Introduction

In an era where digital transformation is paramount, the insurance sector is not left behind. The convergence of insurance and technology, known as insurtech, is redefining the landscape with disruption at its core. This innovative approach leverages digital platforms, virtual agents, and claims processing technologies to streamline operations, enhance customer service, and introduce usage-based insurance models. For the UK’s insurance sector—one of the largest globally—embracing insurtech means not just keeping pace with change but setting the pace for innovation, efficiency, and customer satisfaction in the insurance realm.

This article delves into the UK’s top five insurtech innovations that are pioneering these changes. From Zego’s flexible insurance policies tailored to the gig economy to QuanTemplate’s data management solutions for insurance companies, and Wrisk’s customer-centric insurance platform, each insurtech company highlighted here is pushing the boundaries of what’s possible in insurance. Through the lens of Shift Technology’s AI-driven fraud detection to Ondo’s use of embedded insurance, we will explore how these companies are not merely responding to the demand for digital insurance solutions but are shaping the future of the industry with open insurance, embedded insurance, and beyond, showcasing the profound impact of insurtech insights on the UK’s insurance landscape.

1.Zego

Zego stands out in the UK’s insurtech landscape by offering uniquely flexible insurance policies tailored to the dynamic needs of gig economy workers and self-employed individuals. Their innovative approach to insurance is designed to accommodate the fluctuating work patterns typical of modern freelancers and contractors, providing both security and adaptability.

Core Business Around Flexible Policies

Zego has revolutionized the traditional insurance model by introducing flexible, pay-as-you-go coverage options. This model allows drivers and riders to purchase insurance by the hour, day, or month, depending on their specific working hours, thereby aligning costs directly with their income periods. Such flexibility is particularly advantageous for individuals engaged in delivery and courier services, where work hours can vary significantly from one week to the next.

Gig Economy and Self-Employed Focus

Recognizing the unique challenges faced by gig economy participants, Zego tailors its products to meet their specific needs. The company’s insurance solutions are designed to provide comprehensive coverage whether the insured is on the clock or using their vehicle for personal activities. This seamless integration ensures that drivers are adequately protected at all times, without the need to switch between different policies or providers.

Granular Data Streams for Pricing

Zego leverages advanced telematics and real-time data to offer more personalized pricing models. By using data such as GPS location, vehicle usage, and driving behavior collected through their proprietary app, Zego can assess risk more accurately. This data-driven approach not only helps in crafting fairer pricing but also encourages safer driving habits among its users. Furthermore, Zego’s innovative use of data allows for the creation of risk profiles that are continually updated, ensuring that pricing remains as fair and transparent as possible.

By focusing on flexibility, personalized coverage, and data-centric pricing, Zego effectively addresses the insurance needs of the modern workforce, making it a key player in the UK’s insurtech scene.

2.QuanTemplate

QuanTemplate leverages the power of machine learning and big data to transform the insurance and financial sectors. This platform is designed to enhance the decision-making capabilities of brokers, underwriters, and investors by providing them with advanced analytical tools and comprehensive data insights.

Machine Learning and Big Data

QuanTemplate stands at the forefront of insurtech innovation by integrating machine learning technologies with vast datasets. This integration allows for the automation of data preparation tasks such as catastrophe modeling, pricing, and performance analysis which traditionally were labor-intensive. By streamlining these processes, QuanTemplate not only saves time but also enhances the accuracy and reliability of the data insights provided.

Platform for Brokers and Underwriters

For brokers and underwriters, QuanTemplate offers a suite of tools that facilitate a deeper analysis of risk, optimization of policy pricing, and management of insurance portfolios. The platform’s ability to quickly unify and cleanse data enables professionals to make informed decisions faster, giving them a competitive edge in the market. Additionally, the platform’s advanced algorithms assist in identifying and mitigating risks before they become significant issues.

Investors and Market Dynamics

Investors utilize QuanTemplate to gain a clearer understanding of market dynamics and to identify potential investment opportunities. The platform’s analytics capabilities allow for the exploration of various market scenarios and the impact of global events on portfolio performance. This enables investors to manage their portfolios more effectively and make strategic decisions based on real-time data.

By harnessing the capabilities of machine learning and big data, QuanTemplate not only improves operational efficiencies but also provides key stakeholders in the insurance and financial markets with the tools they need to succeed in a rapidly evolving landscape.

3.Wrisk

Transparency and Customer Engagement

Wrisk is redefining the insurance landscape by prioritizing transparency and customer engagement. Their unique approach features the Wrisk Score, a dynamic measurement similar to a credit score but for personal risk. This innovative scoring system provides real-time insights into how insurance prices are calculated, empowering customers with a clear understanding of their premiums. By answering simple questions, users can see their score change and grasp the impact of their actions on insurance costs. This level of transparency fosters trust and encourages a more informed, engaged user base.

