If you’re managing finance in a B2B business, you’ve likely felt the strain of unpaid invoices firsthand. The average UK SME is owed over £21,000 in overdue payments at any given time. Across Europe, over 45% of B2B invoices are paid late, with some stretching well past 60 days.

What’s worse? Chasing those invoices often damages the very client relationships your team worked hard to build. A strongly worded email or a follow-up call can tip a conversation from businesslike to tense in seconds.

So how do you collect late payments without burning bridges?

That’s exactly what this guide answers. We’ll walk you through several parts like the client’s friction, applying pressure without harming rapport, and using Finexer’s Pay-by-Bank technology to make payment effortless.

By the end, you’ll be equipped with:

- A deeper understanding of why clients delay payments

- A complete framework for resolving overdue invoices without conflict

- A smarter, tech-driven way to get paid instantly while staying professional

Let’s start by digging into the root of the problem.

Why B2B Clients Pay Late and Why It Hurts

You’ve delivered the work. You’ve sent the invoice. But the payment date keeps slipping.

Every delayed payment ties up cash you were relying on. Payroll still needs to be covered. Rent still needs to be paid. Meanwhile, your finance team ends up chasing the same clients with polite reminders and awkward follow-up calls. What should be a routine process becomes time-consuming and uncomfortable.

In most cases, the delay isn’t intentional. Clients might be unclear on payment terms or simply lose the invoice in a crowded inbox. Some are waiting on internal approvals. Others hold back payments near month-end to manage their own cash flow. And for many, the issue is just convenience. If paying the invoice means finding a card, logging into a separate platform, and entering details manually, it often gets pushed to the bottom of the list.

The real issue isn’t just the unpaid invoice. It’s the confusion and friction around the payment process.

This is where Finexer helps. Its Pay-by-Bank portal gives your clients a faster, simpler way to pay straight from their bank account, without any logins or card entry. It removes the common excuses and makes timely payment the path of least resistance.

A Zero-Friction Way Forward

Most overdue payments don’t come from bad intentions. They come from bad experiences. The client wants to pay but feels blocked by long steps, clunky portals, or unclear instructions. That’s why removing friction is often more effective than applying pressure.

With Finexer, you make paying the invoice the easiest part of the process. Its FCA-authorised Pay-by-Bank portal connects directly to 99 percent of UK banks. When your client opens the invoice, they can settle it in just a few clicks from their own banking app. No need to enter card details, register for another account, or jump between systems.

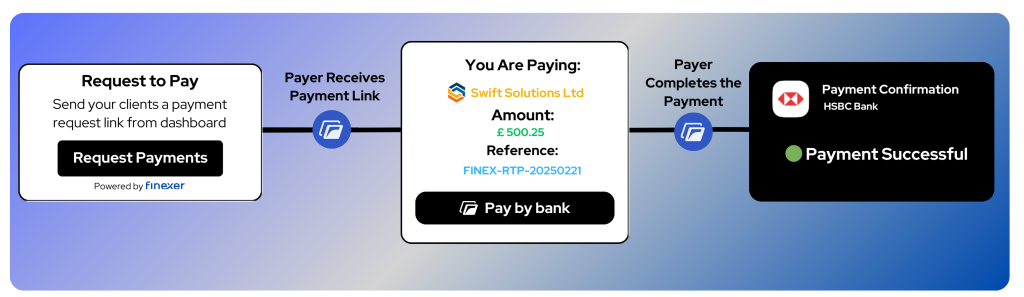

Here’s what that looks like in practice:

- The invoice lands in their inbox with a branded Pay-by-Bank button.

- One tap opens their banking app to confirm the exact amount.

- You receive cleared funds in real time, and the transaction is instantly logged.

This experience isn’t just smoother. It’s faster, more secure, and more professional. It also reduces the chances of disputes, delays, or forgotten invoices.

Finexer’s platform puts you back in control of collections while keeping the client relationship intact. And now that you understand the friction, let’s move into the five-part framework to resolve overdue payments with clarity and confidence.

5 Steps to Collect Late Payments Without Harming Client Relationships

1. Set Clear Terms From the Start

Many payment issues begin long before the invoice is sent. If your client isn’t fully clear on when payment is due, what happens if it’s late, or how they’re expected to pay, delays are almost guaranteed.

