Note: Prices are subject to changeThe information about FreeAgent Pricing in this blog was sourced from publicly available materials on 2026. Please note that details may be subject to change.

Introduction

For startups, managing finances efficiently is crucial. Choosing the right accounting software can make a significant difference. FreeAgent is a popular choice among UK startups, known for its user-friendly interface and comprehensive features. But how does its pricing structure align with the needs of emerging businesses in 2026?

In this guide, we’ll delve into FreeAgent pricing plans, uncover any additional costs, compare it with competitors like Xero, and help you determine if it’s the right fit for your startup.

We will guide you through:

1. FreeAgent Pricing Plans for Startups in 2026

How Much Does FreeAgentCost?

It offers a straightforward subscription model tailored to different business types. Each plan includes essential features such as invoicing, expense tracking, and tax management. The pricing varies based on the business structure: sole traders, partnerships, or limited companies.

| Plan Type | Monthly Pricing (ex. VAT) | Annual Pricing (ex. VAT) | Best For | Features |

|---|---|---|---|---|

| Sole Trader | £19 | £190 | Freelancers, self-employed professionals | Invoicing, expense management, time tracking, payroll, tax forecasting, VAT returns, Self Assessment filing. |

| Partnership & LLP | £27 | £270 | Businesses with multiple owners | All Sole Trader features plus profit share calculation. |

| Limited Company | £33 | £330 | Incorporated businesses | All Partnership features plus Corporation Tax forecasting, dividend vouchers, and Self Assessment filing. |

| Landlord | £10 | £100 | Property rental businesses | Tools to manage rental income and expenses, track property-related finances, and generate necessary financial reports. |

Note: Prices exclude VAT. Discounts of 50% are available for the first six months on monthly plans and the first 12 months on annual plans.

2.Additional Costs: What’s Not Included in FreeAgent’s Base Pricing

Payroll (Paid Add-On)

It offers a payroll feature designed to manage employee salaries, tax deductions, and pension contributions. This service is available as an add-on:

- Payroll for up to 10 employees: £5 per month

- Each additional employee: £1 per month

This option is suitable for startups that require basic payroll processing within their accounting system.

Multi-User Access and Accountant Collaboration

While It allows you to invite accountants and team members, certain access levels or additional user permissions may come with extra charges under its partner program. This is particularly relevant for startups that require multiple users managing financial data.

Making Tax Digital (MTD) and VAT Reporting

For VAT-registered businesses, FreeAgent simplifies VAT returns and supports Making Tax Digital (MTD) compliance. However, if your business needs custom tax reporting, you may incur additional costs for further accounting support.

3. Hidden Fees: What to Watch For

Although FreeAgent’s pricing is largely transparent, there are a few areas where extra costs might arise:

- Bank Feeds: The Open Banking integration is included, but certain banks may require manual imports if not fully supported.

- Extra Users: Some advanced partner-level features may involve additional fees.

- Custom Integrations: Third-party add-ons or specific integrations might have separate pricing.

For most startups, these additional charges are minimal, but it is important to review the features that your business needs before making a decision.

4. Is FreeAgent Worth the Price for Startups?

Considering both the subscription costs and the potential extra fees, FreeAgent can be a cost-effective solution for startups. Its straightforward pricing and comprehensive features make it a strong option for:

- Freelancers and self-employed professionals needing simple invoicing, expense tracking, and tax management.

- Small businesses and VAT-registered startups looking for HMRC-approved VAT filing and tax reports.

- Companies managing payroll in-house with a small team.

On the other hand, startups that require more advanced financial reporting or have complex payroll needs might find that additional tools are necessary.

FreeAgent vs Xero for Starups

| Criteria | FreeAgent | Xero |

|---|---|---|

| Pricing Structures | – Straightforward tiered plans (Sole Trader, Partnership, Limited Co.) – Transparent add-ons (e.g., payroll, multi-user) | – Multiple plans with varying limits on invoices/transactions – Additional fees may apply for certain features or higher usage |

| Features & Functionality | – Invoicing, expense tracking, and tax filing included – HMRC-approved VAT and MTD support – Simple payroll management | – Broad integrations and third-party apps – Advanced reporting features – Suited for businesses with complex needs |

| User Experience & Support | – Clean, user-friendly interface – Tailored support for small businesses and freelancers | – Also user-friendly, but setup can be more involved – Large ecosystem of advisors and integrations |

| Overall Value for Startups | – Ideal for straightforward financial processes – Transparent pricing model | – Better for rapid growth or advanced functionality – Offers scalability and customisation |

📚 Guide to Xero Pricing in 2026

FreeAgent + Finexer: A Complete Financial Solution for Startups

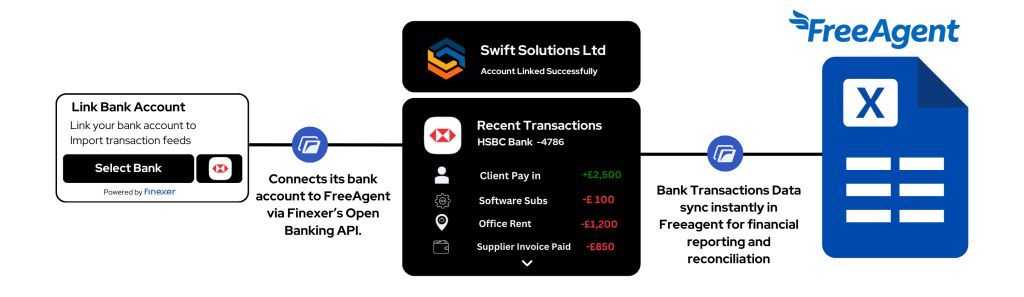

While FreeAgent provides dependable Open Banking-powered bank feeds for transaction syncing, startups often require additional functionality that goes beyond basic data import. Although FreeAgent automatically syncs your transactions, it primarily focuses on this core function. Startups may also need deeper financial insights, real-time verification, and the ability to initiate payments directly. This is where Finexer comes in.

