You’ve probably been there: it’s month-end, your finance team is buried in spreadsheets, manually matching hundreds of transactions. Someone’s chasing down a missing payment reference whilst another team member is three hours into reconciling last week’s bank statement. Sound familiar?

Here’s what most finance leaders miss: the problem isn’t your team’s capability. Manual accounting workflows simply can’t keep pace with modern transaction volumes. That’s where accounting workflow automation becomes essential.

Why Manual Workflows Hold Your Team Back

Think about your current process. Transactions arrive as raw data-amounts, dates, cryptic references. Your team spends hours decoding “REF12345” just to figure out which customer paid which invoice.

Every transaction needs categorising. That’s manageable at 50 transactions monthly. But at 500? Someone’s manually reviewing each one, making decisions, entering codes. Errors creep in. Month-end reconciliation becomes a marathon-downloading statements, cross-referencing systems, investigating discrepancies. The process stretches from hours into days.

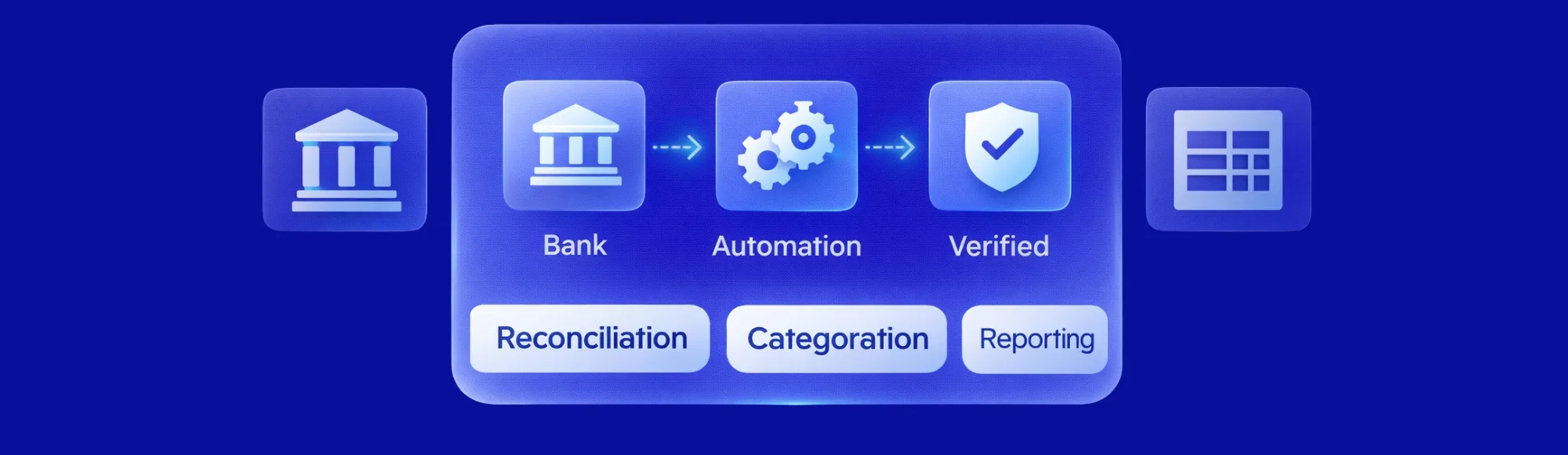

What Does Accounting Workflow Automation Actually Do?

Rather than waiting for end-of-day bank files, automation connects directly to your bank accounts through open banking. Transactions appear instantly-the moment they clear.

Transaction enrichment changes everything. The system grabs merchant information, payment metadata, and remittance details that standard feeds miss. “REF12345” becomes “Customer XYZ – Invoice 847 – Subscription Payment.”

Discover how accounting workflow automation integrates with your ERP

Categorisation happens automatically. The software learns your rules, recognises patterns, assigns codes without human review. Reconciliation runs continuously-as payments arrive, the system matches them against invoices. This is accounting process automation in action. No month-end marathons. Your financial position stays current.

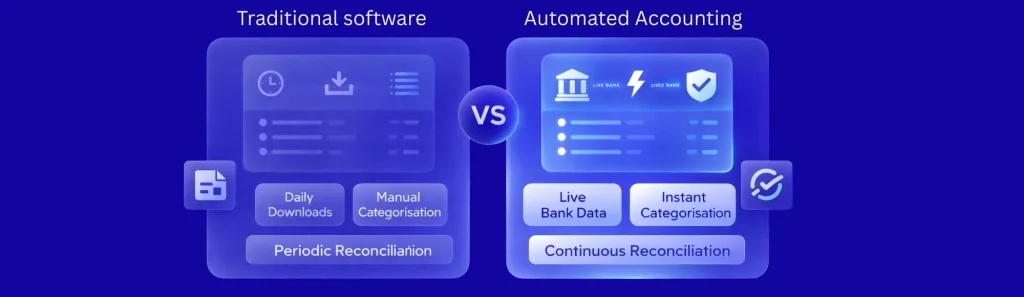

How Is This Different From Traditional Software?

