Keeping track of recurring deadlines, team responsibilities, and client deliverables is one of the biggest challenges accounting firms face, especially as they grow. Spreadsheets, sticky notes, and email threads can only take you so far. Eventually, things start slipping through the cracks: missed filings, duplicated work, and last-minute scrambles that stress out your team and your clients.

That’s where the right accounting workflow software comes in.

These tools are designed to give you visibility over every job in your firm—who’s working on what, when it’s due, and what’s still waiting on a client response. Whether you’re running payroll, preparing VAT returns, or chasing year-end accounts, accounting workflow software helps standardise your processes and automate what shouldn’t be manual anymore.

In this guide, we’ll review 7 of the best options available in 2025.

Keep reading, or jump to the section you’re looking for:

What Is Accounting Workflow Software?

Accounting workflow software is a tool that helps firms track, manage, and complete recurring accounting tasks in an organised and repeatable way. Instead of relying on spreadsheets, email chains, or sticky notes, these platforms centralise your jobs and give your team a clear picture of what’s in progress, what’s overdue, and what needs to happen next.

It’s especially helpful for firms juggling multiple service lines like payroll, bookkeeping, tax returns, or advisory, where timing and consistency matter.

Typical features include:

- Task creation and assignment

- Customisable job templates for common services

- Recurring schedules (e.g. monthly VAT or quarterly accounts)

- Status updates and progress tracking

- Deadline alerts and internal reminders

- Visibility across the team and client base

Unlike full practice management platforms, accounting workflow tools focus specifically on helping firms stay on top of day-to-day work. They’re built for internal operations, not sales, CRM, or billing, and can save hours each week by removing guesswork and manual admin.

Key Features to Look for in Accounting Workflow Software

The right accounting workflow software should make your firm more organised, not more complicated. While there are many tools that promise to improve productivity, the best platforms are the ones that understand how accounting work actually gets done.

Here are five key features that matter most when choosing a solution:

1. Recurring Job Templates That Match Your Services

Accounting is full of repeatable work: monthly bookkeeping, quarterly VAT returns, payroll runs, and year-end accounts. A solid workflow system should let you create job templates for each of these services, with preset checklists and timeframes.

Templates save time, bring consistency across the team, and ensure that important steps aren’t missed during busy periods.

2. Built-in Deadline Reminders and Tracking

It’s not enough to just list tasks. The system should actively help you stay ahead of deadlines by highlighting what’s coming up and alerting you if something is at risk of falling behind.

Having a visual overview of upcoming work makes it easier to plan, especially during peak filing seasons.

3. Clear Task Ownership Across the Team

When multiple people are working on the same client, task clarity becomes crucial. Your workflow platform should allow you to assign jobs and subtasks to specific team members so nothing gets lost or duplicated.

It also helps during handovers, ensuring anyone can jump into a job and understand what’s already been done.

4. Visibility Into Job Progress

Being able to quickly filter tasks by client, status, or due date makes it easier to manage a large workload. Whether you want to see all overdue items or check what’s waiting on client input, smart filters help you focus on the tasks that need attention.

It also gives managers a clearer picture of where time is going and how the firm is performing.

5. Client Collaboration Tools

Gathering documents from clients is one of the biggest bottlenecks in any accounting workflow. Look for software that lets you assign tasks or file requests to clients directly, with the ability to set deadlines and send reminders automatically.

This reduces the time your team spends chasing emails and improves turnaround time on client jobs.

