For B2B companies tired of waiting on PDFs and manual uploads, Open Banking is the shortcut to faster decisions, cleaner data, and smoother payments.

In a recent Mastercard survey spanning the U.S., U.K., Nordic countries, and Australia, 85% of B2B respondents reported actively using Open Banking, and a striking 92% agreed that “Open Banking is essential for future‑proofing my organisation”. But legacy workflows in lending, accounting, and treasury still depend on outdated statements and back-and-forth emails.

That’s changing quickly.

In 2025, leading B2B companies are integrating Open Banking APIs directly into their platforms, pulling live transaction data, verifying identity instantly, and initiating payments without ever leaving their core systems.

The result?

Faster onboarding, lower operational costs, improved accuracy, and less admin overhead.

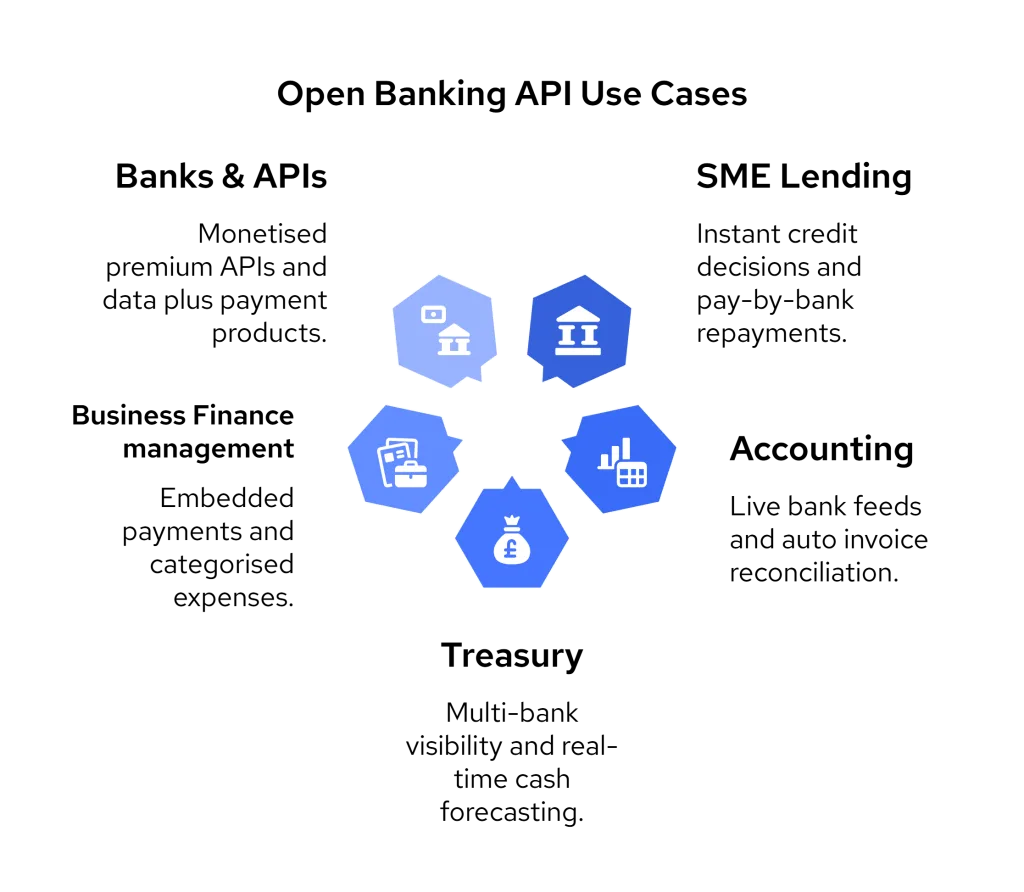

In this blog, we’ll walk through five practical ways B2B companies are already using Open Banking to improve finance operations and unlock scalable growth.

1. SME Lending: Faster Credit Decisions with Real-Time Bank Data

Lending to small and medium-sized businesses often means dealing with missing documents, outdated financials, and slow client response times. Traditional underwriting processes can take days, not because the borrower isn’t creditworthy, but because the lender can’t see the full picture quickly enough.

Open Banking changes that.

Instead of requesting PDFs or relying on old credit bureau data, B2B lenders now use Open Banking APIs to instantly access a borrower’s live transaction history, with full consent. This gives underwriters immediate visibility into income patterns, cash flow fluctuations, and risk signals, helping them make decisions in hours, not days.

Real Benefits for B2B Lending Platforms:

- Automated income and affordability checks using up-to-date bank data

- Real-time fraud detection by flagging anomalies in transaction history

- Faster onboarding for applicants, no need to manually upload documents

- Pay-by-Bank repayment options to simplify collection and reduce processor fees

By integrating Open Banking, lenders move from reactive to proactive. You no longer have to wait for the borrower to provide what their bank can already show you cleanly, compliantly, and in real time.

📚 6 Lending Platforms that Use Open banking

2. Accounting: Real-Time Data, Zero Spreadsheets

Accounting teams and the platforms that serve them are often stuck managing disjointed bank feeds, clunky CSV uploads, and hours of manual reconciliation. For B2B companies handling multi-account, multi-client financials, these inefficiencies compound fast.

Open Banking flips the model.

Instead of relying on clients to send PDF statements or download transactions, accountants can pull live, categorised data directly from business bank accounts. This means no formatting errors, no back-and-forth emails, and no spreadsheet patchwork.

