Making Tax Digital for Income Tax (MTD ITSA) is HMRC’s new reporting system for sole traders and landlords. It replaces the annual Self Assessment return with quarterly digital updates submitted through approved software.

Beginning 6 April 2026, businesses and property owners with annual gross income above £50,000 must join the scheme. The threshold falls to £30,000 in 2027 and to £20,000 in 2028, bringing many smaller clients into scope.

For accountancy firms this means:

- Moving eligible clients onto compatible record-keeping software

- Spreading compliance work across four reporting dates each tax year

- Training clients who still rely on spreadsheets or paper records

The sections that follow explain the scope, deadlines, software rules, exemptions, and a step-by-step preparation plan so your practice can meet every requirement on time.

Keep Reading or jump to the section you are looking for:

1. What Is Making Tax Digital for Income Tax?

Making Tax Digital for Income Tax (MTD ITSA) is the next phase of HMRC’s wider digital filing programme. Under MTD ITSA, anyone in scope must:

- Keep digital records of all business or property transactions

- Send quarterly updates of income and expenses to HMRC through approved software

- Submit an End-of-Period Statement (EOPS) and a Final Declaration after the tax year to confirm all figures

HMRC’s aim is to collect tax information more frequently and cut data entry errors that arise when figures are recreated at year-end.

Key points to remember

- Software is compulsory. HMRC will not offer a free filing tool for MTD ITSA.

- Quarterly updates are cumulative. Each one replaces the previous return for that tax year.

- Payment dates stay the same. Balancing payments and payments on account are still due on 31 January and 31 July.

2. How MTD ITSA Differs from MTD for VAT

Many firms already handle Making Tax Digital for VAT. MTD ITSA follows similar principles but introduces extra steps.

| Requirement | MTD for VAT | MTD ITSA |

|---|---|---|

| Records to keep | VAT sales and purchases | All income and expense lines for self-employment or property |

| Filing frequency | Quarterly VAT returns | Quarterly updates plus EOPS and Final Declaration |

| Threshold | £90,000 taxable turnover (2024–25) | £50,000 gross income from April 2026, then £30,000 in 2027, then £20,000 in 2028 |

| HMRC free software | None | None |

| Additional rules | Digital links for VAT data | Separate digital record sets if you have more than one trade or property business |

Why this matters for practices

- Clients who are VAT-registered may already use compliant software, yet the package still needs an MTD ITSA module before April 2026.

- Non-VAT clients who work on spreadsheets will face their first legal push toward full digital record-keeping.

- Workflows will expand: four income updates, one EOPS, one Final Declaration, and traditional payment schedules.

3. Who Must Follow Making Tax Digital for Income Tax?

Under HMRC rules, the duty to use MTD ITSA depends on annual gross income from self-employment and/or UK property. Gross income means the amount before any expenses or deductions.

*| Start date | Annual gross income that brings you into scope |

|---|---|

| 6 April 2026 | Over £50,000 |

| 6 April 2027 | £30,001 to £50,000 |

| 6 April 2028 | £20,001 to £30,000 |

Partnerships

HMRC has confirmed that partnerships will join MTD ITSA at a later stage. A formal date is still to be announced, but firms should track updates so they can plan software changes for partnership clients.

Mixed income sources

If a client has both trading and property income, add the two figures together to test against the thresholds. For example:

- Self-employment gross income: £42,000

- Rental gross income: £10,500

Total gross income: £52,500

Result: the client crosses the £50,000 line and must start MTD ITSA from 6 April 2026.

Voluntary entry

Any taxpayer may opt in early. Early adoption helps practices test software and smooth client training before the rules become compulsory.

4.Digital Record-Keeping Requirements

When Making Tax Digital for Income Tax applies, every in-scope client must keep their sales, expenses, and other source data in a digital format that can link directly to HMRC.

| Date of Transaction | Description | Amount | VAT Rate | Category |

|---|---|---|---|---|

| 12 Feb 2026 | Office stationery | £36.50 | 20% | Office costs |

Key checks before choosing software

- Does it cover both MTD for VAT and MTD ITSA if the client is registered for VAT?

