Introduction

Imagine a world where verifying income and account balances no longer involves piles of paperwork, endless back-and-forths, or manual errors. For businesses, this is no longer a futuristic idea—it’s a solution available today through open banking.

Income and balance verification gives businesses accessto accurate financial insights in real-time. Whether you’re a lender evaluating a borrower’s credibility, a fintech startup creating personalised financial tools, or a business owner managing operational cash flow, this feature streamlines decision-making like never before.

Recent trends underscore the growing importance of these tools. Open banking adoption continues to rise, with 7.2% of digitally enabled customers actively using data connections as of January 2024. This shift highlights the increasing trust in open banking frameworks and the demand for real-time financial transparency.

In this guide, we’ll explore how income and balance verification works, its practical applications across industries, and why it’s becoming a vital component of modern financial systems. If your goal is to simplify processes, reduce errors, and make smarter financial decisions, you’re in the right place.

We will discuss about:

What is Income & Balance Verification?

Income and balance verification refers to the process of securely accessing and validating an individual’s or business’s financial data, including income, expenses, and account balances. This information is accessed through open banking frameworks, which enable businesses to retrieve data directly from bank accounts with the customer’s explicit consent.

Through income and balance verification, businesses can:

- Confirm the regularity and stability of income.

- Validate current account balances and expense patterns.

- Access reliable financial data without relying on manual documents or outdated statements.

The process leverages Application Programming Interfaces (APIs) provided by open banking platforms. These APIs act as secure bridges between banks and third-party providers, ensuring data is transferred safely and in compliance with regulations like PSD2 and GDPR.

How is it Different from Traditional Methods?

Traditional income verification methods often rely on pay stubs, bank statements, or tax filings—documents that can be outdated or prone to errors. Similarly, balance checks are manual and time-consuming. Income and balance verification through open banking eliminates these inefficiencies by providing real-time, accurate, and automated access to financial data.

For example:

- Instead of manually collecting three months of bank statements, lenders can retrieve verified account information instantly.

- Businesses can automate income analysis and expense tracking, saving time and reducing human error.

How Does Income & Balance Verification Work?

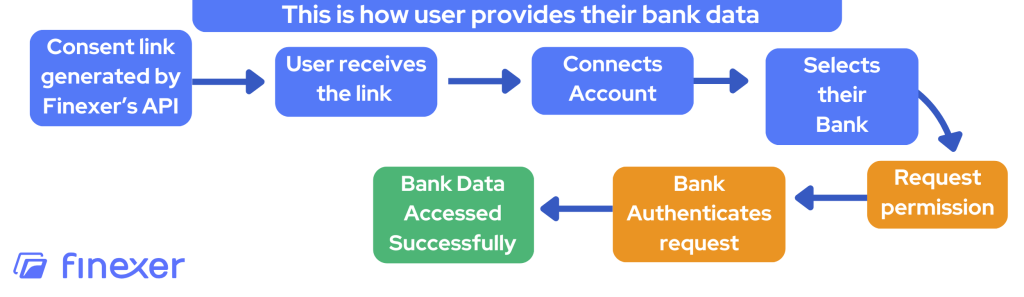

To understand how income and balance verification operates, let’s break it down step by step. This process leverages open banking frameworks and APIs, ensuring security, transparency, and efficiency.

Step 1: Customer Consent

The process begins with the user granting explicit permission to share their financial data. This ensures transparency and puts the customer in control of their information.

- Example: A user applying for a loan might consent to share their income and account balance with the lender for evaluation.

Step 2: Data Retrieval

Once consent is obtained, the open banking API retrieves financial data directly from the user’s bank account. This includes:

- Income details: Salary payments, recurring deposits, etc.

- Balance information: Current account balances and transaction patterns.

- Expense breakdown: A categorised overview of spending.

Step 3: Verification

The retrieved data is automatically validated to ensure accuracy and authenticity. This step eliminates the need for manual document reviews, reducing the risk of errors or fraud.

- Example: A lender can confirm whether a borrower has sufficient income stability to qualify for a loan.

Step 4: Insights and Decision-Making

The verified data is then presented in an easy-to-understand format, enabling businesses to make informed decisions quickly. This can be integrated into dashboards, reports, or decision-making tools.

- Example: An accounting software might use this data to automate expense tracking or provide real-time cash flow insights.

Step 5: Ongoing Monitoring (Optional)

For businesses requiring continuous updates, APIs can fetch real-time financial data periodically based on the permissions granted. This is particularly useful for recurring evaluations or ongoing financial monitoring.

📚 Learn more about Real-time bank transaction data

Practical Applications of Income & Balance Verification

Income and balance verification has become a cornerstone for businesses looking to streamline financial processes, improve decision-making, and deliver personalised services. Here’s how this powerful feature is transforming key industries:

1. Lenders and Credit Providers

Lenders rely heavily on accurate financial data to assess a borrower’s creditworthiness. Income and balance verification removes the guesswork by providing real-time access to verified data, reducing risks and ensuring faster loan approvals.

