Insurtech, short for “insurance technology,” refers to the innovative use of technology to enhance and streamline the insurance industry.

Concept of Open-Banking

Open-banking, a transformative approach in the financial sector, is revolutionising how data is shared between banks and third-party providers. It hinges on the principle of data transparency and user consent, enabling a more personalised financial service landscape.

Open-banking allows customers to share their financial data with third-party providers securely and efficiently. This practice is underpinned by regulations such as the PSD2 in Europe, which mandate banks to open access to their data, provided customer consent is obtained. This shift breaks the banks’ monopoly over customer data, fostering innovation and competition.

Mechanism of Data Sharing

The mechanism of data sharing in open-banking operates through APIs (Application Programming Interfaces). These digital gateways facilitate secure and direct communication between banks and authorised third-party providers. Customers can grant or revoke their consent for data sharing, ensuring control over their personal information.

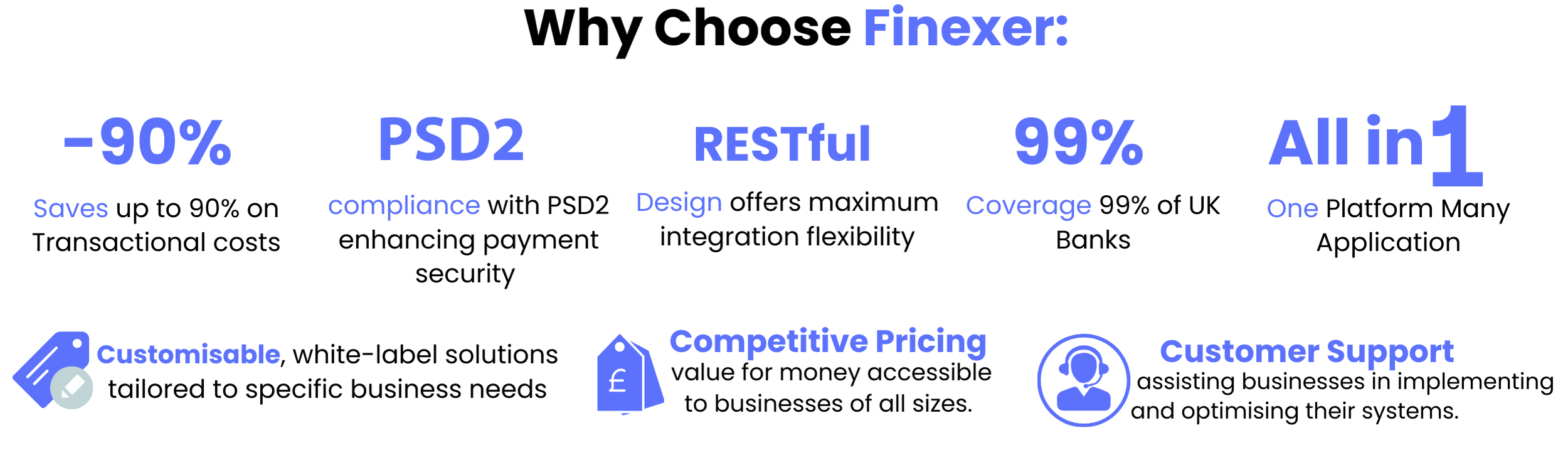

Role of Third-Party Providers like Finexer

Third-party providers like Finexer play a crucial role in the open-banking ecosystem. They use the access provided by open-banking APIs to develop innovative financial solutions that address specific consumer needs. For instance, Finexer can offer personalised financial services by analysing consumer data, leading to more accurate financial advice and tailored product offerings.

Benefits of Open-Banking Solutions for Insurtech

Open banking provides significant advantages for insurtech companies by enhancing transparency and personalisation in their services. Here are some key benefits:

✔ Real-time Access to Financial Data

Open banking enables insurtech companies to access real-time financial data from bank accounts with customer consent. This access allows for a more accurate and swift assessment of customer needs and financial behaviours, facilitating tailored insurance offerings. The ability to analyse spending patterns and financial commitments helps insurtechs offer products that truly match consumer requirements, enhancing customer satisfaction.

✔ Cost Reduction Through Efficiency

The integration of open banking streamlines many processes that traditionally require manual effort and significant time investment. By automating data collection and processing, insurtech companies can significantly reduce operational costs. This automation not only speeds up the underwriting process but also reduces the likelihood of errors, making operations more efficient and cost-effective.

