The UK Is Reaching a Rare Alignment Moment

For investors deciding whether to invest in open banking, timing matters more than enthusiasm.

In the UK, three forces are lining up at the same time: adoption, payments scale, and regulation. This combination does not happen often in financial infrastructure. When it does, it usually marks the point where a market moves from potential to planning.

Open banking in the UK is no longer developing in isolation. It is being used, regulated, and paid through at scale. That makes 2026 less about anticipation and more about consolidation and execution.

This is why the UK stands out globally as a serious place to back open banking over the next phase.

Why 2026 Is the Right Time to Invest in Open Banking (UK)

| # | Reason | What Has Changed | Why It Matters for Investors in 2026 |

|---|---|---|---|

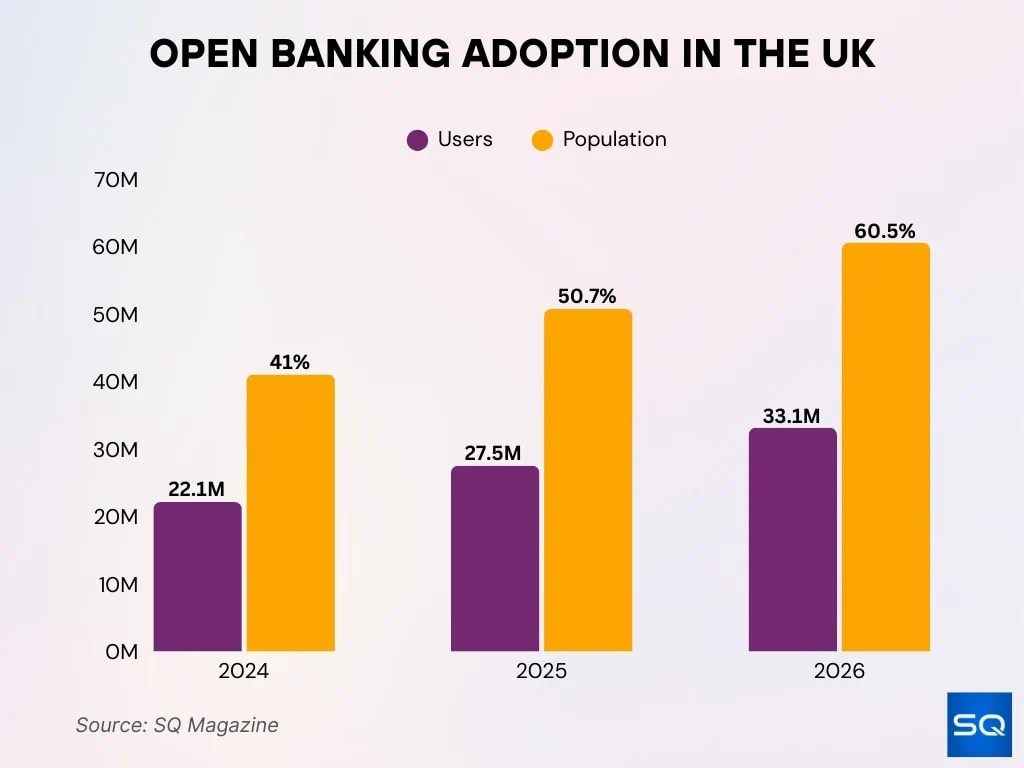

| 1 | Open banking is reaching majority usage | UK open banking users are projected to cross 60% of adults (~33 million people) | Widespread usage reduces adoption risk and confirms that open banking is now part of normal financial behaviour. |

| 2 | Payments are operating at system scale | 31M+ open banking payments per month, representing 7–8% of Faster Payments | High payment volumes indicate that open banking supports real transaction flows rather than limited pilot use. |

| 3 | Governance is moving from interim to permanent | UK open banking is transitioning from a CMA-led programme to long-term regulatory oversight under the Financial Conduct Authority | Clear regulatory ownership improves confidence in long-term stability and reduces uncertainty around future rule changes. |

| 4 | VRPs are preparing for commercial rollout | VRPs already make up 13–16% of open banking payments, with industry-wide rollout expected from 2026 | Recurring payment capability supports repeat revenue models that are easier to forecast and evaluate. |

| 5 | The UK remains a reference market | Analysts continue to position the UK as a global benchmark for open banking and open finance | Solutions proven in the UK can be applied in other regions with lower implementation and regulatory risk. |

| 6 | SME and merchant demand is now practical | UK SMEs are actively using open banking for faster, lower-cost payments and reconciliation | Usage is driven by operational needs, which supports sustained demand rather than short-term interest. |

1. Open Banking in the UK Is Becoming Majority-Usage Infrastructure

One of the clearest signals for investors is how widely a system is used.

Multiple industry sources project that UK open banking users will reach around 33 million by 2026, covering more than 60% of the adult population. At that point, open banking stops being a specialist capability and becomes part of normal financial behaviour.

Even before those projections materialise, the direction is clear. As of early 2025, there were over 13 million active users, growing at roughly 40% year on year. This growth has continued without major incentive programmes or regulatory pushes, which suggests organic demand.

For investors, this matters because infrastructure becomes easier to back once it reaches majority use. The question is no longer whether people will engage with it, but how deeply it will be embedded across products and services.

As open banking in the UK approaches that threshold, the risk profile changes materially heading into 2026.

2. Payments Volumes Have Reached System-Level Relevance

Usage alone is not enough. Payments show whether a system carries real economic weight.

According to Open Banking Limited, the UK processed 31 million open banking payments in March 2025 alone. That represents roughly 7–8% of all Faster Payments, meaning account-to-account APIs are already handling a meaningful share of national payment traffic.

More importantly for investors, those payments are not small. Estimates place the value of open banking payments in that single month between £12.9 and £14.8 billion, with annual payment growth running at around 65–70%.

