A regulated business that safely retrieves financial information from a user’s multiple bank accounts is known as an Account Information Service Provider (AISP). As a trusted middleman, it can only do this with the user’s express and informed consent. Consolidating this data will enable other financial apps to obtain a comprehensive, up-to-date view of a user’s financial situation.

The features of Account Information Services (AIS Open Banking) are transforming the way that businesses in the UK access, evaluate, and use bank data. With more than 11.6 million active open banking users in the UK as of Q1 2025—a 26% year-over-year increase—open banking is clearly being widely adopted by both consumers and businesses.

Over 27 million people, or more than half of all UK adults, are anticipated to use open banking by 2025. Strong AIS API solutions are now used by B2B platforms, ranging from lenders to ERP providers, to enable quick and safe access to real-time bank data. This enables more intelligent underwriting, smooth integration, and the development of sophisticated financial products. Because of the automation and data-rich context made possible by AIS, UK businesses also report improvements in risk profiling, onboarding speed, and cash flow management when they use open banking. Through AIS open banking, businesses gain secure, consented access to customer account data—enabling faster onboarding, more accurate risk assessments, and innovative financial solutions in today’s competitive landscape.

What are AIS features in the UK’s open banking?

The UK’s open banking framework is crucial for regulating Account Information Services (AIS). This framework enables authorised providers, with client consent, to securely access bank account information via APIs. This real-time access to financial data, a significant improvement over manual collection, fosters accuracy in financial processes and drives business innovation. By streamlining access to financial data, open banking enhances existing services and facilitates new financial products, benefiting consumers and businesses.

AIS APIs provide immediate and accurate financial information. While specific AIS API examples might be limited to developer sandboxes or trials, the general principle is secure and authorised access. For example, consider a budgeting app accessing a user’s transaction history and account balances. The data format typically adheres to standardised specifications for secure and consistent data exchange.

Essential AIS Features for UK Companies:

- Access to Bank Data in Real Time: After obtaining customer consent, immediately retrieve transactions, deposits, and transfers for current analysis.

- Account Aggregation & Consolidation: Combine several accounts to provide a unified financial picture that is essential for financing, insurance, and lending.

- Advanced Transaction Categorisation: Make financial reporting and customer segmentation easier by automatically tagging transactions in raw data.

- Balance Checks & Spending Insights: Get real-time balances and income/expense patterns to enhance risk assessment and provide tailored financial guidance.

- Strong Security & Compliance: Finexer’s AIS is FCA-authorised and PSD2-compliant, guaranteeing strong audit trails and GDPR alignment.

How AIS Features Solve B2B Challenges

Challenges vs AIS Open Banking Solutions

Speak to our open banking specialists today to solve the above challenges or more!

Technical guide: how to integrate AIS open banking APIs

Webhooks and RESTful APIs

Standardised endpoints for safely retrieving financial data on demand can be provided by a RESTful API. In addition, webhooks allow for event-driven updates, which guarantee that your platform always has the most recent data by sending real-time notifications to your application when particular actions take place.

Clusters of Granular Data Permissions

Granular data permission clusters are used to manage access and guarantee compliant data handling. By requiring explicit user consent for certain data sets (such as transactions and balances), this system enforces scoped data use, guards against overreach, and complies with privacy principles.

Sandbox Environments

One essential tool for secure development and testing is a sandbox environment. Developers can safely model API calls and user journeys on this isolated replica of the live system, guaranteeing a solid integration prior to deployment.

Flexible Consent Management Flows

These are the user-facing processes that allow access to account information. Flexible consent management flows that give end users clear, transparent, and manageable consent options are essential for user trust and must be in line with UK regulations.

What is AIS in open banking?

Although they are unable to transfer funds or make payments, AIS permits approved third parties to access user bank account information in order to offer financial services and insights.

What’s the difference between AIS and PIS?

PIS initiates payments on users’ behalf through their bank accounts, while AIS grants read-only access to bank account information.

So how does AIS work?

