If you’re still asking users to upload multiple documents, chances are you’re slowing down your KYC verification speed and losing a lot of them before they ever complete onboarding.

According to the Signicat “Battle to Onboard” report (2023), 37% of users abandon signup when asked to upload identity documents. That’s a huge number. And it’s not because users don’t want to verify their identity. It’s because the process feels outdated, confusing, or just too much effort.

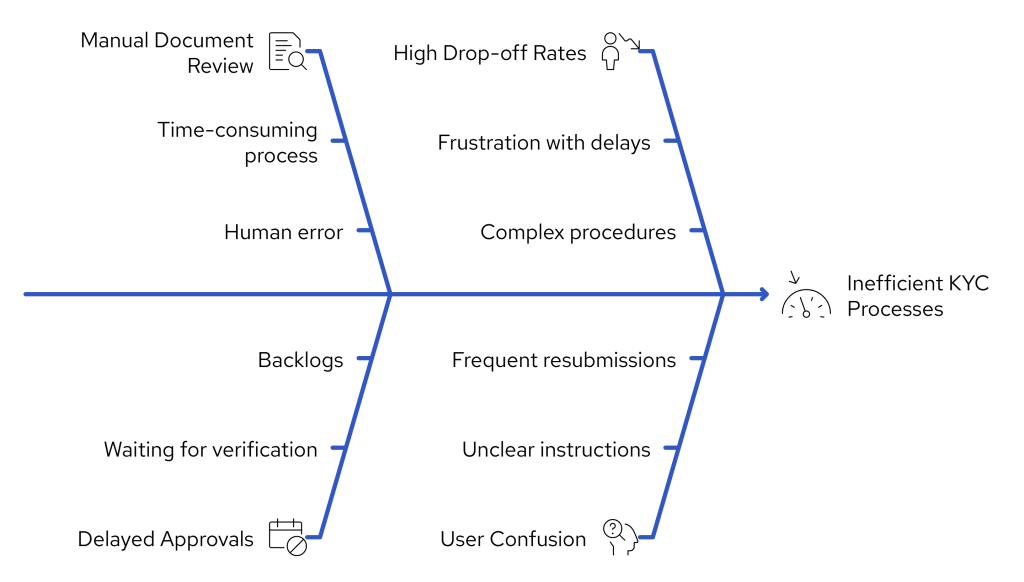

Here’s where most delays come from:

- Blurry or incorrect uploads that get rejected

- Users unsure what documents they need to provide

- Long review queues on your side

- No clear feedback or real-time status updates

All of this hurts your KYC verification speed. Instead of verifying identity in minutes, your team is stuck reviewing documents, chasing users for resubmissions, or waiting for compliance sign-off.

And your users? They’re already gone.

What Today’s Users Actually Want?

People today expect the same speed from onboarding that they get when sending money or ordering food. If your identity check takes more than a few minutes, they’re going to lose patience.

A recent iProov report shows that 65% of users expect verification to take under three minutes. And Deloitte’s Open Banking survey found that users trust their bank app more than third-party portals when it comes to personal data.

That means users are much more comfortable verifying themselves through a bank login than uploading a passport to a random website.

Here’s what they’re looking for:

- A quick, familiar experience

- No back-and-forth with document uploads

- Instant results

- A branded flow they can trust

That’s where identity verification automation through Open Banking comes in. Your user logs into their bank. You instantly pull verified information like their full name, registered address, and account ownership status. The check is complete in minutes — no uploads, no manual reviews, and no friction.

It also builds trust. When users stay inside your branded environment and verify through their own bank, they feel more in control and more confident in your platform.

Open Banking Lets You Cross-Check Identity Instantly, Without the Wait!

One of the biggest reasons KYC slows down is that identity documents need to be manually reviewed. Users upload a passport or driving licence, and then… they wait. Sometimes for hours. Sometimes longer. That delay alone can cost you the customer.

Finexer changes that. Instead of relying on slow, manual reviews, it cross-checks identity documents with verified bank data in real time. This dramatically improves your KYC verification speed without compromising compliance.

Here’s how it works:

- The user uploads an identity document and a selfie

- Finexer extracts key details like name, address, and date of birth from the document

- That data is instantly validated against information pulled from the user’s bank account

- A similarity score is generated by comparing the selfie with the document photo

- The result is a full identity match, completed in minutes, not days

This isn’t just document verification. It’s identity verification automation backed by live, regulated Open Banking data. Your team gets verified results instantly. Your users avoid delays. And the entire flow is built to meet UK KYC, AML, and FCA requirements.

Because the process is fully white-labelled, users stay within your onboarding journey from start to finish, with no third-party redirects and no visible handoffs.

With Finexer, you can collect documents when needed, but eliminate the wait time that usually comes with them. That’s the difference between a standard onboarding process and one that’s optimised for KYC verification speed.

