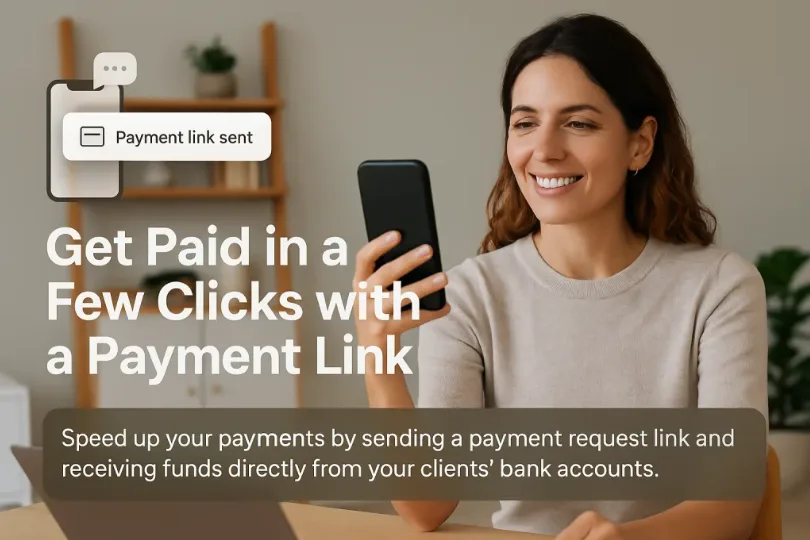

Still relying on clients to manually copy your bank details or enter card info?

There’s a faster, simpler way to get paid and it’s becoming the go-to method for UK businesses: sending a secure payment link.

A payment link is a unique URL you send to your client by email, invoice, or chat that takes them straight to a secure payment page. There’s no account login, no card input, and no chasing for details. The client simply clicks, selects their bank, and authorises the payment using their own banking app.

It’s powered by Open Banking, which connects your invoice or payment request directly to the client’s bank, ensuring fast, secure transfers with all the right details pre-filled.

In this guide, we’ll show you:

- How payment links work behind the scenes

- Why they’re replacing cards and manual transfers

- How UK businesses are using Finexer to get paid faster, with fewer errors

- And how you can start using payment links today, with no technical setup

What Is a Payment Link and How Does It Work?

A payment request link is a simple, secure URL that you share with a client to request payment. It contains all the necessary information for the transaction amount, your bank details, invoice reference and routes the client through a fully secure Open Banking payment flow.

