Ofgem recently forced ten UK energy suppliers to pay £7 million in compensation and refunds to more than 34,000 customers after billing errors and payout delays. Cases like this highlight how slow utility refunds erode trust and trigger costly penalties.

Industry data shows the average utility refund processing time can stretch 10–30 working days, far beyond the regulator’s guideline of “credit returned within ten days.” These energy bill refund delays drive up support calls and hand regulators more reasons to fine suppliers.

This article explains why utility billing refunds take so long and lays out clear steps to speed up utility refunds, from automating meter adjustments to adopting real-time payout rails so finance teams can stop firefighting and customers get their money back fast.

📚 Guide to Open Banking for Utility Billing

When Do Utility Refunds Happen?

Before tackling delays, it helps to understand the real-world situations that trigger utility billing refunds. Across the UK energy and water sector, refunds are issued in several recurring scenarios:

Circumstances That Lead to Utility Billing Refunds

| Circumstance | What Happens | Typical Trigger |

|---|---|---|

| Overpayments | Customer pays twice or exceeds the amount due. | Duplicate online payment or mis-keyed amount |

| Billing Errors | Incorrect meter reading or tariff miscalculation leads to overcharge. | Manual data entry error, faulty meter, rate change applied late |

| Credit Balance at Account Closure | Remaining credit is returned when a service is terminated or the customer switches provider. | Final bill shows positive balance |

How Utility Refunds Are Usually Processed

| Step | Details | What Slows It Down |

|---|---|---|

| Refund Request | Customer contacts provider, completes a refund form or online request. | Form review queues, missing account info |

| Refund Method Chosen | Refund is issued via the original payment rail (card credit, bank transfer, or cheque). Some utilities restrict refunds to cheques only. | Rail limitations, cheque printing cycles |

| Processing Time | Can range from one billing cycle to several months, depending on internal approvals and batch payout schedules. | Manual checks, BACS settlement windows, separate finance sign-offs |

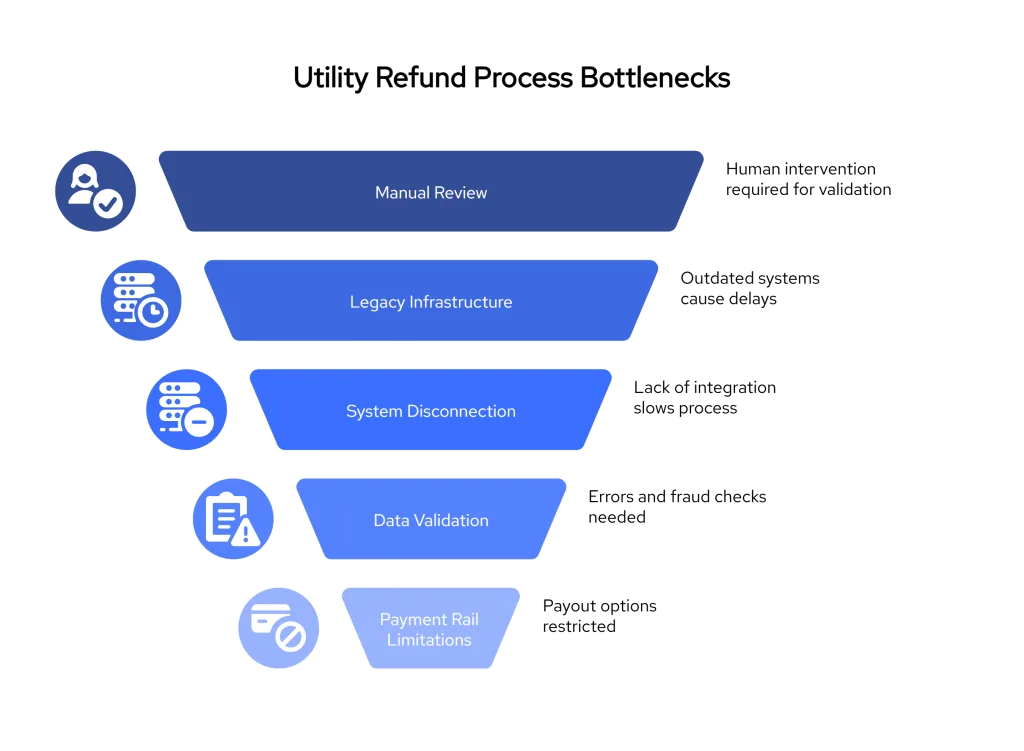

Why Are Utility Billing Refunds So Slow?

