Picture this: you’re about to buy that shiny new gadget online, and you link your bank account to pay. But have you ever wondered how the seller knows that account truly belongs to you? That’s where Open Banking Authentication steps in—and it’s so much more than a fancy buzzword.

Wondering If This Blog Is for You?

If you’re a lender eager to validate borrowers’ bank details, a fintech startup aiming to streamline user onboarding, or a marketplace operator verifying seller payouts, keep reading. You might even be a compliance manager juggling PSD2 and other regulations. In any case, you’ll soon discover how open banking authentication can boost security, trust, and efficiency. By the end of this post, you’ll have a clear roadmap for implementing a streamlined authentication process that protects your business—and your customers.

Let us guide you through:

What is Open Banking Authentication?

Open banking authentication is all about securely confirming that a person or business owns a specific bank account. Using secure, regulated APIs, this process ensures account ownership quickly and safely, without unnecessary hassle. And it’s not optional—regulations like PSD2 in the UK have made these measures a legal requirement. By following these guidelines, businesses can protect themselves from fraud while providing a trustworthy and secure experience for their users.

Not sure what “authentication” actually means? Here’s a simple way to think about it:

- Authentication: Proving someone owns a specific bank account. (“Yes, this is my account number, and I can prove it.”)

- Verification: Proving someone is who they say they are. (“Yes, I am John Doe.”)

While both are essential, authentication focuses specifically on confirming account ownership. It plays a crucial role in keeping financial interactions safe and secure for everyone involved.

Why Is Authentication So Important?

In today’s interconnected financial world, confirming that someone genuinely owns a bank account has evolved from “nice to have” to “must have.” Every time a business processes a loan application, onboards a seller, or pays out earnings, they need to be sure that the bank account in question actually belongs to that individual or company. Skipping this step can lead to fraudulent transactions, chargebacks, and, worst of all, a serious dent in customer trust.

Think about it from a business’s perspective: if anyone can claim ownership of a random bank account, chaos soon follows—financial losses, unhappy customers, and plenty of headaches. Proper authentication helps you avoid these pitfalls, showing your customers you’re on top of security and saving your team from handling expensive fraud cases.

Why Should Businesses Care?

Fraud is a multi-billion-dollar problem. Beyond the immediate financial hit, once trust is lost, it’s tough to rebuild. Customers want to feel safe when they do business with you. By implementing robust authentication, you send a clear message: “We take your security seriously.”

This is where Finexer comes in. Our open banking APIs make authenticating account ownership a snap—reducing fraud and ensuring a seamless onboarding process. No complicated tech. No endless red tape. Just an easy, instant way to protect your business and your customers.

So, the next time you (or your customers) need to connect a bank account, remember: with Open Banking Authentication, you’re not just ticking a compliance box. You’re protecting your reputation, your revenue, and ultimately—your customers.

How Open Banking Authentication Works

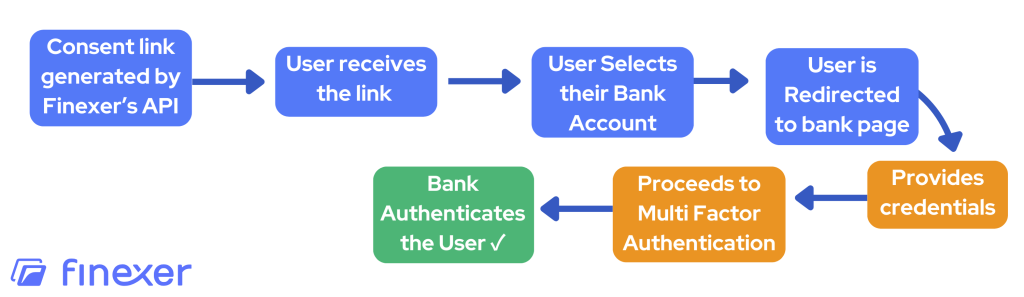

To truly understand the power of open banking authentication, it’s helpful to break down the process into its key steps. By following a standardised and secure framework, open banking authentication ensures that financial transactions remain both safe and efficient.

Step 1: User Consent

Authentication begins with the user granting permission. Whether it’s an individual linking a payment app or a business verifying an account for a loan application, the process always starts with explicit consent. This step is crucial—not just for compliance with regulations like GDPR and PSD2—but also for building trust with users. By giving customers control over their data, businesses create a transparent and secure experience.

Step 2: Secure Redirection

Once the user consents, they are redirected to their bank’s environment or a secure interface provided by the bank. This could be through a browser, an app, or even a dedicated portal. Here, the user confirms ownership of the account by logging in using their bank credentials. Importantly, this step ensures that sensitive data, such as passwords, is never shared directly with the third-party provider.

