Accounting platforms lose customers when bank feeds break. Transactions don’t sync. Users upload spreadsheets manually. Support tickets pile up because reconciliation takes hours instead of minutes. Month-end close gets delayed when payment matching fails.

Building a bank feed API means connecting to UK banks properly, handling transaction data correctly, and keeping feeds active without constant reconnection requests. The technical foundation determines whether your platform becomes trusted infrastructure or just another tool users work around.

What Actually Breaks in Bank Feed Implementation?

Most accounting SaaS teams underestimate three core problems: bank connectivity, transaction categorisation, and data normalisation.

Connectivity fails when providers don’t cover business banks or digital challengers. Your users operate accounts with Starling, Tide, or Revolut Business. If your API doesn’t reach these institutions, users resort to CSV imports.

Transaction data arrives inconsistent. One bank sends merchant names clearly. Another provides reference codes. Without normalisation, your reconciliation features can’t match payments to invoices automatically.

Failed authentication creates operational friction. Users shouldn’t re-authenticate weekly because connection stability wasn’t prioritised during API selection.

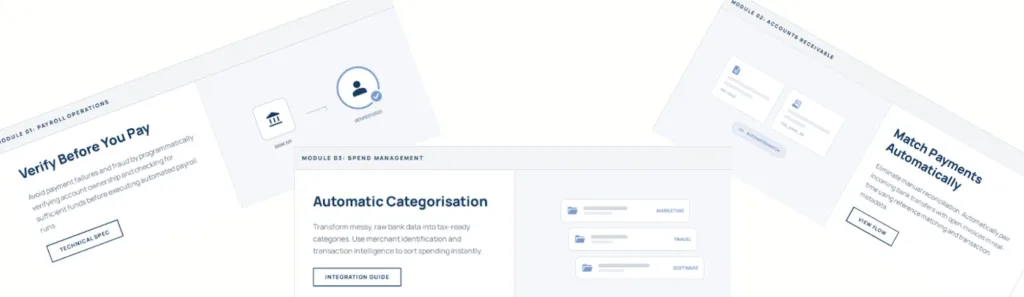

Which Features Drive Actual Usage?

Real-time transaction sync matters more than historical depth for daily accounting workflows, though historical depth remains essential for compliance and audit use cases. for most accounting workflows. When a payment clears, it should appear in the platform immediately. This affects cash flow visibility and payment matching accuracy.

Transaction categorisation reduces manual work. When bank data arrives pre-categorised into expense types, accounting teams spend less time coding transactions. This feature becomes non-negotiable for platforms targeting SME accountants.

Multi-account support handles business reality. UK businesses operate current accounts, savings accounts, and credit facilities across different banks. Your API needs to aggregate these into unified views without asking users to connect each account separately.

Long transaction history access supports compliance checks and audit requirements. Platforms serving regulated businesses need access to transaction records extending beyond 90 days. Some use cases require data going back years for income verification or financial reviews.

How Should Onboarding Actually Work?

Users abandon bank feed setup when the process requires technical knowledge. The connection flow needs to work inside your platform’s existing interface, maintaining brand consistency throughout.

White-label capabilities mean users authenticate with their bank without leaving your environment. Without exposing users to unfamiliar third-party interfaces. No generic interfaces that break user trust.

Clear permission requests prevent confusion. Users should understand exactly what data your platform accesses and why. Vague consent language creates support issues later.

Finexer handles the regulatory layer, letting your team focus on product features rather than compliance documentation. Open Banking authorisation requirements are managed within the API, removing this burden from your development roadmap.

Where Does Your Platform Fit?

UK accounting platforms need real-time bank feeds for accounting workflows that handle payroll processing, supplier payments, and expense tracking. Bank feed APIs remove manual data entry from these processes entirely.

| Platform Type | Without Bank Feed API | With Bank Feed API |

|---|---|---|

| Payroll Providers | Manual verification of employee bank details leads to payment failures and re-processing delays | Direct account verification before payment runs, confirming ownership instantly |

| Invoice Management | Manual matching of incoming payments to invoices, requiring staff time for reconciliation | Automatic payment matching in real time as transactions clear |

| Expense Platforms | Users upload receipts and manually enter transaction details for every expense | Auto-categorised spending with transaction data flowing directly from banks |

The common requirement across these use cases is UK bank coverage that actually works. Claiming 99% coverage means connecting to high street banks, digital challengers, and business banking platforms that UK SMEs actually use.

What Makes API Integration Faster?

