Bank transfer modes in the UK include CHAPS, BACS, SWIFT, and Faster Payments, each designed for different types of transactions. These methods vary in speed, cost, and purpose, offering tailored solutions for routine, high-value, and international transfers.

We will Guide you Through:

Introduction

Are you puzzled by your bank statement or unsure about how to make a specific payment? The UK banking sector uses several terms for transfers that might not be familiar to everyday banking customers.

This guide aims to clear up any confusion and simplify the jargon surrounding CHAPS, BACS, SWIFT and Faster Payments. We’ll explain each type and highlight their differences.

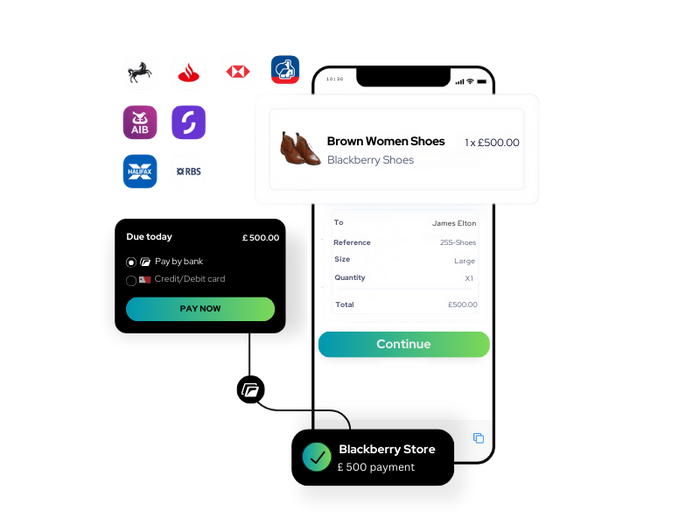

We’ll also briefly introduce a cost-effective alternative to bank payments using the Instant Payment from the financial services provider Finexer. It’s particularly useful for international transfers, allowing you to send money with low fees and competitive Transaction rates.

What are the main types of bank transfers in the UK?

The UK banking system primarily uses four types of bank transfers: CHAPS, BACS, SWIFT and Faster Payments. Each serves a different purpose and has its own costs, speed and requirements. Let’s explore each one in detail.

CHAPS Payment

CHAPS (Clearing House Automated Payment System) is typically used for retail, wholesale and high-value transactions within the UK. Its main advantage is speed, with payments arriving either instantly or on the same day.If you need to make a large, same-day payment, CHAPS is your go-to option. It’s ideal for substantial and time-critical transfers that must be received immediately, such as paying a house deposit. While there’s no minimum limit for a CHAPS payment, it’s rarely used for smaller transfers due to associated fees.

- Purpose: High-value, time-sensitive domestic transactions.

- Processing Time: Same-day, typically within hours.

- Cost: £20-£30 (varies by bank).

- Best for: Large transactions such as property purchases or corporate payments.

- Limitations: High fees make it impractical for small transactions.

BACS Payment

BACS (Bankers Automated Clearing Services) payments are standard transfers between UK bank accounts, used daily by individuals and businesses alike. This fee-free payment method comes in two forms – Direct Debits and Direct Credits. The maximum amount you can send via BACS varies depending on your bank and account type. BACS payments typically take up to three working days to clear.For quicker transfers, you’ll need to use either CHAPS or Faster Payments. To make a BACS payment, you usually only need the recipient’s bank account details, including their sort code.

- Purpose: Routine domestic transfers for individuals and businesses.

- Processing Time: Up to 3 working days.

- Cost: Usually free or minimal.

- Best for: Payroll, direct debits, and non-urgent bank-to-bank transfers.

- Limitations: Slower compared to other payment methods.

Faster Payments

Faster Payments are near-instantaneous transfers¹ between UK bank accounts. Introduced in 2008, they’re a relatively new addition to the UK banking landscape. This is one of the most common transfer types for small, everyday transactions. Faster Payments can be sent 24/7, and the funds arrive in the recipient’s account almost immediately. The best part? You typically don’t pay extra for this service, and it happens automatically.

- Purpose: Quick, everyday transactions within the UK.

- Processing Time: Typically instant, available 24/7.

- Cost: Usually free.

- Best for: Small to medium-sized personal and business transactions.

- Limitations: Some banks impose limits on the maximum transfer amount.