7 Best Accounting Workflow Software in 2025

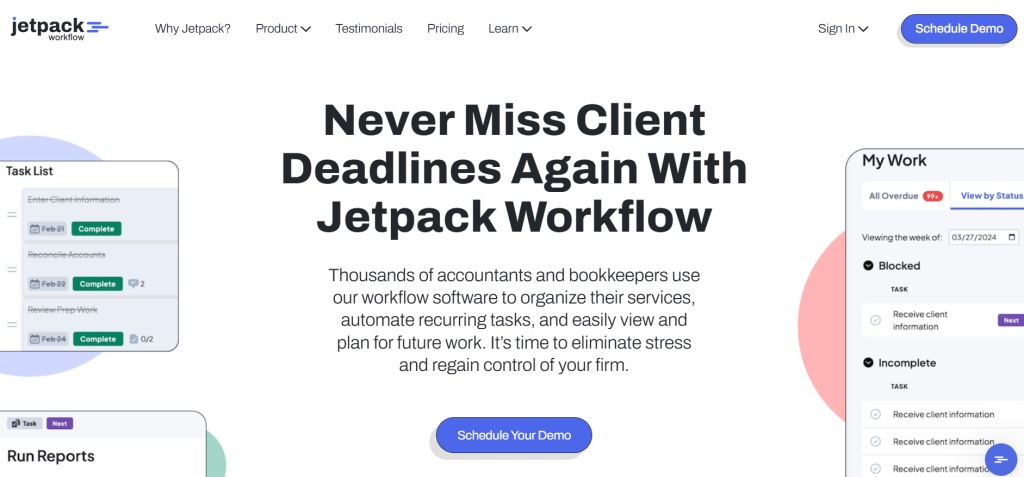

1. Jetpack Workflow

Jetpack Workflow is a dedicated accounting workflow software designed to help firms manage recurring tasks, client deliverables, and deadlines efficiently. It provides a centralised platform to schedule tasks, monitor progress, and maintain team alignment, making it ideal for firms transitioning from manual tracking methods.

Best For

- Small to mid-sized accounting firms offering recurring services like bookkeeping, payroll, and tax preparation.

- Teams aiming to replace manual job tracking with a structured workflow system.

- Accountants focusing on internal workflow management rather than client-facing features.

Key Features

- Recurring job scheduling with customisable templates.

- Visual dashboard displaying job statuses and due dates.

- Customisable stages (e.g., Not Started, Waiting for Client, In Progress).

- Team workload overview and job roll-forward capabilities.

- Built-in alerts to prevent missed tasks.

Pros

- Specifically built for internal accounting workflows.

- User-friendly interface with minimal onboarding time.

- No per-client charges, making it cost-effective for growing firms.

- Supports recurring compliance work with automated scheduling.

Cons

- Lacks document storage and CRM capabilities.

- Limited client-facing features; primarily focused on internal task management.

Pricing

- Monthly Billing: $45 per user/month.

- Annual Billing: $30 per user/month (billed annually).

- 14-day free trial available.

Where This Platform Fits Best

Jetpack Workflow is best suited for accounting firms seeking a reliable solution to manage internal job schedules and enhance task visibility across teams. If your primary objective is to organise and track recurring work without the complexity of additional features, Jetpack Workflow offers a focused and efficient platform.

