The financial services landscape is undergoing a dramatic shift. Today’s users don’t just want visibility into their money, they expect apps to understand their financial behaviours, anticipate their needs, and offer tailored recommendations.

In fact, 75% of UK financial services firms are already using AI, with another 10% planning to adopt it within the next three years, according to the Bank of England.

But AI alone isn’t enough. Even the most advanced models depend on quality data to deliver useful insights. That’s where open banking comes in giving businesses secure, real-time access to verified financial data directly from user accounts.

When combined, open banking and AI unlock the potential for hyper-personalised financial services from dynamic budgeting and tailored credit decisions to real-time fraud detection and financial forecasting.

In this blog, we explore how these two technologies are already reshaping finance in 2025, the use cases gaining traction, and what your business should consider to stay competitive.

Why AI Needs Open Banking (and Not Just Big Data)

AI has evolved dramatically from chatbots to credit underwriting, but when it comes to finance, the quality of the data is everything. Legacy systems often feed models with outdated credit scores, limited transaction histories, or static PDF bank statements. That’s not enough.

Open banking and AI work best together because open banking APIs provide secure, real-time, bank-verified data, directly from user accounts, with their consent. This includes:

- Verified income streams

- Recurring expenses

- Categorised transactions (e.g., rent, subscriptions, fuel)

- Up-to-date balances across multiple accounts

- Cash flow trends over time

These aren’t just numbers, they’re behavioural signals that allow AI models to move beyond generic profiling into hyper-personalised financial services.

That’s where enriched transaction data comes in. Instead of a raw feed of transactions, enriched data offers contextual intelligence:

- Normalised merchant names (e.g., “AMZN Mktp UK” → “Amazon”)

- Merchant categories (e.g., groceries, travel, subscriptions)

- Flagged recurring payments, transfers, or anomalies

- Real-time updates rather than delayed monthly statements

“We want safe and responsible use of AI to drive beneficial innovation,” said Nikhil Rathi, Chief Executive of the Financial Conduct Authority, in reference to balancing AI‑enabled personalisation with consumer protection.

That vision relies on having a reliable, structured, and consent-driven data pipeline, which is exactly what open banking enables. The better your data, the more effective your AI becomes.

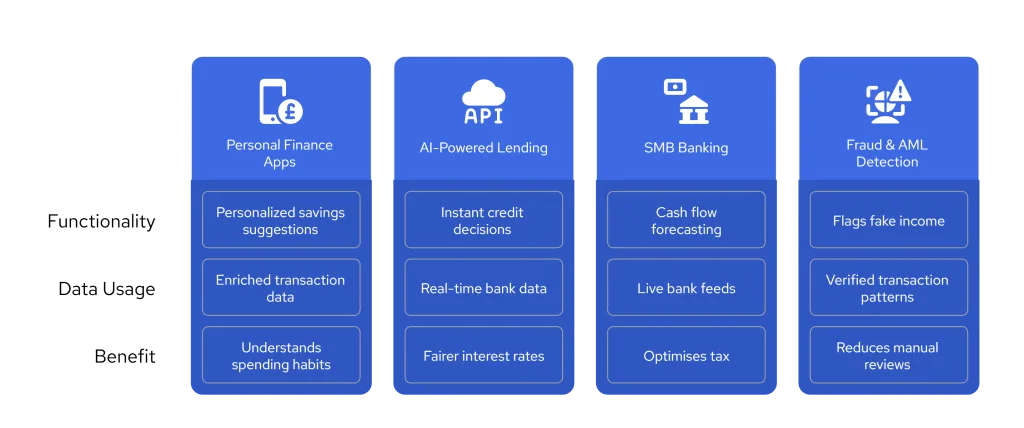

What Open Banking and AI Can Actually Do: 4 Use Cases Already Live in 2025

1. Personal Finance Apps That Understand Your Habits, Not Just Your Balance

Gone are the days of passive dashboards. Today’s top personal finance apps use open banking and AI to go far beyond categorising expenses they offer intelligent guidance based on your unique behaviours.

By feeding enriched transaction data into AI models, platforms can:

- Detect when you’re overspending on subscriptions or food delivery

- Predict future expenses based on recurring trends

- Proactively suggest saving opportunities based on idle balances

Example: A user asks their app, “How much unused cash do I have before payday each month?”

AI instantly analyses patterns across all connected accounts and recommends setting up an automated savings transfer.

This is the new standard for hyper-personalised financial services apps that not only show users their financial picture, but act as intelligent assistants.

2. AI-Powered Lending with Live, Verified Data

In lending, the difference between a good decision and a bad one often comes down to timing and visibility. Traditional underwriting models rely on outdated documents and incomplete disclosures. That’s a risk.

With account information APIs, lenders can now access:

- Verified income over 3–12 months

- Average monthly surplus after expenses

- Evidence of financial resilience or volatility

- Active liabilities across institutions

AI models can use this real-time data to:

- Issue instant credit decisions with full context

- Explain rejections and recommend improvements (e.g., “Reduce overdraft usage by 20% for 3 months”)

- Offer dynamic loan terms based on verified affordability

The result? Fairer decisions, faster processing, and real-time financial insights that reduce both risk and cost.

