For many accounting firms in the UK, managing bank data has traditionally meant working across disconnected systems, downloading statements manually, and waiting on clients for updates. But with the rise of open banking, that’s changed. Today, firms can securely access real-time bank data, reduce back-and-forth with clients, and improve the accuracy of reconciliation and reporting.

The shift has led many practices, from sole accountants to mid-sized firms, to explore reliable open banking providers for accounting firms. These platforms allow direct connections to client bank accounts, providing transaction data and, in some cases, payment initiation tools. For accountants, this means fewer delays, fewer errors, and better visibility across accounts.

In this blog, we’ve shortlisted five providers that stand out in 2025. Each one has been selected based on what matters most to accounting professionals: UK bank coverage, compliance with FCA standards, quality of data access, and compatibility with the tools firms already use.

we will guide you through:

📚 Top 10 Accounting Software in the UK

What Accounting Firms Need from an Open Banking Provider

When evaluating open banking providers for accounting firms, it’s not just about who offers the most features — it’s about which provider supports the daily realities of accounting work. Whether you’re handling bookkeeping for clients, managing reconciliation across multiple accounts, or supporting tax submissions, the right provider should fit easily into your firm’s processes.

Here are some of the core things accounting firms should look for:

1. Strong UK Bank Coverage

Being able to connect to most, if not all, UK banks is essential. Firms shouldn’t have to chase down paper statements or wait for clients to send CSVs. A good open banking provider should offer access to current accounts, savings, business accounts, and more across all major UK banks.

2. Real-Time and Reliable Bank Feeds

Timely access to bank transactions is what enables accurate reconciliation, cash flow visibility, and audit readiness. Firms should look for providers that refresh data frequently and handle transaction errors gracefully.

3. FCA Authorisation and Data Security

Since accountants deal with sensitive financial data, it’s critical that the provider is regulated by the Financial Conduct Authority (FCA). This ensures the platform meets strict data handling and privacy standards.

4. Integration with Accounting Software

Compatibility with popular tools like Xero, QuickBooks, and Sage makes day-to-day work smoother. The less time you spend switching between platforms, the more time you can dedicate to your clients.

5. Financial Data Enrichment

Some providers don’t just share raw transaction data — they help you make sense of it. Categorising transactions, identifying recurring payments, or verifying income can save time and support client advisory work.

6. Payment Initiation (Optional but Useful)

While not every accounting firm handles payments, some do, especially when managing payroll or accounts payable. Providers that support direct account-to-account payments can reduce reliance on manual bank transfers or card networks.

📚 Open Banking Use Cases for Accounting Firms

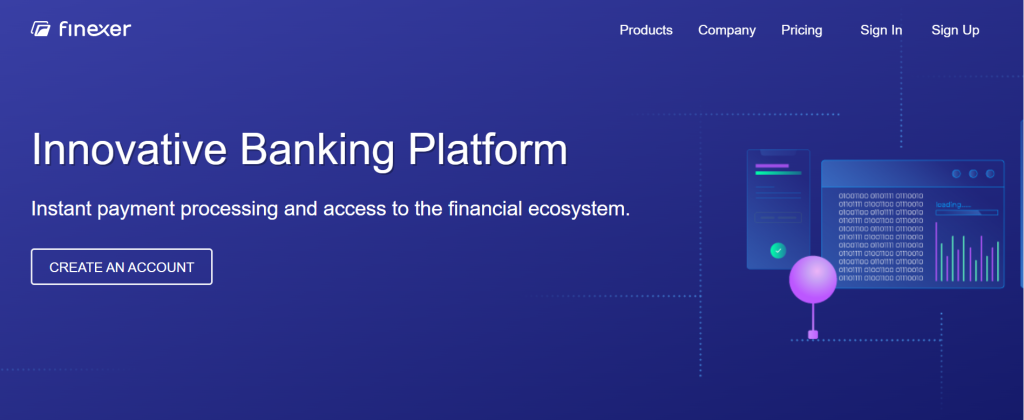

1. Finexer

Finexer is a UK-first open banking platform tailored to firms that want direct, reliable access to client bank data. It supports both AIS (account information services) and PIS (payment initiation services), giving accountants the tools they need to stay on top of reconciliation, reporting, and even payouts.

Unlike some providers that operate across broader regions, Finexer focuses solely on the UK. This means full support for Faster Payments, 99 percent bank coverage across the country, and infrastructure that aligns with FCA requirements out of the box.

For accounting firms working with startups, small businesses, or clients with limited digital tools, Finexer provides a straightforward way to connect bank accounts, fetch clean transaction data, and manage payments when required. It also supports white-label deployment, so firms can offer services under their own name.

