The information about Onfido Pricing in this blog was sourced from publicly available materials on Jan 2026. Please note that details may be subject to change.

We will guide you through:

What is Onfido?

Onfido is a well-known provider of digital identity verification services, trusted by businesses for document checks and biometric authentication. Their technology is widely used in financial services, RegTech, and digital onboarding to verify customer identities and reduce fraud risks.

Onfido’s Core Services

Onfido offers a range of tools to help companies confirm customer identities without manual intervention:

- Document Verification: Customers upload government-issued ID documents such as passports or driving licenses, which Onfido verifies for authenticity.

- Biometric Facial Comparison: It matches a selfie with the photo on the uploaded ID, ensuring that the person is who they claim to be.

- Name and Date of Birth Verification: It cross-checks these details against the document to ensure accuracy.

- API Integration: Businesses can integrate Onfido’s API into their apps or websites to automate identity verification.

Many companies choose Onfido for its global reach and its ability to support multiple types of identity verification processes. Its automated verification reduces the need for manual checks, saving time for businesses that need to onboard customers quickly.

However, while Onfido’s solutions are reliable, the cost can be significant for growing businesses, especially for those that require multiple types of verification.

How Onfido’s Pricing Works

It uses a customised pricing model that varies based on several factors, including the scale and complexity of your verification needs. The key pricing parameters include:

1. Volume of Verifications

The number of identity checks your business processes directly impacts pricing. Higher verification volumes often qualify for discounted rates on a per-verification basis.

Example Checks:

- Document verification (e.g., passports, driving licenses).

- Biometric facial comparison (selfie vs. ID photo).

- Name and date of birth verification.

2. Type of Services Required

Onfido charges based on the specific verification services you use. These can include:

- Document Checks: Verifying government-issued IDs.

- Biometric Checks: Matching selfies to ID documents for authentication.

- Fraud Detection Add-Ons: Advanced fraud detection services may come with additional costs.

3. Geographical Coverage

Onfido supports verification across multiple regions. The costs may vary depending on the countries or regions where you need their services.

4. Business Size and Industry

Pricing is tailored based on the size of your business and the complexity of your operations. For example, enterprise clients with higher compliance needs may receive bespoke pricing structures.

5. Additional Costs

Certain add-ons, such as fraud detection, enhanced biometric capabilities, and manual review processes, can increase the overall pricing.

Is Onfido’s Pricing Worth It?

For businesses needing global biometric verification and document checks, It offers a reliable solution. However, its pricing can be prohibitive for small and medium-sized businesses, especially those operating in highly regulated industries that require both identity and financial data verification.

While Its’s exact pricing is not disclosed, industry sources suggest the median annual spend for Onfido customers is approximately $60,475, with costs ranging from $6,156 to $945,900 per year depending on the verification volume and scope of services required.

Onfido’s Strengths and Drawbacks

When choosing an identity verification solution, it’s essential to evaluate both the strengths and limitations of a provider. Onfido has established itself as a trusted provider in the identity verification space, offering various services such as document verification and biometric checks. However, like any solution, it comes with its pros and cons.

Onfido’s Strengths

- Wide Range of Verification Services

It offers a comprehensive set of tools for identity verification, including document checks, facial recognition, and fraud detection. This makes it an attractive option for businesses in highly regulated industries such as financial services and fintech. - Global Reach

It supports identity verification across multiple regions, making it ideal for companies with an international customer base. Businesses that need to verify users in different countries can benefit from Onfido’s broad coverage. - Customisable API Integration

It’s API allows businesses to integrate identity verification into their existing workflows and apps, enabling seamless customer onboarding. This flexibility is particularly useful for fintechs and digital platforms looking to scale. - AI-Powered Fraud Detection

It’s AI-driven technology helps reduce manual review times and improves fraud detection accuracy. This ensures that businesses can onboard genuine customers quickly while minimising fraud risks.

Onfido’s Drawbacks

- High Cost for Growing Businesses

While Onfido’s pricing is flexible, it can become expensive for companies that need high-volume identity checks or advanced features like fraud detection. Smaller businesses or startups may find it difficult to justify the cost. - Limited Financial Data Verification

Unlike solutions that integrate Open Banking, It focuses primarily on document and biometric verification. This can be a limitation for businesses that require real-time access to bank data for enhanced identity checks. - Manual Review Dependencies

Although Onfido’s AI reduces manual reviews, some edge cases still require human intervention, which can slow down the onboarding process and increase costs.

