Managing client portfolios today requires more than ticking off a risk questionnaire. For UK wealth platforms, risk profiling must evolve to meet stricter compliance rules, changing client behaviours, and the demand for real-time personalisation. That’s where real-time bank data steps in.

Rather than relying on static assumptions, wealthtech firms are now using Open Banking APIs to gain live insights into a client’s income consistency, discretionary spending, and liquidity patterns. These behavioural signals make risk assessments far more accurate and adaptive, especially in volatile market environments.

Quilter’s research on the FCA Consumer Duty reveals that 44% of financial advisors expect profitability to decline due to increased demands for continuous client monitoring and personalised care, while just 5% foresee growth. This shows why wealth managers are adopting real-time bank data and dynamic risk profiling to meet evolving regulations and client expectations.

With the FCA’s Consumer Duty placing greater emphasis on ongoing suitability and fair value, the ability to track risk indicators over time has become a competitive necessity. Wealthtech platforms that embed real-time data into their profiling models not only comply better but also provide better advice, retain more clients, and reduce the chance of misaligned portfolios.

This blog explores how risk profiling is being transformed through real-time financial data, especially in the context of UK regulation and Open Banking adoption. We’ll cover practical examples, data integration strategies, and what a modern, data-backed risk profile report should look like for UK-based financial advisors and platforms.

Risk Profiling vs Traditional Methods: A Real-Time Risk Management Upgrade

Traditional risk profiling in wealth management has long depended on static forms, once-a-year reviews, and broad client categories. These models often fail to reflect real-life financial behaviours, especially in a post-pandemic world where income sources and expenses can change rapidly.

For example, a client who selects “moderate risk” on a form might experience an unexpected drop in income or a significant lifestyle change, but this wouldn’t surface until the next review cycle. This time lag creates blind spots that can lead to misaligned portfolios and compliance risks under the FCA’s suitability requirements.

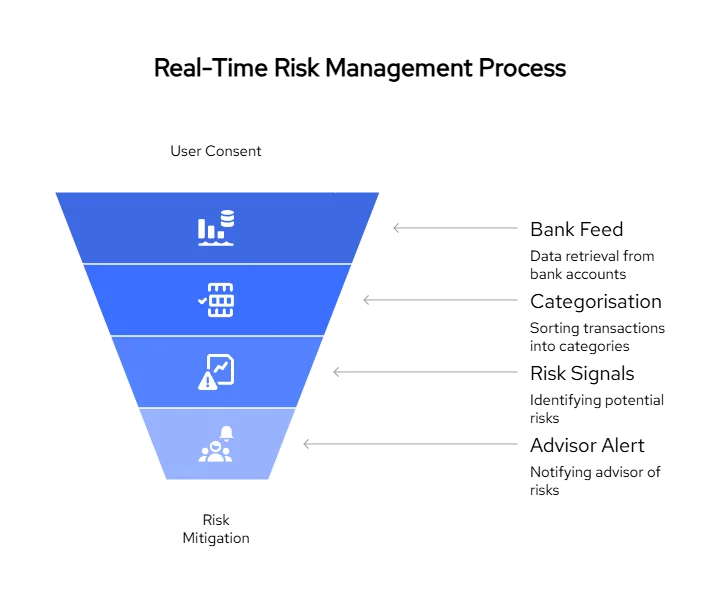

With real-time risk management, wealthtech platforms can detect these shifts as they happen. By integrating with Open Banking APIs, platforms can access a live feed of account data across multiple banks. This includes:

- Income frequency and stability

- Spending patterns across essential and discretionary categories

- Sudden drops in balance or cash reserve depletion

- Changes in financial obligations, like loan repayments

This live data allows platforms to update a client’s risk profile dynamically, flag anomalies, and support advisors in making timely adjustments. Instead of treating risk as a one-time categorisation, real-time systems help turn it into a continuous monitoring process.

| Traditional Profiling | Real-Time Bank Data Profiling |

|---|---|

| One-time forms | Live, ongoing insights |

| Self-reported inputs | Verified behavioural data |

| Annual reviews | Continuous updates |

| Generalised models | Personalised recommendations |

For wealthtech teams, this shift brings two major benefits:

- Better outcomes for clients who receive advice aligned with their current reality.

- Stronger compliance posture, reducing the risk of unsuitable advice or missed reviews.

In short, real-time data transforms risk profiling from a checkbox task into an intelligent, adaptive process that benefits both the platform and the client.

What is risk profiling in wealth management?

Risk profiling is the process of assessing a client’s financial situation, investment goals, and risk tolerance to determine the most suitable investment strategy. In wealthtech, this now includes real-time financial data to improve accuracy and compliance.

How does real-time bank data improve risk profiling?

Real-time bank data provides live insights into income, spending, and financial stability, enabling dynamic updates to a client’s risk profile based on actual behaviour, not just self-reported forms.

Real-World Risk Profiling Examples in UK Wealth Platforms

Seeing how real data enhances client decisions is often more powerful than theory. Here are three risk profiling examples that show how UK wealth platforms are using real-time bank data to go beyond static forms:

Example 1: Income Volatility Detection for Portfolio Suitability

A UK robo-advisory platform used to categorise clients based on self-declared risk tolerance and age. After integrating bank feeds, they began tracking income regularity and discretionary spending. One client originally classified as “balanced” was found to have unpredictable freelance income and low emergency reserves, prompting a shift to a more conservative asset mix.

→ Outcome: Portfolio misalignment was corrected early, reducing the risk of forced withdrawals during market dips.