Best For

- Small to mid-sized accounting firms

- Practices working with UK-based clients

- Firms needing reliable data feeds and optional A2A payments

Key Features

- Full AIS and PIS access through one integration

- Real-time connection to 99 percent of UK banks

- FCA authorised and designed for UK compliance

- White-label capability for client-facing workflows

- Startup-friendly pricing with no setup fees or extra costs

Pros

- Built specifically for UK accounting needs

- Fast onboarding and clear documentation

- Transparent pay-as-you-use pricing

- Option to manage payouts, payroll, and supplier payments

📚 10 Reasons why Finexer is Ideal for Accounting Firms

Cons

- UK only, not suitable for clients with non-UK accounts

- Newer in the Market

Finexer stands out among open banking providers for accounting firms that want to improve data visibility and reduce back-and-forth with clients. For firms seeking a simple way to plug into the UK’s banking infrastructure, it offers strong value with minimal overhead.

How Finexer Helps Accounting Firms

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

2. Crezco

Crezco is an open banking provider focused on making invoice payments easier for small businesses and their accountants. Built in the UK and regulated by the FCA, Crezco integrates directly with tools like Xero and QuickBooks to enable real-time, account-to-account payments without the need for cards or manual transfers.

For accounting firms managing client invoicing or recommending tools to small businesses, Crezco removes friction from getting paid. It turns invoices into pay-by-bank requests, linking clients’ accounting systems to their customers’ bank accounts securely.

While Crezco focuses more on payment initiation than financial data aggregation, it excels at what many firms need day-to-day — faster payments, automatic reconciliation, and better cash flow tracking for clients.

Best For

- Accountants managing invoicing or cash flow for clients

- Firms supporting small businesses on Xero or QuickBooks

- Practices looking to reduce manual reconciliation steps

Key Features

- Real-time A2A payments via open banking

- Seamless integration with Xero and QuickBooks

- Automatically marks invoices as paid when payment is received

- FCA-authorised and UK-focused

Pros

- Simple to use for accountants and clients

- Reduces late payments and manual payment errors

- Helps firms advise clients on efficient payment workflows

Cons

- Payment-focused only, no bank data aggregation tools

- Less suitable for practices with more complex needs

For accounting firms working with small businesses, Crezco is one of the most practical open banking providers for accounting firms, especially if invoice management is a frequent task.

3. Salt Edge

Salt Edge is a UK-based open banking platform that offers comprehensive Account Information Services (AIS) and Payment Initiation Services (PIS). With connectivity to over 5,000 banks across 50+ countries, including full coverage of major UK banks, Salt Edge provides accounting firms with real-time access to client financial data.

Their platform includes advanced data enrichment tools such as transaction categorisation, merchant identification, and financial insights, enabling firms to transform raw transaction data into actionable intelligence.

Salt Edge is FCA-authorised in the UK (Firm Reference Number: 822499), ensuring compliance with the highest security and regulatory standards.

Best For:

- Accounting firms requiring comprehensive financial data aggregation and enrichment

- Practices seeking to enhance client onboarding and financial analysis

- Firms needing a scalable solution with extensive bank connectivity

Key Features:

- Access to 5,000+ banks globally, including full UK coverage

- Real-time account information and transaction data

- Advanced data enrichment: transaction categorisation, merchant identification, financial insights

- FCA-authorised and ISO 27001 certified

- Customizable, white-label solutions for seamless integration

Pros:

- Extensive global bank coverage

- Robust data enrichment capabilities

- Strong compliance and security standards

- Flexible integration options for various business models

Cons:

- Primarily focused on data aggregation; may require additional tools for specific accounting software integrations

- Custom pricing may vary based on specific needs and usage

For accounting firms aiming to leverage open banking for enhanced financial data access and client insights, Salt Edge offers a powerful and compliant solution.

4. Volt

Volt is a UK-based open banking provider that specialises in real-time account-to-account payments. While many accounting firms focus on data access and reconciliation, there are use cases — such as supplier payments, payroll support, or handling payouts — where fast and reliable bank transfers are a priority. That’s where Volt comes in.

Volt’s infrastructure is built to handle high transaction volumes and ensure payment reliability. One of its standout features is its smart routing engine, which chooses the most reliable banking path to reduce failed transactions. This can be helpful for firms managing payments across multiple clients or overseeing finance operations on behalf of businesses.

Though Volt doesn’t offer built-in data enrichment or account aggregation, its strength lies in enabling fast, direct payments with full control through their developer-friendly APIs.

