The UK has become a global leader in Open Banking, and in 2025, it’s clear that open banking startups are driving this momentum. From account verification to real-time payments, these platforms are reshaping how businesses connect to financial services.

But not all Open Banking platforms are created equal.

If you’re building a fintech product, launching a startup, or upgrading legacy systems, you need more than a compliance box-ticker. You need a partner who delivers real value: instant integrations, bank-grade security, and pricing that makes sense from day one.

That’s where the best Open Banking startups work.

In this guide, we’ve handpicked six standout providers based in the UK — startups that are rethinking how Open Banking infrastructure should work.

1. Finexer

Built for UK startups that want control, speed, and affordability from day one

Finexer is one of the most practical choices among UK open banking startups, especially for early-stage companies and lean teams looking to simplify how they move money, access bank data, or verify accounts. Rather than bundling features you may not need, Finexer focuses on giving startups exactly what they’re looking for — fast access to UK bank connectivity, clear pricing, and reliable performance.

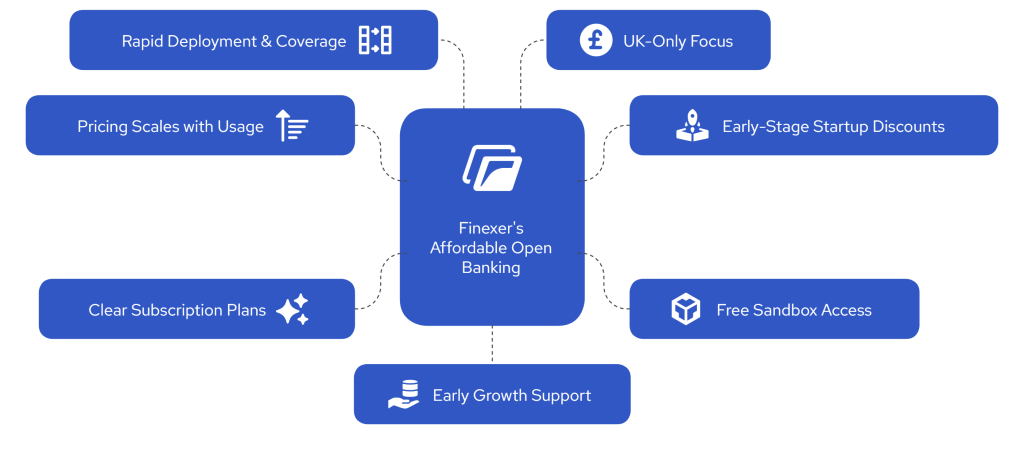

What Makes Finexer Stand Out

- 99% UK Bank Coverage

Finexer connects with nearly every major UK bank via Open Banking APIs, offering wide compatibility for account-to-account payments, data aggregation, and more. - FCA-Authorised

Fully regulated for both AISP and PISP roles, Finexer’s infrastructure is built for long-term compliance, which makes it suitable for both regulated and non-regulated platforms. - Fast Deployment

Many startups need to go live quickly. Finexer’s prebuilt modules and developer-friendly APIs help teams integrate in days, not months, without sacrificing control. - Usage-Based Pricing

Instead of locking businesses into contracts or charging setup fees, Finexer charges based on actual usage. This gives startups room to test, grow, and adapt without worrying about upfront costs. - White-Label Options

For businesses looking to integrate Open Banking into their own products, Finexer offers white-label capabilities for a seamless end-user experience.

Best For

Startups and SMEs in the UK that want a straightforward way to enable payments, access bank data, or run KYC/KYB processes, with predictable pricing and fast go-live options.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

2. Bud

Transforming Open Banking data into business-ready intelligence

Bud has carved a space for itself among leading Open Banking startups in the UK by focusing on what happens after the data arrives. Its core strength lies in transforming raw transaction data into meaningful, structured insights, making it an ideal choice for platforms that want to automate financial decision-making, improve user segmentation, or personalise services based on spending behaviours.

Rather than competing on payments or core connectivity, Bud delivers advanced data enrichment and categorisation features that help financial service providers do more with Open Banking data.

What Makes Bud Stand Out

- Data Enrichment Engine

Bud’s engine classifies transactions, merchants, and behaviours with high precision — useful for lenders, insurers, and fintechs building smarter products. - Affordability, Income & Risk Models

Beyond categorisation, Bud enables teams to assess affordability or detect financial vulnerability using aggregated behavioural patterns. - Modular API Toolkit

Businesses can use only what they need from income verification to affordability scoring to integrate these into their own onboarding or underwriting processes. - Financial Behaviour Insights

Ideal for companies in lending, personal finance, and wealth management, Bud helps reveal a customer’s financial story at a glance.

Best For

Financial institutions looking to extract deeper insights from Open Banking data for credit scoring, risk analysis, or customer personalisation.

3. Salt Edge

A compliance-focused Open Banking startup with wide international reach

Salt Edge is one of the more globally oriented Open Banking startups operating in the UK, known for its focus on regulatory compliance and strong PSD2 infrastructure. For businesses building applications that need to meet strict banking and data standards — especially those operating across borders — Salt Edge offers a robust and secure foundation.

While many startups focus on payments or aggregation alone, Salt Edge blends both with strong identity verification, consent management, and risk monitoring tools designed to support enterprise-grade integrations.