Utility billing refunds are notorious for taking weeks, sometimes even months to arrive in a customer’s account. But what exactly causes these delays?

Here are the top operational bottlenecks:

1. Manual Review & Approval Processes

Most refund workflows still require human intervention. Whether it’s checking for duplicate payments, validating meter readings, or approving refund requests, the steps involve internal ticket queues, approval layers, and manual handoffs between teams.

2. Legacy Refund Infrastructure

Many UK utility companies still issue refunds via BACS or cheques, which add friction and slow processing. Cheques involve printing and postage delays. BACS transfers typically require batch file uploads, which don’t settle instantly and must align with specific payout schedules.

3. Refunds Not Built Into Billing Systems

Traditional billing systems weren’t designed for dynamic, real-time refunds. Often, customer service and finance teams work across disconnected platforms, meaning refunds require cross-team communication and sometimes re-entering payment details.

4. Data Gaps and Validation Errors

When refunds aren’t automatically tied to the original transaction (e.g., in card-based payments), customer support teams must request and validate account information again. This introduces delays and increases the risk of errors or fraud.

5. Limited Payment Rail Flexibility

Even when a refund is approved quickly, limitations in the utility company’s refund rails can delay the actual payout. Some providers can only process card-based refunds for active cards or default to sending cheques for closed accounts.

📚 Guide to Open Banking Refund and withdrawals

The Customer Impact of Slow Utility Billing Refunds

Delayed utility billing refunds aren’t just an internal inconvenience. For customers, they create frustration, distrust, and in some cases, financial hardship, especially when energy bills are rising and households are managing tight budgets.

Here’s how slow refunds affect the customer experience:

1. Loss of Trust

When a customer is told, “Your refund will take 5–10 working days,” but sees no update for weeks, it undermines their trust in the provider. According to a Citizens Advice report, UK energy companies were found to be holding over £1.5 billion in customer credit, much of it due to delays in processing refunds or lack of proactive repayment.

2. Higher Support Volume

Customers waiting for refunds often call or email customer service multiple times to chase updates. This increases call centre costs and clogs support queues, especially during peak billing periods.

3. Poor Reviews and Churn Risk

Slow utility billing refunds are one of the top complaints in online reviews of energy and water providers. Customers are more likely to switch to another provider when their money feels “stuck” and communication is poor.

4. Vulnerable Customers Hit Harder

For low-income households or vulnerable customers, delayed refunds on overpayments or security deposits can mean real cash flow stress. In a 2024 Money Advice Trust survey, 1 in 5 UK households said utility billing delays directly impacted their ability to meet other essential expenses.

