Loan rejection is no longer just about bad credit or missed payments. Many lenders today are turning away applicants with seemingly good financial profiles, credit scores in the 700s, stable employment, and no outstanding defaults. So what’s going wrong?

In most cases, it’s missing or outdated financial data.

Traditional underwriting still leans heavily on credit reports and historical documents. But these tools fall short in capturing a borrower’s real-time financial position. Without live data on cash flow, spending habits, or secondary income sources, lenders are forced to play it safe and say no.

![The Real Reason Behind Loan Rejection (And How to Fix It) 2 [Diagram: Hidden data gaps behind loan rejection — three arrows (thin credit files, irregular income, outdated data) converging on “High Rejection Rate”.]](/wp-content/uploads/2025/06/visual-selection-97-1024x796.webp)

Here’s where most risk models break down:

- Thin-file applicants with little credit history get rejected automatically

- Gig economy workers earning from multiple sources can’t easily prove income stability

- Recently improved financial situations aren’t reflected in static credit files

The result? High rejection rates, customer frustration, and lost revenue for lenders.

80 % of declined UK loan applicants never re-apply with the same lender

How Open Banking Turns Loan Rejection Into Approval

Traditional credit checks often miss the nuances of a borrower’s real-time finances, leading to preventable loan rejection. By tapping directly into an applicant’s bank data (with their consent), Open Banking fills the gaps that static credit files leave behind and equips underwriters with the detail they need to make fairer decisions.

What Lenders Gain From Open Banking

- Income verification in seconds

Live deposits replace payslip uploads and manual checks. - Cash-flow visibility

Spot consistent earnings and responsible spending habits over time. - Multi-account coverage

Capture income from side gigs, freelance work, and secondary jobs. - Behaviour-based insights

Evaluate day-to-day financial behaviour instead of relying solely on a single credit score.

Where It Makes the Biggest Difference

- Freelancers with irregular income

Transaction data confirms steady earnings from platforms such as Upwork or PayPal, even when monthly amounts vary. - Young professionals or students with limited credit history

Real-time spending and saving patterns demonstrate financial responsibility that thin credit files overlook. - Applicants who have recently changed jobs

Current salary deposits are visible immediately, avoiding the delays that trigger automatic declines in traditional systems.

By combining richer data with faster verification, Open Banking helps lenders say “yes” to more genuine applicants while keeping risk in check, transforming loan rejection into sustainable growth for both borrowers and lenders.

📚6 Lending Platforms that Use Open Banking

How Lenders Are Using Finexer to Improve Approval Rates

Loan rejection usually stems from incomplete data, not genuine risk. Finexer’s Open Banking API fetches verified income, cash-flow, and spending insights from applicants’ bank accounts in under 90 seconds, replacing PDFs and manual checks. With this real-time clarity, lenders approve more qualified borrowers faster while keeping risk in check.

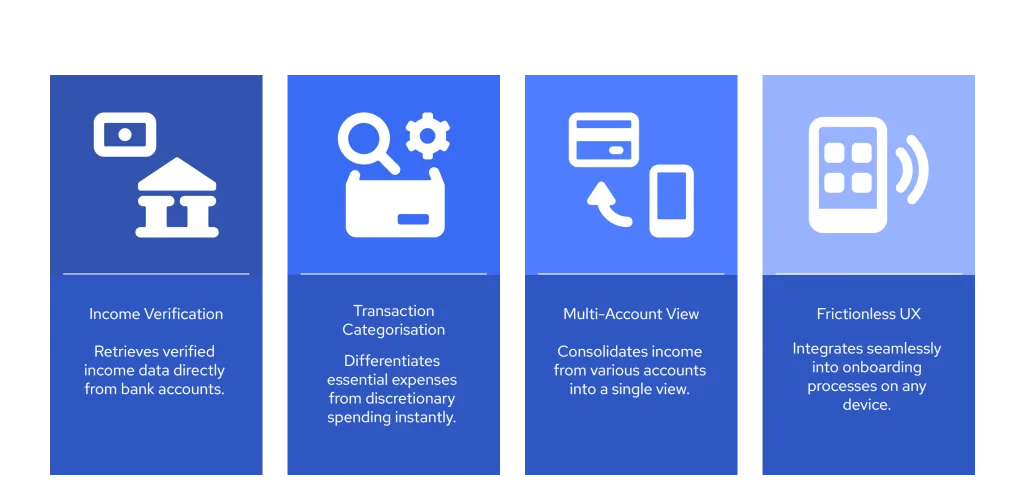

What Finexer Delivers:

- Income and affordability checks via API

Pull verified income data from connected bank accounts in under 90 seconds, no uploads or follow-ups needed. - Smart categorisation of transactions

Understand borrower spending patterns instantly with enriched data that separates essentials from lifestyle expenses. - Support for multi-account visibility

Get a full view of income across current accounts, savings, and even side-hustle income sources. - Low-friction borrower experience

Finexer’s consent-driven flow fits seamlessly into onboarding journeys and works across desktop and mobile.

Results That Matter:

Finexer is already helping lenders:

- Approve more first-time borrowers and thin-file applicants

- Shorten decision times from days to minutes

- Eliminate manual back-and-forth on documents

If you’re trying to reduce preventable loan rejections, Finexer gives you the infrastructure to act on real data fast.

“Our business isn’t about the volume of consents, it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

Penny Phillips, Chief Commercial Officer at Sysynkt.

Get Started

No more chasing payslips. Verify income across accounts in 90 seconds with Finexer’s Open Banking API.

Try NowDon’t Let Incomplete Data Cost You Good Loans

Most loan rejections aren’t about bad borrowers; it’s about blind spots in the data. Traditional credit checks alone can’t capture how someone earns, spends, or saves today. That’s where Open Banking changes the game.

By using real-time financial data, lenders can approve more of the right applicants with speed and confidence, without increasing risk. If your portfolio includes gig workers, students, or first-time borrowers, Open Banking fills the gaps that static credit reports leave behind.

Finexer makes it easy to put this into practice. With fast integration, live income verification, and clean affordability insights, you’ll reduce preventable rejections and build smarter credit products from day one.

Why was my loan rejected with a good credit score?

Even strong credit scores can’t guarantee approval. Lenders may reject due to missing income proof or unclear financial activity.

Can Open Banking help reduce loan rejection?

Yes, it gives lenders live access to income, cash flow, and spending data, making it easier to approve more suitable applicants.

What data do lenders get from Open Banking?

They can access verified income, balances, spending history, and transaction trends, all directly from the applicant’s bank.

Who benefits most from Open Banking credit checks?

Freelancers, students, and first-time borrowers gain the most, since Open Banking shows financial habits that credit reports can’t.

Still rejecting qualified borrowers? Every missed approval is lost revenue. Let’s fix that. Try Finexer Now!