Excel MTD bridging software isn’t about adding another plugin to your spreadsheet. It’s about replacing manual copy-paste workflows with automated bank data pipelines.

Your platform still relies on Excel exports for quarterly MTD reporting. That means version control chaos. Formula errors. Quarter-end bottlenecks.

Businesses expect platforms to handle MTD data collection automatically. Not through downloaded CSVs.

Open Banking APIs provide the infrastructure layer that connects bank accounts to your platform without spreadsheets. Transaction data flows directly from UK banks into your system. You build the MTD categorisation and submission logic.

This article explains how excel mtd bridging software works. Where Open Banking fits. What changes when platforms move away from manual spreadsheet workflows.

Why Does Excel Break MTD Workflows at Scale?

Excel works fine for a single user. It breaks when platforms serve hundreds of businesses submitting quarterly MTD returns.

Human dependency at every step Someone downloads bank statements. Someone opens the right Excel file. Someone pastes data into correct columns.

Every quarter. Every user.

Version control becomes unmanageable Users save multiple versions: “MTD_Q1_final”, “MTD_Q1_final_v2”, “MTD_Q1_actual_final”.

When HMRC queries a submission six months later, which version was used? No one knows.

No real-time data Excel shows what happened last week or last month. By the time data is imported and categorised, the window for financial decisions has closed.

No audit trail HMRC expects platforms to demonstrate where MTD figures came from. Excel doesn’t track who edited what. Or when. Or why.

Platforms can’t scale on Excel-based MTD processes. The operational overhead grows faster than revenue.

What Does Excel MTD Bridging Software Actually Mean?

Excel MTD bridging software describes the infrastructure layer between bank accounts and MTD submission endpoints. Not a spreadsheet add-on.

Think of it as a data pipeline:

Bank accounts → API connection → Your platform → MTD logic → HMRC submission

The bridging happens at the API layer. Instead of exporting bank data to Excel, categorising manually, and uploading to an MTD tool-platforms ingest transaction data automatically and apply MTD rules in real time.

Excel gets removed entirely.

Businesses see the same data-income, expenses, VAT-but it’s generated from live bank feeds rather than manual imports.

This approach works for:

- Accounting platforms serving small businesses

- Payroll systems handling mtd quarterly reporting

- Bookkeeping tools managing multiple client accounts

- Finance platforms building mtd compatible software features

The platform uses the MTD categorisation logic. The API layer handles bank connectivity and data ingestion.

Where Does Open Banking Fit?

Open Banking APIs provide the regulated framework for accessing bank transaction data with user consent.

A business connects their bank account using Open Banking consent flows. Once authorised, your platform receives real-time transaction data directly from the bank.

No downloads. No CSVs. No manual entry.

The data arrives structured:

- Transaction amounts

- Merchant names

- Timestamps

- Payment types (debit, credit, transfer)

- Account balances

This is the same data businesses previously exported to Excel. The difference is speed and accuracy.

Open Banking delivers it instantly, with bank-level verification.

Why this matters for MTD quarterly reporting:

MTD requires accurate income and expense categorisation. When data comes from bank-verified sources rather than user-typed spreadsheets, error risk drops significantly.

Platforms can pull historical data (up to 7 years depending on the bank). Onboarding new users doesn’t require uploading months of old Excel files. The entire transaction history loads automatically.

What Changes After Moving Away From Excel?

We’ve worked with platforms transitioning from Excel-based MTD workflows to automated Open Banking pipelines. The operational improvements show up immediately.

No more manual imports Users authorise their bank once. From that point forward, transaction data flows automatically into the platform every time they log in.

Faster quarter-end processes MTD submission deadlines used to trigger a rush. Users scrambling to update spreadsheets. Finance teams chasing missing data. Support handling error tickets.

With automated bank feeds, quarterly data is already categorised and ready for review. The quarter-end panic disappears.

Fewer categorisation errors Excel relies on users to manually assign income vs expense. Apply correct VAT rates. Flag capital purchases.

When transaction data includes merchant details and payment types, platforms can pre-categorise most entries automatically. Users only review and confirm rather than type everything from scratch.

