Tracking overdue invoices shouldn’t feel like a monthly chore, but for many finance teams, that’s still the reality. If your team relies on spreadsheets to monitor accounts receivable ageing, you already know how much time it takes to update those files and how easy it is for errors to creep in.

Traditional AR ageing reports are static. You download data, manually assign invoices to buckets like “30 days overdue” or “90+ days,” and repeat the same process next week. By the time the report is ready, half the information is already outdated.

But there’s a better way.

In this guide, we’ll walk you through how to automate AR ageing buckets using real-time data, without touching a spreadsheet.

Keep Reading or Jump to the section you’re looking for:

What Is Accounts Receivable Ageing

Accounts receivable (AR) ageing is a financial reporting method used to track unpaid customer invoices based on how long they’ve been outstanding. It breaks down receivables into ageing “buckets” that show how overdue a payment is often grouped by timeframes like 0–30 days, 31–60 days, and so on.

Why is this important?

AR ageing reports help you:

- Identify which customers are consistently late

- Predict potential cash flow issues

- Prioritise collections based on risk

- Report credit exposure to auditors and stakeholders

📚 How To Manage Payment Delays Effectively

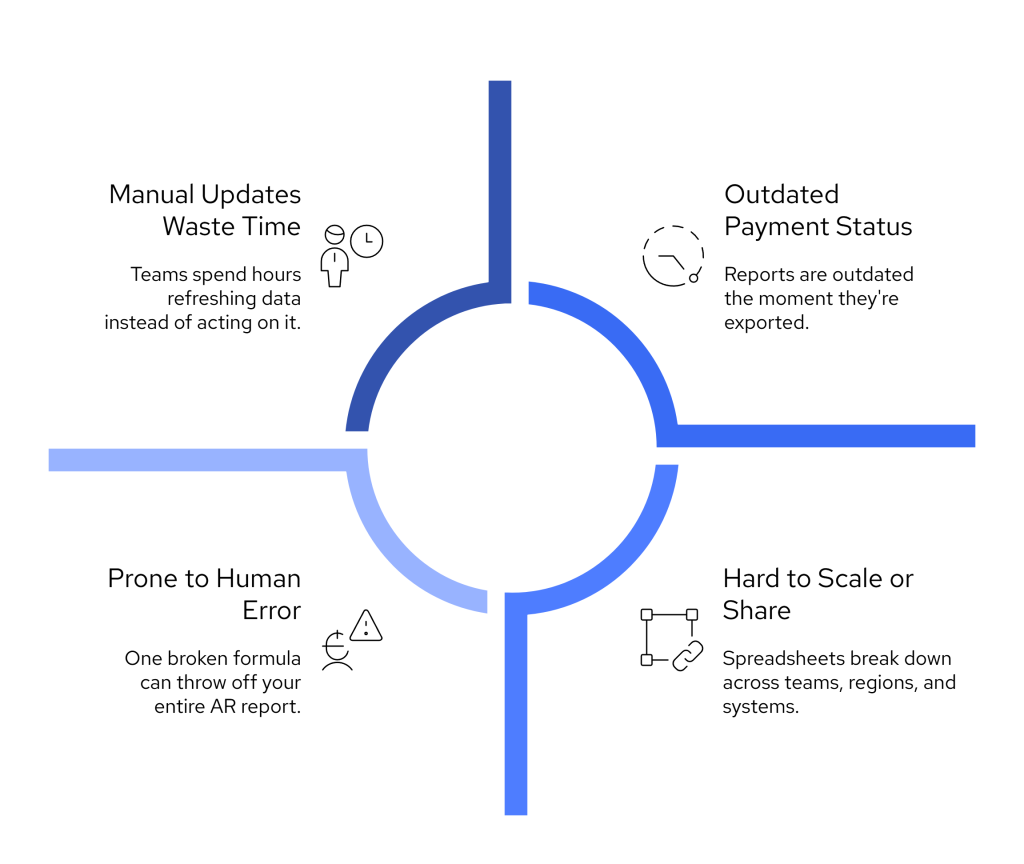

Limitations of Spreadsheet-Based AR Ageing

Spreadsheets are still widely used for tracking accounts receivable ageing, but they’re no longer suitable for growing finance teams that need speed, accuracy, and scale. While they offer flexibility, they also introduce risks and inefficiencies that can affect your entire receivables process.