Best For

- Accounting firms managing payments on behalf of clients

- Firms with clients in e-commerce or marketplace sectors

- Use cases that require fast, direct A2A transfers

Key Features

- Real-time A2A payments using open banking rails

- Smart routing engine to reduce failed transactions

- Developer-first API infrastructure

- FCA-regulated in the UK

- Custom branding options available

Pros

- Built for speed and payment reliability

- Ideal for high-volume or high-frequency payments

- Allows firms to offer custom payment flows to clients

Cons

- No financial data access or transaction insights

- Requires in-house technical support for integration

Volt is a solid option for accounting firms that work closely with clients needing real-time payments. If your firm helps with financial operations beyond just reporting, it’s one of the top open banking providers for accounting firms focused on payments.

5. Bud

Bud is a UK-based open banking provider designed for businesses that need to work with enriched financial data. For accounting firms involved in affordability checks, client onboarding, or financial analysis, Bud offers a way to make sense of raw transaction data without having to process it manually.

Rather than focusing on payments, Bud helps firms and platforms understand their clients’ financial behaviour. Its tools allow you to retrieve transaction histories, identify income and spending trends, and categorise financial activity. This can support lending advice, financial planning, or helping clients better understand their cash position.

Bud’s platform is built with flexibility in mind and is often used in the background of fintech applications, but it can also be valuable to firms that want to offer more personalised services or improve how they assess client finances.

Best For

- Firms providing lending support or affordability checks

- Accounting teams offering advisory or budgeting services

- Use cases requiring categorised transaction data

Key Features

- Advanced transaction categorisation and income analysis

- Real-time access to banking data

- Personal finance insights for client advisory

- FCA-regulated and UK bank coverage

- White-label support available

Pros

- Helps firms go beyond just viewing transactions

- Strong support for personalisation and reporting

- Enables richer client insights with less manual work

Cons

- Not built for payment processing

- Requires clear data permissions from clients

For accounting practices that want to offer deeper support, especially around affordability, cash flow, or advisory services, Bud is a strong open banking provider for accounting firms that value data-driven insight.

Comparison: Open Banking Providers for Accounting Firms

| Provider | UK Bank Coverage | Real-Time Payments | Financial Data Access | White-Label Support | FCA Authorised | Best For |

|---|---|---|---|---|---|---|

| Finexer | 99% of UK banks | Yes | Yes | Yes | Yes | UK-focused firms needing full payments + data |

| Crezco | Major UK banks | Yes | Limited | Yes | Yes | Firms handling invoice payments for clients |

| Salt Edge | Wide UK + international coverage | Optional (via partners) | Advanced | Yes | Yes | Firms needing high-quality data aggregation & categorisation |

| Volt | Broad UK and EU coverage | Yes | No | Yes | Yes | Firms managing real-time, high-volume payouts |

| Bud | 90%+ of UK bank accounts | No (data-only) | Advanced | Yes | Yes | Client insights, affordability, and financial analysis |

Which Open Banking Provider Is Right for Your Accounting Firm?

Every accounting firm has different priorities — some focus on automating invoice payments, others need recurring billing tools, and many are now looking for better access to client financial data. Choosing the right provider comes down to how closely their offering aligns with the services you deliver and the types of clients you support.

For firms involved in processing invoices or chasing late payments, Crezco offers a simple way to turn invoices into direct bank transfers, speeding up collections and reducing admin.

If your focus is on managing real-time payouts or you’re working with high-volume transaction environments, Volt brings reliability through its intelligent payment routing engine. And for firms that need to assess cash flow, verify income, or offer advisory services, Bud stands out for its strong financial data insights.

But if your accounting firm is looking for a platform that brings together real-time payments, access to enriched financial data, KYB checks, and full UK bank coverage, all while staying FCA-compliant. Finexer offers one of the most complete solutions on the market. It’s particularly well suited to UK-based Startups & Accounting firms that want to start fast, support multiple client types, and keep control over branding and compliance.

Whether you’re focused on reconciliation, onboarding, or payments, Finexer allows you to handle all of it through one system, with startup-friendly pricing and no unnecessary complexity.

What are the best open banking providers for accounting firms?

Top providers include Finexer, Crezco, Volt, and Bud, each offering UK-focused features for payments, data access, or KYB.

Which open banking provider is best for UK accountants?

Finexer is tailored for UK firms, offering real-time payments, financial data access, KYB checks, and 99% UK bank coverage.

Do open banking providers help with reconciliation?

Yes. Providers like Finexer and Bud help firms access live bank data, making reconciliation faster and reducing manual input.

Can accountants use open banking for client onboarding?

Yes. Finexer and Bud offer tools like KYB checks and account verification to support onboarding and compliance.

Is FCA approval important for open banking providers?

Absolutely. FCA authorisation ensures the provider meets UK standards for data security and financial services compliance.

Get Accurate Financial data for your Accounting Firm; Schedule your free demo and get 14-days Free Trial by Finexer 🙂