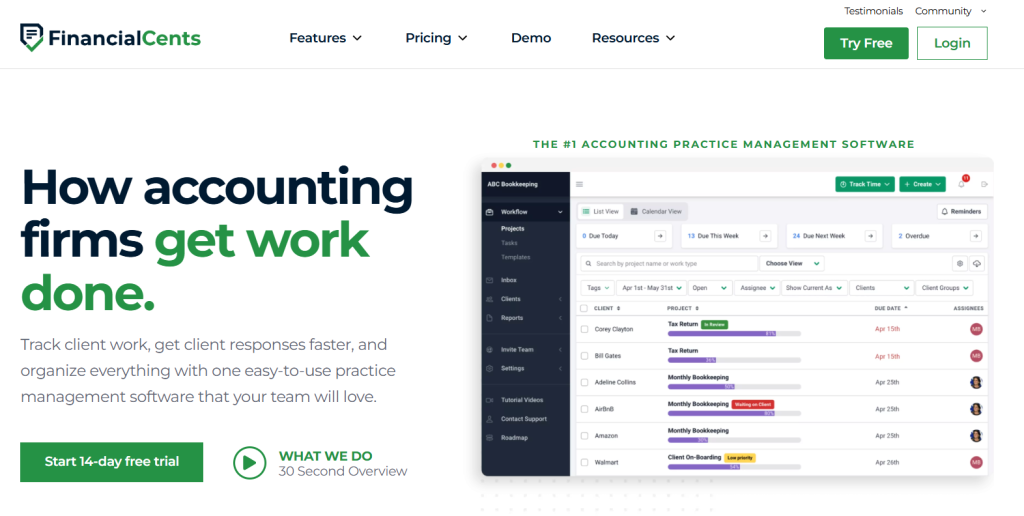

2. Financial Cents

Financial Cents is a cloud-based accounting workflow software designed specifically for accounting and bookkeeping firms. It offers a suite of tools to streamline task management, automate workflows, and enhance team collaboration, making it an ideal choice for firms aiming to improve operational efficiency.

Best For

- Solo practitioners and small to mid-sized accounting firms

- Firms transitioning from manual tracking methods like spreadsheets

- Teams seeking an intuitive platform with robust workflow automation

Key Features

- Workflow Automation: Automate repetitive tasks and set up recurring projects to ensure consistency and save time.

- Client Task Management: Assign tasks to clients with automated reminders, facilitating timely document collection and reducing follow-ups.

- Integrated Email Management: Convert client emails into tasks directly within the platform, keeping communication organised.

- Time Tracking and Billing: Monitor time spent on tasks and generate invoices seamlessly, aiding in accurate billing and profitability analysis.

- Document Management: Securely store and manage client documents with easy access for team members.

Pros

- User-friendly interface with minimal learning curve

- Affordable pricing plans catering to firms of various sizes

- Comprehensive feature set tailored for accounting workflows

- Responsive customer support and onboarding assistance

Cons

- Advanced features like custom integrations may require higher-tier plans

- Limited customisation options compared to some competitors

Pricing

Financial Cents offers several pricing tiers to accommodate different firm sizes:

- Solo Plan: $19/month (billed annually) – Designed for single-user firms, includes core features like workflow automation, client task management, and document storage.

- Team Plan: $49/month per user (billed annually) – Adds features such as integrated email, e-signatures, and enhanced collaboration tools.

- Scale Plan: $69/month per user (billed annually) – Includes advanced automation, custom client task emails, and additional integrations.

- Enterprise Plan: Custom pricing – Offers advanced support, security features, and customisation options for larger firms.

Where This Platform Fits Best

Financial Cents is best suited for accounting firms seeking a dedicated workflow management solution that simplifies task tracking, enhances client collaboration, and automates routine processes. Its intuitive design and accounting-specific features make it a valuable tool for firms aiming to improve efficiency and reduce administrative overhead.