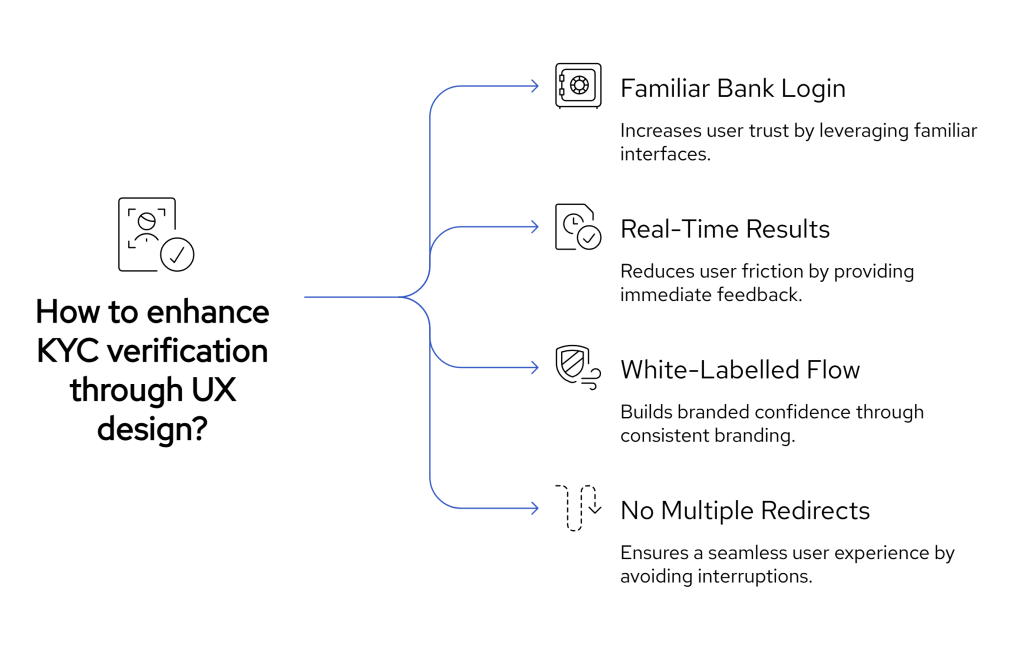

Build Trust Through UX, Not Just Security

Security matters, but so does perception. If your KYC process feels clunky, disconnected, or intrusive, users lose trust, even if you’re fully compliant.

That’s why improving KYC verification speed isn’t just about faster processing. It’s about creating an experience that users actually feel comfortable with. Finexer helps you do both.

Here’s what users notice:

- They aren’t redirected to unfamiliar portals

- They verify through a bank login they already trust

- The design, messaging, and flow all match your brand

- They get results in minutes, not hours

Finexer’s white-labelled identity verification lets you deliver a complete KYC process inside your own onboarding, no off-brand pages, no confusing steps. Whether you’re onboarding an individual or a business client, the experience feels secure, modern, and under your control.

Trust also comes from transparency. When users log in through their bank instead of uploading sensitive documents to a random form, they’re more confident that their data is protected. And when they receive instant confirmation that their identity has been verified, it removes the guesswork entirely.

That’s what sets Finexer apart. It doesn’t just help you meet compliance requirements; it helps you earn trust at the most critical point in the user journey.

And all of this leads to a measurable lift in KYC verification speed and onboarding completion rates. Because when users trust the process, they finish it.

Success Story: VirtualSignature-ID Boosts KYC Verification Speed with Finexer

VirtualSignature-ID, a UK Government-accredited identity and eSignature provider, supports legal and accountancy firms handling high-value transactions.

The Challenge

Their team needed a faster, more efficient way to:

- Verify customer identity

- Perform proof-of-funds and AML checks

- Stay fully compliant without slowing down onboarding

Manual reviews were creating delays and hurting the overall KYC verification speed.

The Solution

They partnered with Finexer to integrate real-time identity checks powered by Open Banking.

With Finexer, VSID can now:

- Match ID documents with bank-verified data instantly

- Validate names, addresses, and account ownership in seconds

- Generate similarity scores to verify selfies against ID photos

“Finexer is easy to work with and flexible in their approach, providing the bespoke services we required alongside a viable commercial package.”

— David Kern, CEO, VirtualSignature-ID

The Result

- Faster client onboarding

- No more delays from manual review queues

- A smoother, branded UX backed by FCA-compliant infrastructure

- Full regulatory compliance, without the operational drag

“Their interface is intuitive, the integration was straightforward, and the support has been excellent. Finexer has proven to be more than a provider — they’re a trusted partner who understands our vision.”

— David Kern, CEO, VirtualSignature-ID

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How can I increase KYC verification speed for my business?

You can improve KYC verification speed by automating identity checks using verified bank data. This reduces manual reviews and enables real-time cross-checking of uploaded documents with information sourced directly from the user’s financial institution.

Is it possible to verify identity without manual document review?

Yes. By combining document uploads with identity verification automation, platforms like Finexer can validate user information in real time using bank-verified data, removing the need for slow manual reviews.

Does using Open Banking improve KYC verification speed?

Absolutely. Open Banking allows access to real-time, verified customer information directly from their bank, significantly accelerating the KYC process and reducing the risk of fraud or error.

What’s the difference between document upload KYC and bank-based verification?

Traditional KYC relies on manual review of uploaded documents, which can take days. Bank-based verification cross-checks identity details in real time, speeding up the process and reducing abandonment during onboarding.

Is identity verification automation compliant with UK regulations?

Yes. Identity verification automation through Open Banking complies with FCA and JMLSG KYC requirements when it retrieves and verifies official customer data such as name and address directly from regulated banks.

Want to Cut Your KYC Verification Time from Days to Minutes? Lets Connect we can help you !