Most letting agents recognise this scenario: you’re waiting three days for a tenant’s bank statements, only to receive incomplete PDFs. Another day passes whilst you request the missing months. Meanwhile, your strongest applicant has accepted a property elsewhere.

Document-based verification creates friction at the worst possible moment. Prospective tenants are making rapid decisions, yet traditional checks require them to locate paperwork, arrange employer references, and wait whilst agents manually review each submission.

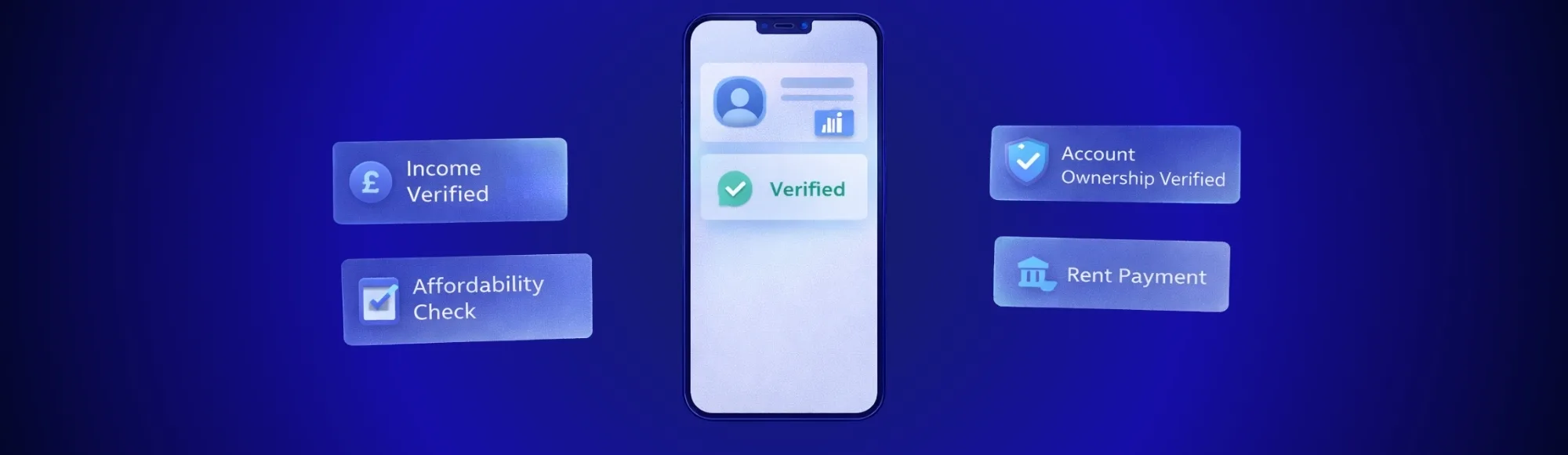

Open banking for renting provides an alternative approach. Bank data flows directly from the tenant’s account to your verification system, with their consent. Income verification, expenditure analysis, and account ownership confirmation occur within minutes rather than spanning multiple days.

Finexer’s platform connects to FCA-authorised Open Banking infrastructure. UK letting agents can verify tenant affordability and process rent payments through secure bank-to-bank channels, reducing reliance on documents that may be outdated or altered.

The Problem with Manual Tenant Referencing

PDFs and uploaded bank statements remain the default verification method for many agencies. This approach presents several operational challenges.

Document authenticity verification proves difficult without specialist tools. Basic editing software allows modification of bank statements-altering figures, dates, or employer information. Screenshots may appear legitimate on first inspection, yet detecting manipulation requires forensic-level scrutiny that most agencies cannot provide. Questionable documents frequently progress through approval stages unchallenged.

Processing timelines directly impact conversion rates. Quality applicants often view multiple properties within tight schedules. When verification extends across three to five days, competing offers may succeed during this window. Strong candidates rarely wait; they secure alternative accommodation whilst checks remain pending.

Data protection obligations increase when storing financial documents. UK regulations require secure handling, defined retention periods, and proper deletion protocols. Incomplete submissions may not reveal issues until after tenancy commencement, potentially exposing landlords to affordability concerns that proper verification would have identified earlier.

Administrative workload consumes resources that could address higher-value activities. Staff hours spent chasing documents and manually entering data represent opportunity costs – time unavailable for landlord relationship management or property marketing initiatives.