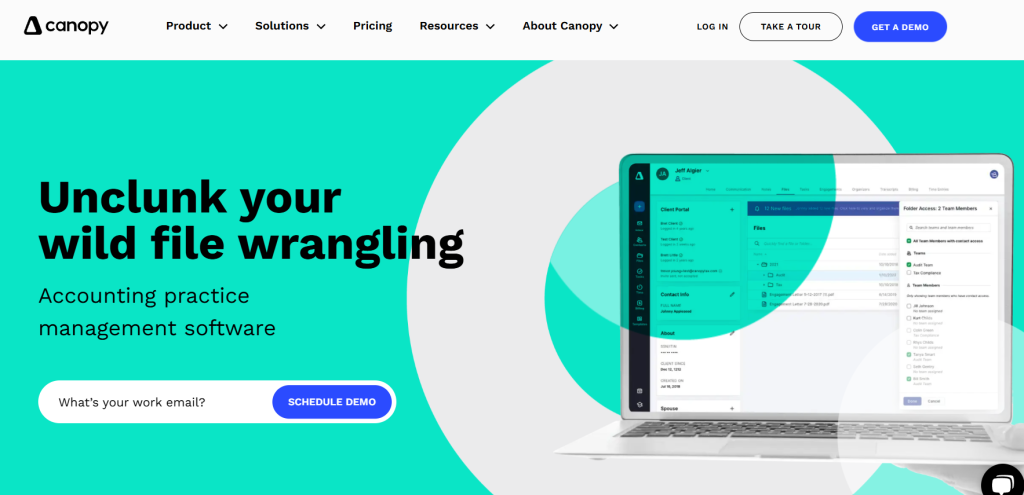

3. Canopy

Canopy is a modular accounting workflow software designed to streamline operations for accounting and tax firms. It offers a suite of tools that centralise client management, automate workflows, and enhance team collaboration, making it an ideal choice for firms aiming to improve efficiency and client service.

Best For

- Small to mid-sized accounting and tax firms seeking an all-in-one solution.

- Firms requiring integrated tools for client communication, document management, and workflow automation.

- Practices aiming to enhance client experience through a secure portal and mobile access.

Key Features

- Client Management: Centralised client database with communication tracking and a secure client portal.

- Workflow Automation: Customisable task templates, automated reminders, and progress tracking to standardise processes.

- Document Management: Secure storage, file sharing, and e-signatures to streamline document handling.

- Time & Billing: Time tracking, invoicing, and payment collection integrated into the workflow.

- Mobile Access: Mobile apps for both practitioners and clients, facilitating on-the-go access to essential information.

Pros

- Modular design allows firms to select and pay for only the features they need.

- User-friendly interface with intuitive navigation.

- Comprehensive feature set tailored for accounting workflows.

- Responsive customer support and onboarding assistance.

Cons

- Pricing can become complex and potentially expensive as additional modules are added.

- Some advanced features may require a learning curve for effective implementation.

Pricing

Canopy offers flexible pricing plans to accommodate different firm sizes and needs:

- Starter Plan: $45/user/month (billed annually) – Includes client engagement and document management features.

- Essentials Plan: $66/user/month (billed annually) – Adds workflow automation, time tracking, invoicing, and payment collection.

- Standard Plan: $150/month for unlimited users – Offers a comprehensive suite with CRM, client portal, and mobile access.

Where This Platform Fits Best

Canopy is best suited for accounting and tax firms seeking a comprehensive, customizable solution to manage client relationships, automate workflows, and streamline document handling. Its modular approach allows firms to tailor the software to their specific needs, making it a versatile choice for practices aiming to enhance efficiency and client service.

4. Client Hub

Client Hub is an all-in-one accounting workflow software designed specifically for cloud-based accounting and bookkeeping firms. It centralises internal workflows and client collaboration, streamlining operations and enhancing efficiency.

Best For

- Small to mid-sized accounting and bookkeeping firms

- Firms seeking an integrated solution for workflow management and client communication

- Practices aiming to automate routine tasks and improve client responsiveness

Key Features

- Workflow Management: Create and manage jobs with customisable task checklists, including recurring tasks and automated client assignments.

- Client Collaboration: Integrated client portal for secure messaging, file sharing, and task management, enhancing client engagement.

- AI-Powered Tools: Features like Magic Workflow automate job creation and task generation, leveraging AI to streamline processes.

- Time Tracking: Monitor time spent on tasks to improve productivity and facilitate accurate billing.

- Accounting Software Integration: Seamless integration with QuickBooks and Xero, enabling automatic syncing of uncategorized transactions and facilitating month-end reviews.

Pros

- Combines internal workflow management with client-facing tools in a single platform

- User-friendly interface with minimal learning curve

- AI-driven features enhance efficiency and reduce manual workload

- Unlimited client access included at no additional cost

Cons

- Mobile app functionality may be limited compared to the desktop version

- Lacks advanced reporting and analytics features found in some competitors

Pricing

Client Hub offers straightforward pricing:

- Standard Plan: $59 per user/month (billed monthly) or $49 per user/month (billed annually)

- Premium Plan: $79 per user/month (billed monthly) or $69 per user/month (billed annually), which includes additional features like advanced onboarding, data migration, and team training

Where This Platform Fits Best

Client Hub is ideal for accounting firms seeking a unified solution that bridges internal task management and client collaboration. Its AI-powered features and seamless integrations make it a valuable tool for firms aiming to enhance efficiency and client satisfaction.

