Many businesses in the UK are experiencing high fees and delays with traditional payment methods. Customers and merchants alike often find that card transactions come with hidden charges and prolonged settlement times that can disrupt cash flow and create uncertainty.

A2A payments in the UK are expected to exceed £190 billion in transaction value by 2025, according to recent projections by Statista and the Open Banking Implementation Entity (OBIE). This explosive growth, driven by rising card fees, demand for faster payouts, and the adoption of Open Banking, signals a major shift in how businesses move money.

In this guide, you will learn about account-to-account payments, a method that directly transfers funds between bank accounts. We will explain what A2A payments are, how they work, and why they may offer a simpler, more reliable way to manage your payments. Our discussion will cover the fundamentals, practical examples, and important updates in the UK payment landscape.

If you have been dealing with high transaction fees, unexpected delays, or a lack of transparency in your payment processes, this guide aims to provide clear and useful insights to help you make informed decisions.

We will guide you through:

What Are Account-to-Account Payments?

Account-to-account payments are a way to move money directly from one bank account to another without involving credit or debit card networks. This method uses the existing banking system to transfer funds directly between the payer’s and the receiver’s bank accounts.

At its core, A2A payments remove the middleman typically seen in card transactions. Instead of processing a payment through card networks like Visa or Mastercard, funds are sent straight from one bank to the other. This direct transfer often means lower costs and a clearer picture of the money moving in and out of your account.

In the UK, A2A payments are supported by systems that enable quick transfers between banks. According to Juniper Research, the value of A2A payments in the UK is projected to grow by 212%, reaching $235 billion by 2027, up from $102 billion in 2024. This rapid growth reflects the increasing adoption of direct bank transfers as businesses look for faster settlements and lower processing fees compared to traditional card payments.

How Account-to-Account (A2A) Payments Work

Account-to-account payments operate through direct bank transfers, eliminating the need for card networks like Visa or Mastercard. This method relies on banking infrastructure that allows businesses and consumers to send and receive payments instantly or within a short settlement window.

Push vs. Pull A2A Payments

1. Push Payments

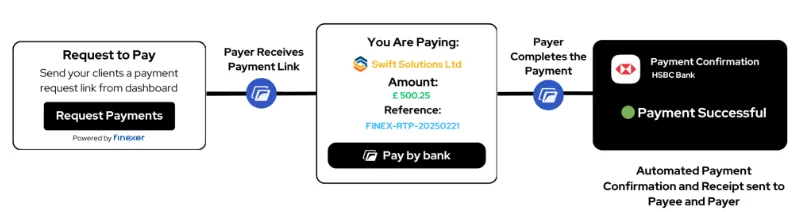

In a push payment, the payer initiates the transaction by authorising a direct transfer from their bank account to the recipient’s account. This method is commonly used for one-time purchases, bill payments, and peer-to-peer transactions.

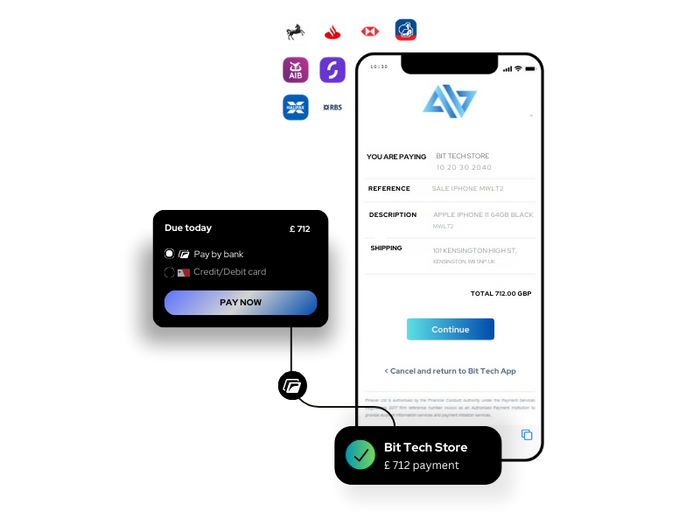

- Example: A customer shopping online selects “Pay by Bank” at checkout, logs into their banking app, and approves the payment. The funds are then transferred immediately to the merchant.

2. Pull Payments

Pull payments allow businesses to withdraw funds directly from a customer’s bank account after obtaining prior authorisation. These are often used for subscriptions, rent payments, or utility bills where recurring transactions are required.

- Example: When a customer sets up direct debit for a monthly gym membership, the gym is authorised to “pull” the amount from their bank account on a set date each month.

📚 Guide to Bank Transfer Modes in the UK

The Role of Open Banking in A2A Payments

A2A payments in the UK are increasingly facilitated by Open Banking, which allows businesses to access bank account data and initiate payments securely with the customer’s consent. Instead of entering card details, customers approve payments directly through their banking app, reducing friction and the risk of fraud.

- Key Benefit: Open Banking A2A payments can settle transactions within seconds using the Faster Payments System in the UK, compared to card transactions that may take days to process.

