The information about Adyen Pricing in this blog was sourced from publicly available materials on 28th Jan 2026. Please note that details may be subject to change.

Choosing the right payment provider is a crucial decision for businesses. It’s not just about the features but also about understanding how the pricing works and how it fits your business’s needs. Adyen, a leading global payment platform, offers a range of services, including open banking capabilities, making it a popular choice among businesses of all sizes.

This blog will explore Adyen’s pricing structure as of 2026, breaking it down into detailed and digestible sections. Whether you’re evaluating it’s suitability or looking for affordable provider, this guide will help you make an informed decision.

We will guide you through:

What Does Adyen Offer?

Adyen is a comprehensive payment platform designed to help businesses manage transactions across various channels and regions. Its features and services include:

1. Global Payment Acceptance

It enables businesses to accept payments from customers worldwide, supporting a wide variety of payment methods, such as:

- Credit and Debit Cards: Includes Visa, Mastercard, and American Express.

- Local Payment Methods: Options like SEPA Direct Debit in Europe, iDEAL in the Netherlands, and Alipay in China.

- Mobile Wallets: Compatibility with Apple Pay, Google Pay, and Samsung Pay.

2. Unified Commerce Solutions

It connects online, in-app, and in-store payments under one system. This unified approach gives businesses a single view of their payment data, helping to improve operational management and customer experience.

3. Open Banking Services

It offers open banking capabilities, allowing businesses to:

- Facilitate Account-to-Account Payments: Real-time, secure transactions directly between bank accounts, reducing reliance on card networks.

- Access Financial Data: Retrieve and verify account information for smoother payment experiences.

- Leverage Cost-Effective Solutions: Open banking transactions often have lower fees compared to traditional payment methods, making it an attractive option for businesses handling large transaction volumes.

4. Risk Management and Fraud Prevention

Adyen’s advanced fraud detection tools use machine learning to analyse transactions in real time, identifying and preventing potential fraudulent activities. This helps businesses protect revenue without sacrificing user experience.

5. Real-Time Reporting and Analytics

Adyen’s platform provides tools for tracking payments, analysing transaction trends, and generating actionable financial reports. These insights help businesses improve their payment strategies and operational efficiency.

6. Financial and Developer Tools

Adyen includes:

- Multi-Currency Accounts: Support for payouts and reconciliation in multiple currencies.

- Developer-Friendly APIs: Comprehensive tools for integrating Adyen’s platform with existing business systems, providing flexibility for businesses with custom requirements.

How Does Adyen’s Pricing Work?

Adyen employs a transparent and flexible pricing model tailored to meet the needs of businesses across industries. Unlike fixed or tiered models, It uses an Interchange++ pricing structure, offering a breakdown of costs for every transaction. This approach provides businesses with visibility into exactly what they are being charged.

1. Interchange++ Pricing Model

Adyen’s pricing structure includes three key components:

- Interchange Fee: This is the fee set by the customer’s card issuer (e.g., Visa or Mastercard). It varies depending on the card type (debit or credit), transaction size, and region.

- Scheme Fee: Charged by the card network, such as Visa or Mastercard, and depends on the type of card and region.

- Adyen’s Processing Fee: It charges a fee for handling the transaction, typically ranging from €0.10–€0.15 per transaction.

This model is designed to give businesses a clear understanding of the costs associated with each transaction.

2. Open Banking Transactions

Adyen supports open banking payments, which offer businesses a cost-effective alternative to traditional card payments. Key details include:

- Cost Efficiency: Open banking payments generally have lower fees compared to card-based transactions, as they bypass card networks.

- Real-Time Payments: Businesses benefit from faster settlements and real-time fund transfers between bank accounts.

- Adyen’s Processing Fee for Open Banking: Businesses are charged a flat processing fee per transaction, though specific rates may vary depending on the region and transaction volume.

3. Additional Fees to Consider

While Adyen’s pricing is transparent, certain services come with additional costs:

- Currency Conversion Fees: Transactions involving currency conversion may incur additional charges.

- Refund Processing Fees: Adyen charges the same processing fee for refunds as it does for the original transaction. The interchange and scheme fees are not refunded.

- Dispute Fees: For chargebacks, Adyen charges a fixed fee of €25 per dispute, although this may vary by region.

4. Custom Pricing for High-Volume Businesses

For businesses with large transaction volumes, Adyen offers custom pricing tailored to their needs. Custom packages may include:

- Volume Discounts: Reduced rates based on transaction volume.

