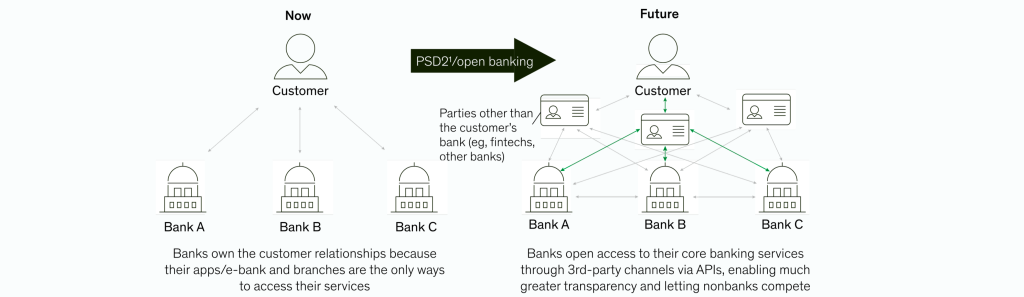

Open banking is a financial services model that allows third-party developers to access financial data in traditional banking systems through application programming interfaces (APIs). This model completely changes the way financial data is shared and accessed.

What You Will Learn From This Blog

✓ Understanding Credit Scoring

✓Traditional vs. Open Banking Factors

✓ Impact of Open Banking

✓ Finexer’s Solutions

Introduction

In an era where financial inclusivity is paramount, the interplay between Open Banking and credit scoring marks a significant leap forward in understanding and assessing an individual’s financial behavior and creditworthiness. Open Banking, a revolutionary system that provides third-party access to financial information through the use of APIs, is reshaping the landscape of credit scoring by offering a more nuanced view of an individual’s financial picture. This groundbreaking approach not only enhances risk assessment and affordability checks but also paves the way for more informed lending decisions. By leveraging real-time transaction data, Open Banking facilitates a comprehensive view of an individual’s financial health, moving beyond traditional metrics to include aspects like income verification and financial behavior.

This article will explore the fundamental principles of credit scoring, delineate the traditional factors involved, and provide an overview of Open Banking and its pivotal role in modern financial assessments. By examining the impact of Open Banking on credit scoring, we will uncover how this integration offers a deeper, more accurate assessment of creditworthiness, incorporating elements such as social credit scoring and open credit. This evolution towards a more transparent and user-friendly approach to credit assessment promises to empower businesses of all sizes in the UK, from Proptech to credit and lending enterprises, offering them innovative solutions to meet the challenges and opportunities of modern finance.

What is Credit Scoring?

Credit scoring is a method used by lenders to determine the creditworthiness of individuals and businesses. It involves a statistical analysis that predicts the likelihood of a borrower defaulting on a loan. This score is crucial as it influences the terms of credit, including interest rates and loan approvals.

Definition and Range:

A credit score is typically represented as a three-digit number ranging from 300 to 850, where a higher score indicates better creditworthiness .

The most common models for calculating credit scores include FICO and VantageScore, with FICO being used by approximately 90% of lenders .

Factors Influencing Credit Scores:

Payment History: This is the most significant factor, accounting for 35% of the score. It reflects whether payments on loans and credit cards are made on time .

Credit Utilisation: Making up 30% of the score, this shows how much credit the individual is using compared to their credit limit .

Length of Credit History: Longer credit histories are deemed less risky and contribute 15% to the score .

Types of Credit in Use and New Credit: These factors account for 10% each. They assess the mix of credit types handled and the number of recent credit applications .

Usage by Lenders:

Lenders use credit scores to assess the risk of lending to an individual or business. A high score can lead to better loan conditions such as lower interest rates and higher borrowing limits .

Besides financial institutions, credit scores are also considered by landlords, employers, and utility companies to evaluate reliability and financial responsibility .

Credit Reference Agencies:

Scores are calculated by credit reference agencies that maintain records of individuals’ and small businesses’ financial behaviour. These agencies collect data on credit relationships and payment histories to create detailed credit reports .

Impact on Financial Products:

The credit score affects eligibility for various financial products like mortgages, auto loans, and credit cards. It plays a pivotal role in the terms offered by lenders, impacting overall financial planning and management .

Understanding credit scoring is essential for anyone engaging in financial activities where credit might be extended. It not only affects the ability to obtain loans but also influences the conditions under which these loans are granted.