Documentation quality determines implementation speed. Teams shouldn’t spend weeks interpreting vague endpoint descriptions or undocumented error responses. Clear banking API integration guides with working code examples reduce deployment time significantly.

Technical support during onboarding prevents delays. When authentication flows fail or webhook responses don’t match documentation, direct engineering support resolves issues within hours instead of days.

Finexer deployments complete 2-3 times faster than market alternatives, with onboarding support lasting 3-5 weeks. This matters when your product roadmap depends on launching bank feed features by specific dates.

How Does Testing Work Before Going Live?

Sandbox environments let development teams test bank feed functionality without connecting to live banking systems. This removes risk from the integration process entirely.

Testing should cover authentication flows, transaction data formatting, and error handling before production deployment. Teams identify edge cases early, preventing issues that would otherwise surface during user onboarding.

Finexer provides sandbox access with realistic test data, allowing developers to experiment with connectivity, authentication, and authorization without interacting with real banking systems. SDKs for popular languages reduce integration complexity further, with pre-built components handling authentication and data parsing automatically.

Fraud protection measures operate at the transaction level, monitoring for unusual patterns and flagging suspicious activity. These safeguards protect both businesses and customers from fraudulent activities without adding friction to legitimate transactions.

How Does Pricing Affect Product Economics?

Fixed monthly fees don’t scale with actual usage patterns. Early-stage platforms pay for capacity they haven’t reached yet. Growing platforms hit tier limits and face surprise overage charges.

Usage-based pricing charges for transactions processed, not potential volume. This model works better for platforms in growth phases or those serving businesses with seasonal transaction patterns.

Cost reduction compared to traditional payment rails becomes significant at scale. When transaction fees drop by up to 90% compared to card-based alternatives, the savings improve unit economics for both your platform and your customers.

Why UK-Only Focus Matters

UK accounting regulations, tax requirements, and banking infrastructure differ from other markets. Providers attempting to serve multiple regions often compromise on regional depth.

A UK-focused API connects to institutions that matter for UK businesses: high street banks, building societies, digital challengers, and business banking platforms. This coverage removes the need for fallback options or manual workarounds.

Regulatory compliance happens at the appropriate level. FCA authorisation, Strong Customer Authentication requirements, and data protection standards are built into the API rather than retrofitted later.

Transaction monitoring and fraud detection features operate continuously, identifying irregular patterns while maintaining smooth processing for legitimate activity.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try NowWhat Should Your Build Roadmap Look Like?

Start with basic transaction sync to prove the technical foundation works. Users need to see their bank transactions appearing in your platform reliably before advanced features matter.

Add transaction categorisation next. This feature removes manual work and demonstrates value quickly. Pre-categorised expenses make reconciliation faster, which is what accounting teams actually measure.

Build multi-account aggregation after core features work. Businesses operating multiple accounts need consolidated views. This capability differentiates professional accounting platforms from basic bookkeeping tools.

Implement historical data access for compliance-focused use cases. Platforms serving regulated businesses or those requiring audit trails need transaction history extending beyond recent months.

Use Case: Payroll Platform Implementation

A UK payroll provider integrated Finexer’s bank feed API to verify employee payment accounts before processing payroll runs. Previously, incorrect account details caused payment failures and re-processing delays.

With direct bank connectivity, the platform confirms account ownership instantly. Payroll administrators see verification status before approving payment batches. Failed payments dropped significantly, reducing support tickets and improving processing reliability.

The white-label integration maintained the platform’s existing interface. Employees authenticated with their banks without leaving the payroll system. Implementation completed within their planned release window, with technical support resolving edge cases during the first month of production use.

Get started with Finexer and build bank feed features your users will actually trust.

What UK banks does a proper bank feed API need to cover?

Coverage should include all major high street banks, digital challengers like Monzo and Starling, and business banking platforms such as Tide and Revolut Business.

How long does typical bank feed API integration take?

With proper documentation and technical support, deployment completes in 3-5 weeks, significantly faster than market alternatives requiring months of implementation.

Can bank feed APIs access historical transaction data?

Yes, subject to bank availability, access extends up to 7 years for compliance checks, income verification, and audit requirements.

What happens when bank authentication expires?

Properly implemented APIs handle re-authentication smoothly through the same white-label flow, minimising user disruption and support tickets.

How does usage-based pricing work for bank feed APIs?

Pricing scales with actual transaction volume processed, avoiding fixed monthly fees that don’t match real usage patterns or growth phases.

A regulated, faster way to enable bank feeds for UK accounting platforms.