All facts on Ozone API and TrueLayer were taken from their websites on 24 May 2025 and may change.

Keep reading or jump to the section you’re looking for:

Comparison: Ozone API vs TrueLayer

| Feature/Metric | Ozone API | TrueLayer |

|---|---|---|

| Primary Focus | Open Banking compliance stack for banks & B2B | Enterprise-grade data and payments APIs |

| UK Bank Coverage | Covers major UK banks via Open Banking Standard | Covers major UK consumer banks |

| Compliance Toolkit | Reference implementation, conformance suite | Policy updates, PSD2 guides, 90-day rule help |

| Deployment Speed | Fast (pre-built regulatory artefacts) | Medium (quick POC, slower custom rollout) |

| Payments Support | VRP, CoP, single & bulk payments supported | Pay-by-bank, VRP, refund support |

| Best For | Banks, ERP tools, compliance-led B2B platforms | Consumer-facing fintechs, e-commerce, wallets |

Key Features and Capabilities

Ozone API

Ozone positions itself as more than just a connector; it’s a compliance infrastructure provider. Their platform includes a reference implementation of the UK Open Banking standard, which gives banks and regulated firms a shortcut to meet PSD2 and FCA expectations without building from scratch.

Key capabilities include:

- Conformance suite to speed up audits

- Support for VRP and CoP is baked into the core platform

- Open-source tooling to simulate full regulatory environments

It’s designed to help product teams move quickly through security, compliance, and legal reviews by offering “ready-to-test” flows out of the box.

TrueLayer

TrueLayer offers a broader product suite aimed at fintechs, consumer apps, and digital wallets. Its APIs cover both data and payments, and its Pay-by-Bank product is widely used in UK e-commerce.

Core strengths include:

- Enterprise-grade APIs for both A2A payments and financial data

- Variable recurring payments and refund workflows

- Robust SDKs and hosted consent flows for a clean end-user journey

TrueLayer appeals to teams that want to build custom payment experiences while keeping infrastructure reliable and scalable.

Compliance & Launch Speed

Ozone API: Compliance-First by Design

Ozone was built around Open Banking standards, and it shows. Rather than layering compliance on top of an API, Ozone starts with regulation and builds tools outward. Its reference implementation includes:

- Pre-built endpoints that align with the UK Open Banking Implementation Entity (OBIE) specs

- A conformance suite you can run internally for pre-audit checks

- Built-in support for features like 90-day re-authentication, CoP (Confirmation of Payee), and Strong Customer Authentication (SCA)

This allows product and compliance teams to pass internal reviews and external audits much faster, especially in banks or B2B platforms where governance is heavy.

TrueLayer: Policy-Aware, but Dev-Led

TrueLayer also supports all major UK compliance features, including SCA, VRP, and the updated PSD2/RTS rules. However, it assumes your team will design the compliance workflows yourself using their APIs.

You’ll find:

- Detailed guides on topics like 90-day rules and AML triggers

- PSD2 policy explainers written by their in-house legal team

- Fewer built-in regulatory tools — more guidance, less pre-configuration

That means faster prototyping, but often longer time-to-market when you hit internal compliance reviews.

Coverage & Market Fit

Ozone API: UK-Centric with Deep Standards Alignment

Ozone is focused almost exclusively on the UK market. Instead of spreading across geographies, it has invested in building tooling around the UK’s regulatory ecosystem.

Coverage includes:

- Major UK retail and commercial banks via the Open Banking Standard

- APIs aligned with OBIE specifications

- Target use cases include: banks building PSD2 stacks, B2B fintechs, ERPs, and regtech platforms

This makes Ozone a strong fit for firms that need FCA alignment first, not cross-border scalability.

TrueLayer: UK + EU Market Coverage

TrueLayer also covers major UK banks but goes further with broad EEA support, including countries like France, Germany, Spain, and Italy.

Market reach highlights:

- Coverage of major UK consumer banks

- Live in multiple European Economic Area (EEA) countries

- Expanding across use cases like e-commerce, personal finance, and investment apps

TrueLayer is best for platforms with multi-country ambitions or those that need one provider for both UK and EU operations.

Developer Experience

Ozone API: Standards-Based, Lightweight Dev Stack

Ozone’s developer experience is focused on helping you pass audits and go live quickly. It includes:

- Open-source reference implementation and conformance suite

- A lightweight, standards-first documentation portal

- Tools designed more for internal dev teams at banks or platforms that care about compliance-first builds

It doesn’t offer extensive frontend SDKs or embeddable widgets; it assumes you want control, not pre-built UX.

TrueLayer: Dev-Centric with Polished SDKs

TrueLayer is known for offering one of the smoothest developer onboarding flows in Open Banking. You get:

- SDKs for Node.js, Python and more

- Hosted sandbox for fast testing

- Embedded consent flows and production-ready UI components

This makes it ideal for product-led fintechs that want to ship custom payment experiences and iterate quickly.