Traditional Factors in Credit Scoring

1.Income

Income does not directly impact credit scores as it is not included in credit reports . However, changes in income can indirectly affect credit scores if they lead to missed payments or higher debt levels .

2.Payment History

Payment history is the most critical factor, accounting for 35% of a credit score. Consistent on-time payments enhance scores, while missed payments can significantly harm them .

3.Length of Time Using Credit

The length of credit history contributes 15% to the credit score. Older accounts generally benefit the score more than newer ones, as they demonstrate a longer history of credit management .

Types of Credit

Having a mix of different credit types, such as credit cards, mortgages, and installment loans, affects 10% of the score. This diversity helps to improve the credit score by showing responsible management of various credit forms .

New Credit and Debt Levels:

Opening multiple new credit accounts in a short period can be detrimental as it represents 10% of the credit score. Frequent inquiries and increased debt levels can signal risk to lenders .

By understanding these traditional factors, individuals can better manage their financial behaviours to maintain or improve their credit scores.

Open Banking: An Overview

Definition and Principles

Open Banking, also known as “open bank data,” is a financial practice that grants third-party service providers access to consumer banking, transaction, and other financial data via application programming interfaces (APIs) . This system allows for the networking of accounts and data across institutions, enhancing innovation and reshaping the banking industry . The core principles of Open Banking include real-time data sharing, payment initiation, and providing comprehensive product and service information which facilitates consumer comparison and informed decision-making .

Key Features and Benefits

One of the pivotal features of Open Banking is the ability for consumers to securely share their financial data with other financial institutions . This capability is supported by APIs that use the customer’s data to offer a range of financial service options, create marketing profiles, or even initiate new transactions on behalf of the customer . Open Banking not only fosters competition among banks but also encourages them to adopt new technologies and improve customer service, ultimately benefiting the consumers with lower costs and better technology .

Furthermore, Open Banking empowers consumers by giving them control over who can access their financial data. Through secure APIs, customers ensure that their login details remain confidential, and they can specify the level of access third parties have to their banking information . This level of control extends to the ability to authorize or block payments, providing significant security and autonomy to the consumer .

The integration of Open Banking has led to the development of innovative financial products and services tailored to the specific needs of customers. These include enhanced budgeting tools, smarter customer onboarding processes, and more efficient affordability checks, all of which contribute to a more personalised and efficient financial experience .

Challenges in the UK Credit and Lending Sectors & Finexer’s Solution

Challenges

Data Accessibility and Quality ✘

- Limited datasets in traditional credit checks hinder a comprehensive view of an applicant’s financial health.

- This limitation can increase credit risks and lead to suboptimal lending decisions.

Finexer’s Solutions

Enhanced Data Accessibility and Quality ✓

Finexer’s platform leverages open banking APIs to access real-time bank transaction data, providing lenders with a more accurate and comprehensive financial profile of applicants. This enriched data allows for better credit risk assessment and decision-making.

- Real-time Data: Access to up-to-date financial data ensures that lenders can evaluate the most current financial status of applicants.

- Data Enrichment: Merchant enrichment and categorization features clean up transaction descriptions, add merchant details, and categorize expenses accurately.

Fraud and Security Concerns ✘

- Persistent issues with fraud and security in the credit and lending sectors.

- The sophistication of fraudsters requires robust verification and authentication measures.

- Ensuring transaction and personal data security is crucial but often costly.

Enhanced Fraud and Security Measures ✓

Finexer implements advanced security protocols and fraud detection mechanisms to protect both the lender and the borrower.

- Enterprise-level Security: REST APIs, AES-256 data encryption, fraud detection, TLS 1.2, and SHA-1 HMAC ensure robust security.

- Verification Tools: The platform includes KYC/KYB features, using bank data and facial recognition tools to verify identities, thereby reducing fraud risks.

Regulatory Compliance ✘

- The financial sector must comply with numerous regulations like GDPR, PSD2, and AML directives.

- Compliance demands significant resources and can slow innovation.

Enhanced Regulatory Compliance ✓

Finexer’s platform is fully compliant with PSD2 and other regulatory requirements, helping institutions save on the cost and complexity of compliance.

- PSD2 Compliance: Ensures that all transactions and data handling processes adhere to European regulatory standards.

- Automated Processes: Simplifies adherence to GDPR and AML directives, reducing the compliance burden.

Inconsistent Customer Experience ✘

- Customers encounter fragmented experiences and cumbersome application processes.

- Inconsistent service quality across different channels (online, in-person, mobile) leads to dissatisfaction and reduced customer loyalty.