5. TaxDome

TaxDome is an all-in-one accounting workflow software designed to centralise and automate operations for tax, bookkeeping, and accounting firms. It integrates client management, workflow automation, document handling, and billing into a single platform, enhancing efficiency and client experience.

Best For

- Accounting and tax firms of all sizes seeking a unified solution

- Practices aiming to automate workflows and improve team collaboration

- Firms looking to enhance client engagement through a branded portal and mobile app

Key Features

- Workflow Automation: Customise workflows with ready-made templates or build your own to align with your firm’s processes.

- Client Portal and Mobile App: Offer clients a secure, branded portal and mobile app for document sharing, messaging, and task management.

- Document Management: Securely store, share, and e-sign documents with unlimited storage.

- Time Tracking and Billing: Track billable hours, generate invoices, and process payments through integrations with Stripe and CPACharge.

- CRM: Manage client information and communications in one place.

- Integrations: Connect with QuickBooks Online, Zapier, and various tax software programs.

Pros

- Comprehensive feature set tailored for accounting workflows

- User-friendly interface with customisable workflows

- Enhances client experience with branded portal and mobile app

- Reduces administrative tasks through automation

Cons

- Pricing may be higher for smaller firms or those with seasonal staff

- Initial setup and customisation can be time-consuming

Pricing

TaxDome offers several pricing plans:

- Solo Plan: Designed for individual practitioners.

- $800/year per user (1-year term)

- $750/year per user (2-year term)

- $700/year per user (3-year term)

- Pro Plan: Includes advanced collaboration tools and analytics.

- $1,000/year per user (1-year term)

- $950/year per user (2-year term)

- $900/year per user (3-year term)

- Business Plan: Offers premium support and enterprise-level features.

- $1,200/year per user (1-year term)

- $1,150/year per user (2-year term)

- $1,100/year per user (3-year term)

Where This Platform Fits Best

TaxDome is ideal for accounting firms seeking a comprehensive solution to manage internal workflows and client interactions. Its robust feature set and automation capabilities make it a valuable tool for firms aiming to enhance productivity and client satisfaction.

6. Karbon

Karbon is a robust accounting workflow software designed to streamline operations for accounting firms. It centralises client communication, task management, and workflow automation, enhancing team collaboration and efficiency.

Best For

- Mid-sized to large accounting firms seeking comprehensive workflow management.

- Teams aiming to automate routine tasks and improve client communication.

- Firms requiring integration with existing accounting tools and platforms.

Key Features

- Workflow Automation: Automate repetitive tasks, set up recurring work, and utilise customisable templates to standardise processes.

- Integrated Email Management: Manage client emails within the platform, assign emails to team members, and track communication history.

- Client Portal: Provide clients with a secure portal for document sharing, task management, and communication.

- Time & Budget Tracking: Monitor time spent on tasks and projects, and compare actuals against budgets to assess profitability.

- Team Collaboration Tools: Facilitate internal communication with shared notes, @mentions, and real-time updates.

- Reporting & Analytics: Gain insights into team performance, workflow efficiency, and client engagement through detailed reports.

Pros

- Comprehensive feature set tailored for accounting workflows.

- User-friendly interface with intuitive navigation.

- Strong integration capabilities with popular accounting tools.

- Scalable solution suitable for growing firms.

Cons

- Pricing may be higher compared to some competitors.

- Initial setup and customisation can be time-consuming.

Pricing

Karbon offers three pricing tiers:

- Team Plan: $59 per user/month (billed annually) or $79 per user/month (billed monthly). Includes essential workflow and collaboration tools.

