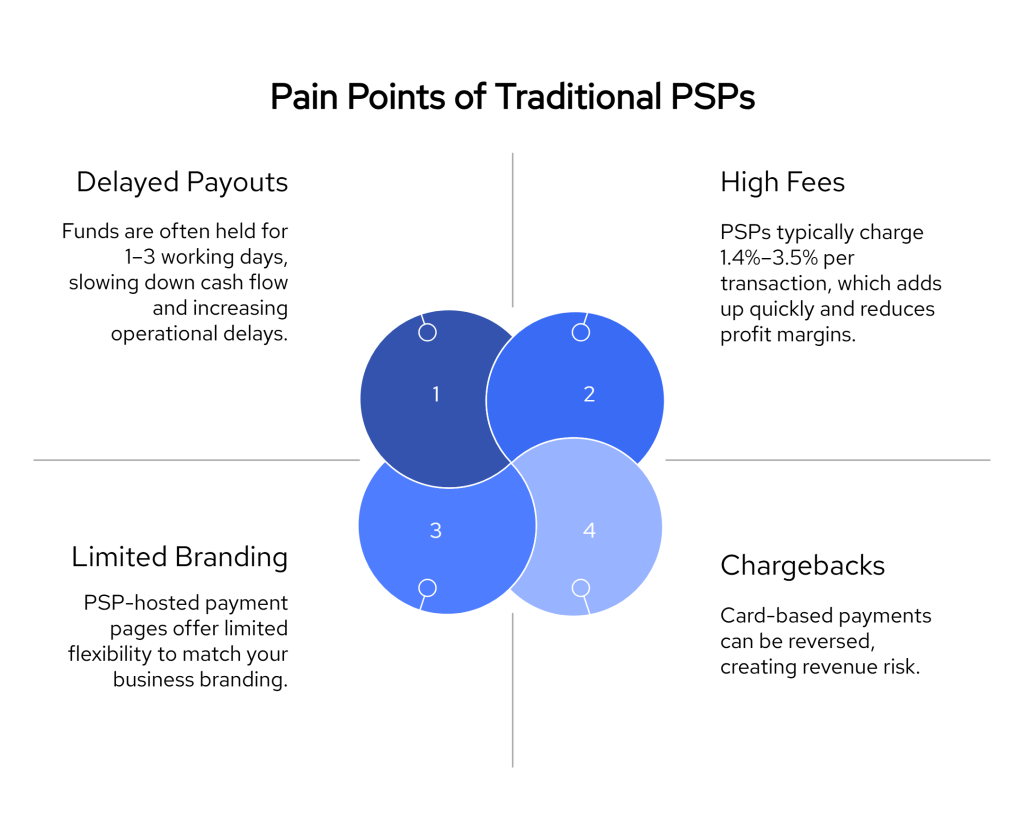

If you’re tired of paying high card fees, waiting days for payouts, or dealing with messy chargebacks, you’re not alone. Traditional Payment Service Providers (PSPs) like Stripe, PayPal, and Worldpay have helped many businesses get started, but they weren’t built for the speed or flexibility today’s businesses need.

In this guide, we’ll walk through what it actually looks like to move from a traditional PSP setup to Open Banking-based payments. You’ll learn:

At Finexer, we work with startups, accountants, and online platforms across the UK that are making this transition, so we know where the friction points are and how to make the process smoother.

If you’re exploring alternatives to PSPs or want more control over how you get paid, this guide is built to help you make an informed move.

What’s Driving the Shift from Traditional PSPs?

PSPs like Stripe and PayPal have made it easy to get started with online payments. But as businesses grow, many begin to feel the strain of their limitations. Here’s what’s pushing more UK firms to look for alternatives:

1. Payment Fees That Quietly Add Up

Card-based PSPs typically charge a mix of percentage-based fees and fixed per-transaction costs. For example, a single payment might cost you 1.9% + £0.20. While that might seem reasonable on one transaction, it’s a different story at scale.