Cleaner audit trails Every transaction in an Open Banking-based system includes a timestamp, consent log, and data source.

If HMRC questions an MTD submission, the platform can show exactly where each figure originated-down to the specific bank account and transaction date. Excel can’t provide that level of traceability.

How Do Platforms Use APIs Instead of Spreadsheets?

Excel MTD bridging software relies on REST APIs and webhooks to automate data ingestion.

REST API for initial data pull When a user connects their bank account, the platform calls the Account Information API to retrieve historical transaction data.

This could be 90 days, 6 months, or longer depending on MTD reporting requirements. The data returns as JSON. The platform stores it in its own database.

Webhooks for ongoing updates Rather than users manually refreshing data, webhooks notify the platform whenever new transactions post to the connected bank account.

The platform automatically pulls the latest data and updates the user’s MTD records in real time.

Data transformation and categorisation Raw bank transaction data needs to be transformed into MTD-compliant categories. Platforms build logic to:

- Identify income vs expenses

- Apply VAT rules based on transaction type

- Flag capital purchases vs operating expenses

- Match transactions to invoices or receipts

This is where the platform’s MTD expertise matters. The API delivers the data. The platform applies the business logic.

Aggregation for quarterly reporting When MTD submission deadlines approach, the platform aggregates categorised transactions for the relevant period. Applies any adjustments or corrections. Prepares the final figures for HMRC submission.

All of this happens without Excel. The user sees a dashboard. Reviews categorised income and expenses. Make corrections if needed. Approves the submission.

The platform handles the data pipeline behind the scenes.

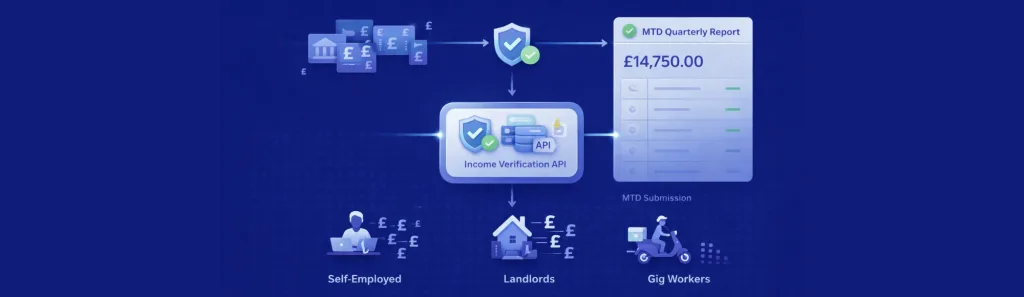

How Does Income Verification API Work in MTD Context?

Income verification APIs add an extra layer of accuracy to mtd quarterly reporting. Instead of users manually declaring income figures, the platform pulls verified income data directly from bank transactions.

This matters for:

Self-employed users Freelancers and sole traders receive payments from multiple clients across multiple accounts. An income verification api consolidates all income sources automatically. Nothing gets missed in MTD submissions.

Landlords managing rental income Landlords using MTD software need to report rental income accurately every quarter. Income verification APIs pull rent payments directly from tenant bank transfers. No manual tracking in Excel.

Platforms serving gig economy workers Drivers, delivery workers, and platform-based earners receive frequent small payments. Aggregating these manually in a spreadsheet is time-consuming and error-prone.

Income verification APIs categorise and sum these payments automatically.

The result: more accurate MTD submissions with less manual effort.

What Should You Look For in Excel MTD Bridging Infrastructure?

If your platform is evaluating Open Banking providers to replace Excel-based MTD workflows, these are the critical capabilities:

Open Banking-based connectivity The provider should be FCA-authorised with direct connections to UK banks. Third-party aggregators add complexity and compliance risk.

99% UK bank coverage Your users bank with Barclays, HSBC, Lloyds, NatWest, Monzo, Starling, and dozens of others. The API provider needs to support all of them-not just the top 5.

Real-time transaction feeds MTD accuracy depends on up-to-date data. Look for providers offering real-time or near-real-time transaction updates via webhooks, not daily batch refreshes.

REST API with comprehensive documentation Your development team needs clear, complete API documentation with code examples in multiple languages. The faster they can integrate, the sooner you can launch.