- Negotiated Fees: Special agreements for businesses with unique payment requirements, such as multi-region operations or subscription-based models.

5. Subscription Billing and Financial Services

Adyen also provides billing solutions and financial tools:

- Subscription Billing: It charges a small percentage fee for managing recurring payments and invoicing.

- Multi-Currency Accounts: Fees may apply for currency management and reconciliation services.

Key Takeaway

Adyen’s pricing model is flexible and transparent, with businesses paying only for the services they use. By leveraging Interchange++ and open banking payments, It offers a scalable solution that can accommodate various business models and transaction volumes.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

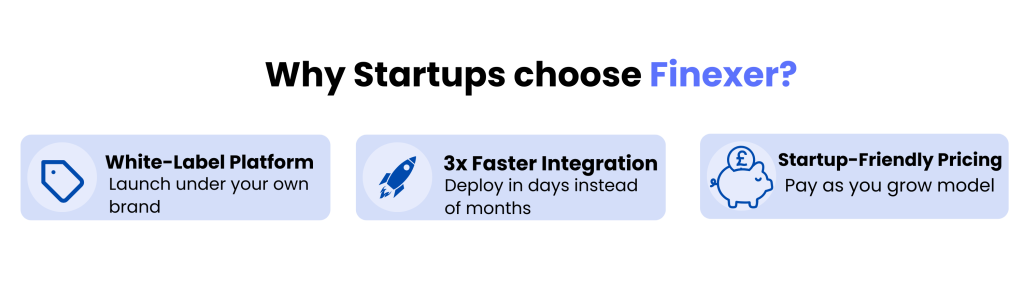

Affordable Alternative to Adyen for UK Businesses

While Adyen offers a robust payment platform with transparent pricing and global reach, its structure may not suit every business, particularly startups and SMEs seeking a more straightforward or cost-effective solution. For such businesses, alternatives like Finexer provide a compelling option with their localised approach and affordability.

1. Cost-Effective Pricing

Adyen’s pricing structure, based on the Interchange++ model, provides transparency but can become complex for businesses managing high volumes of transactions or operating in multiple regions. In comparison:

- Finexer’s Pricing: Finexer offers a flat and consumption-based pricing model, eliminating variability and making it easier for businesses to predict costs.

- Reduced Fees: Independent analyses suggest businesses can save up to 90% on transaction fees with Finexer compared to traditional providers.

2. Simplified Integration

Adyen’s robust APIs and customisation options are ideal for businesses with in-house technical resources, but for startups or smaller teams:

- Finexer’s Ease of Integration: Finexer offers user-friendly APIs and a fast onboarding process, reducing the time and resources required to go live.

- Quick Deployment: Businesses can start processing payments within weeks, helping them focus on growth instead of lengthy setups.

3. Localised Approach for UK Businesses

For businesses primarily operating in the UK, working with a provider that focuses on local markets can be advantageous:

- Finexer’s UK Focus: Finexer connects directly with 99% of UK banks, ensuring reliable connections and optimised payment processing for local customers.

- Compliance Made Easy: Built-in FCA authorisation and GDPR compliance tools remove the burden of navigating complex regulatory requirements.

4. Open Banking Advantages

Adyen supports open banking services, but alternatives like Finexer excel in leveraging this payment method for affordability and speed:

- Lower Transaction Costs: Open banking payments through Finexer bypass card networks, resulting in reduced fees.

- Real-Time Transfers: Instant account-to-account payments improve cash flow and customer satisfaction.

5. Dedicated Support for Startups and SMEs

Adyen’s enterprise-grade solutions are tailored for high-volume businesses, but startups and SMEs may benefit more from Finexer’s focused support:

- Hands-On Guidance: Finexer provides dedicated support to help businesses navigate integration, compliance, and scaling challenges.

- Tailored Solutions: Custom recommendations ensure businesses get the most out of their payment systems without unnecessary costs.

Final Thoughts

Adyen’s transparent pricing and global capabilities make it an excellent choice for enterprises with complex needs. However, for UK-based businesses seeking simplicity, affordability, and local expertise, providers like Finexer offer a tailored alternative. By understanding your business’s specific requirements, you can select the payment provider that best supports your growth and operational goals.

Try Open Banking with Finexer in 2026 ! Schedule your free demo and get started Finexer 🙂