If you’re running a subscription model, managing high-value client payments, or dealing with hundreds of transactions a week, these fees can quietly eat into your margins. And since they’re often blended into PSP dashboards, many businesses don’t realise how much they’re losing until it starts to affect profitability.

2. Delayed Access to Cash

Traditional PSPs don’t settle funds instantly. Most hold on to payments for 1 to 3 working days before releasing them to your account. Some even take longer depending on the payment method or processing volume.

This might not matter if you’re running a low-frequency ecommerce store. But for startups, agencies, accountants, or platforms that rely on regular cash flow to pay staff, vendors, or clients, these delays are far from ideal.

3. Chargebacks: More Risk, More Admin

Chargebacks are a built-in feature of card payments. If a customer disputes a payment, whether it’s a misunderstanding or intentional, the PSP may pull the funds back while investigating.

For small businesses, this can be incredibly disruptive. You’re often required to prove the legitimacy of the charge, and even then, the outcome isn’t guaranteed. Worse still, high chargeback rates can lead to penalties or account restrictions.

With direct bank payments through Open Banking, this issue doesn’t exist, because payments are authorised directly by the customer with their bank.

4. Fixed Payment Flows and Limited Control

Most PSPs give you pre-built payment pages or basic APIs. While that’s fine for standard transactions, it becomes limiting if you want more flexibility, like:

- Sending payment requests with your own branding

- Collecting funds across multiple clients in one flow

- Automating regular payouts alongside collections

You’re forced to build workarounds or rely on additional software just to make the system fit your workflow.

5. Open Banking Is a Real, Viable Alternative

Until recently, there weren’t many options outside card-based PSPs. But Open Banking changed that. It lets customers pay businesses directly from their bank accounts with no card details, no middlemen, and instant confirmation.

This isn’t just a new payment method. It’s a shift in how businesses can manage incoming and outgoing funds, with more control, lower costs, and faster settlement as standard.