- Use Cases:

- Faster Loan Approvals: Automate the evaluation of income and expenses, enabling decisions in minutes instead of days.

- Risk Assessment: Analyse transaction patterns, income stability, and spending behavior to determine a borrower’s financial health.

- Default Prevention: Lenders can identify risky financial habits early, reducing the likelihood of loan defaults.

- Example:

A lending company integrates income verification APIs to automatically assess loan applications. By analysing salary deposits and expense patterns, it reduces loan approval times from 3 days to a few hours, offering a better customer experience and minimising risk.

2. Fintech Startups

Fintech companies thrive on providing innovative and user-friendly financial solutions. Income and balance verification allows these startups to develop cutting-edge tools that enhance user engagement and improve financial decision-making.

- Use Cases:

- Budgeting and Savings Tools: Provide users with personalised financial insights by analysing their income and spending habits.

- Credit Scoring: Develop advanced scoring models that go beyond traditional credit checks by incorporating real-time cash flow analysis.

- Fraud Detection: Detect anomalies in transactions to flag suspicious activities and ensure the safety of users’ financial data.

- Example:

A fintech startup builds a personal finance app that categorises expenses, tracks income, and offers savings recommendations. Using income verification, the app delivers tailored financial advice to its users, improving retention rates and user satisfaction.

📚 Download Finexer’s USP for Startups in the UK

3. Small and Medium-Sized Businesses (SMBs)

For SMBs, managing finances efficiently is critical to staying competitive. Income and balance verification offers accurate, real-time insights into cash flow, empowering business owners to make informed financial decisions.

- Use Cases:

- Cash Flow Management: Track operational expenses and incoming revenue in real time to avoid financial bottlenecks.

- Tax Preparation: Automatically categorise expenses and income for seamless tax filings, reducing manual errors and saving time.

- Payroll Validation: Verify employee account balances to ensure timely and accurate payroll processing.

- Example:

An SMB owner uses balance verification tools to monitor monthly cash flow and track incoming payments. By accessing real-time data, the owner can plan investments and avoid cash shortages during peak business cycles.

4. Accounting and ERP Services

Income and balance verification brings automation to accounting and ERP (Enterprise Resource Planning) systems, making financial management simpler, faster, and more accurate.

- Use Cases:

- Bank Reconciliation: Automatically match bank transactions with invoices, eliminating the need for manual entry and reducing errors.

- Financial Reporting: Generate instant, real-time financial reports for audits, tax filings, and compliance purposes.

- Expense Categorisation: Simplify bookkeeping by providing categorised expense data directly from the user’s bank account.

- Example:

An ERP software integrates income verification to produce quarterly financial statements for clients. This automation saves accountants hours of manual work, increasing their efficiency and allowing them to focus on strategic tasks.

5. Payment Processors

Payment platforms can leverage income and balance verification to enhance security, ensure faster processing, and deliver seamless payment experiences for users.

- Use Cases:

- Balance Checks: Confirm the availability of funds before processing high-value transactions to prevent failures.

- Fraud Mitigation: Monitor transaction patterns to detect unusual activity and flag suspicious accounts.

- Real-Time Payment Confirmation: Provide instant verification and confirmation of successful payments.

- Example:

A payment processor integrates balance verification to ensure sufficient funds before initiating large transactions. This reduces transaction failures, improves customer trust, and minimises operational delays.

6. Financial Advisors and Wealth Managers

Financial advisors can use income and balance verification to provide their clients with tailored advice based on real-time financial insights.

- Use Cases:

- Wealth Planning: Create investment strategies by analysing current account balances and regular income streams.

- Debt Management: Recommend debt reduction strategies by reviewing expenses and repayment capacity.

- Real-Time Financial Insights: Offer clients on-demand updates about their financial health for better decision-making.

- Example:

A financial advisory firm uses balance verification to monitor its clients’ cash flow and expenses. By having real-time access to financial data, advisors can provide timely recommendations on investments and savings strategies.