What Makes Salt Edge Stand Out

- Global Bank Connectivity

Salt Edge supports over 5,000 banks across more than 50 countries, making it a suitable option for UK companies with cross-border ambitions. - Strong PSD2 & Open Banking Compliance

Their platform is built to comply with both UK and EU regulatory requirements, helping reduce legal friction during implementation. - Consent Management Tools

Offers built-in user consent dashboards, expiry management, and re-authentication workflows — a major plus for firms under tight compliance scrutiny. - Fraud Prevention Modules

For fintechs dealing with sensitive financial data, Salt Edge includes tools to detect suspicious activity and help protect end-users from risk.

Best For

Fintech platforms operating in highly regulated environments, or those needing extensive bank coverage across both UK and international markets.

4. Token.io

Built for pan-European account-to-account payment flows

Token.io has become a notable name among Open Banking startups by specialising in account-to-account (A2A) payments across the UK and Europe. It provides a unified platform for initiating payments and managing authorisations, particularly useful for platforms operating in multiple markets or supporting enterprise clients.

Its strength lies in supporting high-volume, multi-jurisdiction payment scenarios, offering a developer-first approach with flexibility across local regulatory environments.

What Makes Token.io Stand Out

- Multi-Country Payment Support

Token enables seamless A2A payments across multiple countries via a single integration, reducing complexity for international platforms. - Embedded Payment Experience

Businesses can fully embed the Token checkout into their platforms for a branded, frictionless payment journey. - Strong PISP Focus

Token has concentrated its efforts on the payments layer of Open Banking, giving it an edge in high-throughput, low-latency payment workflows. - Support for Variable Recurring Payments (VRP)

Early adoption of VRP capabilities helps businesses manage subscription models or flexible payment flows with user-authorised access.

Best For

SaaS platforms, marketplaces, and regulated businesses managing account-to-account payments across the UK and EU, especially those with recurring or multi-party payment needs.

5. Volt

Global payment orchestration through Open Banking rails

Volt positions itself as a high-performance Open Banking startup with a global footprint. While many UK-based providers focus on domestic use cases, Volt’s core offering is designed for scale, helping businesses route, settle, and manage bank payments across borders in real time.

Its infrastructure is particularly appealing for platforms handling large volumes of payments or operating across multiple payment service providers (PSPs). By offering smart routing, instant settlement support, and an intelligent reconciliation engine, Volt brings enterprise-grade capabilities to Open Banking payments.

What Makes Volt Stand Out

- Global Real-Time Payments Network

Volt has established its own network that extends beyond the UK, enabling fast A2A payments across multiple markets with dynamic routing. - Smart Payment Routing

Automatically selects the optimal route for each transaction, improving success rates and reducing friction at checkout. - Centralised Orchestration Dashboard

Businesses can manage all payment flows in one place, with tools for reconciliation, refunds, and settlement tracking. - Payment Intelligence Layer

Volt provides visibility into transaction health, helping finance teams diagnose failed payments and optimise for performance.

Best For

Marketplaces, payment processors, and fintech platforms handling high transaction volumes or operating in multiple countries require a resilient, orchestrated Open Banking infrastructure.

6. Brite Payments

Pan-European A2A payments with instant settlement

Brite Payments is one of the newer Open Banking startups making waves across Europe, with a growing presence in the UK. Its focus lies in enabling instant account-to-account payments across multiple markets, particularly useful for e-commerce, subscription services, and platforms that rely on recurring or high-frequency transactions.

By combining Open Banking connectivity with built-in KYC and compliance modules, Brite gives businesses the ability to not only move money but also verify customers in a single flow.

What Makes Brite Payments Stand Out

- Instant Settlements

Unlike traditional bank transfers that may take hours or days, Brite’s platform settles transactions in real time, even across borders. - Recurring Payments Support

Enables subscription businesses to request and manage variable recurring payments (VRPs) within regulatory guardrails. - Built-in Compliance & KYC

Offers identity verification tools to help businesses onboard users while processing payments, simplifying the overall workflow. - Wide European Coverage

Brite supports Open Banking payments across 25+ markets in Europe, with growing bank coverage in the UK.

Best For

E-commerce businesses and platforms operating across Europe that need fast, reliable A2A payments and built-in user verification, especially in recurring or cross-border use cases.

Choosing the Right Open Banking Startup for 2025

As Open Banking adoption continues to accelerate across the UK, startups are no longer just customers of financial infrastructure — they’re now builders, integrators, and product innovators. The open banking startups featured in this guide each bring something different to the table: from advanced data enrichment to cross-border payment orchestration.

But if your focus is the UK market, and you need something that’s fast to deploy, compliant by design, and accessible to teams of all sizes, Finexer stands out.

With nearly complete UK bank coverage, usage-based pricing, and a platform that supports both data and payments, Finexer is tailored for early-stage businesses and scaling fintechs alike. Whether you’re building payroll tools, onboarding flows, or internal financial ops, it gives you everything you need, without overcomplicating the process.

In a space where complexity can slow teams down, Finexer helps you go live in days, not months, while maintaining control and clarity every step of the way.

What is the best Open Banking provider for UK businesses?

Finexer is a top choice for UK startups with FCA approval, wide bank coverage, and usage-based pricing that scales with your business.

How fast can I integrate an Open Banking solution?

Finexer enables integration in days, not months, with developer-friendly APIs and no complex onboarding processes.

Do Open Banking platforms charge setup fees?

Finexer doesn’t charge setup fees or require monthly minimums for Startups. You only pay based on actual usage.

Looking for an Open banking provider? Switch to Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