- Business Plan: $89 per user/month (billed annually) or $99 per user/month (billed monthly). Adds workflow automation, integrations, and advanced reporting.

- Enterprise Plan: Custom pricing. Offers advanced customisation, dedicated support, and unlimited usage limits.

Where This Platform Fits Best

Karbon is ideal for accounting firms seeking a comprehensive solution to manage internal workflows and client interactions. Its robust feature set and automation capabilities make it a valuable tool for firms aiming to enhance productivity and client satisfaction.

7. Uku

Uku is a modern accounting workflow software built specifically for accounting firms that want a cleaner, more efficient way to manage recurring jobs, team schedules, and client communication. With a sharp focus on visibility and automation, Uku helps firms deliver consistent services without letting things fall through the cracks.

It’s widely used by accounting teams across Europe and offers strong task planning, billing tools, and workload tracking in one streamlined interface.

Best For

- Accounting firms delivering structured, recurring services

- Teams needing clear job visibility and team workload planning

- Firms seeking a unified tool for task, time, and billing management

Key Features

- Recurring task templates with automated scheduling

- Client dashboards with job history and shared notes

- Time tracking and billing built into every task

- Role-based user permissions and workload balancing

- Client document storage and file versioning

- Integrations with Google Calendar, Outlook, Xero, and more

Pros

- Built specifically for accountants and bookkeepers

- Combines job tracking, time management, and invoicing

- Offers excellent visibility into staff capacity

- Intuitive design and strong UX for daily use

Cons

- Client portal is more limited compared to tools like TaxDome

- Custom integrations may require setup assistance

Pricing

Uku offers flexible plans based on firm size and feature needs:

- Solo Plan – £0/month

Ideal for solo accountants.

Includes: 1 user, 25 clients, unlimited tasks, time tracking, reporting, calendar, CRM, and templates. - Team Plan – £29/user/month

Best for growing firms needing automation and client collaboration.

Adds: Client portal, email sync, billing, access management, custom fields, live chat, integrations, AML, and project tracking. - Elite Plan – £39/user/month

Designed for larger teams needing deeper performance insights.

Adds: Google Drive/OneDrive integration, advanced audit logs, client budgeting, capacity planning, and an open API. - Enterprise Plan – £79/user/month

Tailored for larger firms that require onboarding support and custom integrations.

Includes: Dedicated account manager, early feature access, assisted imports, and custom workflows.

Where This Platform Fits Best

Uku is best suited for accounting firms that need structure, visibility, and time management without overcomplicating daily operations. It’s a great option for firms that want to standardise service delivery and track performance while keeping client work on schedule.

Choosing the Right Accounting Workflow Software for Your Firm

Accounting firms don’t need more spreadsheets or scattered to-do lists; they need tools that help them deliver work on time, stay organised, and reduce unnecessary back-and-forth. That’s exactly what the right accounting workflow software offers.

Whether you’re a solo practitioner handling monthly bookkeeping, or a multi-person firm managing year-end accounts and advisory projects, there’s a platform built to match the way you work.

- Choose Jetpack Workflow or Financial Cents for simple, repeatable task tracking.

- Go with Canopy, Client Hub, or TaxDome if you need client collaboration alongside workflow tools.

- Consider Karbon or Avii for more advanced control, automation, and visibility across your firm.

Whatever your choice, the goal is the same: less admin, fewer missed steps, and more time to focus on your clients.