How Open Banking Fits into Renting Workflows

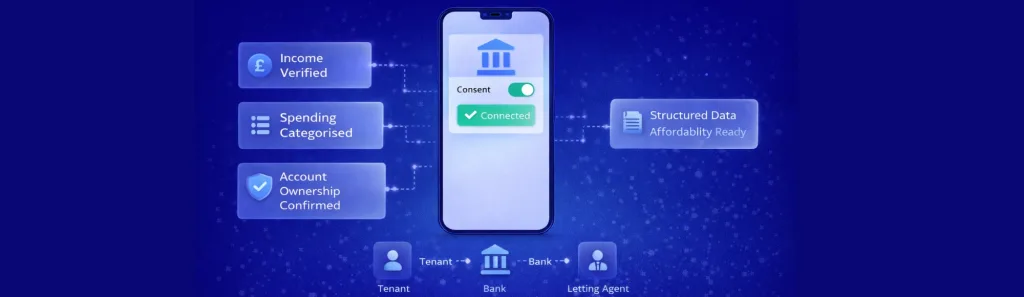

Open banking rent verification establishes secure, consent-based connections between letting agents and tenant bank accounts. Rather than requesting document uploads, the system retrieves data directly from banking institutions through authorised channels.

UK financial regulations govern this entire process. Tenants must provide explicit consent before any data access occurs. Access windows carry time limitations, and no permanent credentials are stored within agent systems.

Three core capabilities support lettings operations:

Income verification through transaction data. Salary deposits, freelance payments, and benefit income appear as they occur within tenant accounts. This approach replaces payslip requests and self-reported income figures with verified banking records.

Expenditure categorisation without manual input. Existing rent obligations, loan commitments, and recurring subscriptions receive automatic classification. Affordability assessments draw from comprehensive spending patterns rather than tenant-compiled lists of outgoings.

Account ownership verification for fraud prevention. Bank account verification for landlords confirms that applicants control the accounts they claim to own. Identity fraud risks decrease, and rent payment sources become verifiable before tenancy commencement.

Processing occurs within minutes. Tenants authenticate through mobile banking interfaces, and structured data reaches agent systems immediately-eliminating document waiting periods that traditionally span multiple days.

Where Finexer Fits into Your Lettings Process

Finexer maintains connections to 99% of UK banking institutions through FCA-authorised Open Banking infrastructure. The platform manages tenant verification, affordability assessment, and payment processing without requiring agencies to develop or maintain financial technology systems internally.

Tenant Onboarding

Applicants authenticate through their existing bank security protocols. Finexer retrieves transaction history following consent provision, then structures this information for lettings-specific analysis.

Income source identification occurs automatically. Employer salary transfers, freelance deposits, and state benefit payments receive categorisation without manual review. Payslip requests and employer reference procedures become unnecessary in most scenarios.

Expenditure patterns undergo systematic analysis. Current rent obligations, utility commitments, and loan repayments surface clearly within the data structure. This enables accurate affordability assessment without requiring applicants to manually document every outgoing payment.

The verification cycle completes rapidly. Document upload stages, chase procedures, and manual data entry processes are eliminated from the workflow.

Affordability Verification

Open banking rent verification provides transaction-level insight into applicant finances rather than relying on self-reported information. Actual spending behaviour becomes visible through banking records.

The data structure includes:

- Income from all sources (employment, self-employment, benefits)

- Current housing costs (rent or mortgage commitments)

- Credit obligations (loan repayments, finance agreements)

- Regular recurring expenses (subscriptions, utilities, insurances)

- Variable expenditure patterns that may affect cashflow stability

Presentation occurs in structured formats that support consistent criteria application. Agencies can establish thresholds-for instance, rent should not exceed 30% of net monthly income-and receive automated flagging of applications falling outside parameters.

Finexer provides verified financial data without making tenancy decisions. Agencies apply their own assessment criteria based on landlord requirements and regulatory compliance obligations.

Rent Payment Collection

Rent payments via Open Banking operate as direct account-to-account transfers, bypassing card network infrastructure. Funds move directly from tenant banking facilities to agent or landlord accounts.

Transaction costs decrease compared to card-based payments, whilst chargeback exposure is eliminated entirely. Bank account verification for landlords confirms payment origination from verified sources, reducing fraudulent transaction risk.

Payment failure rates decrease with open banking for renting infrastructure. Transfers initiate from verified accounts with confirmed available funds, avoiding common issues associated with expired card credentials or insufficient balances.

Recurring payment authorisation is supported. Tenants may authorise regular monthly transfers without repeated authentication requirements. This provides Direct Debit-style convenience whilst often achieving faster settlement times.

Why Traditional Verification Methods Create Bottlenecks

Manual referencing processes introduce delays throughout tenant onboarding. Administrative staff allocate significant time to document pursuit, authenticity assessment, and manual data transcription.