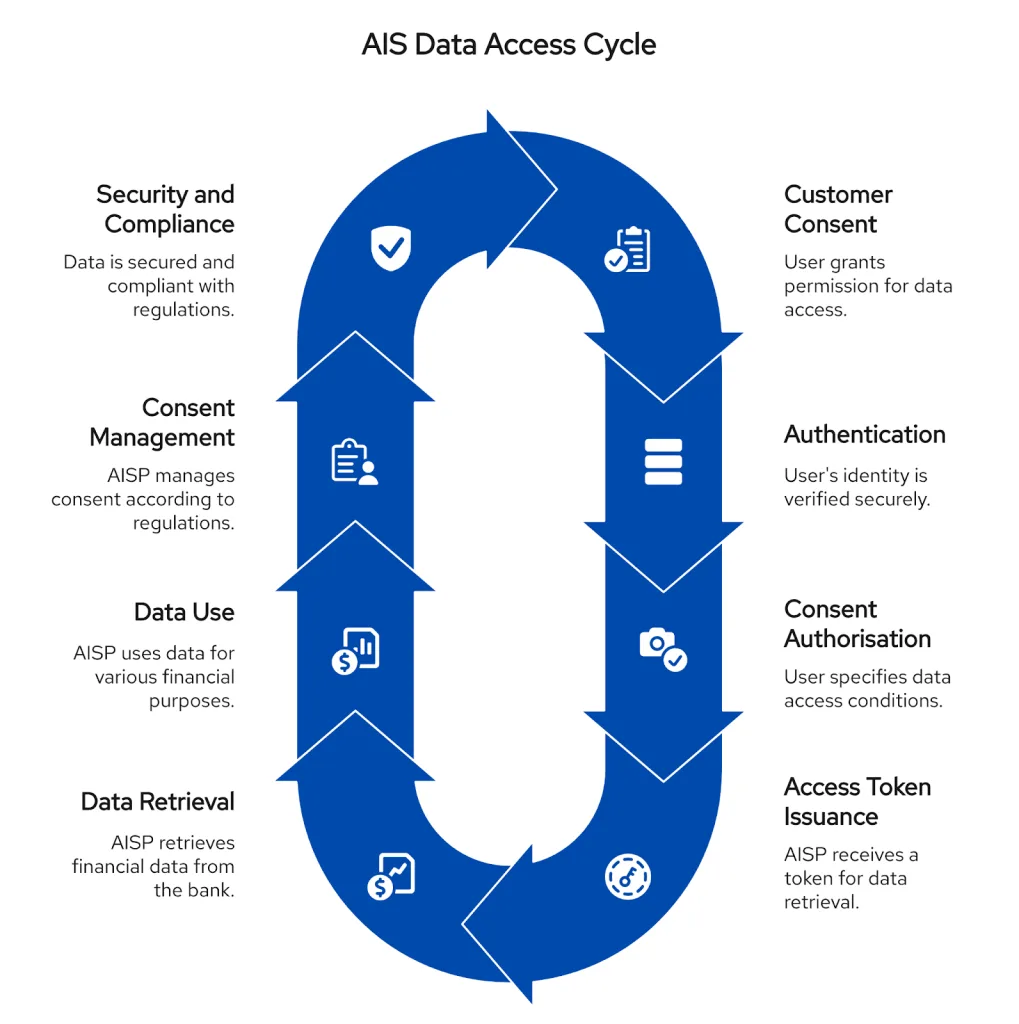

Given below are steps that allow AIS to provide the value it is known for:

- Customer Consent: An Account Information Service Provider (AISP) may access a customer’s or business’s bank account information with the express consent of the user.

- Authentication: To verify identity and consent, the customer is safely authenticated through the bank’s authentication procedure, which typically uses multi-factor authentication.

- Consent Authorisation: The client agrees to data sharing under controlled conditions and chooses which accounts and data the AISP may access.

- Issuance of Access Token: The AISP is granted an access token upon authorisation, which enables it to safely retrieve transaction and account information from the bank.

- Data Retrieval: The AISP retrieves historical and current transaction data, balances, and account information by submitting queries to the bank’s open banking APIs using the access token.

- Data Use: For purposes like credit evaluation, budgeting, identity verification, or financial analytics, the AISP prepares and displays the financial data to the company or user’s application.

- Consent Management: The AISP must abide by the consent expiration policies established by regulators, and the customer has the ability to withdraw or renew consent.

- Security and Compliance: All data is safeguarded through encryption, robust customer authentication, and audits in compliance with GDPR, FCA, and PSD2 regulations.