Improved Customer Experience ✓

Finexer enhances the customer experience by offering instant payments, simplified application processes, and seamless integration across different channels.

- Instant Payments: Facilitates faster disbursement of funds using Faster Payments rails.

- Integrated Solutions: A unified platform that supports in-app, online, and QR code payments, providing a consistent and smooth user experience.

Inefficiencies in Payment Processing ✘

- Traditional payment systems are slow and costly.

- Credit and lending institutions face delays in fund disbursement and increased transaction costs due to inefficient payment rails.

Efficient Payment Processing ✓

Finexer reduces the costs and inefficiencies associated with traditional payment systems by offering instant A2A payments and bulk payout options.

- Cost Reduction: Fixed-fee open banking payments significantly reduce the costs compared to traditional card payments.

- Instant Recompense: Payments settle instantly, enhancing cash flow management for both lenders and borrowers.

Overview of Finexer’s Capabilities

Finexer offers an open banking platform that integrates with multiple banks via secure APIs, providing a comprehensive solution to many of the challenges faced by the credit and lending sectors. The platform focuses on instant payments, data enrichment, and robust verification methods.

Impact of Open Banking on Credit Scoring

Real-Time Data Access ✓

Open Banking revolutionises credit scoring by providing lenders with access to real-time financial data. This immediate availability of data allows for a more accurate and up-to-date assessment of an applicant’s financial health . By integrating real-time transaction data, such as consistent salary and rent payments, credit scoring becomes not only more comprehensive but also more reflective of the current financial status of individuals and businesses .

Enhanced Risk Assessment ✓

The use of Open Banking enables a more nuanced risk assessment process. Traditional credit scoring often relies on historical data that may not fully capture an individual’s current financial situation. With Open Banking, lenders can analyse detailed transaction data, offering insights into spending habits, income stability, and overall financial behaviour . This data-driven approach allows for the development of next-generation credit models that consider a broader set of financial indicators, significantly enhancing the accuracy of creditworthiness evaluations .

Fraud Prevention ✓

Open Banking also plays a crucial role in enhancing security and reducing fraud. By allowing direct access to bank data, it eliminates the need for document submission that can be easily falsified . The technology underpinning Open Banking, including APIs, employs advanced security measures such as encryption and tokens, which bolster the overall safety of the financial data exchanged . Additionally, mechanisms like strong customer authentication (SCA) are employed to verify the authenticity of the data, further mitigating the risk of fraud .

Conclusion

Throughout this examination of Open Banking and its transformative role in credit scoring, we’ve delved into how this innovation offers a more informed perspective on an individual’s financial behaviour and creditworthiness. It has become evident that Open Banking not only enriches the traditional credit scoring model with real-time financial data, but also enhances the lending process by allowing a more accurate assessment of risk and creditworthiness. This technology represents a significant leap forward in financial inclusivity and risk management, offering a deeper insight into an individual’s financial health beyond what was previously possible with traditional credit scoring methods.

In light of the advancements presented by Open Banking, the implications for CFOs and CIOs in businesses across the UK are profound. The integration of Open Banking solutions promises not only to refine risk assessment practices but also to open up new avenues for innovation in financial products and services. By embracing these changes, financial leaders can drive their organisations toward a more data-driven approach in their lending processes, enhancing both the efficiency and precision of creditworthiness evaluations. For businesses looking to stay ahead in the modern financial landscape, leveraging the capabilities of Open Banking is not just an opportunity; it’s becoming a necessity.

FAQs

What does open banking entail?

Open banking enables companies to access comprehensive financial data, which aids in making informed decisions ranging from risk analysis to investment planning. This data provides a more detailed insight than traditional financial statements.

What purpose does credit scoring serve?

Credit scoring systems are essential for determining the creditworthiness of both individuals and businesses. These systems use statistical algorithms and past credit performance to assess the probability of a borrower failing to meet their credit obligations.

How is credit scoring conducted by banks?

Banks use credit scoring models that assign varying importance to factors such as the amount of debt, payment history, and credit utilisation ratio. This helps in standardising the assessment of an applicant’s creditworthiness and in setting the terms of credit.

What benefits does open banking offer?

The latter half of 2023 saw a significant increase in open banking usage. By January 2024, approximately 13% of digitally active consumers were utilising open banking services, equating to one in seven consumers and 18% of small businesses.

GET IN TOUCH

Discover how Open Banking can revolutionise your credit assessment process and drive financial innovation—read on to learn more!