1. Manual Updates Take Up Valuable Time

Each time your team wants to check the status of outstanding invoices, someone has to pull data from the accounting system, copy it into a spreadsheet, and sort the invoices by how overdue they are. If any payments have come in, those need to be manually reconciled with the invoices. This routine often takes hours and needs to be repeated weekly or even daily, depending on your collection cycle.

Over time, these manual updates become a hidden cost, pulling your finance team away from more strategic tasks.

2. High Risk of Errors and Inconsistencies

Spreadsheets are vulnerable to human error. One broken formula or an accidental paste into the wrong cell can throw off your entire report. Ageing buckets might be misclassified. Invoices may be duplicated or missed altogether. If multiple team members make changes to the same file, version control becomes a serious problem.

Even a small error in AR reporting can cause reputational issues, late collections, or disputes with clients.

3. Delayed Visibility into Payment Status

Spreadsheets only show you what’s true at the time of export. If a client makes a payment after your report is created, the document is immediately out of date. That means finance teams are often chasing clients for payments that have already been made, or worse, overlooking overdue invoices because the spreadsheet doesn’t reflect the latest bank data.

Without real-time insight, it’s difficult to prioritise collection activities or provide accurate cash flow forecasts.

4. Difficult to Scale Across Systems and Stakeholders

Sharing spreadsheet-based reports across teams or departments introduces friction. Files are emailed back and forth, often with outdated or conflicting information. If your company uses more than one accounting platform or operates across multiple regions, consolidating data into one spreadsheet becomes a manual and error-prone task.

As your organisation grows, spreadsheets become a bottleneck that slows down AR tracking and makes accurate reporting harder to maintain.

How Open Banking Solves the AR Ageing Problem

One of the biggest challenges in accounts receivable management is not knowing exactly when a customer has paid, especially when your reports depend on outdated bank feeds or manual reconciliation. This timing gap creates delays, confusion, and extra work for finance teams.

Open Banking eliminates that gap.

From Delayed Reports to Real-Time Visibility

Open Banking gives you secure, regulated access to your business’s bank account data, updated in real time. With this data connected to your finance systems, your team can:

- See cleared payments the moment they arrive

- Automatically match payments to outstanding invoices

- Update AR ageing buckets without lifting a finger

Instead of waiting for spreadsheets to be refreshed or bank files to be downloaded, your ageing reports are always current, driven by live, verified transactions.

Why This Changes Everything for AR Teams

When AR data is disconnected from actual bank activity, finance teams spend hours manually checking whether payments have landed, then adjusting reports to reflect what’s been paid and what’s still due.

With Open Banking in place, there’s no more uncertainty. If a client paid at 10:02 AM, your dashboard reflects it by 10:03, not the next day, not the end of the week. This real-time connection allows:

- Faster follow-ups on overdue invoices

- Confident reporting on receivables performance

- Fewer mistakes in collections and client communication

And because Open Banking in the UK is regulated by the FCA, every connection is secure, compliant, and designed for financial operations.

📚 Guide to Creating an Enforceable Late Fee Policy

How to Implement Real-Time AR Ageing Buckets

Switching from manual spreadsheets to a fully automated, real-time AR ageing process doesn’t have to be complex, but it does require the right infrastructure. Below is a step-by-step guide to building an automated ageing system using live bank data and your existing finance tools.

Step 1: Connect Your Bank Feed Using Open Banking

Start by integrating your business bank accounts with a secure Open Banking provider like Finexer. This will give you real-time access to all incoming cleared transactions across all UK banks your business uses.

Once connected, these feeds become the single source of truth for when payments are received.