✔ Greater Market Reach

Open banking allows insurtech companies to reach a broader audience by providing services that are more accessible and appealing to a tech-savvy generation. The ease of data sharing and processing enables these companies to offer quick and personalised services to a larger customer base, expanding their market reach and enhancing their ability to compete in a crowded market.

✔ Enhanced Customer Experience

Open banking revolutionises the insurtech landscape by offering more personalised services. By accessing real-time financial data, insurtech companies can tailor their products to better suit individual customer profiles, enhancing satisfaction and trust.

✔ Improved Risk Assessment

The integration of open banking allows for more accurate risk assessments. Access to detailed financial histories enables insurtech firms to offer premiums that accurately reflect the risk, potentially lowering costs for both the provider and the insured.

✔ Streamlined Operations

Open banking facilitates smoother operations within insurtech firms. Automated data retrieval reduces manual entry errors and speeds up processes such as claims handling and underwriting, leading to more efficient service delivery.

Challenges and Mitigation Strategies

Cybersecurity Threats⚠️

One of the significant challenges facing the insurtech sector is cybersecurity. Insurtech companies, with their reliance on digital platforms, are particularly vulnerable to cyber-attacks, which can lead to substantial financial losses and erode customer trust. Mitigation strategies include implementing advanced security protocols, regular system audits, and employee training in cybersecurity best practices.

Regulatory Hurdles⚠️

Regulatory compliance presents another hurdle for insurtech firms. Navigating the complex landscape of financial regulations can be both time-consuming and costly. Non-compliance can result in hefty fines and damage to reputation. To overcome these challenges, insurtech companies invest in compliance technologies and seek to hire experts in financial regulation to ensure ongoing adherence to legal standards.

These strategies are pivotal in addressing the operational challenges within the insurtech industry, ensuring stability and fostering trust among consumers.

Variable Recurring Payments (VRP)

Why Variable Recurring Payments are Revolutionising Insurtech

Variable Recurring Payments (VRP) are significantly transforming the insurtech landscape by enabling more dynamic and flexible payment solutions. VRPs allow customers to authorize insurance companies to collect variable amounts from their accounts, depending on the due premiums. This flexibility supports tailored payment schedules, aligning closely with customers’ financial flows and reducing transaction friction.

How VRPs Improve Efficiency and Customer Satisfaction in Insurance

The implementation of VRPs streamlines the payment process, reducing administrative overhead and enhancing operational efficiency. For customers, this means quicker processing of claims and policies without the need for manual intervention, leading to higher satisfaction due to the seamless experience. Insurance companies benefit from improved cash flow management and reduced delays in payments, which in turn minimizes exposure to payment defaults.

The Future of Payment Solutions in Insurtech: Embracing Variable Recurring Payments

Looking forward, VRPs are set to play a pivotal role in the evolution of payment solutions within the insurtech industry. By providing a mechanism for handling varying payment amounts automatically, VRPs are ideal for adapting to changes in policy rates or insurance coverage needs, without requiring constant manual updates. This adaptability makes them a cornerstone for future innovations in personalized insurance services.

Brief mention of Finexer’s VRP solution

Finexer ‘s implementation of VRP solutions exemplifies their commitment to leveraging advanced technology to solve common problems in the insurtech sector. Their system not only facilitates instant and efficient payment processing but also ensures compliance with evolving financial regulations, thereby enhancing both security and trust between the insurer and the insured.

Future Outlook and Industry Impact

Predictions for the Future of Insurtech

The insurtech industry is poised for transformative growth, driven by the adoption of open banking solutions. These technologies enable more precise risk assessments and personalized product offerings, leading to increased efficiency and customer satisfaction. As regulatory environments continue to evolve, insurtech companies that leverage open banking are expected to gain a competitive edge, adapting more swiftly to market changes and customer needs.

Innovations Driven by Open-Banking

Open banking is catalysing significant innovations within the insurtech sector. By facilitating secure and instant access to financial data, it allows for the development of tailored insurance solutions that cater to the unique needs of each customer. Innovations such as real-time data processing and enhanced analytical capabilities enable insurers to offer dynamic pricing models and flexible coverage options, enhancing the overall customer experience.

Long-Term Benefits for Insurers and Customers

The long-term impact of open banking on the insurance industry promises substantial benefits for both insurers and their clients. For insurers, the integration of open banking leads to streamlined operations, reduced costs due to automated processes, and lower fraud risks. Customers, on the other hand, will enjoy more transparent services, competitive pricing, and policies that reflect their actual risk profiles and financial behaviours, thereby increasing trust and loyalty towards their insurers.