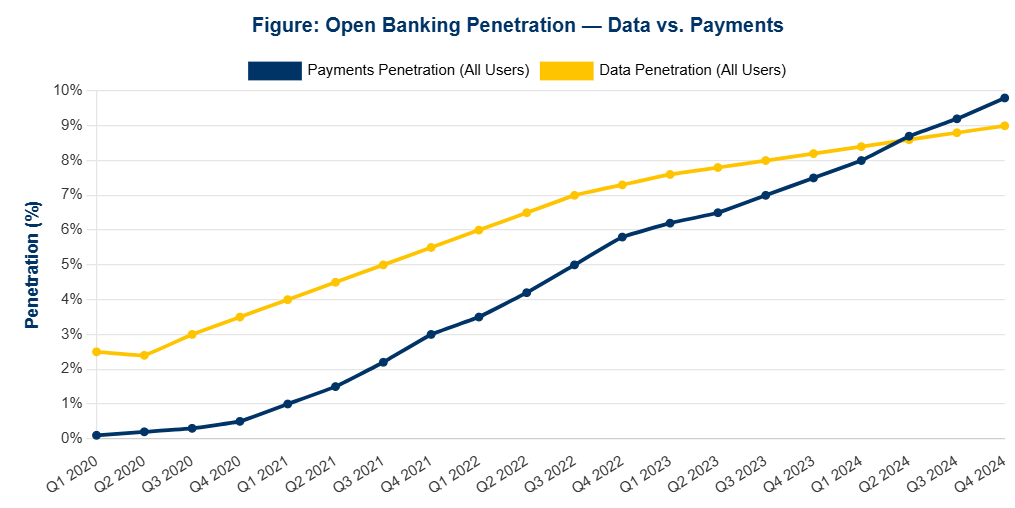

Statistical Insights

Open banking is rapidly gaining traction, with 8.2% of digitally enabled consumers using open banking payments and 7.2% leveraging data connections by January 2024. This surge reflects growing trust and signals that now is the perfect time to adopt open banking for streamlined processes like Income & Balance Verification. Source

Challenges and How to Overcome Them

While income and balance verification offers immense benefits, businesses must navigate certain challenges to fully leverage its potential. Understanding these challenges and addressing them effectively ensures a smooth and secure implementation.

1. Data Security and Privacy

The Challenge:

Accessing sensitive financial data raises concerns about data breaches and privacy violations. Customers need to trust that their information will be handled securely and responsibly.

How to Overcome It:

- Use secure APIs that adhere to regulatory frameworks like PSD2 and GDPR.

- Implement encryption protocols to safeguard data during transmission and storage.

- Maintain transparency with users by providing clear consent workflows that explain how their data will be used.

- Partner with trusted Open banking platforms that prioritise security and regulatory compliance.

2. Customer Trust and Adoption

The Challenge:

Convincing customers to share their financial data can be difficult, especially if they are unaware of the benefits or concerned about misuse.

How to Overcome It:

- Clearly communicate the value of income and balance verification, such as faster loan approvals or improved financial planning.

- Use simple and user-friendly consent mechanisms that instill confidence.

- Highlight the regulatory safeguards in place, such as compliance with GDPR and PSD2, to reassure users that their data is safe.

3. Integration Complexity

The Challenge:

Integrating open banking APIs with existing systems can be technically challenging, especially for businesses with legacy infrastructure.

How to Overcome It:

- Partner with providers like Finexer, which offer developer-friendly APIs and robust documentation for seamless integration.

- Use tools that simplify API implementation and compatibility with multiple banks.

- Test the integration rigorously before full deployment to ensure smooth functionality.

4. Regulatory Compliance

The Challenge:

Open banking frameworks are governed by strict regulations, and businesses must ensure compliance to avoid legal issues and maintain customer trust.

How to Overcome It:

- Stay updated on regulatory requirements such as PSD2 in the UK and GDPR for data protection.

- Partner with open banking platforms like Finexer that are already compliant with these regulations, eliminating the burden of managing compliance independently.

- Train employees on the importance of regulatory compliance to prevent accidental breaches.

Don’t Worry—We’ve Got You Covered!

Overcoming Compliance hurdles is simpler with Finexer’s Secure Verification. Enjoy a 14-day free trial and discover how effortless verification can be.

Why Choose Finexer for Income & Balance Verification?

When it comes to income and balance verification, you need a solution that is secure, reliable, and easy to use. Finexer offers exactly that—a trusted platform that helps businesses access financial data seamlessly while ensuring compliance and customer trust. Here’s why Finexer is the right choice for your verification needs:

1. Access to 99% of UK Banks

With Finexer, you’re not limited by which banks your customers use. Our platform connects to almost every bank in the UK, providing you with real-time access to income, expense, and balance data. Whether it’s for individuals or businesses, you get the data you need, when you need it.

2. Fully Compliant with Regulations

Handling sensitive financial data requires strict adherence to regulations like PSD2 and GDPR. Finexer is built on a foundation of compliance, so you can rest assured that all data is managed securely and ethically. This not only protects your business but also builds trust with your customers.

3. Easy Integration for Any Business

Finexer’s developer-friendly APIs make integration simple, even for businesses without extensive technical resources. Our clear documentation and expert support ensure you can get up and running quickly, saving you time and effort.

4. Secure and Reliable Infrastructure

When you work with financial data, reliability isn’t optional—it’s critical. Finexer guarantees nearly 100% uptime, so you’ll always have uninterrupted access to real-time financial information. Plus, we use advanced security measures to ensure that data is protected every step of the way.

5. Tailored to Your Needs

Finexer isn’t a one-size-fits-all solution. Whether you’re a fintech startup creating innovative apps, a lender assessing credit applications, or a small business managing cash flow, our platform adapts to your specific needs. From scalable solutions to custom branding options, Finexer is designed to work for you.

6. Dedicated Support Every Step of the Way

We understand that adopting new technology can feel overwhelming, but you’re not alone. Finexer’s team of experts is here to guide you, whether you’re integrating our APIs, troubleshooting an issue, or just exploring new possibilities.

Try Income & balance check today! Schedule your demo and get a 14 days free Trial by Finexer 🙂