Step 2: Sync With Your Accounting or ERP System

Next, link your bank data to the system that holds your invoice records, whether it’s Xero, QuickBooks, Sage, NetSuite, or a custom ERP. This connection allows your system to match incoming payments to open invoices based on unique identifiers, amounts, or reference data.

Finexer supports flexible integrations with both standard and custom platforms, so you’re not limited by your tech stack.

Step 3: Automate Ageing Bucket Categorisation

Once payments are matched to invoices, the system should automatically categorise outstanding invoices into appropriate ageing buckets:

- 0–30 days (Current)

- 31–60 days

- 61–90 days

- 91+ days (High-risk)

This logic can be built into your accounting software or implemented within your business intelligence tools.

Step 4: Build a Real-Time AR Dashboard

Feed the categorised data into a dashboarding tool like Power BI, Looker, Tableau, or Google Data Studio. This dashboard should include:

- Aged receivables by bucket

- Outstanding amount per client

- Historical trends in ageing

- Filters by region, entity, or client segment

This gives your team one place to monitor AR ageing without exporting a single spreadsheet.

Step 5: Enable Alerts and Follow-Up Workflows

You can now layer automation on top of your dashboard. For example:

- Trigger internal alerts when invoices enter the 60+ or 90+ day bucket

- Automatically send reminders to clients based on invoice status

- Schedule weekly updates for your team using dynamic dashboard links

The result is a live, always-accurate ageing system that updates itself, with no spreadsheets, no manual inputs, and no missed payments.

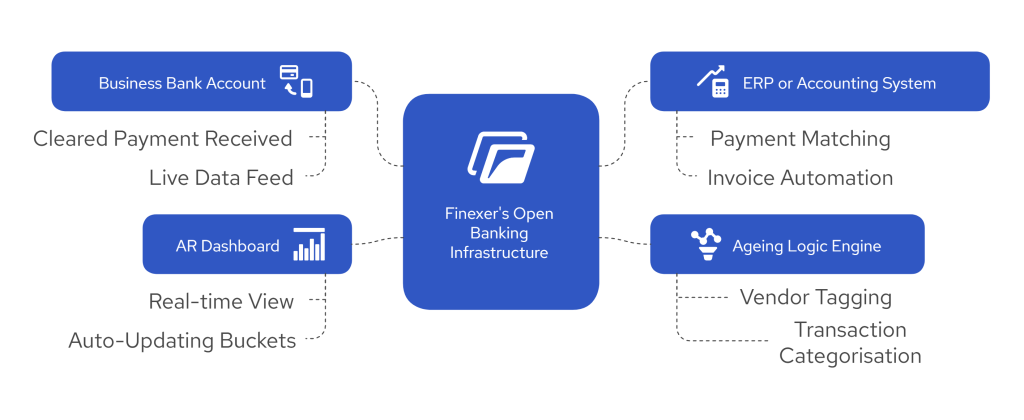

How Finexer’s Open Banking Infrastructure Supports Real-Time AR Ageing

Finance teams don’t need more spreadsheets; they need better data. The real bottleneck in receivables management isn’t the invoice system; it’s the lack of real-time payment visibility.

That’s exactly where Finexer fits in.

As a UK-based, FCA-authorised Open Banking provider, Finexer delivers cleared transaction data directly from your bank accounts to your finance systems in real time. This infrastructure allows you to automate AR ageing, eliminate manual reconciliation, and build dashboards that always reflect your actual cash position, not yesterday’s exports.

Here’s how Finexer supports each part of the process:

1. Real-Time Access to Cleared Payments

Finexer connects to over 99% of UK banks using regulated Open Banking APIs. As soon as a client payment settles in your account, Finexer streams the cleared transaction, including date, amount, payer details, and reference, to your connected system.

This removes the typical 24–48 hour lag found in most bank feeds and ensures your ageing buckets are always current.

2. Accurate Payment-to-Invoice Matching

By combining invoice metadata (e.g., reference numbers, customer IDs, expected amounts) with real-time payment data, Finexer enables automated matching logic at the transaction level. This process can be integrated directly into your ERP or accounting tool, so invoices are marked as paid automatically as soon as the payment is detected.