Emerging Trends in Insurtech

The insurtech industry is rapidly evolving, driven by the need for innovation, efficiency, and enhanced customer experiences. Companies like Finexer are at the forefront, leveraging open banking solutions to address challenges such as insurance fraud, which costs billions annually, and compliance with regulatory standards, which is both time-consuming and costly. By integrating instant payment solutions and fraud prevention mechanisms, these innovations not only streamline operations but also significantly reduce costs and improve the accuracy of risk assessments.

Potential Impact on the Insurance Industry

The adoption of open banking by insurtech companies is set to transform the insurance industry by enabling more personalized insurance products. Access to real-time financial data allows for better risk assessment and product tailoring, which enhances customer satisfaction and loyalty. Moreover, the ability to process claims faster and more accurately with automated systems can revolutionize the traditional insurance model, making it more efficient and user-friendly.

How Companies Can Stay Ahead

To remain competitive, companies must embrace these technological advancements. Investing in technologies like AI and machine learning for better data analysis and decision-making is crucial. Additionally, fostering a culture of innovation within the organization can help anticipate market trends and customer needs, ensuring the company not only stays relevant but also leads in the digital transformation of the insurance sector .

Conclusion

Throughout this analysis, we’ve articulated the driving forces behind insurtech companies’ shift towards open-banking solutions, highlighting the efficiency and personalisation these technologies bring to the table. Open banking’s role in transforming the insurance sector is palpable, from enhancing customer experiences with personalised insurance products to streamlining operations through instant payments and robust fraud prevention measures. Finexer , standing at the forefront of this revolution, exemplifies how leveraging open banking can directly address the specific pain points of insurtech firms, such as the need for real-time data access and more accurate risk assessments. Here, the integration of technologies like AI and machine learning by companies like Finexer elucidates a future where insurance is not only more tailored to individual needs but also more accessible.

As the industry continues to evolve, the adoption of open banking solutions by insurtech firms signals a shift towards more dynamic and customer-centric models of operation. Finexer’s innovative approach, particularly in implementing Variable Recurring Payments (VRPs), showcases the powerful impact of these technologies in achieving efficiency and customer satisfaction. The extensive benefits outlined, from enhanced risk assessment to cost reduction and improved customer loyalty, underscore the significance of open banking in the insurtech landscape. By embracing technologies that facilitate instant payments and bolster fraud prevention, insurtech companies are well-positioned to navigate the complexities of the modern financial ecosystem. For those looking to stay ahead in this rapidly changing environment, consider Finexer’s solutions for implementing VRPs, as they offer a critical pathway to innovation and excellence in the insurance industry.

FAQs

1. Why is Open Banking considered the future of financial technology?

Open Banking is set to revolutionise the future of FinTech by enabling third-party companies to utilise and process vast amounts of data through advanced technologies like Big Data and machine learning. This enhancement will significantly elevate the quality and value of services provided to users.

2. What impact does Open Banking have on the insurance industry?

Open Banking facilitates access to customers’ financial information, providing insurers with a wealth of data. This allows insurance companies to formulate more precise insurance policies and premiums, benefiting both the insurers and the insured.

3.What makes Finexer’s VRP solution stand out in the insurtech market? A: Finexer ‘s VRP solution leverages advanced technology to offer instant and efficient payment processing while ensuring regulatory compliance. This dual focus on efficiency and security positions Finexer as a leader in innovative payment solutions for the insurtech industry.

4. What makes Open Banking innovative?

Open Banking introduces several advantages for financial institutions, developers, and consumers, including the chance to explore new business models and revenue opportunities. It enables collaboration with third parties to broaden service offerings and gives fintech application users greater control over their data sharing preferences.

5. What is Open Banking and why is it significant?

Open Banking empowers consumers by giving them greater control over their financial data and enabling the creation of new services and applications. For non-financial entities, it provides the capability to offer tailored financial services, make more informed data-driven decisions, and innovate in areas such as payments and account management.

6. How does Finexer’s VRP solution handle regulatory changes? A: Finexer’s VRP solution is designed to stay compliant with evolving financial regulations, ensuring that all transactions meet current standards. This proactive approach to compliance enhances the security and trustworthiness of the payment process.

Streamline your insurance transactions with Finexer’s cutting-edge VRP system!