Example 2: Life Event Triggers Prompting Risk Reassessment

Another wealthtech firm embedded logic into its risk profiling model to detect life changes. For example, when a client’s bank data showed maternity-related expenses and a shift to single income, the system flagged a risk profile review.

→ Outcome: Advisors reached out proactively to revisit investment goals and temporarily reduce risk exposure.

Example 3: Detecting Overexposure via Spending and Borrowing Trends

One hybrid advisory platform uses categorised bank transactions to flag clients whose high-risk investments are not backed by financial discipline. For instance, a high allocation to growth stocks combined with rising credit card debt triggered an internal review.

→ Outcome: The advisor recommended diversifying into less volatile assets and increasing cash reserves.

These risk profiling examples demonstrate how real-time data creates context, not just categories. Platforms that move from static segmentation to behavioural insight are better positioned to serve their clients, meet regulatory standards, and scale more intelligently.

Get Started

Start using Finexer to access real-time bank data from 99% of UK banks — fast, affordable, and white-label ready.

Try NowHow Open Banking for Wealth Management Enables Dynamic Risk Profiling

Static inputs can’t keep up with dynamic clients but Open Banking can. For UK wealthtech platforms, integrating Open Banking isn’t just a compliance trend; it’s becoming a strategic foundation for real-time risk profiling.

Through Account Information Services (AIS), platforms can securely access a client’s banking data with their consent. This includes:

- Live account balances across multiple banks

- Categorised transaction history (e.g. groceries, rent, salary)

- Historical cash flow trends

- Signals for income stability, credit usage, or irregular spending

By connecting these data feeds directly into onboarding and portfolio management workflows, wealth platforms are able to assess suitability based on real behaviour, not assumed profiles.

How It Works in Practice:

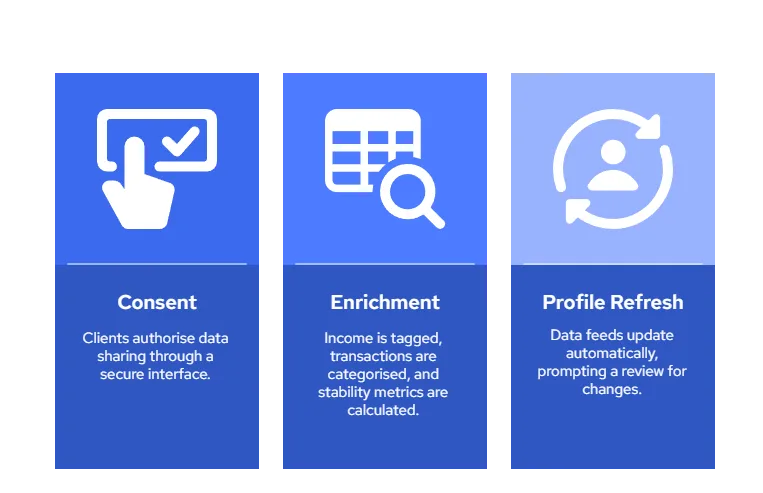

- Consent via a one-click link: Clients authorise data sharing through a secure interface.

- Enrichment layers: Income is tagged, transactions are categorised, and stability metrics are calculated.

- Profile refresh: Data feeds update automatically, so if something changes, like a missed salary payment or new recurring expense, the system can prompt a review.

Open Banking also enables passive monitoring, which is a huge leap forward from annual reviews. Platforms can automate nudges to advisors or clients when risk signals deviate from expected ranges, all while staying aligned with FCA guidance on ongoing suitability.

This makes Open Banking for wealth management not just a data tool, but a compliance and experience advantage.

How You Can Do It with Finexer

Building a real-time risk profiling workflow doesn’t have to mean months of development or regulatory uncertainty. With Finexer, UK wealthtech platforms can plug directly into Open Banking infrastructure to access clean, categorised financial data from 99% of UK banks, all through a single API.

What Finexer Provides for Risk Profiling:

- Real-Time AIS Feeds: Instant access to verified account data, including balances, income history, and transaction categorisation.

- Income Stability Metrics: Automatically detect volatility in earnings, frequency of payments, and reliability of cash flow.

- Custom Categorisation: Go beyond default tags with tailored classifications that match your risk model logic.

- Consent-Driven Access: Every data point is pulled via secure, user-authorised links, fully compliant with UK Open Banking standards.

- White-Label Experience: Embed consent flows and client dashboards directly into your wealth platform with minimal dev effort.

Why Wealth Platforms Choose Finexer

- FCA-authorised AIS provider

- Built specifically for UK fintechs, no global clutter

- Developer-first integration

- Transparent, usage-based pricing with no hidden costs

- Hands-on support during onboarding (3–5 weeks)

If your team is looking to move from static forms to dynamic, data-backed risk profiling, Finexer helps you do it faster and stay compliant from day one.

Ready to see it in action? [Request a demo] or get access to our sandbox environment.

Is using Open Banking for risk profiling FCA-compliant?

Yes. Using Open Banking APIs for client-consented data access is fully compliant under FCA regulations, as long as the provider is authorised and proper consent mechanisms are in place.

What should a modern risk profile report include?

It should include categorised income/expense data, risk indicators (like volatility or debt ratios), suitability assessments, and a timestamped audit trail, all based on real-time bank feeds.

How quickly can we implement this with Finexer?

Finexer offers fast deployment, with most wealthtech platforms integrating and going live 2–3x faster than market average. Full developer support and white-label options are available during onboarding.

Ready to move from static reports to dynamic, FCA-compliant risk profiling? Start using Finexer to access real-time bank data!