Step 3: Multi-Factor Authentication (MFA)

To strengthen security, many banks require multi-factor authentication (MFA). This step involves the user confirming their identity through one or more additional methods, such as:

- A One-Time Password (OTP) sent via SMS or email.

- Biometric Authentication, like a fingerprint or facial recognition.

- Hardware Tokens or authentication apps that generate time-sensitive codes.

This step provides an extra layer of protection, ensuring that only the legitimate account owner can complete the process.

Insights

In 2022, the most widely used authentication technology among companies worldwide was Multi-Factor Authentication (MFA). Meanwhile, 48% of organisations adopted passwordless authentication methods to bolster security and mitigate fraud risks. Source

Step 4: Confirmation to the Third-Party

Once the bank is satisfied with the user’s authentication, it notifies the third-party provider (TPP) that the account has been authenticated and is valid. This notification is sent securely, often using encrypted API connections. At no point does the TPP gain direct access to the user’s credentials; they only receive the confirmation needed to proceed.

How Does This Process Protect Users and Businesses?

By following these steps, open banking authentication creates a secure, closed-loop system. Fraudsters can’t impersonate legitimate account holders without access to the multiple layers of verification in place. At the same time, businesses can confidently interact with authenticated accounts, reducing the risks of chargebacks, fraudulent applications, or disputes.

An Example in Action

Let’s consider an example. A user wants to link their bank account to a budgeting app. Here’s what happens:

- The app asks for permission to connect to the user’s bank account.

- The user is redirected to their bank’s login page to enter their credentials.

- After logging in, the bank requests an additional verification step, such as entering an OTP.

- Once the user completes the verification, the bank confirms to the app that the account is authenticated. Now the app can securely access transaction data, enabling the user to manage their finances.

This seamless flow not only protects sensitive data but also enhances the user experience by making the process quick and hassle-free.

Real-World Applications

Open banking authentication isn’t just a technical process—it’s a practical solution with widespread applications across industries. Let’s explore how this technology is being used in real-world scenarios to address common challenges and improve outcomes for businesses and customers alike.

1. Lending and Credit Applications

For lenders, trust is everything. Before approving a loan or extending credit, financial institutions need to ensure that the applicant owns the account associated with their income or repayment plan.

- The Challenge: Without account authentication, lenders risk approving loans for applicants using false or fraudulent bank details. This could lead to non-repayment and financial losses.

- The Solution: With open banking authentication, lenders can confirm ownership of a bank account instantly. This reduces paperwork, speeds up the decision-making process, and minimises the risk of fraudulent applications.

- Example: A mortgage provider uses authentication to verify that the applicant owns the bank account where their salary is deposited. This quick verification ensures both accuracy and compliance.

2. Fintech Apps and Digital Wallets

Fintech applications often rely on connecting to users’ bank accounts to offer features like budgeting, payments, and money transfers. Ensuring only legitimate account holders can link their accounts is critical for these platforms.

- The Challenge: Fraudsters attempting to link stolen or unauthorised accounts can exploit apps to commit financial crimes or misuse services.

- The Solution: Open banking authentication ensures that only the rightful owner can link their account to a fintech app. By redirecting users to their bank’s secure environment for verification, apps can confidently onboard new users.

- Example: A budgeting app allows users to analyse their spending by connecting their bank account. Through authentication, the app ensures that only the actual account holder can gain access, preventing data breaches or unauthorised activity.

📚 Guide to Real-time Transaction data

3. Marketplace Platforms and Payout Verification

Online marketplaces, whether for goods, services, or freelance work, frequently handle payouts to sellers or service providers. Verifying that these payouts are sent to the correct bank account is critical.

- The Challenge: Without proper authentication, payments could be sent to the wrong account, leading to disputes and loss of trust in the platform.

- The Solution: Marketplace platforms use open banking authentication to verify account ownership before processing payouts. This ensures that funds are directed to the correct individual or business.

- Example: A freelancing platform uses authentication to confirm that a service provider owns the bank account linked to their profile. This eliminates errors in payouts and builds trust with users.

4. Fraud Prevention Across Industries

Fraud prevention is a universal concern, and open banking authentication addresses this challenge head-on. By requiring users to verify account ownership through multiple layers of security, businesses can significantly reduce the risk of fraud.

Insights

Implementing multifactor authentication (MFA) significantly enhances account security and prevents Fraud. A Microsoft study found that over 99.99% of MFA-enabled accounts remained secure during their investigation period. Source

5. Faster Onboarding for Businesses

Authentication doesn’t just prevent fraud; it also speeds up customer onboarding. Businesses can verify account ownership in seconds, eliminating the need for manual checks and lengthy delays.

- The Challenge: Lengthy onboarding processes can frustrate customers and increase the risk of drop-offs.