While Onfido’s services are reliable and suitable for large enterprises with global operations, businesses operating primarily in the UK might benefit more from solutions like Finexer, which combine Open Banking data with biometric verification at a lower cost.

Finexer: A Cost-Effective Alternative

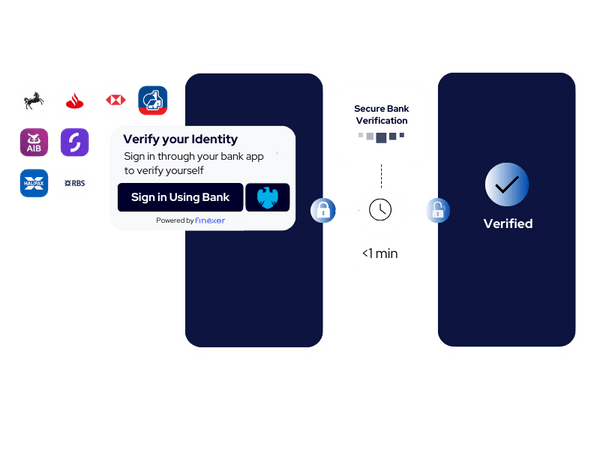

1. Rapid Onboarding in 90 Seconds

Finexer’s platform is designed to verify user identities quickly. By referencing live bank data, it completes checks in less than 90 seconds, significantly reducing onboarding time.

- Why It Matters: Shorter wait times decrease the likelihood of potential customers abandoning the registration process.

2. Bank Data Matching for Fraud Prevention

Finexer connects to 99% of UK banks, allowing it to verify a user’s name and account information against official bank records. This extra step of checking bank data helps close the gaps that could otherwise be exploited through forged IDs alone.

- Result: A more secure onboarding system that guards against fraudulent accounts.

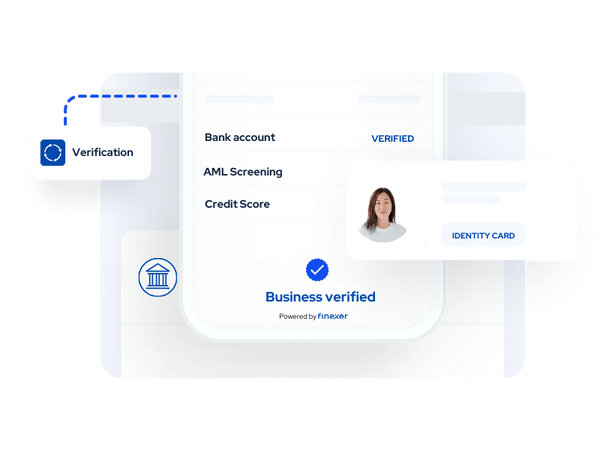

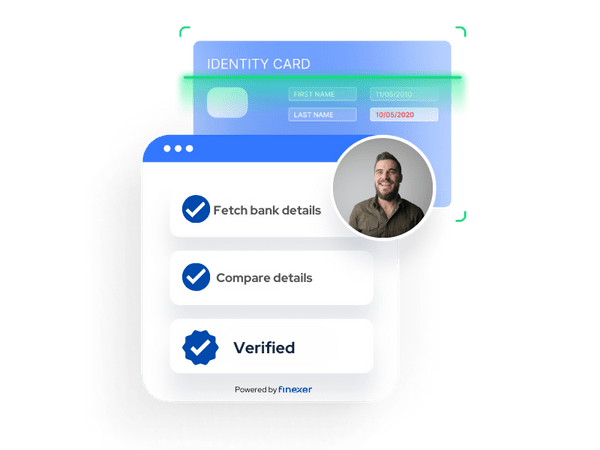

3. Combined Biometric and Document Verification

In addition to bank data, Finexer’s system includes:

- Facial Recognition: Matches a user’s selfie with their official ID photo.

- Document Extraction: Reads passports and driving licenses automatically.

- Name and Date of Birth Checks: Confirms personal details in real time.

By consolidating all these methods, Finexer offers stronger defense against identity fraud.