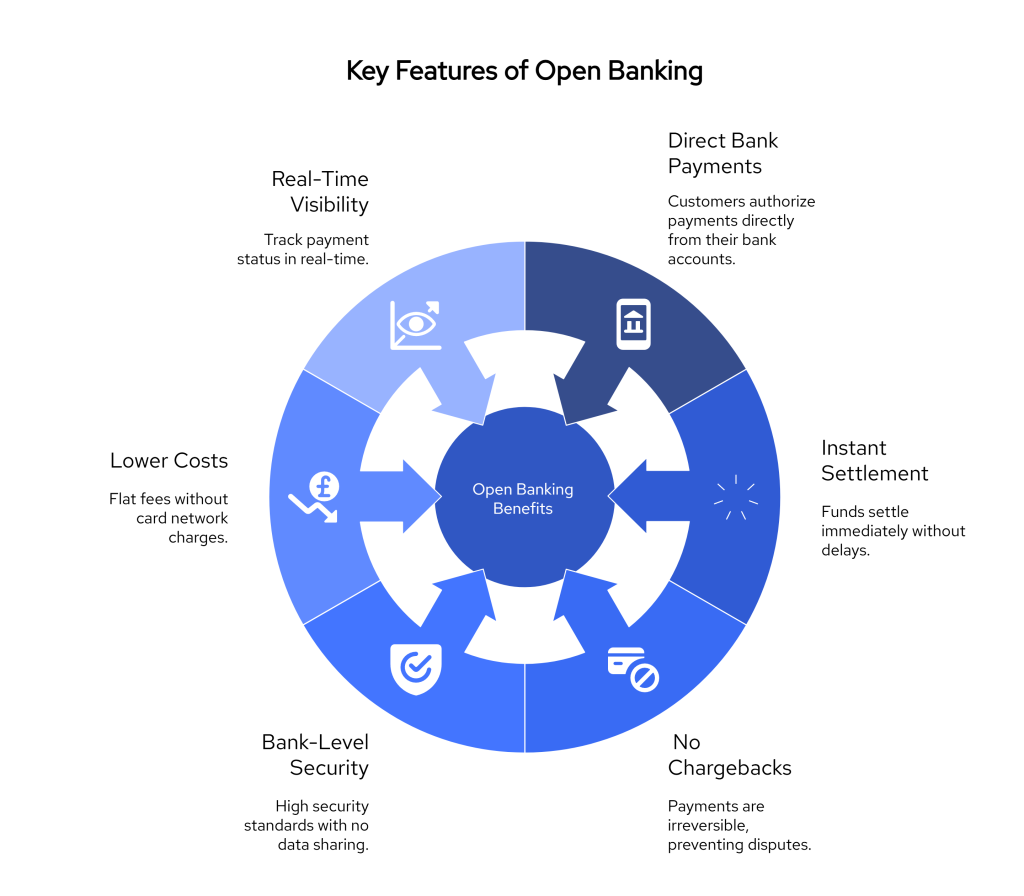

How Open Banking Works Differently

Open Banking isn’t just another payment option; it’s a new foundation for how money moves between businesses and customers. Instead of routing payments through card networks or third-party processors, Open Banking connects users directly to their bank accounts to authorise payments in real time.

The result is faster settlements, fewer intermediaries, and lower overall cost.

Here’s a closer look at what sets Open Banking apart from traditional PSPs:

1. Customers Pay Directly from Their Bank

When someone pays through Open Banking, they’re not entering card details or going through a third-party wallet. Instead, they approve the payment directly from their bank account, usually within their mobile banking app or online portal.

There’s no need for the business to collect or store payment credentials. The customer is simply redirected to their bank, confirms the payment, and is returned to your site. It’s a clean, direct flow — and for most users in the UK, it’s already familiar thanks to secure banking apps.

2. Instant Payment Authorisation and Settlement

Traditional PSPs often involve a delay between when a payment is made and when funds arrive in your account. That window might be 1 to 3 working days, depending on the provider.

With Open Banking, that delay disappears. Once a payment is authorised, it’s processed immediately, and in many cases, the money appears in your account within seconds.

This near-instant settlement helps businesses stay on top of cash flow and reduces the need to constantly track outstanding payments.

3. Bank-Level Security with No Data Sharing

Open Banking was designed to work within the UK’s regulatory framework. That means every transaction is verified using Strong Customer Authentication (SCA), typically two-factor login through the customer’s bank.

Importantly, businesses never see or store the customer’s login information. The entire process is handled by the bank, using secure APIs that were built specifically for this type of interaction. It’s safer for the customer and removes sensitive data from your payment flow entirely.

4. No Chargebacks or Reversals

In card-based systems, a transaction can be reversed by the cardholder through a chargeback, even weeks after the payment is made. This creates extra risk for businesses and often leads to disputes, refund processes, or financial loss.

With Open Banking, there’s no chargeback mechanism. Once a payment is authorised and processed, it’s final. That’s a major benefit for businesses dealing with large-ticket items, digital goods, or high-volume sales.

5. Lower Costs Per Transaction

Traditional PSPs charge a mix of percentage-based fees and fixed charges. For credit card transactions, this often ranges from 1.5% to 3.5% per payment, depending on region and volume.

Open Banking payments usually involve a flat fee per transaction — no card network fees, no interchange charges, and no markups from acquirers. Over time, this can result in significant savings, especially for businesses processing large volumes or recurring payments.

6. Transparent, Real-Time Visibility

Open Banking doesn’t just send or receive payments — it gives you live status updates. You’ll know exactly when a payment is approved, when it’s received, and whether any steps failed along the way. That level of transparency makes it easier to reconcile accounts, manage customer support, and track cash inflow without guesswork.