Pricing Overview

| Feature | Ozone API | TrueLayer |

|---|---|---|

| Pricing Model | Licencing + usage (per connection/call) | Volume-based; custom enterprise tiers |

| Public Pricing? | No (inquiry-based) | No (custom quotes on request) |

| SME-Friendly? | Moderate – ideal for B2B & banks | Yes, especially for fintech MVPs |

Pros & Cons

| Feature | Ozone API | TrueLayer |

|---|---|---|

| Pros |

– Built for UK Open Banking compliance – Fast FCA approval with reference implementation – Ideal for banks & B2B platforms – Includes open-source conformance tools |

– Covers UK + EU banks – Hosted consent flows & Pay-by-Bank – Great SDKs for rapid builds – Developer-friendly onboarding |

| Cons |

– Not built for consumer apps – Lacks frontend SDKs – Limited global expansion |

– Compliance tools are less pre-packaged – More dev work needed for customisation – Slower for complex enterprise rollout |

A Cost-Effective Alternative for Regulated UK Platforms

If you’re comparing Ozone API or TrueLayer for your Open Banking integration, there’s a third option built specifically for regulated UK platforms: Finexer.

It is an FCA-authorised Open Banking provider designed for firms that need more than just API access. Whether you’re building accounting software, ERP tools, payroll systems, or a financial services platform, Finexer helps you go live faster, without the compliance drag or over-engineering.

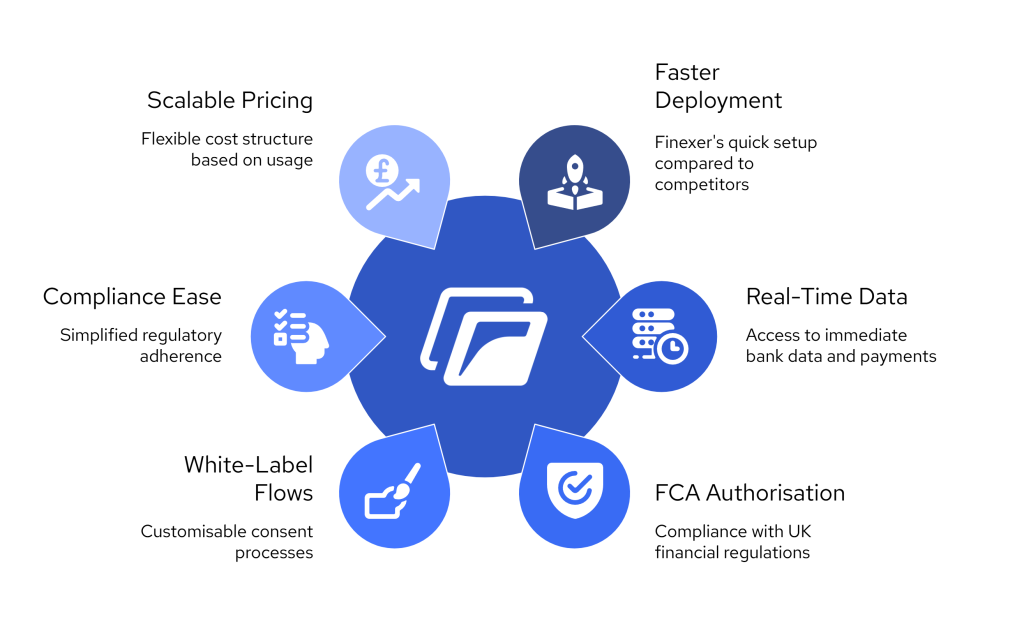

Built for UK-First Compliance, Speed, and Affordability

Finexer combines the regulatory depth of Ozone with the developer accessibility of TrueLayer and delivers more control, flexibility, and cost efficiency.

Key Finexer Advantages:

- 2–3x faster deployment compared to traditional providers

- Real-time access to bank data and A2A payments across major UK banks

- Secure, FCA-aligned infrastructure trusted by regulated teams

- White-labelled consent flows that reflect your brand, not ours

- No licensing complexity or paperwork delays, Finexer handles the compliance layer

- Usage-based pricing is designed to scale affordably with your platform

While others force a trade-off between compliance and usability, Finexer delivers both, with faster integration, full UK bank coverage, and a pricing model that fits growing platforms.

For firms building in the UK’s regulated environment, Finexer is the infrastructure layer built for execution, not just integration.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Which provider is better for FCA-regulated UK firms?

Ozone API offers built-in FCA-aligned tooling, while TrueLayer supports UK rules but needs more dev effort.

Do both providers support VRP and CoP?

Yes. Both support VRP and CoP. Ozone includes them natively; TrueLayer offers them via its payments API.

Is Finexer a suitable alternative to both?

Yes. Finexer offers fast deployment, FCA-authorised access, and affordable Open Banking APIs for regulated UK firms.

Finexer is built for regulated UK firms that want speed, affordability, and control. Book a Demo now and get benefits 🙂