear interface for non-accountants | Client limits on lower-tier plans |

| Strong invoicing and payment features | Not as many advanced accounting tools as competitors |

| MTD support for UK VAT compliance | Less suitable for product-based businesses needing inventory management |

6. KashFlow

KashFlow is a UK-based accounting platform known for its focus on the needs of small businesses. It’s currently under the IRIS Software Group, which specialises in solutions for payroll, HR, and financial management. KashFlow helps with everyday bookkeeping tasks, VAT returns, and optional payroll features for those with employees. Below are accurate, up-to-date details on its core features and typical pricing.

Key Features

- MTD-Ready VAT Submissions

KashFlow integrates with HMRC, allowing you to file VAT returns according to Making Tax Digital guidelines. - Invoicing & Quotes

Users can create professional invoices and quotes, send them to clients, and set up automatic reminders for overdue payments. - Bank Feeds & Reconciliation

Connect KashFlow to your UK bank account to import transactions, then categorise and reconcile them in one place. - Optional Payroll Add-On

For businesses with employees, KashFlow Payroll (offered by IRIS) handles wage calculations, pension contributions, and payslips. - Integration with Payment Services

Integrates with PayPal & Stripe to help you get paid faster.

Who It’s Best For

- Small UK Businesses

KashFlow was designed with UK tax rules in mind, making it a strong fit for local sole traders and small limited companies. - Owners Seeking Basic Accounting & Payroll

The optional payroll add-on means you can handle wages, taxes, and bookkeeping in one system if needed. - Individuals Prefering a UK-Centric Platform

Since KashFlow focuses on UK requirements, it’s particularly user-friendly for businesses that don’t need advanced international features.

Pricing

- Essential and Business Plans

KashFlow typically offers two main plans. The Essential plan starts around £8–£10 per month, while the Business plan is usually around £20–£25 per month. - Payroll Add-On

Adding payroll functionality can increase the monthly cost. The exact fee varies based on the number of employees. - Free Trial

A 14-day free trial is usually available, allowing you to test the platform before committing.

| Pros | Cons |

|---|---|

| Built with UK tax and MTD requirements in mind | Advanced features require higher-tier plans |

| Optional payroll integration via IRIS | Interface may feel basic compared to some modern competitors |

| Flexible invoicing and payment integrations | Limited multi-currency support on lower plans |

7. Capium

Capium is a cloud-based accounting software designed with accountants and small businesses in mind. It combines bookkeeping, tax filing, and client management features, making it especially appealing for those who manage multiple business accounts under one platform.

Key Features

- Multiple-Client Management

Accountants can switch between clients in a single dashboard, streamlining processes like VAT returns and year-end accounts. - Tax Compliance

Capium covers Corporation Tax, Personal Tax, and VAT submissions in line with HMRC rules, including Making Tax Digital. - Bank Feeds & Reconciliation

Supports direct connections to major UK banks, so transactions flow automatically into the software. - Practice Management Tools

Time tracking, task assignment, and document sharing features help small accountancy practices or businesses collaborate. - Payroll Integration

Offers integrated payroll, simplifying wage calculations, payslips, and real-time information (RTI) submissions.

Who It’s Best For

- Accountants & Bookkeepers

The platform is tailored for professionals handling multiple clients, ensuring they can view and manage each account with ease. - Small Firms with Growing Needs

Built-in tools for team collaboration and tax compliance make Capium suitable for businesses that plan to expand. - UK-Based Operations

Since it’s developed with UK tax rules in mind, local businesses can rely on it for up-to-date compliance.

Pricing

- Modular Pricing

Capium typically offers separate modules (e.g., Accounts Production, Tax, Practice Management), allowing you to pick and pay for what you need. - Monthly or Annual Plans

Costs vary based on the number of modules and the scale of your operation. - Free Trial

A time-limited trial is generally available for new users who want to test core features before subscribing.

(Check Capium’s official site for the latest details on plans and pricing.)