Partnerships and Innovations

Wrisk has established significant partnerships that enhance their offerings and expand their reach within the insurance industry. Collaborations with major automotive manufacturers and financial institutions, such as Allianz Automotive and BMW, underscore their commitment to integrating insurance solutions with global brands. These partnerships not only leverage Wrisk’s technological strengths but also align with their strategy to innovate and disrupt traditional insurance models. For instance, their collaboration with Allianz Automotive is designed to deliver customer-centric solutions that are simple and transparent, resonating with Allianz’s overall strategy of modernization and customer focus.

Mobile App Focus

The focus on mobile app development is central to Wrisk’s strategy, aiming to meet the modern consumer’s need for flexibility and accessibility. Their app provides a seamless digital insurance experience, allowing customers to manage their insurance needs effortlessly. Features like balance top-up and the ability to adjust coverage reflect their commitment to providing tailored solutions that cater to dynamic lifestyles. The app’s design emphasizes ease of use, with intuitive navigation and the ability to integrate various types of insurance under a single plan. This approach not only simplifies the insurance process but also enhances the overall user experience, making insurance management straightforward and user-friendly.

4.Shift Technology

Shift Technology harnesses artificial intelligence to transform the insurance industry, focusing on fraud detection and claims management. Their solutions are designed to automate and optimize critical decisions, combining best-in-class AI with deep insurance expertise to deliver accuracy that surpasses human capabilities.

AI Solutions for Fraud Detection

Shift Technology provides a robust platform for fraud detection, utilizing AI to mimic the deductive reasoning of fraud handlers. This approach allows for quick and thorough analyses, enabling insurers to detect and investigate fraud more efficiently. The platform’s capabilities include analyzing nearly two billion claims, highlighting its extensive experience and effectiveness in fraud detection. Shift’s AI-driven solutions not only identify potential fraud but also offer detailed contextual guidance, enhancing investigators’ ability to make informed decisions swiftly.

Investors and Technological Backbone

With a recent Series D investment of $220 million, Shift Technology is poised for expansion in key global markets, including the U.S., Europe, and Asia. This funding will also bolster R&D efforts, focusing on new solutions for decision automation and optimization. Shift’s commitment to innovation is supported by the largest data science team in the world dedicated solely to AI-driven insurance decisions, ensuring their technology remains at the forefront of the insurance industry.

Protection Against Cyber Attacks

Shift Technology prioritizes security across all its operations, adhering to the highest standards of data privacy and protection. Their SaaS solutions are delivered via secure servers in certified data centers, featuring physical and technical safeguards. Shift conducts regular audits and adheres to strict GDPR standards, ensuring that all customer data is handled with the utmost security. This comprehensive approach to cybersecurity not only protects against data breaches but also builds trust with clients, affirming Shift’s commitment to secure and reliable insurtech solutions.

By integrating advanced AI with a focus on security and comprehensive fraud detection, Shift Technology significantly enhances the capabilities of insurers, driving efficiency and safeguarding against risks in the digital age.

5.Ondo

Sustainable Risk Reduction

Ondo InsurTech is at the forefront of transforming the insurance industry through innovative technology aimed at sustainable risk reduction. Their mission is focused on the global scale-up of their patented system, LeakBot, which significantly diminishes the risks associated with domestic water leaks. Annually, these leaks contribute to approximately $17 billion in claims in the USA and UK alone, not to mention the environmental impact of wasted water and energy used in water treatment processes. By targeting early detection and prevention, Ondo’s solutions not only reduce the financial burden on homeowners and insurers but also contribute to environmental sustainability.

LeakBot Product

LeakBot stands out as a leading InsurTech solution designed to tackle one of the most common yet overlooked issues—domestic water leaks. This smart device can be easily installed by homeowners and operates by continuously monitoring the water flow within a property. If a leak is detected, the system alerts the homeowner via a mobile app, and in many cases, facilitates swift resolution by connecting them with a network of professional engineers. This proactive approach has been proven to reduce water damage claims costs by up to 70%, showcasing LeakBot’s effectiveness in mitigating risks before they escalate into more significant problems.

Global Partnerships

Ondo’s strategy extends beyond product innovation, focusing also on expanding its reach through strategic global partnerships. With operations across Scandinavia, the UK, and the US, Ondo has collaborated with major insurance carriers such as Admiral Group PLC, Nationwide, and Ageas UK. These partnerships often involve providing LeakBot devices to customers at no initial cost, with insurers covering the service on a recurring basis. Such collaborations not only enhance the adoption of Ondo’s technologies but also align with the insurers’ goals of reducing claim frequencies and costs. This model of cooperation highlights Ondo’s commitment to integrating their solutions into the broader insurance market, driving forward the insurtech revolution one partnership at a time.

