What You Will Discover:

How Open Banking Helps UK Startups and Small Businesses

The landscape of business banking is changing rapidly, particularly for small businesses and startups in the UK. According to the latest data from January 2024, one in five small businesses (18%) now actively use open banking services1. This adoption rate notably outpaces consumer usage, demonstrating how valuable these services have become for business operations.

What Open Banking Means for Small Businesses

The growing acceptance of open banking among businesses isn’t surprising when considering its practical benefits. Studies show that small businesses save an average of 8 hours per week through automated financial processes that open banking enables2. This technology provides companies with direct access to their financial data, simpler payment processing, and clearer insights for making business decisions.

Benefits Shown Through Numbers

Research has revealed concrete results: small and medium businesses using open banking reported 35% better cash flow management and 40% faster payment processing3. These improvements directly affect daily operations and business growth.

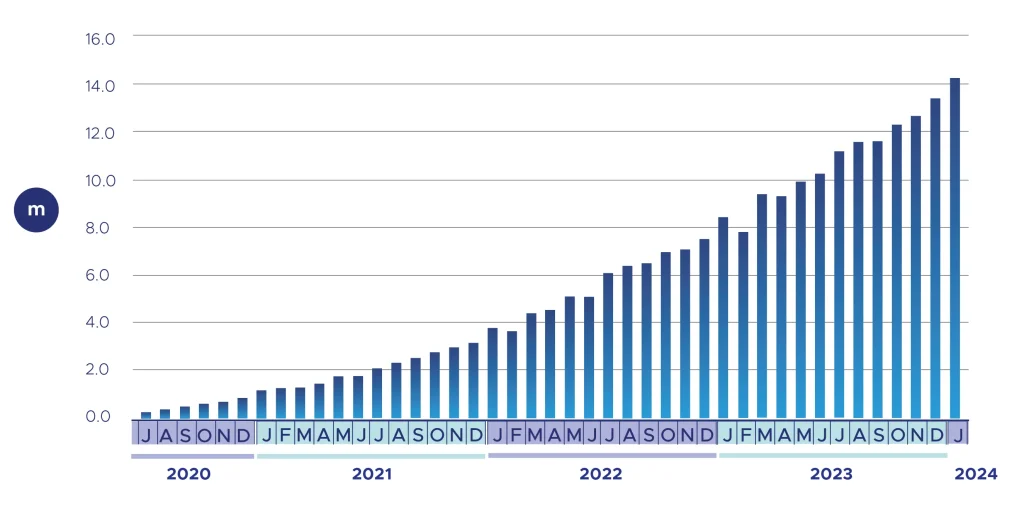

Open banking payments growth

Open banking payments in the UK reached a significant milestone in January 2024, with an impressive 14.5 million transactions processed through the CMA9 banks. This record-breaking figure demonstrates the rapidly growing adoption of open banking technology, showing a robust 69% increase compared to the same period last year. Breaking down these transactions, immediate one-time payments dominated the landscape at 92%, while variable recurring payments accounted for 8% of the total volume.

The momentum behind open banking adoption shows no signs of slowing down. Looking at the broader picture, 2023 marked a transformative year for open banking payments, with total transactions soaring to 130 million. This represents nearly double the previous year’s volume of 68 million payments, translating to a remarkable 90% year-over-year growth. This sustained upward trajectory underscores the increasing confidence and trust that users are placing in open banking payment solutions.

For example, a small retail business in Manchester previously spent hours managing payments and checking accounts across different banks. After implementing open banking, they now handle all financial tasks through one platform, allowing more time to serve customers and expand their business.

Skip Months of research & Talk to our Open Banking Expert for Free

Current Business Requirements

Modern business operations require careful management of time and resources. Open banking addresses these needs through several key functions:

Bank Account Management: Businesses can now view and manage multiple bank accounts in one place, removing the need to log into several different banking websites.

Financial Overview: Companies can see all their financial information in one view, helping them make more informed choices about their money.

Protected Transactions: With oversight from the Financial Conduct Authority and strong security measures, businesses can conduct their financial operations safely4.

Future Development

The UK currently leads Europe in open banking use, with over 400 regulated companies providing these services5. This growth means small businesses can now access financial tools that were once only available to large companies.

When choosing an open banking service, businesses should consider their growth plans, the provider’s ability to grow with them, and the level of support offered. The right provider becomes vital to a business’s financial operations while remaining affordable for growing companies.

Finexer: The Most Affordable Open Banking Provider

Finexer has emerged as the most cost-effective solution for startups and small businesses in the competitive landscape of UK open banking providers. It offers up to 90% savings on transaction costs compared to traditional providers. Finexer’s approach combines this remarkable affordability with comprehensive features, making advanced financial technology accessible to growing companies without straining budgets.