Traditional PSPs vs Open Banking

If you’re trying to decide whether Open Banking is a practical alternative to your current PSP, this table breaks down the key differences across cost, speed, control, and risk.

| Feature | Traditional PSPs | Open Banking (e.g., Finexer) |

|---|---|---|

| How Payments Work | Routed through card networks | Direct from customer’s bank account |

| Transaction Fees | 1.4% – 3.5% + fixed fee per payment | Flat fee (typically £0.10–£0.30 or 0.1%–0.5%) |

| Settlement Time | 1 to 3 working days | Instant or near-instant |

| Chargebacks | Common; cardholder disputes can reverse payments | Not possible; payments are final |

| Customer Data Handling | Card and billing details stored or tokenised | No sensitive data shared or stored |

| Security & Compliance | Varies by provider; requires PCI compliance | Bank-level security; fully SCA and PSD2 compliant |

| Recurring Payments | Supported via card-on-file | Now possible using VRP (Variable Recurring Payments) |

| Customisation & Branding | Limited without extra development | More flexible with APIs or white-label support |

| Payouts & Bulk Transfers | Often requires separate tools | Supported directly within most Open Banking platforms |

| Best For | Standard ecommerce, card-based billing | UK-based firms seeking lower fees & faster payments |

What to Expect When You Switch to Open Banking

Switching from a traditional PSP to Open Banking isn’t just a tech upgrade — it’s a shift in how you handle money across your business. And for many UK firms, the shift is already happening.

According to the Open Banking Implementation Entity (OBIE), over 11.6 million Open Banking payments were made in January 2024 alone — a 74% increase year-on-year. Adoption isn’t just growing; it’s accelerating, especially in sectors that rely on fast, reliable bank payments.

Here’s what you can realistically expect when making the move.

1. Quick, Flexible Setup Options

Getting started doesn’t require a big build or months of development. Depending on your needs, most providers offer:

- Hosted links to request payments with no code

- Embed-ready buttons for low-code teams

- Full APIs for platforms and SaaS firms that need full control

With a provider like Finexer, businesses typically go live within a few days, not weeks. For accounting firms and tech platforms handling client payments, this can be the fastest way to reduce fees without changing your core workflow.

2. A Familiar Payment Experience for Customers

Customers don’t need to download an app or create new login details. When they pay via Open Banking, they’re securely redirected to their bank, approve the payment, and return to your site. It’s the same process they use to send money between accounts — just applied to your payment flow.

With 99% of UK banks now supporting Open Banking, your customers are almost certainly already set up for it.

For businesses that explain the process in advance — even with a short line like “Pay directly from your bank — no cards, no delays” — uptake is strong.

3. Immediate Payment Status + Faster Access to Funds

Unlike PSPs that send payouts in daily batches, Open Banking payments settle immediately or within minutes. You also get instant confirmation once the customer approves the payment — no more waiting for card authorisation or failed transactions.

For firms chasing invoices or running multiple payouts per day, that speed translates directly into better cash flow and less admin.

4. Fewer Risks, Fewer Disputes

Chargebacks are a common frustration with card payments, especially for digital goods or service-based firms. But with Open Banking, every payment is directly authorised by the customer through their bank, and can’t be reversed after processing.

This removes a major source of unpredictability, while also reducing time spent handling disputes or writing off lost revenue.

5. Lower Transaction Costs — No Hidden Fees

Card-based PSPs often charge multiple fees: interchange, network, processing, and monthly minimums. Open Banking skips all of that.

Most providers charge a flat transaction fee — typically between £0.10 and £0.30, or around 0.1%–0.5% of the transaction value. For businesses handling large or regular payments, this can mean 30–70% cost savings compared to traditional PSP rates.

The more you process, the more you keep.

6. Improved Control Over Payments and Branding

Want to send clients a branded payment link? Schedule recurring payouts? Integrate payment data into your dashboard? Open Banking makes all of that possible, without relying on third-party plugins or workaround tools.

Many providers (including Finexer) offer white-label options, so you can keep your branding front and centre while still benefiting from bank-level infrastructure underneath.

Why Finexer Is a Smart Fit for Businesses Making the Switch

When you’re moving away from a traditional PSP, choosing the right Open Banking provider makes all the difference. Finexer is built specifically for UK businesses, with the flexibility, coverage, and control that modern firms expect.