Key Benefits of A2A Payments for Businesses and Consumers:

1. Lower Transaction Costs:

Account-to-account payments reduce reliance on traditional card networks, which often charge high fees. By transferring funds directly between bank accounts, businesses can save money on processing charges. This means more of your revenue stays in your pocket, especially important for companies handling large or frequent transactions.

2. Faster Settlement Times

Payments made through these systems are processed using bank transfer infrastructures, such as the Faster Payments System in the UK. This allows money to move between accounts within seconds, improving cash flow and reducing the waiting period that can hinder daily operations.

3. Enhanced Transparency

With direct transfers, every transaction is clearly recorded on bank statements. Both businesses and customers can easily track payments, making it simpler to reconcile accounts and manage finances.

4. Improved Security and Reduced Fraud Risk

A2A payments require explicit authorisation from the account holder. This extra layer of security helps lower the risk of fraud and unauthorised transactions. By avoiding the storage of sensitive card details, the risk of data breaches is also reduced.

5 . Better Customer Control

Customers can view and manage their payment authorisations directly through their online banking platforms. This direct oversight gives them greater confidence in managing their finances and makes it easier to cancel recurring payments if needed.

Top Use Cases and Industry Applications for A2A Payments:

1. E-commerce and Online Retail

Online stores often face high processing fees and delays with traditional card payments. By using A2A payments, merchants can receive funds directly from customers’ bank accounts, which may lower costs and speed up access to money. This method is especially useful for businesses with a high volume of transactions.

2. Lending and Credit Services

Lenders use A2A payments to both disburse funds and collect repayments. Direct transfers help in reducing the time it takes for funds to be received or repaid, which is crucial for managing cash flow and reducing the risk associated with delayed payments.

3. Subscription-Based Services

For services that require regular payments, such as monthly memberships or utility bills, A2A pull payments allow businesses to collect funds automatically once the customer has given permission. This method helps maintain consistent cash flow without the need for repeated manual authorisation.

4. Remittance and Cross-Border Transactions

A2A payments offer a more cost-effective alternative for sending money across borders. By avoiding intermediary fees common in traditional card transactions, remittance services can offer lower fees and faster transfer times to customers sending money internationally.

5. B2B Payments

In business-to-business transactions, quick and reliable payment processing is essential. A2A payments provide companies with a way to settle invoices faster and with fewer fees, which can improve financial planning and reduce administrative overhead.

6. Accounting & Payroll

Organisations increasingly rely on direct bank transfers to manage routine financial operations. By integrating A2A payments with accounting and enterprise resource planning (ERP) systems, companies can automate repetitive tasks such as employee payroll, supplier settlements, and other bulk payment processes.

Using A2A for batch processing means that multiple transactions can be combined into a single transfer, reducing manual data entry and the likelihood of errors. This method ensures that payments are processed accurately and on schedule, while also providing a clear audit trail that is essential for compliance and financial transparency. Recent studies indicate that businesses employing direct bank transfers for payroll and batch processing experience fewer reconciliation issues and a more straightforward accounting process.

Regulatory Updates and Future Trends in A2A Payments for 2025

1. Regulatory Updates and Future Trends

Recent changes in the regulatory framework are shaping how A2A payments operate in the UK. New guidelines, such as those outlined under PSD3 and updated local standards, are designed to protect both businesses and consumers by ensuring transparency and security in every transaction. These rules help maintain clear audit trails and promote fairness in payment processing.

2. Impact of Regulatory Changes

Updated regulations require banks and payment service providers to adhere to stricter protocols when initiating A2A payments. These protocols include enhanced verification methods and clearer customer consent procedures. As a result, businesses can expect a more secure environment with fewer instances of fraud or error, and clearer documentation for audits and compliance reviews.

3. Future of Open Banking and A2A Payments

The landscape for A2A payments is set to continue evolving. As more banks and financial institutions adopt Open Banking standards, customers will have increased control over their financial data and payment authorisations. In addition, the growing use of batch processing for payroll, supplier payments, and other routine transactions will further simplify financial management. This steady progress is likely to lead to wider adoption across various industries, with more businesses turning to A2A payments as a reliable alternative to traditional card transactions.

How to Implement A2A Payments

Step 1: Assess Your Business Needs

Begin by evaluating your current payment processes. Identify areas where delays, high fees, or reconciliation errors occur. Consider if your business would benefit from direct bank transfers for payroll, supplier payments, or recurring billing.

Step 2: Choose the Right Payment Provider

Research payment service providers that offer A2A solutions, ensuring they support UK banking standards and Open Banking protocols. One provider to consider is Finexer, known for its clear documentation, reliable service, and straightforward API. Finexer makes it easier to integrate A2A payments into your systems while offering support tailored to your needs.

Step 3: Plan the Integration with Your Systems

Work with your IT or ERP team to plan the integration of A2A payments with your accounting and payroll systems. This includes setting up batch processing capabilities if you handle multiple transactions at once. Ensure that your software can communicate effectively with the chosen provider’s API.