Conclusion

The exploration of the UK’s insurtech innovations reveals a transformative landscape where technology not only meets the traditional insurance needs but also anticipates future challenges with inventive solutions. From Zego’s flexible insurance models designed for the gig economy to Shift Technology’s AI-driven fraud detection, these innovations emphasize the industry’s shift towards customer-focused, data-driven services. The integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics across these platforms highlights a collective movement towards enhancing efficiency, security, and customer engagement in the insurance sector. By emphasizing the adaptability and forward-thinking approaches of companies like QuanTemplate and Wrisk, the article underscores the pivotal role insurtech plays in shaping a resilient, customer-centric insurance future.

Reflecting on these insights, the significance of insurtech innovations extends beyond immediate technological advancements, setting a foundation for sustained transformation within the global insurance landscape. The case studies and examples discussed not only illustrate the potential of these technologies to streamline operations and mitigate risks but also project a future where insurance becomes more accessible, personalized, and integrated into everyday life. As the industry continues to evolve, fostering partnerships and adopting open innovation models will be critical for companies aiming to lead in the insurtech arena. The journey of insurtech in the UK thus not only narrates a story of present achievements but also charts a path forward, filled with opportunities for enhanced efficiency, elevated security, and enriched customer experiences, heralding a new era in insurance.

FAQs

How is InsurTech in UK?

InsurTech in UK aims to revolutionize the insurance industry by integrating technology, striving to position the UK as the world leader in insurance innovation.

How many InsurTech companies are there in the UK?

The UK, particularly London, is a major hub for InsurTech companies. It boasts approximately 280 InsurTech firms, representing the highest density per capita among the world’s major economies. This number makes London comparable to the rest of Europe combined and second globally, trailing only Silicon Valley.

What does InsurTech involve?

InsurTech involves the introduction of new technologies designed to transform the insurance sector. This transformation is achieved by reducing costs for both consumers and insurance companies, improving operational efficiency, and increasing overall customer satisfaction.

What is the definition of InsurTech?

InsurTech refers to the innovative application of technology within the insurance sector and is considered a branch of FinTech, which encompasses broader financial technology applications.

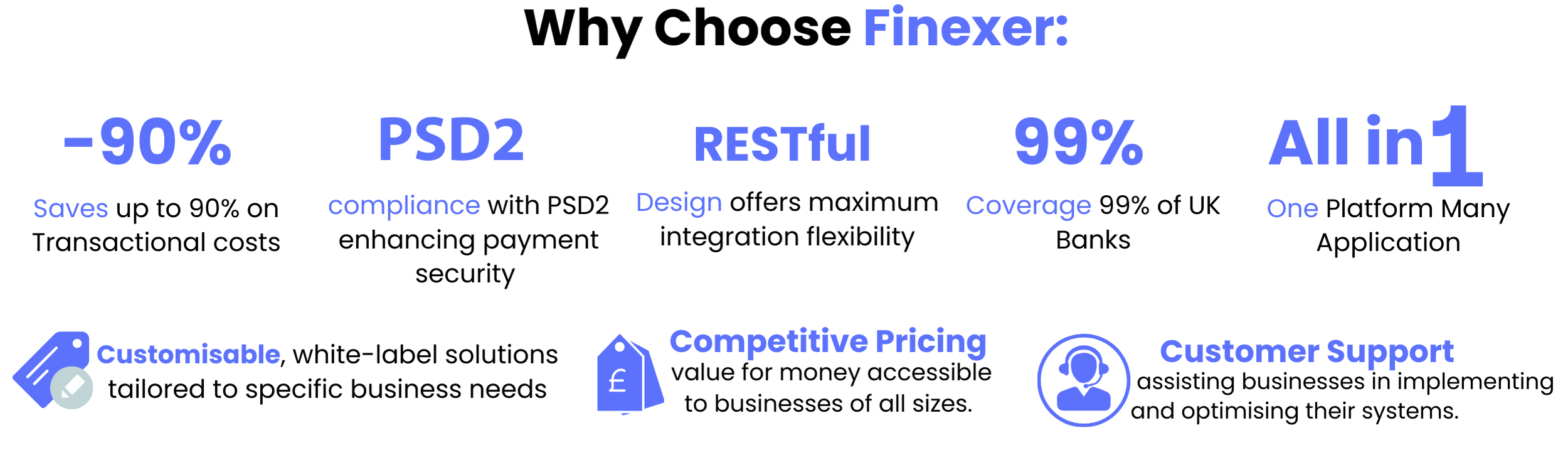

Discover the future of the insurance industry with us—join the conversation on innovative insuretech solutions and explore Finexer!