Pros & Cons

| Pros | Cons |

|---|---|

| Focused on multi-client and practice management | Fewer tutorials and community resources compared to major brands |

| Built-in modules for tax, accounts, and payroll | Interface may not be as modern as some competitors |

| Complies with HMRC’s MTD for VAT | Modular pricing can get costly if you need multiple services |

8. Clear Books

Clear Books is a UK-based provider of accounting software, designed to help small businesses and accountants handle day-to-day financial tasks with HMRC compliance in mind. Below is an overview of Clear Books’ main capabilities, verified for accuracy.

Key Features

- VAT & Making Tax Digital (MTD)

Clear Books offers direct submissions for VAT returns, aligning with the UK’s MTD regulations. - Bank Feeds

Connect your UK bank account to automate transaction imports, reducing manual data entry. - Invoicing & Quotes

Users can create professional invoices and quotes, track payments, and send reminders for overdue amounts. - Reporting & Analytics

Generate real-time reports on profit and loss, balance sheets, and cash flow to keep a clear view of your business finances. - Payroll (Add-On)

Clear Books Payroll is available if you have employees and need a platform to manage wages, tax deductions, and payslips.

Who It’s Best For

- Small UK Businesses

Clear Books is built around UK compliance, making it suitable for limited companies, sole traders, and partnerships. - Accountants & Bookkeepers

The software allows multiple users, letting accounting professionals manage multiple clients under one interface. - Budget-Conscious Owners

Different pricing levels provide options based on whether you need basic bookkeeping or more robust financial tools.

Pricing

- Tiered Plans

Often split into smaller packages (e.g., Small, Large) with a starting price around £10–£15 per month. - Payroll Add-On

Offered at an additional monthly cost, with fees sometimes tied to the number of employees. - Free Trial

A 30-day free trial is commonly available, giving you a chance to test the features before subscribing.

Pros & Cons

| Pros | Cons |

|---|---|

| UK-based platform with MTD compliance | May have fewer integrations than larger competitors |

| User-friendly reporting and dashboard | Advanced features often require higher-tier plans |

| Optional payroll add-on | Less known outside of the UK, so international support is limited |

9. Wave

Wave offers core bookkeeping and invoicing features suitable for small businesses and accounting professionals who manage clients with simpler requirements. It provides a free plan that includes expense tracking, basic reporting, and invoice creation, making it appealing for situations where you want to keep costs low.

Key Features

- Accounting & Invoicing at No Cost

Users can record transactions, send invoices, and accept online payments. - Bank Integration

Connect UK bank accounts to import transactions, which helps reduce manual data entry. - Receipt Management

Upload pictures of receipts to organise and store them digitally. - Basic Reporting

Generate profit and loss statements and balance sheets to help monitor financial health.

Who It’s Best For

- Accountants Serving Small, Cost-Sensitive Businesses

If your clients have minimal accounting needs and don’t require advanced tax support, Wave can fit well. - Freelancers and Sole Traders

Individuals who only need simple invoicing and bookkeeping tools may appreciate the cost savings. - Basic Cash-Based Operations

For companies without complex VAT obligations or multi-currency transactions, Wave’s features can cover essential tasks.

Points to Note

- No Direct MTD Support

Wave doesn’t currently offer built-in tools for Making Tax Digital. Accountants may need an external bridging solution for VAT submissions. - Optional Payment Processing

Online payment features carry transaction fees; this is separate from the free accounting elements.

| Pros | Cons |

|---|---|

| Free core bookkeeping and invoicing | Lacks built-in VAT and MTD capabilities |

| Easy to set up for clients with simple needs | Limited support for complex or growing businesses |

| Allows receipt scanning and basic reporting | Transaction fees apply for online payments |

10. ZipBooks

ZipBooks is another online accounting software solution that can serve UK-based clients. It offers invoicing, financial reporting, and time-tracking features in a straightforward interface. While it doesn’t provide direct MTD filing, it includes enough functionality for accountants overseeing smaller clients who don’t need advanced tax integrations.