SWIFT payment

SWIFT (Society for Worldwide Interbank Financial Telecommunication) payments are designed specifically for international transfers. If you need to send money between your UK bank account and an account in another country, you’ll likely use SWIFT. It is actually a network of banks, each identified by their unique SWIFT code.

While SWIFT transfers are reliable for international payments, they’re not the swiftest option. The average transaction takes 1-4 business days. Transfer duration often hinges on the destination and banks involved. Your payment might pass through several banks en route, which increases time and potentially cost.

Regarding expenses, SWIFT payments typically incur a fee from your bank. If other banks are involved in the process, you (or your recipient) might face additional charges known as correspondent or intermediary bank fees.

- Purpose: International money transfers.

- Processing Time: 1-4 business days.

- Cost: £5 to £25, plus possible intermediary bank fees and exchange rate markups.

- Best for: Sending money abroad securely.

- Limitations: Can be expensive and slow compared to other international transfer solutions.

Comparing CHAPS, BACS, SWIFT, and Faster Payments

| Payment Method | Advantages | Limitations |

|---|---|---|

| CHAPS |

|

|

| BACS |

|

|

| SWIFT |

|

|

| Faster Payments |

|

|

What are the costs for CHAPS, BACS, SWIFT, or Faster Payments?

The cost of each transfer type: While fees may vary among UK banks and providers, here’s an overview of expected charges:

| Payment Type | Approximate Cost |

|---|---|

| CHAPS | Typically £20-£30 |

| BACS | Usually free or minimal cost |

| SWIFT | Bank-set fees ranging from £5 to £25 + possible intermediary/recipient bank charges + potential exchange rate markup |

| Faster Payments | Usually free or minimal cost |

How long do different payment methods take?

Besides fees, you’ll want to know the processing times for various bank transfer types. This is crucial if you need a payment to arrive promptly.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Choose Finexer for Faster Payments?

Finexer offers a smarter, more efficient alternative to traditional bank transfers, eliminating delays and high costs. Here’s why businesses and individuals trust Finexer for their payments:

✔ Real-Time Transactions – Instantly transfer funds, 24/7, without waiting for banking hours or processing delays.

✔ Low-Cost, Transparent Pricing – Enjoy startup-friendly rates with no hidden fees or excessive bank charges.

✔ Direct Access to 99% of UK Banks – Seamless payments with a single integration, ensuring speed and efficiency.

✔ Enterprise-Grade Security & FCA Compliance – Built on a fully regulated infrastructure, ensuring safety and compliance with UK financial standards.

✔ Scalable & Customizable – Whether you’re a startup or an enterprise, Finexer provides white-label solutions and scalability without additional tech investment.

✔ 3X Faster Deployment – Get up and running quickly with hassle-free integration and real-time onboarding support.

How long does a bank transfer take in the UK?

->BACS: Up to three working days.

->CHAPS: Same-day processing if initiated within bank cut-off times.

->Faster Payments: Typically processed within seconds, though it can take up to two hours.

->SWIFT: International transfers can take between one to four working days, depending on the countries and banks involved.

Are there limits on the amount I can transfer using Faster Payments?

What details are required to make a bank transfer?

To initiate a bank transfer, you’ll typically need:

->The recipient’s name.

->Their sort code (a six-digit number identifying the bank branch).

->Their account number (usually eight digits).

->A payment reference to help the recipient identify the payment’s purpose

How secure are bank transfers in the UK?

Bank transfers in the UK are generally secure, protected by robust banking regulations and security protocols. However, it’s essential to ensure you’re sending money to trusted recipients and to double-check all details before confirming a transfer to avoid errors or potential fraud.

Can Finexer be integrated with existing business systems?

Yes, Finexer offers robust APIs that allow seamless integration with various business platforms, including accounting software and ERP systems. This integration facilitates automated payment processing and real-time financial data access.

What are the benefits of using Finexer over traditional bank transfers?

Finexer provides several advantages over traditional bank transfers, including:

->Instant Payments: Real-time fund transfers without delays.

->Cost-Effective Solutions: Lower transaction fees compared to traditional banks.

->Enhanced Security: Advanced security measures to protect transactions.

->Seamless Integration: Easy integration with existing business systems for streamlined operations.

Now Experience Faster Payments with Finexer! Schedule your free demo and get a 14 days Trial by Finexer 🙂