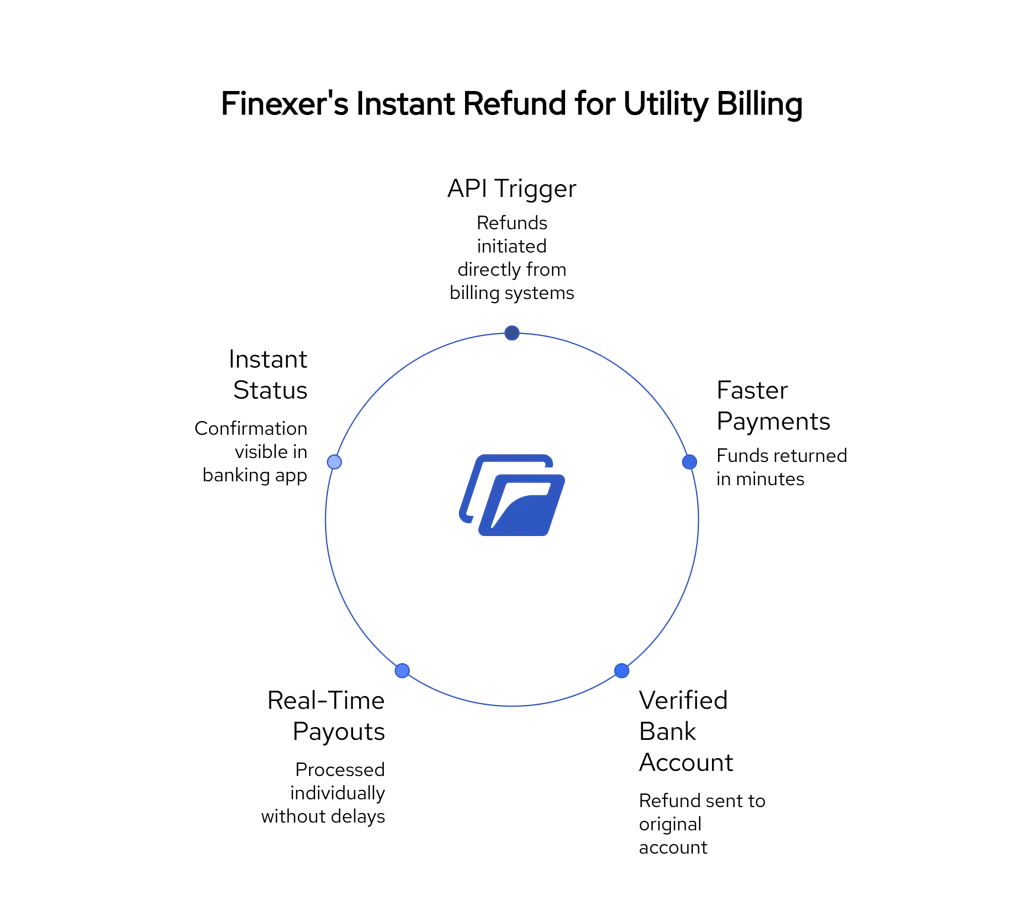

Fixing Refund Delays with Finexer’s Open Banking Solution

Manual refund processes are slow, error-prone, and costly, especially in the utilities sector where billing complexity and customer sensitivity are high. That’s why leading UK utility providers are turning to Finexer’s Open Banking solution to handle utility billing refunds faster, more securely, and with fewer internal touchpoints.

Unlike traditional refund systems that rely on paper forms, batch processing, or delayed BACS payments, Finexer allows utility teams to issue refunds instantly via a secure API, using the exact bank account tied to the original transaction.

Here’s how Finexer transforms the refund experience:

| Traditional Bottleneck | With Finexer’s Open Banking API |

|---|---|

| Refund requests handled manually | Triggered directly from your billing system |

| BACS and cheque delays | Funds returned within minutes via Faster Payments |

| Customers asked to re-submit bank details | Refund goes to the verified account from initial payment |

| Refund queues processed in bulk | Each refund is sent individually in real time |

| Refund status unclear to the customer | Instant confirmation visible inside their banking app |

This isn’t just about speed, it’s about confidence. Finexer’s infrastructure is FCA-authorised, supports 99% of UK banks, and plugs directly into existing billing software with minimal disruption. That means your finance team gets better control, your customers get faster refunds, and your support inbox stays quieter.

If your refund system still relies on paper trails, long SLA windows, or third-party cheque processors, it’s time to upgrade. Finexer gives you full control, real-time traceability, and a smoother experience for everyone involved.

Fix Your Refund Delays Today!

Join Finexer and automate overpayment returns, customer credits, and account closures—securely and instantly.

Try NowWrapping Up: Automating Utility Billing Refunds for Faster Resolution

Refunds are an unavoidable part of utility operations, but the way they’re handled doesn’t have to be slow or manual. Whether it’s correcting a billing error, handling credit balances after a service change, or issuing repayments due to overcharges, modernising your utility refund processing can significantly improve both customer experience and internal efficiency.

By understanding the reasons behind slow utility billing refunds like legacy processes, reliance on manual form submissions, and inconsistent refund methods, providers can start implementing changes that reduce delays and costs.

Finexer offers a purpose-built Open Banking API that helps utility firms not only send and receive payments in real time but also handle automated refund workflows and reconciliation with ease. The ability to return funds directly to verified bank accounts within minutes doesn’t just eliminate friction, it reduces disputes, lowers admin overhead, and improves overall satisfaction.

What causes delays in utility billing refunds?

Manual processing, form-based requests, and outdated systems often delay utility billing refunds by days or even weeks.

How long do utility billing refunds take in the UK?

Traditional utility billing refunds can take 5 to 30 days, depending on the provider’s process and payment method.

Can utility overpayments be refunded automatically?

With modern billing systems, overpayments can trigger automated utility billing refunds without customer action.

Are utility billing refunds issued to the same payment method?

Yes, most refunds are returned to the original payment source, such as bank accounts or credit cards.

How can utility providers speed up refund processing?

Using Open Banking APIs like Finexer, providers can issue real-time utility billing refunds directly to verified bank accounts.

Say Goodbye to Manual Refunds! Try Finexer, cut overhead admin, speed up refund time & improve customer trust 🙂