Key Features

- Invoicing & Payment Tracking

Send customised invoices, see if clients have viewed them, and track payment status. - Bank Feeds

Connect UK bank accounts to import transactions for reconciliation. - Time Tracking

Log hours for billable services, which is especially helpful for freelancers or service-oriented businesses. - Reporting Dashboard

Keep an eye on profit and loss, cash flow, and balance sheets to guide financial decisions. - Multi-Currency

Bill clients in various currencies, useful if your clients have international customers.

Who It’s Best For

- Accounting Professionals Serving Service-Based Firms

Time tracking and simple project billing make ZipBooks appealing for businesses that primarily charge by the hour or project. - Clients Needing Basic Features

If advanced VAT handling isn’t a top priority, ZipBooks can manage general invoicing and bookkeeping. - Users Seeking a Lower Price Point

ZipBooks offers a free starter plan and paid options that expand capabilities as needed.

Points to Note

- No Direct MTD

Like Wave, ZipBooks doesn’t offer a built-in solution for MTD. An external bridging tool would be necessary for digital VAT filing. - Paid Plans in USD

Subscription fees are listed in USD, so currency conversion may apply for UK-based clients.

Pros & Cons

| Pros | Cons |

|---|---|

| Free starter plan offers essential tools | Doesn’t include native VAT or MTD filing |

| Time tracking built into the platform | Plans priced in USD, requiring currency conversion |

| Works well for service-oriented businesses | Might be limited for complex accounting needs |

How to Choose the Right Accounting Software?

Selecting a suitable accounting software is crucial for accountants and businesses in the UK. Whether your focus is on VAT compliance, payroll, or multi-user access, matching the right tool to your specific requirements can streamline day-to-day financial management.

- Scope of Services

Determine whether your top priority is automated invoicing, payroll, multiple-client management, or advanced reporting. Different platforms excel in each area. - Scalability & Add-Ons

If you expect your client base or operation to grow, look for software that can expand alongside you, offering additional modules or upgrading capacity without excessive fees. - Compliance & Reliability

Confirm the software supports Making Tax Digital (MTD) or easily integrates with bridging solutions. Staying on the right side of UK regulations reduces stress and avoids penalties. - User Experience & Support

Platforms with a clear interface, detailed guides, and responsive customer support can simplify the learning curve, especially if you’re juggling multiple clients or complex bookkeeping needs.

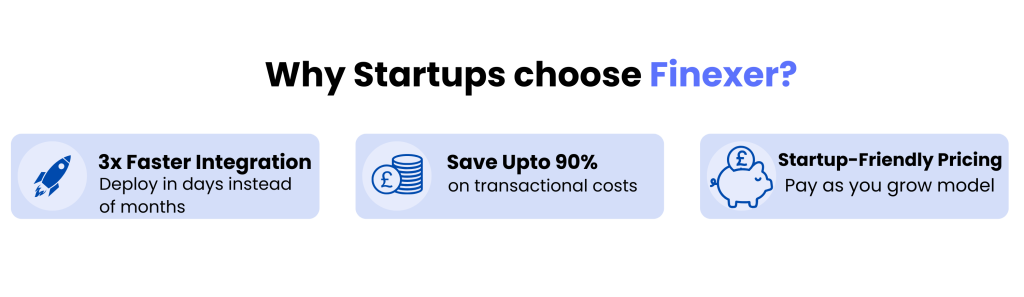

Why Integrate Finexer into your Accounting Software

For accounting professionals seeking to integrate banking data, accept payments, and onboard clients, The Finexer can offer valuable add-on services that align with many of the UK-friendly accounting solutions discussed here:

- Real-Time Transaction Sync:

Automatically update your chosen accounting software with new transactions, reducing manual data entry.

