Estate agents and property platforms must verify who the client is, who owns the bank account, and where funds come from. Most still rely on uploaded IDs, bank statements, and proof-of-funds PDFs. Reviews take days and still allow fraud.

Verification becomes faster and safer when performed using open banking data instead of documents. Estate agents can combine their existing KYC provider with OB data from Finexer to strengthen AML and financial verification. Platforms request user consent and receive verified financial data directly from banks within minutes.

This architectural difference matters because verification speed determines which platforms close deals and which lose clients to competitors with faster onboarding.

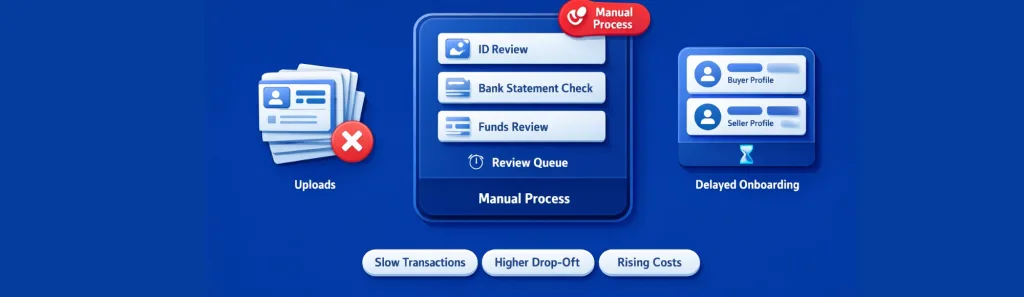

Why Manual AML Checks Slow Estate Agent Onboarding

Most estate agent platforms still rely on document submission workflows. Clients upload ID documents, bank statements, and proof-of-funds letters. Your team queues them for review. Someone checks identity documents. Another person verifies bank account ownership. A third assesses funds authenticity.

What this creates operationally:

- Delayed buyer and seller onboarding extends transaction timelines

- Fall-throughs increase when verification takes longer than property searches

- Compliance risk surfaces when document authenticity cannot be confirmed

- Staff costs scale linearly with platform volume requiring more reviewers

- Manual processing bottlenecks constrain platform growth capacity

The fundamental issue isn’t verification thoroughness-it’s that document-based workflows require human review for every client. Modern aml checks for estate agents using open banking data eliminate these bottlenecks through automated verification.

What AML Checks for Estate Agents Verify via Open Banking

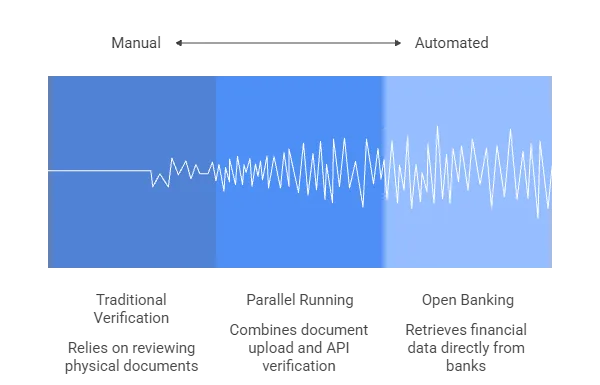

Traditional verification treats verification as documents to review. Open banking data enables verification through direct retrieval from authoritative sources.

When clients consent to verification through your platform, OB data APIs retrieve financial information directly from banks. Identity verification happens through your existing KYC provider. Open banking access confirms bank account ownership and available funds. Your platform receives structured data rather than unstructured documents.

What Financial Data Gets Verified

The verification scope depends on your platform’s compliance requirements:

Bank Account Ownership (via Open Banking):

- Account holder name matching platform registration

- Account status confirming its active and operational

- Ownership match against identity data

Funds & Financial Signals:

- Current balance demonstrating available funds

- Income inflows showing regular financial activity

- Transaction behaviour indicating legitimate sources

- Overall financial patterns supporting AML assessment

Identity Verification: Estate agents use their existing KYC provider for identity checks. Finexer provides the financial data layer through open banking connectivity.

Finexer provides verified financial data from banks. Platforms apply their own AML logic and thresholds.

The open banking data returns structured JSON rather than PDFs requiring interpretation. Your platform’s logic processes API responses automatically instead of humans reviewing documents manually.

What I’ve Seen Work in Estate Agent Verification

Working with estate agent platforms implementing AML checks for estate agents uk reveals consistent patterns:

Parallel running reduces migration risk. Platforms maintain document upload alongside API verification initially. This validates API accuracy against known outcomes before full transition. Manual processes phase out gradually as confidence builds.

Consent flow UX significantly impacts completion rates. When authentication feels burdensome, clients abandon onboarding. Effective platforms treat API authentication as integrated workflow rather than an external process. Careful UX design around consent journeys maintains high completion rates.

Exception handling defines operational quality. No automated system handles every edge case. Platforms succeeding with AML checks for estate agents define clear thresholds for what triggers manual review. Successful implementations tune these based on actual fraud rates and team capacity.

