bulk payments system is a banking system that enables you to make payments to multiple payees on a bulk list. The bulk list is made up of beneficiaries chosen to receive payment from a single account.

What You Will Discover:

How Do Contractors Currently Manage Payroll in Construction?

Contractors in the construction industry typically handle employee payments using traditional methods like direct bank transfers or physical checks. This process is often manual, requiring each fee to be processed and tracked individually. It’s a time-consuming task that demands attention to detail to avoid errors, such as incorrect amounts or missed payments.

Finance teams or contractors must meticulously track and reconcile these payments, often relying on basic tools like spreadsheets. This not only eats up valuable time but also leaves room for mistakes. Additionally, ensuring that all payments comply with regulations adds another layer of complexity to the process.

Overall, managing payroll in this manner can be cumbersome and inefficient, making it harder for contractors to focus on what truly matters—delivering successful projects.

What Problems Do Contractors Might Face in Managing Payments?

High Costs: Traditional methods like bank transfers and checks have higher transaction fees, which reduce profit margins.

Manual and Time-Consuming: Contractors often handle payments manually, which is labour-intensive and inefficient. It takes up valuable time that could be better spent on core activities.

High Error Risk: Manual processes increase the likelihood of errors, such as duplicate payments or incorrect amounts, leading to disputes and project delays.

Lack of Visibility: Without integrated systems, contractors struggle to have real-time visibility over payments, complicating budget management and payment execution.

Compliance and Security Issues: Ensuring regulatory compliance and secure payments is challenging without automation, increasing the risk of non-compliance and fraud.

Can these Inefficiencies be eliminated with one effective solution?

Yes, these inefficiencies can be eliminated with one simple and effective solution: Bulk payments.

Think about how much time and effort goes into manually processing payments for all your suppliers, subcontractors, and workers. It’s a tedious process that takes up your valuable time and increases the risk of making costly mistakes, like sending duplicate payments or getting the amounts wrong.

With bulk payments, you can handle all these transactions at once. Imagine processing dozens, even hundreds, of payments in one go, without worrying about errors or delays. It’s like having a supercharged version of your current system, but much faster and more reliable.

Bulk payments also give you better control over your finances. You’ll have real-time visibility into where your money is going, making it easier to manage your budget and ensure everyone gets paid on time. Plus, by automating the process, bulk payments help you stay on top of regulatory requirements and keep your transactions secure, without the constant manual checks.

And let’s not forget about the cost savings. By consolidating your payments, you reduce the fees associated with traditional payment methods, which can add up over time. Bulk payments also eliminate the need for redundant processes, allowing you to focus on what matters—getting your projects done efficiently and effectively.

It’s a smart move that can make a big difference in managing your payments, letting you put your energy where it belongs: on your projects and your team.

📚 Read more about Bulk Payments

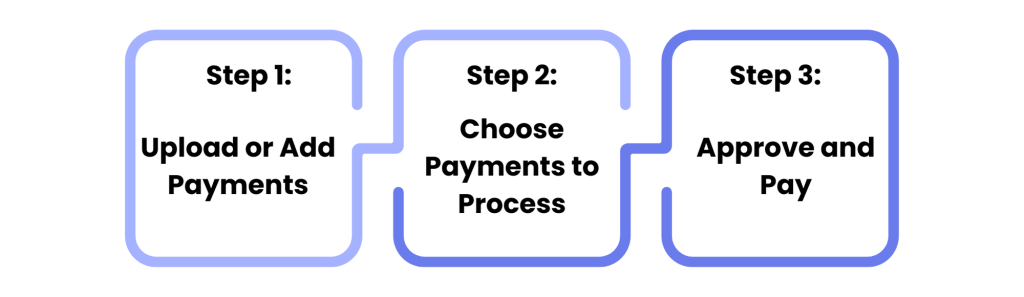

How Does it Work?

Step 1: Upload or Add Payments

- Upload a CSV: Start by uploading a CSV file that contains all your payment details. This file will list the payments you need to process in one go.

- Sync with Integrations: Automatically sync outstanding invoices and bills from your accounting software, making sure all due payments are ready.

- Manual Entry: If needed, you can manually add or adjust payment details directly within the platform.

Step 2: Select the Payments

- Review the payments you’ve uploaded or synced and choose which ones to include in this payment run.

Step 3: Approve and Pay

- Choose the bank account from which the payments will be made.

- Approve the payment run, and the system will process all selected payments in one go.

This streamlined process allows you to handle multiple payments efficiently, saving time and reducing the risk of errors.

📚 Guide to Bulk Payouts in 2025

Are Bulk Payments Secure?

Yes, bulk payments are secure.

Encryption: Bulk payments use advanced encryption to protect sensitive data during transmission.

Compliance: These platforms adhere to regulations like GDPR and AML, reducing fraud risks.

Authentication: Multi-factor authentication ensures only authorised users can process payments.

Monitoring: Real-time monitoring detects and mitigates suspicious activities instantly.

Audit Trails: Comprehensive audit logs ensure transparency and accountability.

What are the Benefits of Using Bulk Payments?

If your business is growing and you’re managing more outgoing payments, you might wonder if there’s a better way to handle them. Bulk payments could be the answer, and here’s why:

✓ Secure Transactions: Bulk payments are safeguarded by advanced encryption, ensuring your financial data stays protected. Since these payments often involve recurring amounts, they also make detecting and preventing fraudulent activities easier.

✓ Quick and Efficient: Bulk payments allow you to process multiple transactions instantly, which is perfect for time-sensitive payments like payroll. This speed ensures everyone gets paid on time, reducing stress and keeping your business running smoothly.

✓ Cost Savings: Handling payments in bulk is more economical than processing each one individually. It reduces administrative work and helps you avoid the higher fees associated with multiple transactions, protecting your bottom line.

Bulk Payments Service provider

Finexer’s bulk payment services are designed to reduce the administrative burden of managing multiple transactions, helping businesses save time and minimise errors. The platform also ensures that all payments are processed securely, adhering to the highest compliance and data protection standards. With features like real-time monitoring, multi-factor authentication, and detailed reporting, Whether you’re a small business or a large enterprise, Finexer’s bulk payment solutions can help you streamline your payment processes, reduce costs, and focus on what matters most—growing your business.

Are you interested in Switching to bulk payments for quick and secure multiple payments with a single click !