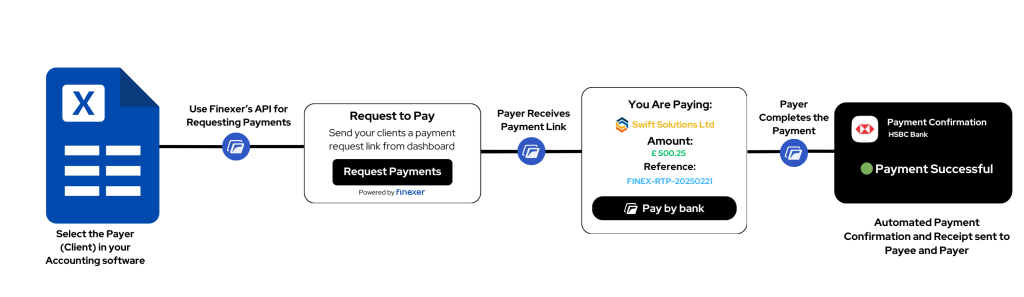

- Seamless Payment Handling:

Process client payments through The Finexer, allowing you to track incoming funds in tandem with invoices raised in your accounting platform.

- Efficient Onboarding:

The Finexer supports streamlined account creation for new clients, making it easier to handle KYC (Know Your Customer) checks or compliance steps, and integrate client data into your financial workflows.

By pairing your accounting software with The Finexer’s services, you create a more robust financial ecosystem, combining automated data capture, straightforward payment workflows, and smooth client onboarding in one place.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Final Thoughts

Finding the right accounting software doesn’t have to be overwhelming. Whether you choose a well-known platform like Xero or QuickBooks, or opt for a more budget-friendly tool like Pandle or Wave, the best choice is the one that fits your budget, meets your main financial needs, and follows UK rules like Making Tax Digital (MTD).

By adding Finexer into the mix, you can connect real-time bank data, accept payments, and onboard clients with less hassle. This makes your accounting workflows smoother and keeps everything in one place.

Which Accounting Software Is Best for Small Businesses in the UK?

The “best” option depends on your needs. If you want a simple, budget-friendly choice, you might consider platforms like Pandle or Wave. For more robust features—like payroll, multi-user access, and advanced reporting—Xero, QuickBooks Online, or Sage Accounting may be more suitable. Always check for Making Tax Digital (MTD) compliance if you’re VAT-registered.

Is Making Tax Digital (MTD) Compliance Necessary, and How Do I Ensure My Software Is Ready?

Yes. Under MTD rules, VAT-registered businesses in the UK must keep digital records and submit VAT returns electronically to HMRC. To stay compliant, pick an accounting software with built-in MTD tools or use a bridging solution that links your records to HMRC. Look for an official statement from your provider confirming MTD support.

Can I Accept Payments and Manage Payroll Through My Accounting Software?

Many accounting platforms offer invoice creation and payment tracking. Some, like QuickBooks Online and Sage Accounting, also provide payroll modules. If you don’t need payroll immediately, some tools let you add it later. You can also integrate third-party payment processors (e.g., PayPal, Stripe,Finexer) depending on your software.

How Does Finexer Integration Help With Banking and Client Onboarding?

Finexer complements most UK-friendly accounting software by providing:

Banking Data Sync: Automates transaction updates, saving time on manual uploads.

Payment Acceptance: Allows you to process client payments directly, keeping financial records accurate.

Onboarding & Verification: Supports quick client setup and KYC checks, which can be vital for compliance.

By combining Finexer with your chosen software, you get a unified financial ecosystem that eases daily bookkeeping tasks and speeds up client onboarding.

Is Free Accounting Software Enough, or Should I Consider Paid Plans?

Free tools like Wave or free tiers of ZipBooks can handle basic invoicing and expense tracking, which might suffice for sole traders or very small operations. However, if you need MTD filing, multi-currency, or advanced features such as payroll and detailed reporting, you’ll likely need a paid plan from providers like Xero or QuickBooks. Evaluate your budget, tax requirements, and growth plans before making a final decision.

Ease Accounting process with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂

![Top 10 Accounting Software in the UK 1 10 Best Accounting Software for Small Businesses UK [2025]](/wp-content/uploads/2025/02/Top-10-software.jpg)