Use cases of AIS in open banking for UK businesses

- Credit risk and lenders:

Lenders can access real-time transaction histories and balances through AIS open banking, which enhances credit evaluations and lowers the risk of loan default by continuously monitoring accounts. Compared to manual or slow data methods, this dynamic data enables more accurate affordability checks.

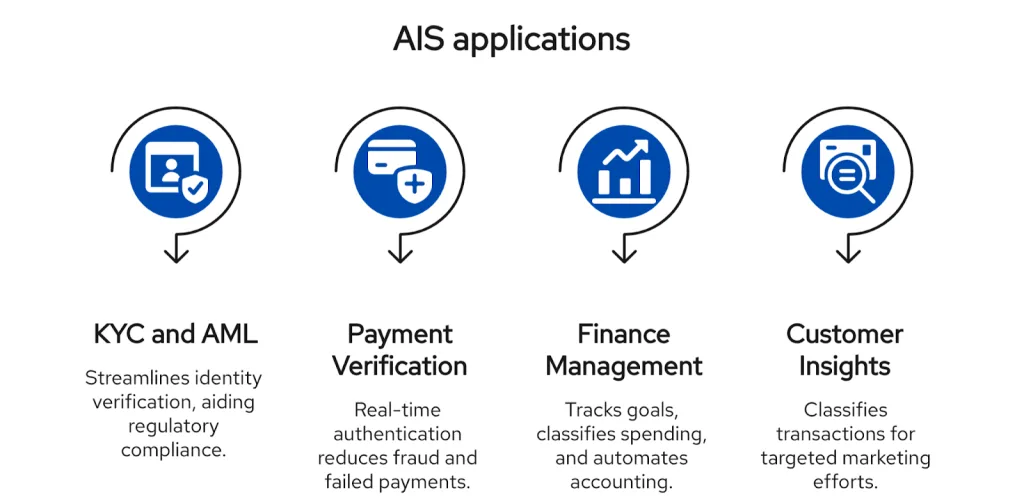

- KYC and AML Compliance:

Businesses can expedite Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures by directly confirming a user’s identity using bank account information. Instant verification is made possible by AIS APIs, which also help to comply with strict regulatory requirements and reduce onboarding friction.

- Payment Verification and Fraud Prevention:

By authenticating account information in real time during transactions, platforms that use open banking can instantly verify the ownership of a customer’s bank account, assisting merchants in lowering fraud and unsuccessful payments.

- Personal and Business Finance Management:

Fintech applications use AIS data for financial goal tracking, spending classification, and intelligent budgeting. They also automate checks for business accounting software and customise user experiences.

- Enhanced Customer Insights and Marketing:

Businesses can classify transactions by merchant and type using AIS-enriched data, which enables targeted marketing and customised product offerings based on actual spending patterns.

Applications of AIS are not limited to these; AIS can be used in all sectors that require businesses to fetch a client’s bank transaction data for more informed decisions.

How secure is AIS data access?

To guarantee safe, authorised, and legal access to client banking information, AIS employs encryption, regulated APIs, and multi-factor authentication.

What type of data does AIS provide?

To assist businesses and consumers in better managing their finances, AIS provides real-time access to account balances, transaction histories, payment information, and categorised spending data.

Why Choose Finexer for AIS Open Banking in the UK?

More than just data access is required for AIS-powered open banking implementation; you also need compliance, dependability, and a partner who is aware of business challenges. Finexer offers a PSD2-compliant, FCA-authorised AIS API that is designed for security and scalability.

Our platform enables lenders, fintechs, ERPs, and marketplaces to optimise onboarding, enhance risk assessments, and expedite the delivery of innovative financial products through real-time data access, sophisticated categorisation, and strong consent management.

What makes Finexer unique?

- FCA-approved and PSD2-compliant: reliable, safe, and authorised by regulators.

- Real-time bank data: balances, transactions, and insights as of right now.

- Improved financial data: Organised and contextualised to facilitate more intelligent decision-making.

- Developer-first strategy: webhook-driven updates, sandbox testing, and thoroughly documented APIs.

- Scalable for B2B platforms: Our AIS APIs are designed for performance and expansion, spanning from lending to ERP integration.

Use AIS Open Banking in conjunction with Finexer to transform your financial processes. Hop on a call with us now!