Step 4: Test the Payment Process

Before going live, perform a series of tests to confirm that transactions are processed correctly. Verify that funds are transferred within the expected time frames and that your accounting system accurately records every transaction.

Step 5: Train Your Staff

Ensure that your finance and operations teams understand the new payment process. Provide training on how to monitor transactions, handle exceptions, and reconcile accounts using the new system.

Step 6: Monitor and Review

After implementation, continuously monitor the performance of your A2A payment system. Collect feedback from your team and customers, and be prepared to make adjustments based on changing business needs or regulatory updates.

How Finexer’s A2A Payments Empowered B2B Automation

A2A payments aren’t just about cost savings and faster transactions—they are also transforming how businesses manage their finances. One company that has successfully integrated A2A payments is Sysynkt, a leading B2B SaaS provider specialising in business process automation.

The Challenge: Finding an Open Banking Partner for Business Payments

Sysynkt operates in a space where businesses, not just consumers, need seamless bank connectivity. Many traditional Open Banking providers primarily cater to consumer payments, making it difficult for Sysynkt to find a partner that truly understood B2B financial workflows, accounting integrations, and bulk transactions.

Finexer stood out as the right fit because of its flexible API, business-first approach, and strong Open Banking infrastructure, making it easier for Sysynkt to integrate real-time A2A payments into its automation platform.

How Finexer Solved the Problem

Unlike other Open Banking providers focused on individual transactions, Finexer enabled Sysynkt to process high-value B2B payments effortlessly. The collaboration allowed Sysynkt to:

✅ Provide seamless bank-to-bank transfers without relying on card networks.

✅ Ensure compliance with FCA regulations while maintaining enterprise-grade security.

✅ Simplify batch processing for business transactions, making bulk payments easier to manage.

✅ Improve customer satisfaction by offering faster, direct payments that integrate with accounting platforms.

What Sysynkt Says About Finexer

“Finexer’s willingness to work closely with us, rather than treating us as just another customer, was truly refreshing. We needed a partner that understood B2B financial operations, and Finexer delivered exactly that.”

— Penny Phillips, Chief Commercial Officer at Sysynkt

A Long-Term Partnership for Growth

Sysynkt and Finexer continue to work together to enhance automation in business payments. As Open Banking adoption increases, this partnership highlights how tailored A2A payment solutions can drive efficiency and reliability for businesses managing high-volume transactions.

Get Started

Start your 14-day free trial today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Why Businesses Choose Finexer for A2A Payments

Finexer is designed for businesses that want a simple, scalable, and cost-efficient way to accept A2A payments. Whether you’re a growing startup or an established business, Finexer provides fast integration, transparent pricing, and direct access to 99% of UK banks.

✅ Faster Payments with Instant Access

With Finexer, businesses can connect to UK banks instantly and process payments up to 2-3x faster than traditional methods. Faster settlements mean better cash flow and fewer payment delays.

✅ Scalable Without Extra Costs

Unlike other providers, Finexer allows businesses to start small and scale smoothly, whether handling 100 or 100,000 transactions, with 98% uptime and no additional technical investment.

✅ Simple, Transparent Pricing

Finexer offers startup-friendly, consumption-based pricing, meaning you only pay for what you use, with no long-term contracts or hidden enterprise fees.

✅ Compliance and Security Covered

Regulatory compliance is a major concern for UK businesses. Finexer is FCA-authorised, ensuring full security and compliance without businesses needing to manage legal complexities.

What Are Account-to-Account (A2A) Payments?

Account-to-Account (A2A) payments involve the direct transfer of funds from one bank account to another, bypassing intermediaries like card networks or payment processors. This method streamlines transactions, offering faster processing times and reduced fees. A2A payments are commonly used for peer-to-peer transfers, bill payments, and business transactions.

How Do A2A Payments Benefit Businesses and Consumers?

A2A payments offer several advantages:

Cost Savings: By eliminating intermediaries, businesses and consumers can reduce transaction fees.

Speed: Funds are transferred directly between accounts, often resulting in faster settlements.

Security: Direct transfers minimise the exposure of sensitive financial information to third parties.

Convenience: Users can initiate payments easily through their banking platforms without the need for additional payment instruments.

Are A2A Payments Secure?

Yes, A2A payments are secure. Since they involve direct bank-to-bank transfers, there are fewer parties handling the transaction, reducing potential vulnerabilities. Additionally, these payments often utilise strong customer authentication measures, ensuring that only authorised users can initiate transactions.

Now Faster A2A Payments with Finexer in 2025 ! Schedule your free demo and get a 14 days Trial by Finexer 🙂

![The Ultimate Guide to Account-to-Account (A2A) Payments in 2025 1 101Guide: Account to Account Payements in the UK[2025]](/wp-content/uploads/2025/02/A2A-Payments.jpg)