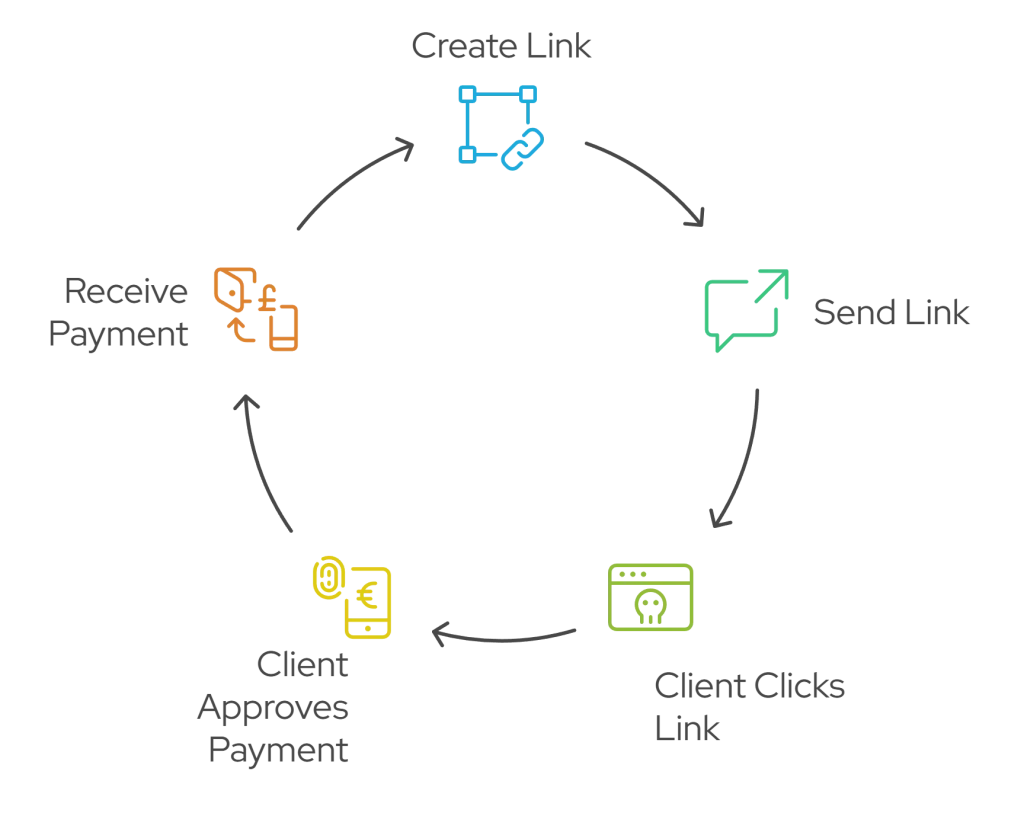

Here’s how it works in practice:

- You create the link

Using a platform like Finexer, you generate a payment request in your dashboard or via API. You choose the amount, set a reference (like an invoice number), and click ‘Create Payment Link’. - You send the link

Send it via email, WhatsApp, invoice, or client portal. No need for the client to sign up or log in. - The client clicks the link

They’re taken to a secure, branded payment page where they select their bank. - The client approves the payment

They log into their banking app (or web interface) and confirm the payment with a fingerprint, Face ID, or passcode. - You get paid often, instantly

Once authorised, the money moves directly from their account to yours, with all details (amount, reference) pre-filled and error-free.

📚 Retail Payment Methods in 2025

Why UK Businesses Are Replacing Cards and Manual Transfers with Payment Links

Old payment methods aren’t just slow, they’re costly and error-prone. That’s why more UK businesses are now replacing traditional bank transfers and card payments with secure payment request links. Here’s why:

1. No Card Fees

Card processors like Stripe or PayPal often charge between 1.4% and 3%. That might not sound like much until you’re invoicing thousands per month. With a Request to pay link, there are no card networks involved, which means no card fees cutting into your margin.

2. Instant Settlement

Manual bank transfers can take days to reconcile. Card payments take even longer to clear. A payment request link powered by Open Banking can settle funds instantly or on the same working day, helping you keep your cash flow moving.

3. No Manual Errors

When clients copy/paste sort codes or type amounts manually, mistakes happen. Request to Payment links eliminate that. You control the details: amount, reference, destination all locked in. The client simply authorises the payment. Nothing gets lost or mistyped.

4. Fewer Payment Chasing Emails

Clients appreciate how frictionless the process is. No login, no cards, no waiting. Just click and pay. That ease means fewer delays and fewer awkward “just following up” emails from your side.

5. Professional Experience

With platforms like Finexer, your payment request links can be branded, trackable, and customised. It looks polished. It builds trust. And it signals to your clients that paying you is as easy as paying a utility bill.

Real-World Use Cases: Who Is Using Payment Links in the UK Today?

Payment request links are not just a fintech novelty; they are quietly fixing specific cash-flow headaches across multiple industries. Below are the five sectors where adoption is accelerating, along with the problems solved and the day-to-day results businesses are seeing.

| Sector | Typical Pain Point | How a Payment Link Solves It | Practical Outcome |

|---|---|---|---|

| Freelancers & Consultants (designers, copywriters, coaches, IT specialists) |

• Late payments after project hand-off • Clients mis-typing sort codes or forgetting references |

• Send a branded payment request link immediately after deliverables are approved • Amount, reference, and bank details are pre-filled |

• Clients pay in under two minutes from their mobile banking app • Automatic reconciliation inside accounting software |

| Professional Services (accountants, law firms, compliance consultants) |

• Recurring retainers collected via manual BACS • High card processing fees on large invoices |

• Generate monthly links via API and embed in PDF invoices • Open Banking transfers cost pennies rather than percentages |

• same day settlement instead of 5-day card clearing • Up to 2.5 percent reduction in fee leakage on high-value invoices |

| Trades & Construction (builders, electricians, plumbers) |

• Deposits needed before work starts • Clients on-site without card terminals |

• Text a payment link from a phone or tablet • Customer uses Face ID or fingerprint in their bank app to approve |

• Deposits confirmed before materials are ordered • Fewer cancelled jobs and no card-reader rental costs |

| Charities & Fundraisers |

• Donor drop-off on card checkout pages • Reconciliation headaches with direct debits |

• Share a QR-coded payment link at events or online • Donor’s name and Gift-Aid reference flow straight into the ledger |

• Up to 26 percent higher completion rate compared with web card forms (internal case studies) • Same-day visibility of funds for rapid relief campaigns |

| B2B Wholesale & Distribution |

• Large order values trigger card limits • Sales teams waste time chasing finance teams for payment proof |

• Sales rep emails a payment request link immediately after purchase order approval |

• Instant settlement unlocks next-day shipping • Order-to-cash cycle shortened by 3–4 days on average |

Note: Every use case above can be enabled with Finexer’s dashboard or API, letting you create single-use or multi-use payment links that drop straight into invoices, emails, SMS, or chat apps.