Making Premium Features Affordable for Startups

Traditional open banking solutions often price their services with large enterprises in mind, creating significant cost barriers for smaller businesses. With transaction costs typically ranging high in the industry, Finexer has reimagined this pricing model with a startup-first approach, delivering up to 90% cost reduction on transactions.

This dramatic saving allows startups to allocate more resources to growth and development rather than operational costs. Their consumption-based pricing starts at rates specifically designed for early-stage businesses, allowing companies to access sophisticated banking features without enterprise-level commitments.

Small businesses particularly benefit from this pricing structure. They only pay for what they use, eliminating the burden of fixed costs that can impact cash flow during crucial growth periods. This flexible model grows with the business, ensuring that financial technology remains affordable throughout the company’s development.

Cost-Effective Implementation and Integration

One often overlooked aspect of affordability is the cost of implementation. Finexer addresses this through their rapid deployment system, which connects businesses to all UK banks up to three times faster than competitors. This efficiency translates directly to cost savings in technical resources and development time. Their straightforward integration dashboard reduces the need for extensive technical expertise, helping businesses minimise implementation expenses.

Value-Added Features Without Premium Pricing

Despite its affordable pricing, Finexer includes several premium features that typically come with additional costs from other providers:

- White-Label Capabilities: Businesses can customise the platform to match their brand identity without paying enterprise-level fees for white-labeling.

- Built-in Compliance: The FCA-authorised infrastructure handles regulatory requirements automatically, saving businesses the substantial cost of managing compliance independently.

- Scalable Infrastructure: The platform supports growth from 100 to 100,000 transactions while maintaining 98% uptime, without requiring additional technical investment.

Reducing Operational Costs

Finexer’s single-app approach consolidates all financial operations into one intuitive platform. This consolidation eliminates the need for multiple banking portals and reduces the operational overhead that often comes with managing various financial systems. For growing businesses, this means fewer resources dedicated to financial operations and more focus on core business activities.

Strategic Partnership Without Premium Fees

While many providers charge additional fees for strategic support, Finexer includes expert guidance as part of their standard service. Their team provides strategic planning, optimisation insights, and growth recommendations, helping businesses maximise the value of their open banking investment without incurring extra costs.

Testing and Security Without Extra Charges

During the onboarding process, Finexer conducts rigorous testing to ensure all systems align perfectly with business needs. This thorough approach helps identify and resolve potential issues early, preventing costly problems down the line. The platform’s security measures and regular updates are included in the base pricing, eliminating surprise costs for essential security features.

📚 Learn more about Security in Open banking

Long-term Cost Benefits

For startups and small businesses, choosing Finexer represents not just immediate savings but long-term financial benefits. The platform’s ability to scale without requiring additional technical investment means businesses can grow without worrying about sudden jumps in their open banking costs. This predictability in expenses is particularly valuable for startups managing tight budgets.

Market Access Without Premium Pricing

Finexer provides instant connectivity to 99% of UK banks through a single integration. This comprehensive market access, typically a premium feature with other providers, comes standard with Finexer’s affordable pricing model. Small businesses can compete effectively in the financial space without paying enterprise-level fees for market connectivity.

Experience the most affordable open banking solution for UK startups firsthand. Schedule your demo today

Final Thoughts for Growing Startup & Small Businesses

Choosing the right open banking partner is crucial for startups and small-to-medium businesses in the UK. Finexer’s focus on serving smaller, growing companies shows in every aspect of its service—from pricing and implementation to support and scalability. Their platform proves that advanced financial technology doesn’t need to be the exclusive domain of large enterprises with big budgets.

As more UK startups embrace open banking, Finexer’s approach ensures that businesses can start small, keep costs low, and scale their financial operations effectively as they grow. This accessibility to professional banking tools and significant cost savings helps level the playing field for emerging businesses in the competitive UK market.

Footnotes

- Open Banking Implementation Entity (OBIE), “Open Banking Impact Report January 2024 ↩︎

- UK Finance, “Small Business Digital Banking Report 2023 ↩︎

- Federation of Small Businesses (FSB), “State of Small Business Banking Survey 2023 ↩︎

- Financial Conduct Authority (FCA), “Open Banking Security Standards Guidelines 2023” ↩︎

- Open Banking Excellence (OBE), “European Open Banking Market Analysis 2023” ↩︎

Join the growing community of UK businesses that are saving up to 90% on transaction costs while accessing premium features at startup-friendly prices.