There’s no need for manual reconciliation or spreadsheet tracking; ageing buckets update instantly.

3. ERP and Accounting Platform Compatibility

Finexer is designed to be integration-ready. Whether you use Xero, QuickBooks, Sage, NetSuite, Oracle, or an in-house ERP, Finexer’s data API can be integrated to power your receivables workflow. It works as a financial data layer feeding your internal systems with reliable, up-to-date payment records.

This gives you flexibility without needing to switch platforms or restructure your reporting processes.

4. Ageing Buckets That Update Themselves

Using the real-time data from Finexer’s Open Banking API, you can apply custom logic to sort unpaid invoices into predefined ageing buckets: 0–30, 31–60, 61–90, or 90+ days. Because invoice status updates as soon as payments are confirmed, ageing buckets shift dynamically, without requiring any human input or spreadsheet recalculations.

The result: a self-updating, audit-ready view of your receivables, accurate to the hour.

5. Powering AR Automation Workflows

Finexer provides the data infrastructure to automate AR Ageing Process. For example, if your AR platform or internal tool supports automation, you can use Finexer’s API to trigger actions like:

- Sending a request to pay link when an invoice enters the 31–60 day bucket

- Creating a task for the collections team once a balance exceeds 90+ days

- Updating internal dashboards or reports in real time

Finexer provides the payment event data you decide how your systems respond.

6. Built for UK Compliance and Security

All data transmitted through Finexer is encrypted, FCA-regulated, and compliant with UK Open Banking standards. That includes Strong Customer Authentication (SCA), secure consent management, and consistent API uptime.

You get real-time financial visibility without compromising on security or compliance obligations.

In short, Finexer gives your team the infrastructure to run a real-time AR ageing process. It doesn’t replace your accounting system; it enhances it with the cleared payment data your spreadsheets can’t provide.

No delays. No guesswork. No spreadsheets.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Wrapping Up

Manual AR ageing reports slow your team down and leave too much room for error. When you’re relying on spreadsheets, delayed bank feeds, and manual reconciliation, it’s hard to stay ahead of overdue invoices and even harder to act on them quickly.

By automating your AR ageing process with live bank data, you free your team from constant updates, reduce follow-up delays, and get a clearer view of your receivables health. And with Finexer’s Open Banking infrastructure, you can achieve this without building anything from scratch.

Finexer connects directly to over 99% of UK banks, giving you:

- Real-time visibility into cleared payments

- Automatic invoice matching

- Self-updating ageing buckets

- Easy integration with the tools you already use

No spreadsheets. No manual work. Just a real-time AR process that helps your business get paid faster and make smarter decisions.

How can I automate AR ageing without using spreadsheets?

You can automate AR ageing by connecting your accounting system to live bank data using Open Banking APIs. This allows your system to match cleared payments to invoices and automatically update ageing buckets without manual effort.

What are the benefits of using Open Banking for AR reporting?

Open Banking gives you real-time access to cleared payments across all UK bank accounts. This helps you eliminate reconciliation delays, update AR reports instantly, and make informed decisions without relying on static spreadsheets.

Which platforms can Finexer integrate with for AR automation?

Finexer integrates with popular platforms like Xero, QuickBooks, Sage, Oracle NetSuite, and custom ERP systems. It streams real-time transaction data into your existing workflow without requiring system changes.

Is Finexer compliant with UK Open Banking regulations?

Yes. Finexer is fully FCA-authorised and compliant with UK Open Banking standards. All data is encrypted, and access is granted through secure, regulated APIs with Strong Customer Authentication (SCA).

Find out how Finexer can help you automate your AR Ageing Process with Instant Bank Data! Get Expert guidance for free 🙂

![Guide to Real-time AR Ageing Buckets Without Spreadsheets 1 5 Steps to Automate AR Ageing Without Spreadsheets [2025]](/wp-content/uploads/2025/05/AR-ageing.jpg)