Manual AML Checks vs API-Based AML Checks for Estate Agents

Your current workflow probably involves document upload, review queue management, cross-referencing against external data, authenticity assessment, and approval decision. Each stage adds time and requires human capacity. Open banking data changes this fundamentally.

| Verification Aspect | Manual AML Checks | API-Based AML Checks |

|---|---|---|

| User Action | Find documents, scan/screenshot, upload files | 2-minute banking app authentication |

| Data Format | Unstructured PDFs requiring interpretation | Structured JSON from source systems |

| Time to Verify | 3–5 days in review queue | Minutes from authentication |

| Fraud Risk | High (edited documents pass visual checks) | Eliminated (data direct from source) |

| Operational Cost | Linear scaling with volume | Fixed infrastructure cost |

| Scalability | Requires hiring more reviewers | Infrastructure handles volume |

The architectural difference impacts platform scaling economics. Document review requires human capacity that increases proportionally with volume. Open banking data infrastructure handles volume increases without proportional cost growth, making aml checks for estate agents uk scalable and cost-effective.

What Estate Agent Platforms Should Look For in AML APIs

Data source coverage determines whether your implementation handles all verification scenarios or requires fallback to manual processes. When implementing aml checks for estate agents uk with open banking data, comprehensive bank coverage becomes critical.

Technical integration requirements that matter:

UK bank coverage – Access to 99% of UK banks ensures virtually all clients verify through existing accounts

Regulated open banking connectivity – FCA-authorised infrastructure for compliant data access

Integration with existing KYC providers – Open banking data complements your identity verification tools

Webhooks – Asynchronous notifications for verification completion

Sandbox – Testing environment matching production behaviour

Data granularity – Detailed transaction and account data for comprehensive AML assessment

Consent handling – Compliant flows meeting UK data protection requirements

Compliance with UK regulatory frameworks isn’t optional. The infrastructure must operate under FCA authorisation for open banking access and handle personal data under GDPR requirements.

Why API-Based Verification Beats Document Uploads

Document verification relies on client-provided evidence that your team authenticates. Using open banking data for aml checks for estate agents retrieves information directly from source systems through regulated infrastructure. The architectural difference eliminates entire categories of fraud whilst improving speed.

Edited bank statements cannot pass verification because no document gets submitted-OB data retrieves transaction information directly from the bank. Forged identity documents become irrelevant when identity data comes from official databases. Authentication happens at source rather than through document inspection.

Additionally, real-time data provides current information rather than historical snapshots. Bank balance verification confirms available funds today, not last month when the statement was generated. This timeliness matters for platforms assessing financial capability.

Why Platforms Choose Open Banking Data for AML Checks

When estate agent platforms implement open banking data infrastructure for financial verification in aml checks for estate agents uk, several operational improvements emerge:

Faster deal progression – Clients complete financial verification in minutes instead of days, removing onboarding friction from transaction timelines

Lower compliance cost – Automated verification reduces manual review hours whilst improving data accuracy and audit trail quality

Reduced fraud exposure – Source-level data authentication eliminates forged bank statements and edited PDFs that pass visual inspection

Better user experience – Quick authentication through familiar banking apps beats uploading documents and waiting days for approval

Scales without hiring – Infrastructure handles volume growth without proportional increases in verification team capacity

If your estate agent platform handles onboarding, Finexer’s open banking data infrastructure can supply the verified financial information needed alongside your existing KYC provider.

How Finexer Enables Financial Verification for AML

Finexer provides open banking data access for estate agent platforms:

- Open banking connectivity using FCA-authorised infrastructure

- Access to bank account and transaction data across 99% of UK banks

- Pay by Bank and financial data APIs

- Infrastructure that complements your existing KYC provider

Finexer does not perform KYC or AML decisions. Finexer provides the financial data layer through open banking data that platforms use alongside identity verification to build comprehensive AML workflows.

The platform connects to 99% of UK banks through regulated open banking infrastructure. This coverage means virtually all your clients verify financial information through their existing banking relationships.

Finexer provides 3-5 weeks of dedicated onboarding support. This ensures open banking integration aligns with your specific platform architecture and verification requirements rather than forcing generic implementation patterns.

Estate agent platforms using open banking for financial verification report significant operational improvements. Manual review queues disappear. Onboarding times drop from days to minutes. Fraud rejection becomes automatic. Your verification team capacity redirects from routine checking to genuine exception cases requiring judgment.

Explore PropTech verification use cases

Pricing works on actual verification volume rather than fixed fees. This aligns costs with your platform’s transaction patterns-whether consistent onboarding or seasonal spikes-without requiring capacity forecasting or minimum commitments.

See what financial data Finexer provides

The API integrates through standard REST endpoints with comprehensive webhook support. Your engineering team gets sandbox access matching production behaviour for thorough testing before live deployment.

Learn how law firms automate AML checks

What are AML checks for estate agents?

Anti-money laundering verification confirming client identity, bank account ownership, and source of funds to comply with UK regulations requiring estate agents to prevent money laundering through property transactions.

How does a KYC API support AML checks?

Estate agents use existing KYC providers for identity verification. Open banking data from Finexer adds the financial verification layer-confirming bank account ownership, available funds, and transaction patterns to support comprehensive AML assessment.

Are AML checks mandatory for estate agents in the UK?

Yes-UK Money Laundering Regulations require estate agents to verify client identity and assess money laundering risk before engaging in property transactions.

Can AML checks be automated using open banking?

Yes-open banking provides direct access to bank account and transaction data through regulated APIs, enabling automated verification of account ownership and fund sources instead of manual document review.

How quickly do API-based AML checks process requests?

Minutes from client authentication to verified data return, compared to 3-5 day queues for manual document review and cross-referencing against external data sources.

Ready to Implement API-Based Verification?

See how Finexer enables AML checks for estate agents in minutes instead of days

Book Demo Now