Document fraud detection presents ongoing challenges. PDF manipulation and fabricated statements require forensic-level analysis to identify-resources that most agencies cannot economically justify. This vulnerability exposes operations to unsuitable tenant acceptance risks.

Compliance obligations expand when agencies store financial documentation. UK data protection frameworks mandate secure handling protocols, defined retention schedules, and eventual secure deletion procedures. These requirements add administrative overhead without contributing to core business activities.

Open banking rent verification addresses these constraints through direct banking data access. Document storage becomes unnecessary as transaction information flows from banking institutions to agent systems. Authenticity concerns diminish because data originates from regulated financial institutions rather than tenant-supplied files.

How Quickly Can Tenant Checks Complete with Automation?

Automated verification through open banking for renting substantially reduces processing timelines compared to document-dependent workflows.

The technical sequence operates as follows:

Tenant authentication occurs through existing bank security infrastructure. Connection establishment happens within seconds, with transaction history retrieval following immediately.

Income and expenditure categorisation proceeds automatically. Software algorithms classify transactions, identify income sources, and calculate affordability metrics without manual analytical input.

Structured data reaches agent systems in near-real-time. Document waiting periods, manual transcription tasks, and employer reference procedures are eliminated from the critical path.

Speed advantages carry particular significance in competitive lettings markets. Quality applicants frequently schedule multiple property viewings within single days. Agencies that complete eligibility confirmation most rapidly typically secure tenancy agreements ahead of competitors.

What Letting Agents Gain from Automated Verification

Agencies implementing open banking rent verification report substantial reductions in application processing timelines. Same-day affordability assessments become achievable in many cases, compared to multi-day document-based cycles.

Administrative workload decreases across operations. Staff resources shift from document pursuit and data transcription towards client-facing activities-property viewings, landlord communication, and market positioning initiatives.

Affordability criteria application becomes standardised. Agencies establish parameters (such as rent-to-income ratios), with automated systems flagging applications requiring manual assessment. This consistency supports audit trails and reduces subjective decision-making variations.

Faster processing also correlates with improved applicant retention. Extended verification periods create opportunities for competing offers to succeed. When checks complete rapidly, quality applicants remain engaged throughout the approval process, improving conversion metrics.

Contact us to discuss how Finexer can support your lettings operations.

Operational Considerations

Data access operates under time constraints. Tenant consent authorises access for defined periods rather than indefinite duration. Once authorisation windows expire, fresh consent becomes necessary for subsequent data access. This structure reduces long-term data retention obligations for agencies.

Finexer operates through FCA-authorised infrastructure. The platform connects via authorised Open Banking providers rather than holding direct licensing. Agencies utilising the service do not require independent FCA registration.

Deployment timelines vary by implementation scope. Integration encompasses API connection, existing system compatibility testing, and operational onboarding support. Finexer provides technical assistance throughout implementation to ensure workflow compatibility.

Pricing follows usage-based models. Charges apply per tenant verification or payment transaction processed. Fixed monthly fees and minimum volume commitments are absent, making the service accessible across agency sizes-from boutique operations to high-volume portfolios.

UK banking coverage reaches 99%. Connections exist with major high-street institutions and challenger banks. When tenant banks fall outside coverage, traditional documentation serves as fallback verification.

How to Get Started

- Initial consultation with Finexer addresses current workflow requirements and integration objectives specific to your agency operations.

- API integration proceeds through internal development resources or third-party technical partners. Finexer supplies comprehensive documentation and technical support throughout implementation.

- User acceptance testing validates platform functionality within existing tenant onboarding processes before operational deployment.

- Live deployment enables open banking for renting capabilities for tenant verification and payment collection.

Ongoing support remains available during the onboarding period to address operational adjustments or technical queries that emerge.

Is Open Banking legal for tenant referencing in the UK?

Yes. The Financial Conduct Authority regulates Open Banking operations, and tenants must provide explicit consent before any bank data access occurs.

Can tenants refuse to use Open Banking?

Tenants retain the right to choose traditional document-based referencing methods. However, open banking rent verification typically completes within substantially shorter timeframes.

Does Open Banking replace credit checks?

No. Open banking rent verification addresses income and expenditure verification, whilst credit checks examine borrowing history and creditworthiness. Many agencies utilise both verification methods.

How secure is Open Banking for tenant data?

FCA regulations mandate strong customer authentication protocols. Finexer does not store tenant banking credentials within its systems.

What happens if a tenant’s bank is not supported?

Coverage extends to 99% of UK banking institutions. In rare cases where banks remain unconnected, tenants may provide traditional documentation or authenticate through alternative accounts.

Get Started

A regulated, faster way to verify tenants with real-time UK bank data access through open banking for renting

Book Demo Now