How to Add a Payment Link to Your Invoice Using Finexer

You don’t need any coding skills, plugins, or merchant accounts to start using Request to payment links. With Finexer, you can create and send a payment request link in under a minute, right from your dashboard.

Here’s how it works:

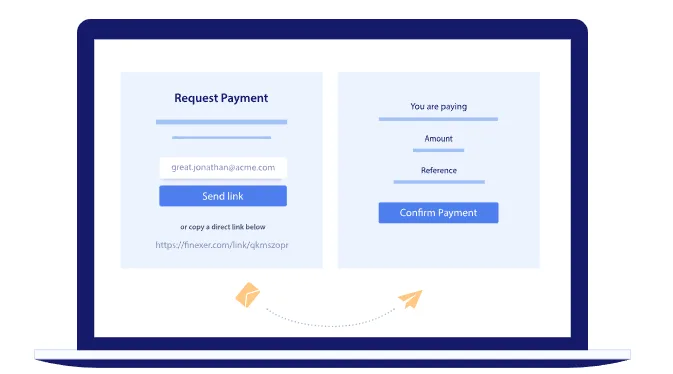

Option 1: Use the Finexer Dashboard (No Code Required)

Step 1: Log in to your Finexer account

Once you’re in the dashboard, go to the Payment Requests section.

Step 2: Create a new payment link

Enter the amount, a reference (like invoice number or client name), and select the destination account.

Step 3: Customise the payment link (optional)

You can add a description, set an expiry date, and apply your branding, so it looks professional and client-ready.

Step 4: Copy and share the link

Send it by email, SMS, WhatsApp, or embed it directly into your invoice. The link is secure, unique, and pre-filled with everything your client needs.

Step 5: Get notified when payment is made

You’ll receive an instant confirmation, and the funds are typically settled on the same working day.

Option 2: Use the Finexer API (For Developers)

If you prefer automation or need to embed payment links into your own platform, Finexer’s developer-friendly API gives you full control:

- Generate payment links dynamically from your system

- Attach metadata like client ID or invoice reference

- Monitor payment status in real time via webhook

- Fully white-label the flow with your own branding

This is ideal for accounting software, CRMs, or customer portals where you want to offer instant bank payments without adding extra steps.

Start sending secure payment links in under 5 minutes

No setup fees. No complex integration. Just faster, simpler payments with Finexer

Try NowWrapping Up

In a world where speed, clarity, and simplicity matter more than ever, payment links offer a smarter way to get paid. No more copying bank details, chasing unpaid invoices, or losing revenue to card fees. Just a secure payment request link that takes your client directly to a branded, pre-filled payment flow and moves the money straight into your account.

For UK businesses, it’s not just about getting paid, it’s about getting paid faster, with fewer errors and zero friction.

With Finexer, you can start sending secure payment links in minutes, directly from your dashboard or via API. Whether you send one invoice a week or a hundred a day, the experience stays consistent, professional, and instant.

Is a payment link secure?

Yes. Finexer payment links are powered by Open Banking and protected by bank-level encryption. The client always authorises the payment inside their own banking app using fingerprint, face ID, or passcode. No card details, passwords, or sensitive data are ever exposed.

Do my clients need to install anything?

No. There’s no app, no sign-up, and no login required for the client. They simply click the link, choose their bank, and approve the payment. It works from any smartphone or desktop browser.

Can I use this with my existing invoices?

Yes. You can paste a payment link into any PDF, email, or messaging app. If you use accounting tools like Xero, QuickBooks, or Sage, you can add it into your invoice template. No plugins or gateways needed.

What if the client enters the wrong reference or amount?

They can’t. You control the link. When you create a payment request with Finexer, you set the exact amount, reference, and destination account. It’s all pre-filled and uneditable, so payment errors are eliminated.

How fast do I get paid?

In most cases, same-day settlement, and often within seconds of payment authorisation. There’s no multi-day delay like with card processors or BACS.

Can I track who paid and when?

Yes. Every payment request link in Finexer is fully trackable. You’ll know who clicked, when they paid, and can easily reconcile against invoices. You can also receive real-time status updates via dashboard or webhook.

Thousands of UK businesses are already sending payment request links with Finexer! Try now with no Setup or cancellation fees 🙂