Here’s how Finexer supports a smooth and future-ready transition:

1. Covers 99% of UK Banks

You can accept payments from nearly every major and challenger bank in the UK. That means fewer failed transactions and wider reach, no matter who your clients or customers bank with.

2 .Real-Time Payments with Instant Confirmation

As soon as a customer approves the payment, the funds move, and you’ll know immediately. This helps businesses improve cash flow and avoid chasing delayed or missing payments.

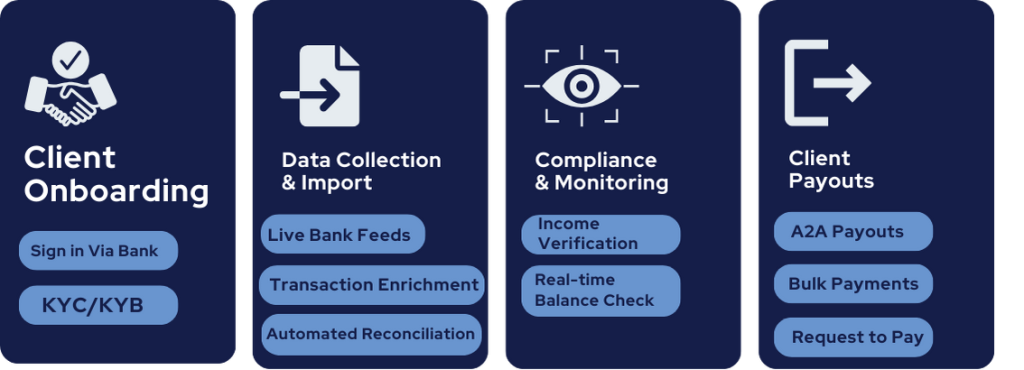

3. Access to Both Payments and Bank Data

With Payment Initiation (PIS) and Account Information (AIS), Finexer lets you collect funds and view account details. Ideal for firms managing onboarding, reconciliation, or ongoing financial workflows.

4 .Launch in Days with Flexible Setup Options

Finexer offers no-code links, drop-in modules, and full API support. Whether you’re a solo firm or a platform with developers, you can get started quickly and grow into full control when needed.

5. White-Label Support for Client-Facing Workflows

Need to keep your own branding front and centre? Finexer lets you offer payments and account features under your own name — perfect for accounting platforms or service providers managing client payments.

6 .FCA-Authorised

Finexer is fully authorised by the Financial Conduct Authority and operates only in the UK. That means no delays, no regional workarounds, and full alignment with local compliance from day one.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Can Open Banking fully replace a traditional PSP like Stripe or PayPal?

In many cases, yes — especially for UK-based businesses focused on invoice payments, client billing, or recurring transactions. Open Banking supports direct bank payments, and with solutions like Finexer, you also get account verification, data access, and payout features. However, if you rely heavily on card payments or global coverage, you might keep a PSP alongside Open Banking during the transition.

Are Open Banking payments safe for business use?

Yes. Open Banking payments are authorised directly through the customer’s bank, using Strong Customer Authentication (SCA). You don’t handle card data or passwords, and every transaction is processed through secure, FCA-regulated APIs. Providers like Finexer are also fully authorised and built to meet UK compliance standards.

How fast are Open Banking payments compared to PSPs?

Open Banking payments typically settle instantly or within seconds — unlike traditional PSPs, which may hold funds for 1 to 3 working days. This means faster access to your revenue and less time spent waiting for payouts.

Do Open Banking payments support recurring billing?

Recurring billing is becoming more widely supported through Variable Recurring Payments (VRP), which are being rolled out by banks in stages. Even without VRP, you can use Open Banking for one-off payments, renewals, and scheduled billing with customer authorisation.

What businesses benefit most from switching to Open Banking?

Open Banking is especially useful for UK startups, accountants, SaaS platforms, and any business that handles direct customer or client payments. It’s cost-effective, fast, and built for businesses that want more control without the overhead of card networks.

Switch to Open banking with Finexer! Schedule your free demo and get a 14 days Trial by Finexer 🙂