Your current software downloads yesterday’s transactions once daily. You categorise manually. Reconciliation happens periodically. Traditional systems weren’t built for accounting workflow automation.

Modern accounting process automation runs constantly. Bank connections are live. Categorisation is instant. Reconciliation never stops. Traditional systems show where you were yesterday. Automated systems show where you are now.

What About Subscription Businesses?

Running a SaaS business with 800 monthly subscribers? Under manual processes, someone’s matching 800 payments, figuring out subscription periods, updating revenue recognition, investigating failures.

With automated reconciliation software, this happens continuously without staff intervention. Payments match to customers automatically. Revenue recognition updates based on terms. Failed payments trigger your workflow immediately-not three days later. This is precisely what modern bookkeeping automation software should deliver.

Learn how automated bookkeeping works with open banking APIs

Twenty hours of manual reconciliation becomes zero. Your team analyses data rather than collecting it.

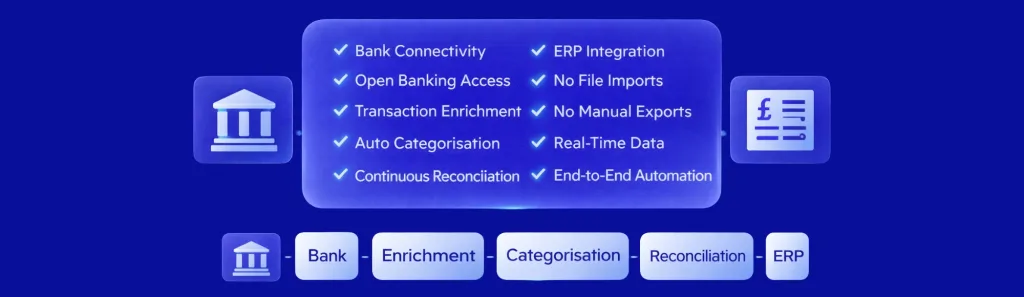

What Should You Look for in Bookkeeping Automation Software?

- Direct bank connectivity is critical

If a system relies on downloading files, it’s only digitising manual work – not truly automating accounting. - Open Banking enables true automation

Open Banking connections deliver real-time, transaction-level data that file imports simply cannot match. - This is the core difference between automation and bookkeeping

Traditional bookkeeping digitises processes. Accounting workflow automation eliminates them. - Transaction enrichment is a non-negotiable requirement

Real automation depends on accessing merchant data, payment references, and contextual details. - Enriched transactions allow automatic categorisation

No human review needed when merchant and reference data is available. - Basic transaction feeds are not enough

Without enrichment, systems cannot reliably categorise or reconcile. - High-quality reconciliation software must include enrichment

Otherwise, reconciliation remains semi-manual. - Integration is mandatory, not optional

Software that requires manual exports has simply shifted the workload. - Look for direct ERP integrations

Categorised and reconciled transactions should flow straight into your ERP. - True accounting automation removes all manual handoffs

From bank → enrichment → categorisation → reconciliation → ERP, in one continuous pipeline.

How Finexer Solves These Challenges

Finexer connects to 99% of UK banks through open banking, pulling complete transaction data in real-time. That coverage means your entire banking operation works through one platform. It’s accounting workflow automation designed specifically for UK businesses.

Explore accounting workflow software capabilities

You’re not rebuilding your tech stack; you’re adding a layer that makes existing systems work better. As bookkeeping automation software, Finexer integrates with your current accounting platform. The system provides 3-5 weeks of dedicated onboarding support to ensure smooth implementation.

Businesses report up to 90% reduction in transaction processing costs. That’s the actual difference between manual categorisation and automated reconciliation software working at scale.

Pricing is usage-based rather than fixed subscriptions. You pay for actual transaction volume, not estimated capacity. For growing businesses, costs scale naturally with operations rather than requiring contract renegotiations.

What is accounting workflow automation?

Software that handles transaction categorisation, reconciliation, and reporting automatically by connecting directly to bank accounts rather than requiring manual data entry.

How does automated reconciliation work?

The system continuously matches incoming transactions against invoices using enriched bank data from open banking APIs, eliminating manual month-end processes.

What makes this different from standard accounting software?

Traditional software requires manual categorisation and periodic reconciliation; workflow automation handles these tasks continuously using real-time bank connections.

Can it handle complex categorisation rules?

Yes-platforms learn from historical patterns and apply rules based on merchant data, payment references, and transaction context, improving accuracy over time.

What support does Finexer provide during implementation?

Finexer offers 3-5 weeks of dedicated onboarding support, including bank connections, rule configuration, and integration assistance with your existing accounting software.

Ready to Automate Your Accounting Workflow?

See how Finexer reduces manual processing by up to 90% with real-time reconciliation

Book Demo Now