- The Solution: By automating authentication through open banking APIs, businesses can onboard customers quickly and securely.

- Example: An e-commerce platform uses open banking authentication to verify customers’ bank accounts before offering financing options at checkout. The process takes just moments, ensuring a smooth user experience.

Key Benefits for Businesses

Across all these use cases, the advantages for businesses are clear:

- Reduced Fraud Risk: Authenticating accounts prevents unauthorised access and fraudulent transactions.

- Improved Customer Trust: By using secure authentication methods, businesses demonstrate their commitment to protecting user data.

- Faster Transactions: Automation ensures quick verification, which benefits both businesses and customers.

- Regulatory Compliance: Following open banking standards like PSD2 ensures that businesses meet legal requirements without additional effort.

Secure Your Transactions Today!

Experience seamless and secure account authentication with Finexer. Start your free 14-day trial and see how easy it is to protect your business and customers.

How Finexer Simplifies Open Banking Authentication

Now that we’ve explored how open banking authentication works and its real-world applications, it’s time to understand how Finexer makes it easy for businesses to implement and benefit from this critical process. By providing a streamlined solution, Finexer eliminates technical hurdles and ensures businesses can focus on what matters most—serving their customers securely and efficiently.

1. A Single API to Connect with 99% of UK Banks

Integrating with multiple banking systems can be a daunting task for any business. Finexer simplifies this process with a one-stop API that connects to the vast majority of banks in the UK. Instead of spending time and resources integrating with individual banks, businesses can rely on Finexer to provide seamless connectivity.

- What This Means for You: A single integration handles authentication requests across nearly all UK banks, saving time, reducing complexity, and lowering development costs.

- Real-World Impact: Whether you’re a fintech app onboarding new users or a marketplace verifying seller accounts, Finexer’s API ensures a consistent and reliable authentication experience.

2. Scalability to Match Business Growth

As your business grows, the demand for secure and fast authentication increases. Finexer’s platform is built to handle thousands of authentication requests daily, ensuring scalability without compromising performance.

- What This Means for You: You can grow your user base confidently, knowing that your authentication system can keep up with increasing demand.

- Example: A lending platform processes hundreds of loan applications daily. With Finexer’s scalable infrastructure, they can authenticate account ownership instantly, regardless of volume.

3. Compliance Handled by Experts

Navigating regulatory requirements like PSD2, GDPR, and FCA authorisation can be overwhelming. Finexer takes care of these complexities, ensuring that all authentication processes meet the highest legal and security standards.

- What This Means for You: Focus on your business operations while Finexer ensures full compliance with regulatory frameworks.

- Example: A startup launching a fintech app doesn’t need to worry about keeping up with evolving regulations—Finexer’s solution is always up-to-date.

4. Customisation for Your Brand

Finexer understands that customer experience is key. That’s why its solution allows businesses to embed authentication workflows into their own platforms with full branding capabilities.

- What This Means for You: Maintain a consistent user experience by customising prompts, emails, and interfaces to reflect your brand’s identity.

- Example: A marketplace platform uses Finexer’s white-label authentication flow to match its existing user interface, ensuring customers feel they are interacting directly with the platform.

5. Easy Integration and Support

Finexer makes it simple for businesses to get started with:

- User-Friendly Documentation: Clear and detailed guides make the technical integration process straightforward.

- Pre-Built SDKs: Ready-to-use tools minimise development time and effort.

- Dedicated Support: A team of experts is available to assist with onboarding and troubleshooting.

- What This Means for You: Even businesses without extensive technical resources can implement Finexer’s solution with ease.

6. Measurable Benefits for Your Business

By implementing Finexer’s authentication API, businesses can enjoy measurable improvements in efficiency and customer satisfaction:

- Reduced Fraud Costs: Authenticating account ownership minimises risks associated with fraud and chargebacks.

- Faster Onboarding: Instant authentication speeds up customer onboarding, leading to higher conversion rates and happier users.

- Improved Customer Trust: A secure and smooth authentication process reassures customers that their data is safe.

📚 Download Finexer’s USP for Startups in the UK

Get Started

Ready to bring open banking authentication into your workflow? Finexer makes it easy. Whether you’re looking to reduce fraud, simplify onboarding, or build customer trust, our single API does the heavy lifting for you. Reach out to our team for a quick chat or demo, and let’s make secure banking connections a reality for your business.

- Layered Security: Open Banking uses encrypted APIs, secure redirection, and MFA, creating multiple barriers for fraudsters.

- Real-Time Validation: Fraudsters can’t just input random account numbers; they must pass the bank’s own verification checks in real time.

- Limited Data Sharing: Because user credentials remain with the bank, the opportunity for data interception is significantly lower.

Try Open Banking Authentication today! Schedule your demo and get a 14 days free Trial by Finexer 🙂