Webhooks for automated updates Webhook support eliminates the need for your platform to poll for new data constantly. The API provider notifies you when new transactions arrive.

Usage-based pricing Fixed enterprise contracts make sense for large-scale deployments. But platforms serving SMBs need pricing that scales with actual usage-not upfront commitments.

3-5 weeks of onboarding assistance Open Banking integration isn’t plug-and-play. Look for providers offering hands-on support during implementation-not just documentation and a support email.

How Does Finexer Fit?

Finexer provides the Open Banking connectivity infrastructure that platforms use to build Excel-free MTD workflows.

We handle:

- Bank account connections across 99% of UK banks

- Real-time transaction data ingestion via REST API

- Webhooks for automated updates

- Historical data retrieval (up to 7 years depending on bank)

- FCA-authorised compliance management

Your platform handles:

- MTD categorisation logic

- User interface and experience

- HMRC submission workflows

- Client relationship and support

Finexer isn’t mtd compliant software-we’re the data layer underneath it.

Platforms use our APIs to eliminate Excel-based data collection and build automated MTD pipelines that scale.

Use Case: Accounting Platform Replacing Excel MTD Workflows

An accounting platform serving 500+ small businesses was losing clients to competitors offering automated bank feeds. Their users complained about manual bank statement downloads every month. Excel template errors causing MTD submission failures. Time spent reconciling mismatched data.

They integrated Finexer’s Open Banking APIs to replace the Excel workflow.

What changed:

- Users connected bank accounts once via secure Open Banking consent

- Transaction data flowed automatically-no more downloads

- Platform pre-categorised income and expenses using merchant data

- MTD submissions became review-and-approve rather than data entry marathons

- Quarter-end support tickets dropped by 60%

The result: Faster onboarding. Fewer errors. Happier users.

The platform shifted from competing on price to competing on operational efficiency.

What I Feel About Excel MTD Bridging Software

Excel was never designed for multi-user, real-time financial data management. It’s a spreadsheet tool-excellent for ad-hoc analysis, budgeting, and one-off calculations.

But when platforms try to scale MTD compliance on Excel workflows, they hit operational limits quickly.

I’ve seen platforms spend more time managing Excel version control, formula errors, and user support tickets than building features their clients actually want.

The moment they replace spreadsheets with automated bank feeds, the entire product experience shifts.

Users don’t care about Open Banking APIs or REST endpoints. They care about logging in, seeing accurate financial data, and submitting MTD returns without stress.

Excel stands in the way of that experience.

If your platform is still asking users to download bank statements and upload them to Excel templates, you’re competing with one hand tied behind your back. Automated bank feeds are no longer a premium feature-they’re table stakes.

We work with platforms making this transition because we’ve seen how much operational friction it removes. Not just for users. But for product teams, support teams, and compliance teams.

When data collection is automated, everyone’s job gets easier.

That’s why excel mtd bridging software matters. It’s not about technology for technology’s sake. It’s about removing the bottleneck that prevents platforms from scaling MTD compliance efficiently.

What is excel mtd bridging software?

Excel MTD bridging software refers to the API infrastructure that automates bank data collection for MTD reporting, replacing manual spreadsheet workflows with real-time bank feeds.

Does Open Banking replace MTD software?

No. Open Banking provides the data layer-transaction feeds from bank accounts. Platforms still build the MTD categorisation logic and HMRC submission workflows on top of that data.

Can platforms use Excel and Open Banking together?

Yes, but it defeats the purpose. Open Banking removes the need for Excel by automating data collection. Using both creates duplicate workflows and increases error risk.

How long does it take to integrate Open Banking APIs?

Most platforms complete integration in 3-5 weeks with hands-on support from the API provider. This includes sandbox testing, production deployment, and initial user onboarding.

Is income verification api the same as MTD software?

No. Income verification APIs pull verified income data from bank accounts. MTD software uses that data to calculate quarterly tax obligations and submit returns to HMRC.

Ready to Replace Excel with Automated MTD Workflows?

See how Finexer’s Open Banking APIs eliminate spreadsheet chaos and scale your platform’s MTD compliance.

Book Demo Now