1. Enhanced Financial Insights with AIS

Account Information Services (AIS):

FreeAgent effectively syncs transactions using the Open Banking framework. However, Finexer takes this a step further by offering enhanced financial insights. With Finexer’s AIS API, startups can receive real-time income verification, detailed categorisation of transactions, and affordability checks. This gives you a deeper view of customer or business financial health, beyond just basic transaction data.

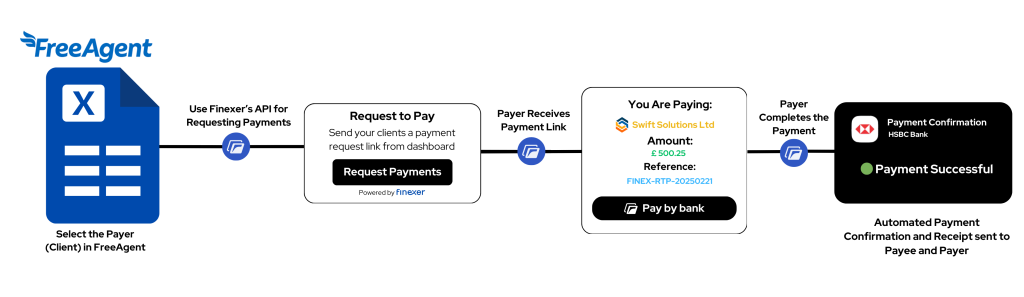

2. Direct Payments with PISP

Payment Initiation Services (PISP):

Although FreeAgent tracks transactions via Open Banking, it does not currently support direct payment initiation. Startups still rely on traditional bank transfers or third-party solutions. Finexer’s PISP API fills this gap by enabling businesses to initiate payments/Request to pay directly from FreeAgent. This reduces reliance on cards and manual bank transfers, streamlining the payment process within the same platform.

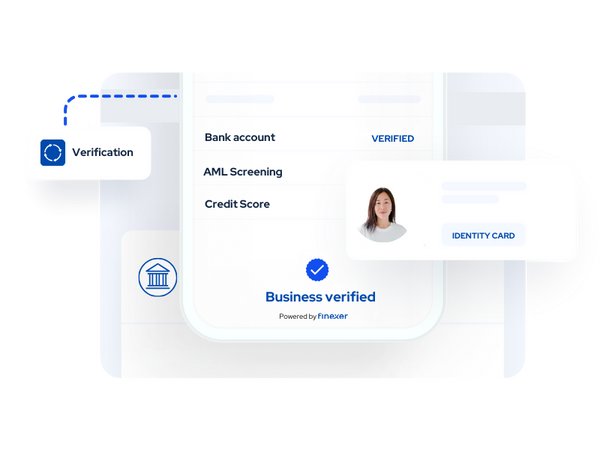

3. Open Banking Verification

While FreeAgent focuses on accounting, Finexer offers an additional layer of security through Open Banking verification. By integrating Finexer’s verification API, startups can instantly verify customer and supplier bank details before processing payments. This step helps prevent errors and reduce the risk of fraud, making your financial operations more secure.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Integrating Finexer into Your FreeAgent Setup

By combining FreeAgent’s essential accounting tools with Finexer’s advanced Open Banking API, startups can transition from simple transaction tracking to a fully automated, data-driven financial management system. This integration provides:

- Real-Time Bank Data: Gain enhanced financial insights that go beyond basic transaction feeds.

- Instant Payment Initiation: Initiate secure, direct Open Banking payments from within your FreeAgent dashboard.

- Bank Account Verification: Verify bank account details instantly, reducing the risk of fraud and errors before processing payments.

What is FreeAgent Pricing for Startups?

FreeAgent pricing for startups is a subscription-based model that offers different plans based on the type of business (e.g., sole trader, partnership, limited company). Each plan includes core accounting features like invoicing, expense tracking, and tax filing, with optional add-ons for payroll and multi-user access.

Does FreeAgent Offer a Free Trial?

Yes. FreeAgent typically provides a free trial period (often 30 days) that allows startups to explore the platform’s core features without committing to a paid plan.

How Does Finexer Integrate with FreeAgent?

Finexer offers an Open Banking API that complements FreeAgent’s existing features. By integrating Finexer with FreeAgent, startups can gain advanced financial insights, initiate direct payments, and verify bank details instantly, enhancing the standard FreeAgent experience.

Ease Accounting process with Finexer in 2026 ! Schedule your free demo and get started with Finexer 🙂