- Can you export full data if the client later moves to a different system?

- Is support offered by telephone, chat, or ticket, and is that included in the licence fee?

- Are automatic bank feeds available and reliable for the client’s bank?

- Can the user set up separate ledgers for each trade or property business, as required by HMRC?

📚 Top Free Accounting Software for Startups

Quarterly digital updates

From the chosen system, clients will send four cumulative updates each tax year:

| Period Covered | Filing Deadline |

|---|---|

| 6 Apr – 5 Jul | 7 Aug |

| 6 Apr – 5 Oct | 7 Nov |

| 6 Apr – 5 Jan | 7 Feb |

| 6 Apr – 5 Apr | 7 May |

An election is available to use calendar quarters (1 Apr–30 Jun, etc.) if that better matches existing management accounts. The election must be set in software before the first update of the tax year.

End-of-Period Statement and Final Declaration

After the fourth update, the client or their agent must:

- Adjust the digital records for year-end items such as stock or accruals.

- Submit the End-of-Period Statement (EOPS) to lock in the final trading profit for each business.

- File a single Final Declaration that adds any other income (for example interest or dividends).

These steps replace the traditional Self Assessment return. Payment dates remain 31 January and 31 July where payments on account apply.

5. Exemptions and Digital Exclusion

Some clients will not have to join Making Tax Digital for Income Tax. Others can apply for exemption if it is not reasonable for them to keep digital records or use online services.

Automatic exemptions

These clients do not need to follow MTD ITSA and do not have to apply:

| Situation | Why They Are Exempt |

|---|---|

| Gross income £20,000 or below | The legal threshold keeps them outside the rules. |

| No UK National Insurance number on 31 January before the tax year | HMRC systems cannot enrol them. |

| Foster carers or shared-lives carers whose only income is qualifying care income | Their income is taxed under special rules. |

| VAT-registered traders already granted exemption from MTD for VAT | The VAT exemption carries across to income tax. |

Digital exclusion

A client can apply for exemption if using software is not practical because of:

- Age

- Disability or a long-term medical condition

- Location with no reliable internet service

- Religious beliefs that prevent electronic record-keeping

HMRC will also accept applications from anyone who can show that neither they nor a partner, friend, or agent can keep digital records on their behalf.

Process

HMRC plans to allow online or paper applications from October 2025. While an application is being reviewed, the client does not have to follow MTD ITSA.

Temporary exemption for new businesses

If a client starts trading or begins to let property on or after 6 April 2025, they enter MTD ITSA only when their first Self Assessment return shows income above the relevant threshold. The start date is the 6 April that follows the 31 January filing deadline for that return.

Voluntary entry

Clients under the thresholds may opt in early. Reasons to consider early adoption include:

- Aligning VAT and income tax processes on one platform

- Smoothing the learning curve before the rules become compulsory

- Gaining year-round view of profits to improve cash-flow planning

Checklist for accountants

- Review 2024-25 returns to identify clients likely to exceed £50,000.

- Flag potential exclusion cases now so applications can be filed in late 2025.

- Document decisions in your engagement letters. HMRC expects agents to hold evidence supporting any exemption claim.

- Set reminders for new business and property clients started after April 2025 so their MTD status is checked once their first return is filed.

📚 Top 7 Open Banking Use Cases for Accounting Firm

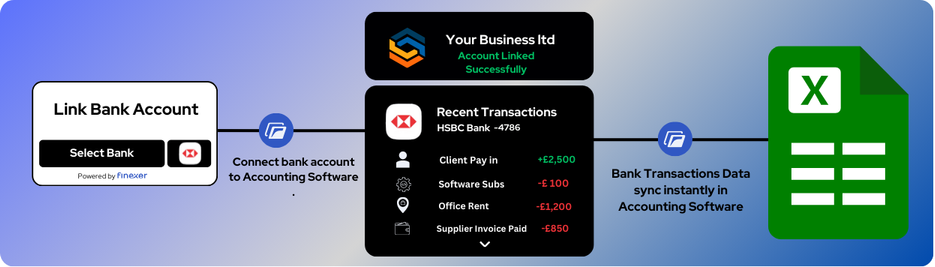

6.Open Banking Feeds: A Practical Way to Cut MTD Admin

Quarterly updates under Making Tax Digital for Income Tax rely on accurate, up-to-date data. Pulling that data straight from the bank is faster and more reliable than keying each figure by hand.