This shifts how open banking should be viewed. Payments at this level are no longer marginal. They create space for sustainable business models across payment service providers, platforms, and infrastructure firms.

As this volume carries forward into 2026, open banking payments in the UK move from an alternative rail to a recognised part of the payments mix. That visibility is a key condition for long-term investment decisions.

3. Year 2026 Brings a Structural Reset in UK Open Banking Governance

One of the main reasons investors are re-examining whether to invest in open banking is regulation.

Until now, UK open banking has operated under interim arrangements tied to the original CMA programme. That phase is coming to an end. From 2026, open banking in the UK moves toward a permanent regulatory and governance framework, rather than time-bound oversight.

UK regulators have been explicit about this direction. The Financial Conduct Authority has confirmed that the focus from 2026 will be on long-term governance, industry coordination, and scaling payment use cases such as Variable Recurring Payments. This signals a shift from programme delivery to infrastructure stewardship.

This matters for investors because regulatory uncertainty is one of the biggest brakes on capital. Transitional regimes create hesitation. Permanent frameworks reduce it. Once rules, oversight, and responsibilities are clearly assigned, investment decisions become easier to justify internally.

📚UK Open Banking Governance 2025-2026

4. VRPs and Account-to-Account Payments Are Moving Into Scale Use Cases

One of the strongest signals for anyone looking to invest in open banking is how recurring payments are changing in the UK.

Variable Recurring Payments (VRPs) are no longer theoretical. By 2025, they already accounted for roughly 13–16% of open banking payment volumes, even though their use has been limited mainly to early scenarios such as account sweeping. That level of share, at this stage, shows demand exists before full commercial rollout.

Regulators and industry bodies are now preparing for that rollout. The Financial Conduct Authority has confirmed that 2026 will focus on supporting industry-wide VRP adoption, alongside the launch of the UK Payments Initiative (UKPI). UKPI is backed by 31 payment and financial services firms, with first live commercial VRP payments expected in Q1 2026.

There is already proof that large, repeat payment use cases work. In January 2025 alone, 1.3 million HMRC self-assessment payments worth £4.7 billion were made using open banking. This shows that high-value, high-trust payment flows can run through bank-to-bank rails without friction.

5. The UK Remains a Reference Market for Open Banking Investment

For investors, location matters as much as timing. The UK continues to stand out as a market where open banking is tested under real conditions before being adopted elsewhere.

Industry analysts, including KPMG, still describe the UK as a reference model for open banking and the wider move toward open finance. This matters because products that work within the UK’s regulatory and banking environment tend to translate more easily into newer regimes across Europe, MENA, Latin America, and parts of Asia.

There is also a domestic case to back. Independent market research forecasts the UK open banking market to grow from around USD 1.15 billion in 2025 to over USD 4.3 billion by the mid-2030s, driven by payments, SME usage, and platform-led adoption. That provides investors with a local revenue base rather than a pure expansion bet.

6. SME and Merchant Pain Points Are Creating Durable Demand

Demand for open banking in the UK is increasingly shaped by everyday business pressure, not fintech curiosity.

A 2025 survey of 500 UK SMEs found growing interest in open-banking-powered payments because they are faster and cheaper than cards, while also reducing manual bank transfers. The same survey highlighted gaps in awareness and confidence, which creates room for providers that can make adoption simple and explain value clearly.

At the same time, payment mix is shifting. With open banking already handling around 7–8% of Faster Payments and growing at 50–70% year on year, SMEs are encountering it more often through tax, billing, and supplier payments. Once these flows are in place, switching back is rare.

How Open Banking Is Being Used in 2026

In 2026, open banking in the UK is no longer something businesses are trialling. It is part of how routine financial processes are handled.

Account Information Services are now commonly used to support automation across accounting, payments, and compliance. Businesses are building workflows around bank data rather than treating access as an add-on.

Payments are following the same direction. With commercial Variable Recurring Payments now in place, bank-to-bank payments are being used for repeat and operational use cases instead of isolated transactions.

“We now see open banking used as part of everyday automation, not as a feature teams are experimenting with,” says Ravi Ranjan CEO at Finexer.

Conversations have changed as well. Teams no longer ask what open banking is. They arrive with a clear view of the problem they want to solve and where open banking fits.

“The discussion has shifted from education to execution,” he adds.

How Finexer Fits the 2026 Open Banking Market

Finexer helps UK businesses apply open banking in live operations, supporting automation, payments, and recurring financial processes.

- UK-only focus

Concentrates exclusively on the UK market, reflecting local banking standards, regulatory expectations, and real adoption patterns. - Account Information Services for operational use

Provides access to live and historical bank data used in accounting, reconciliation, verification, and compliance workflows. - Account-to-account and recurring payment support

Enables pay-by-bank and Variable Recurring Payment use cases that are increasingly part of routine business operations. - API-first and system-neutral

Designed to integrate into existing platforms and finance systems without changing how teams already work. - Regulatory complexity handled at the infrastructure layer

Operates within UK open banking requirements, reducing the compliance burden on businesses using the API. - Built for ongoing use, not pilots

Serves teams deploying open banking as part of day-to-day processes rather than short-term trials.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowIs it still early to invest in open banking in the UK in 2026?

Yes. By 2026, open banking in the UK has reached routine usage, payments at scale, and stable regulatory oversight, making it easier to evaluate as an investment.

What has changed most in UK open banking by 2026?

Open banking is no longer experimental. Businesses are using it consistently for automation, payments, and recurring financial processes.

Is open banking adoption limited to large enterprises?

No. Small and mid-sized UK businesses are actively using open banking for payments, reconciliation, and automation.

Explore how UK businesses are using open banking at scale in 2026 with Finexer!