4. Transparent Pricing Built for SMBs

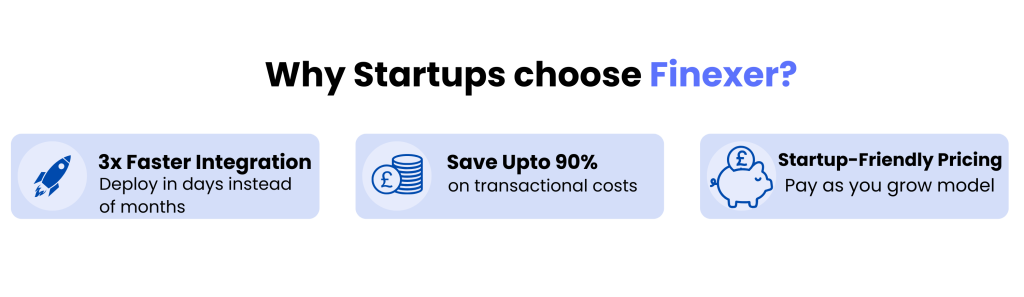

Finexer’s tiered pricing structure is designed to be budget-friendly, especially for fintech startups and small to medium businesses. Unlike some providers that keep costs hidden, Finexer outlines fees based on verification volume and feature usage.

- Why It Matters: Businesses can scale their verification needs without unexpected add-ons or complex negotiations.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

5. Limited Technical Complexity

Finexer’s developer-friendly API helps teams integrate quickly, even if they lack extensive technical resources. The platform is built for easy deployment, reducing delays that can arise from complicated setups.

- Outcome: Faster go-live times and a better user experience.

6. Best Suited for Cost-Conscious Onboarding

Finexer’s affordable pricing and rapid verification speed make it ideal for businesses seeking to:

- Onboard users smoothly, without incurring steep costs.

- Protect against fraud through a multi-layered verification process.

- Adapt to fluctuating demand, thanks to flexible plans and clear cost structures.

Who Benefits Most from Finexer?

Finexer is well-suited for companies in fintech, lending, and e-commerce, especially those targeting the UK market. Its emphasis on Open Banking data helps firms comply with local regulations while confirming a user’s identity and financial status.

- Growing Enterprises: Lower monthly costs mean businesses can scale without sudden increases in verification fees.

- Startups and SMEs: Straightforward pricing helps smaller companies budget effectively.

- Firms Needing Extra Accuracy: Access to both biometric data and bank records offers a level of certainty beyond basic checks.

Key Takeaways

- Onfido: Strong global footprint, recognised brand, and robust biometric tools but offers limited cost transparency and lacks direct bank data checks.

- Finexer: Combines financial data and biometric checks in a single platform, delivering faster results and clear affordable pricing, making it well-suited for cost-conscious businesses.

Which Service Should You Choose?

- Go with Onfido: If you have a large or international user base and need a recognised identity verification provider with extensive document and biometric coverage.

- Choose Finexer: If you require a quicker, more affordable onboarding process that leverages UK bank data for stronger fraud prevention.

How does Onfido price its identity verification services?

It offers customised pricing based on factors like verification volume, document checks, and add-on features. However, exact costs are not published. Prospective users must contact Onfido directly for a quote tailored to their needs.

Is Onfido more suitable for large enterprises or smaller businesses?

Larger enterprises often benefit from Its’s global coverage and biometric features. Smaller businesses, however, may find Onfido’s lack of transparent pricing and potential add-on fees challenging to budget for.

Why does Finexer focus on Open Banking data for verification?

Finexer uses bank data to instantly confirm a person’s name and account ownership. This reduces the chance of fraud by matching details against live bank records, something that standard document checks alone can’t achieve.

How quickly can Finexer verify a user’s identity?

Finexer’s system often completes verifications in Less than 90 seconds, combining bank checks with biometric data. This rapid turnaround helps businesses reduce onboarding times and customer drop-offs.

Which solution is best for fraud prevention?

Both Onfido and Finexer offer strong fraud protection. Onfido relies on biometric and document checks, while Finexer combines these methods with bank data. Finexer’s multi-layered approach often reduces fraud risks by verifying financial details in real time.

Try Secure Open banking Verification with Finexer in 2026 ! Schedule your free demo and start deployement by Finexer 🙂