Why B2B Accounting Teams Are Embracing It:

- Live bank feeds from multiple accounts, normalised, enriched, and instantly accessible

- Faster reconciliation with auto-matching of incoming payments and invoice records

- Onboarding clients in clicks, with real-time KYC data and account verification

- Built-in payment initiation, allowing invoices and tax payments to be triggered from within the accounting software

For accounting platforms, Open Banking also unlocks new service layers like cash flow forecasting, budgeting tools, and proactive financial alerts all powered by verified transaction data.

If your accounting workflow still starts with an Excel file, it’s time to rethink what your finance stack could look like.

📚 Top 7 Open Banking Use Cases for Accounting

3. Treasury Management: Total Visibility Across Every Bank Account

For treasury and finance leaders, one of the biggest blockers to strategic decision-making is fragmented data. When balances, payments, and cash flow forecasts are spread across multiple systems and bank portals, even simple questions like “What’s our available liquidity right now?” can take hours to answer.

Open Banking solves this with a single connection.

By integrating Open Banking APIs, B2B companies can instantly aggregate account data from across all their domestic and international banks in real time. That means treasurers get a live view of cash positions, pending payments, and historical flows across the group, all in one secure dashboard.

Key Benefits for Treasury Teams:

- Real-time balance visibility across global entities and currencies

- Consolidated data feeds for faster decision-making and less spreadsheet juggling

- Automated cash flow forecasting, scenario modelling, and re-forecasting

- Lower transaction costs, thanks to direct-to-bank payments without intermediaries

This kind of financial control doesn’t just improve oversight, it enables CFOs and treasury teams to shift from reactive reporting to proactive optimisation. In today’s environment, that’s a competitive edge few can afford to ignore.

4. Business Finance Management: Automate the Daily Grind

For many growing businesses, day-to-day finance operations still rely on manual invoicing, spreadsheets, and reconciliation done at the end of the week (or month). These inefficiencies slow down teams, delay payments, and create unnecessary cash flow gaps.

That’s where Open Banking APIs come in, powering a new wave of B2B finance automation platforms that centralise real-time financial data, trigger instant payments, and eliminate friction from everyday tasks.

What Open Banking Enables for BFM:

- Real-time bank data lets businesses track balances and transactions across all accounts in one dashboard

- Invoice reconciliation is streamlined with enriched transaction data and automated matching

- Embedded payments allow users to send or request payments directly from the platform no cards, no redirects

- Budgeting, forecasting, and tax planning become proactive thanks to live insights from connected accounts

For freelancers, startups, and mid-market B2B companies alike, this means less time spent on admin and more confidence in financial planning. No more guessing when a payment landed or chasing clients with emails, the data does the work for you.

5. Banks: Unlocking New Revenue with Embedded Payments and Data APIs

Banks have long viewed Open Banking as a regulatory requirement, something to comply with, not necessarily capitalise on. But in 2025, that mindset is shifting.

Forward-thinking banks are launching Open Banking APIs not just to meet PSD2 standards, but to offer real value to their B2B clients. These APIs allow banks to provide premium services like real-time bank data access, invoice reconciliation tools, and even embedded payments that B2B companies can integrate into their own platforms.

How Banks Are Monetising Open Banking:

- Offering secure data access and B2B finance automation features as API-based add-ons

- Enabling corporates to pull enriched transaction histories across accounts

- Providing plug-and-play tools for onboarding, KYC, and recurring payment collection

- Charging for usage-based access to value-added services like categorised insights and instant payouts

By stepping into this space, banks can become more than a place to store money they become infrastructure providers in the B2B ecosystem. That not only increases retention but opens new recurring revenue streams.

How Finexer Helps B2B Companies Put Open Banking into Action

If you’re a B2B company looking to move beyond manual uploads, legacy finance tools, or delayed verification workflows, Finexer gives you the API infrastructure to do it faster and smarter.

With Finexer, you can:

- Access real-time bank data from UK accounts with full customer consent

- Trigger embedded payments directly from your platform, no need for cards or third-party gateways

- Automate invoice reconciliation using enriched, categorised transaction data

- Use developer-friendly Open Banking APIs that integrate easily into lending, accounting, treasury, or BFM platforms

- Offer seamless onboarding with built-in client consent flows, account verification, and recurring data access

Whether you’re serving SMEs, building finance software, or operating across multiple accounts and clients, Finexer helps you reduce admin, cut costs, and deploy Open Banking-powered features 2–3x faster than the market average, without the compliance complexity.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowHow are B2B companies using Open Banking in the UK?

UK B2B firms use Open Banking to automate lending, reconcile invoices, access real-time data, and speed up payments.

What are the benefits of Open Banking APIs for UK finance teams?

Open Banking APIs help UK teams reduce admin, verify clients faster, and improve cash flow with live account data.

Does Open Banking support invoice reconciliation for UK businesses?

Yes. Open Banking automates reconciliation by matching live bank data to invoices, cutting errors and payment delays.

Why is real-time bank data important for UK B2B companies?

It improves cash visibility, risk checks, and decision-making by showing accurate financial activity across accounts.

How does Finexer support Open Banking for B2B companies in the UK?

Finexer offers fast-deploying APIs for live bank data, embedded payments, and invoice automation across UK platforms.

Want clean, well-documented Open Banking APIs for B2B use cases? We provide 3-5 weeks of hands-on assistance with no setup fees 🙂