3. Small Business Banking with CFO-Level Intelligence

Small and medium businesses (SMBs) often don’t have access to finance teams, but now they don’t need one. AI trained on bank-verified data can act like a built-in CFO.

By analysing incoming and outgoing transactions, AI tools can:

- Forecast short-term cash flow gaps

- Recommend VAT-saving opportunities based on categorised spend

- Flag supplier anomalies or changes in recurring costs

Open banking enables real-time access to business bank accounts, while AI turns that data into actionable insights, without the need for spreadsheets or manual reconciliation.

4. Fighting Fraud and Money Laundering with Smarter Detection

In industries like fintech, insurance, and gambling, compliance with AML and fraud regulations is non-negotiable. Traditional methods rely on document uploads and static thresholds, which are easy to manipulate.

With open banking and AI, compliance teams can:

- Detect fake income patterns (e.g., circular transfers between personal accounts)

- Flag accounts with behaviour inconsistent with declared profiles

- Enforce dynamic thresholds for unusual spending, based on peer behaviour

Machine learning models trained on enriched transaction data become more accurate over time, constantly learning to spot new fraud vectors without needing human intervention.

This approach not only strengthens defences but also reduces the operational burden of manual reviews and false positives.

Beyond Open Banking: The AI-Powered Future of Open Finance

What happens when access to banking data expands to the rest of your financial life? That’s the promise of open finance and when paired with AI, it opens the door to a truly personalised, predictive financial ecosystem.

Unlike open banking, which focuses on current and savings accounts, open finance extends secure data-sharing to:

- Investment portfolios

- Mortgages and loans

- Pension schemes and insurance policies

- Credit cards, savings goals, and debt profiles

When AI is granted access to this wider financial landscape, it stops reacting to single behaviours and starts delivering hyper-personalised financial services across every product a customer touches.

Examples of What Becomes Possible

- Smart Rebalancing: AI could recommend moving pension contributions based on market volatility and long-term goals, then execute the change automatically.

- Proactive Insurance Switching: Based on your current usage, risk profile, and upcoming renewal dates, your finance app could suggest a cheaper or better-suited provider before you ask.

- Debt Consolidation Guidance: By analysing interest rates, repayment history, and upcoming obligations, AI could flag when refinancing would save money, and show exactly how much.

- Unified Financial Health Reports: Instead of siloed dashboards, users get a holistic, real-time view of their net worth, projected savings, and actionable improvement paths.

This level of prediction isn’t science fiction, it’s achievable when open banking and AI evolve together. And in markets where open finance regulations are already advancing (like the UK and EU), early adopters will gain a massive strategic advantage.

Why It Matters

Most financial tools today are still reactive. They wait for users to log in, ask a question, or perform a manual action. But with the power of enriched, verified data and AI prediction, we move into a new category: anticipatory finance.

It’s no longer about giving people access it’s about helping them act, automatically, on what that access reveals.

Firms that embrace this shift won’t just retain customers, they’ll become indispensable to their financial lives.

Build AI-Powered Financial Services Faster with Finexer

If you’re building AI-powered tools and need live, clean, and compliant access to banking data, Finexer is purpose-built for your stack.

Finexer provides enriched, real-time bank data through secure Open Banking APIs, enabling your AI models to generate precise financial insights without relying on outdated statements or unreliable sources.

Whether you’re developing personal finance tools, SME dashboards, or AI-driven lending engines, Finexer offers what most platforms don’t:

- Enriched data out of the box: Categorised transactions, merchant tagging, and recurring payment identification

- Built for fast deployment: Finexer integrates 2–3x faster than legacy providers, helping your team go live quickly

- Developer-friendly APIs: Unlimited Sandbox, with 3-5 weeks of hands-on support throughout onboarding

- Affordable pricing: Finexer uses a flexible, usage-based model that suits startups and scale-ups alike

- UK market focus: Finexer is fully compliant with PSD2 and GDPR, with extensive UK bank coverage

For businesses aiming to deliver hyper-personalised financial services using open banking and AI, Finexer enables a faster, cleaner path to product success, without the noise.

“Our business isn’t about the volume of consents—it’s about delivering high-quality services to some of the biggest names in the industry. We needed a partner who understood the importance of providing business-focused solutions, and Finexer joined us on that journey.”

Penny Phillips, Chief Commercial Officer at Sysynkt .

Building a finance product that needs smarter decisions?

Finexer gives you enriched transaction data that AI can actually learn from.

Try NowHow does AI use open banking data?

AI uses real-time bank data to deliver personalised insights, detect patterns, and automate financial decisions securely.

What is enriched transaction data?

It’s categorised, cleaned, and labelled banking data that AI can analyse to generate smarter and more precise recommendations.

Can open banking improve lending decisions?

Yes. It gives lenders real-time income and expense data, enabling faster, fairer, and more accurate credit decisions.

Is open banking safe for AI use?

Yes. Data is user-permissioned and shared via secure APIs under PSD2 and GDPR regulations.

What are key AI use cases in finance?

Top use cases include PFM tools, lending automation, fraud detection, SME insights, and real-time financial forecasting.

Fast, affordable Open Banking APIs, built for AI teams. Backed by live support → Talk to our team