| Manual Entry | Live Bank Feed |

|---|---|

| Type or copy every receipt and payment | Transactions flow into the ledger once the client approves the connection |

| Higher risk of missed items or transposed figures | Full list of credits and debits arrives with dates and amounts locked |

| Chase clients for statements near each deadline | Data is already in place; focus shifts to review and coding |

How the feed works in practice

- Client grants secure consent through their online banking page.

- Your bookkeeping or tax software pulls transactions for up to 90 days (longer once refreshed).

- Rules or bank-matching tools suggest codes; the team reviews and confirms.

- Coded totals roll straight into the next MTD update.

Time and error savings you can expect

- Matching a bank statement line to a ledger code takes seconds instead of minutes.

- Missing-transaction queries fall sharply, especially for cash-heavy trades.

- Less rework at year-end, because quarterly numbers have been verified in real time.

Why Choose Finexer for MTD Income Tax

Finexer’s Open Banking feed is built for accountants who need reliable data before each quarterly update. Here is why practices are connecting their bookkeeping software to Finexer:

| Benefit | What It Means for Your Firm |

|---|---|

| Near-universal bank coverage | Pull transactions from 99 percent of UK banks, so even niche lenders appear in the same feed. |

| Fast deployment | Connect a client account in days not months and see cleared transactions in the ledger straight away. |

| Usage-based pricing | Pay only for the feeds you run each month; no fixed bundles or long-term minimums. |

| FCA-authorised infrastructure | Data flows through UK servers under strict security and compliance controls. |

| White-label option | Offer clients a co-branded dashboard that mirrors the live data you see in your practice system. |

| Start small, scale smart | Pilot the feed with one client, then switch on additional licences as you migrate more of your portfolio. |

How to integrate

- Open the integrations panel in your MTD-ready bookkeeping or tax package.

- Select Finexer Bank Data and follow the on-screen link to authorise the connection.

- Invite the client to approve secure consent through their online banking page.

- Map incoming transactions to your existing chart of accounts or rules engine.

- Review the feed after the first sync, then set a monthly check-in before each filing deadline.

With live bank data flowing automatically, your team can focus on review and advice instead of manual entry, making every quarterly update faster and more accurate.

What counts as “gross income” for the thresholds?

Use turnover before any expenses or fees. Add self-employment takings and UK rent receipts, even if an agent deducts charges before paying you.

Do clients still file a Self Assessment return?

No. Four updates, one End-of-Period Statement and one Final Declaration replace the return, but tax payments are still due on 31 Jan and 31 Jul.

Is HMRC providing free software?

HMRC offers no free tool. Clients must use commercial software or a spreadsheet linked to HMRC through approved bridging software.

Can spreadsheets still be used?

Yes, if every entry remains digital and bridging software submits the totals. Re-typing or copy-paste breaks the digital link requirement.

What happens if a client misses a quarterly deadline?

Each late update earns a penalty point. Hitting the threshold triggers a fixed fine, and further late filings add extra charges.

How can bank feeds help with MTD?

Live bank feeds import transactions automatically, cutting manual entry errors and speeding quarter-end checks, so MTD updates take less time.

Why choose Finexer for bank feeds?

Finexer links to 99% of UK banks, activates in days, and charges only for the feeds you use. Its FCA-authorised, UK-hosted platform and white-label dashboard let your data scale effortlessly as more clients join MTD.

Pull bank feeds automatically to your Accounting software; Switch to Finexer! Schedule your free demo and get a 14-day Trial by Finexer 🙂