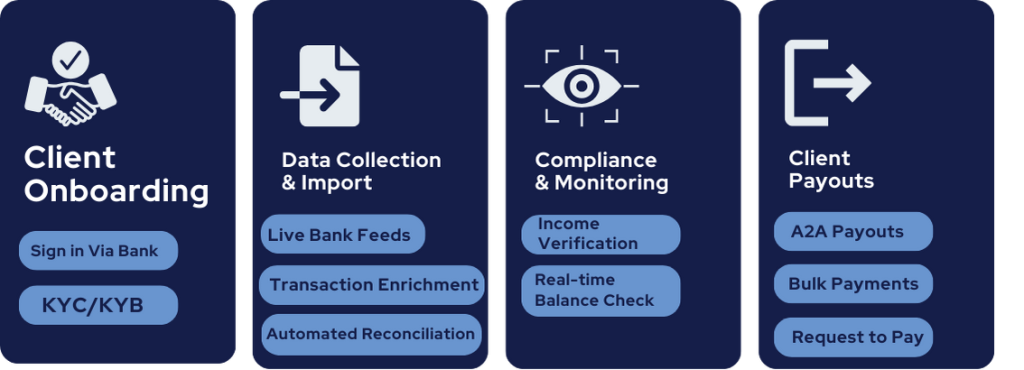

How Finexer Helps Accounting Firms

Even with the best accounting workflow software in place, much of your day is still spent waiting on clients to send bank statements, manually categorising transactions, or chasing documents for KYC checks. These are the bottlenecks that break your rhythm, delay reports, and eat into your team’s time.

That’s where Finexer helps.

Finexer isn’t a workflow tool — it’s what fuels your workflow.

While your accounting workflow software keeps jobs on track, Finexer ensures the data you’re working with is current, verified, and ready to use. It connects directly to UK banks using Open Banking to pull in real-time financial information, so you’re not left waiting on clients to send statements or upload spreadsheets.

Here’s how it improves your accounting workflows in real terms:

1. Cut Data Collection Time by 70%

With Finexer’s Account Information Services (AIS), you get instant access to your clients’ bank transactions, balances, and account details—all without needing to ask for PDF statements. What used to take hours of back-and-forth now takes minutes.

2. Stop Manually Categorising Transactions

Finexer automatically enriches and classifies each transaction, whether it’s payroll, tax payments, or utility bills. This removes the repetitive work your team does every month and keeps your general ledger cleaner from day one.

3. Accelerate Onboarding with Built-In KYC & KYB

When you onboard a new client, Finexer lets you verify their business details, confirm bank ownership, and gather financial history in one step. No more email trails asking for company documents or chasing down directors for identity checks.

4. Sync Clean Data Into Your Workflow Tools

Finexer integrates with your accounting platforms and financial dashboards, so that the data inside your workflows is always fresh. That means fewer errors, no outdated balances, and more accurate reports—without needing to chase or double-check inputs.

5. Stay Ahead During Busy Periods

In peak months like January or April, small delays add up fast. Finexer helps eliminate those “waiting on client” stalls, giving your team more control over turnaround time and helping you hit deadlines with less stress.

Why It Matters

When your data is delayed, everything else drags. With Finexer in place, you get:

- Faster starts to jobs

- Cleaner books

- Less admin per client file

- More bandwidth to take on new work

Whether you’re preparing accounts, chasing receipts, or supporting advisory decisions, Finexer ensures your workflow software runs on real, up-to-date data, not guesses.

What is accounting workflow software?

It’s a tool that helps accounting firms manage tasks, track job progress, assign responsibilities, and stay on top of recurring client work like payroll, VAT, and tax filings.

How is it different from practice management software?

Practice management software includes broader features like CRM, billing, or document portals. Accounting workflow software focuses specifically on tracking and delivering core services efficiently.

Which software is best for small firms?

Jetpack Workflow and Financial Cents are both great options for smaller firms. They’re simple to use, easy to set up, and built specifically for recurring accounting work.

Can these tools replace spreadsheets and email tracking?

Yes. Most tools let you build templates, set recurring tasks, and automatically track deadlines, helping you move away from messy spreadsheets and inbox-based job lists.

Do these tools integrate with Xero or QuickBooks?

Many do. Tools like Karbon, Client Hub, Canopy, and Financial Cents offer direct integrations with Xero, QuickBooks, or Zapier to reduce manual entry and improve workflow accuracy.

Ease your Accounting Workflow with Finexer! Schedule your free demo and get a 14 days Trial by Finexer 🙂