Start every engagement with written payment terms. Make sure the due date is clear and visible on every invoice. If you charge late fees, state the amount and when it applies. Include these same details in your proposals, contracts, and welcome emails.

When clients know exactly what to expect, they’re less likely to delay or dispute your invoice.

2: Automate Friendly Reminders

Following up on payments is necessary, but it shouldn’t feel awkward or personal. The longer you wait to send reminders, the more pressure builds, and that can harm relationships.

Instead of chasing with repeated emails, use Finexer’s automated Request to Pay feature. It sends a professional nudge directly to the client, including all invoice details and a secure Pay-by-bank for immediate settlement.

This request lands as a notification through their bank or preferred channel, making it harder to miss and easier to act on. The tone stays neutral, and the payment process stays effortless.

When reminders are timely and convenient, you rarely need to escalate.

3. Remove Payment Friction

The harder it is to pay you, the more likely clients are to postpone. If they need to dig out a card, log into a platform, or double-check amounts manually, it becomes another admin task on their list.

Finexer removes this friction with its Pay-by-bank feature. Every invoice or reminder can include a secure, pre-filled payment link that opens directly in the client’s banking app. They simply tap the link, authenticate, and approve the transfer—no cards, no forms, and no logins required.

Payments are confirmed in real time, and funds arrive instantly. It’s fast, compliant, and branded with your business identity.

Make it easy to pay, and you’ll rarely need to follow up.

4. Offer Split-Payment Flexibility

Some clients want to pay but genuinely can’t clear the full invoice at once. Forcing a single lump sum risks either non-payment or a damaged relationship.

Instead, give them the option to split the amount into two or three scheduled payments. With Finexer, these can be set up as automatic, recurring Pay-by-Bank transfers that require no follow-up once confirmed.

This shows understanding while still protecting your cash flow.

5. Maintain Control Without Creating Conflict

When clients fall behind on payments, it’s easy to assume bad intent. But in many cases, delays are caused by confusion, competing priorities, or internal bottlenecks on their end. That’s why control doesn’t have to mean confrontation.

Instead of escalating too quickly, focus on creating a structured process that gives your team clarity on what’s due, what’s been communicated, and what steps come next. Keeping communication consistent, neutral, and grounded in facts allows you to protect your cash flow without harming the relationship.

A well-defined system not only improves collections, it builds trust with the clients you want to retain long-term.

Solution Spotlight: How Finexer Helps You Get Paid Faster Without Tension

When invoices go unpaid, the issue is rarely just about the money. It’s about communication gaps, clunky processes, and the pressure that builds between your team and the client. That’s why the most effective solution is the one that removes effort from both sides.

Finexer provides a complete Pay-by-Bank experience that makes invoice settlement easy, instant, and fully compliant. It works quietly in the background—no setup headaches for your client, and no follow-ups for your team.

Here’s what it does for your finance process:

- Instant Pay-by-Link: Add a secure payment link to any invoice or reminder. Clients open it, authenticate in their bank app, and approve payment in seconds.

- No card details or logins required: Reduces delays caused by card expiry, password resets, or unnecessary form fields.

- Real-time settlement: You receive cleared funds immediately, improving cash flow without waiting for card settlement periods.

- White-label experience: The payment page carries your business name and logo, keeping interactions professional and consistent.

- Covers 99% of UK banks: Broad compatibility ensures no client is left out due to banking limitations.

- FCA-authorised infrastructure: Every payment is secure and fully compliant with UK regulations.

Whether you’re collecting one-off invoices or recurring B2B payments, Finexer helps you maintain strong client relationships while reducing Days Sales Outstanding.

If you’re looking to modernise your accounts receivable process without adding friction, this is the tool built to do just that.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

How do I collect B2B payments without damaging client relationships?

Focus on clarity and convenience. Send invoices with clear terms, follow up with polite automated reminders, and include a one-tap Pay-by-Link so clients can settle instantly.

When should I send a reminder for an unpaid B2B invoice?

Send a friendly nudge on the due date, a second reminder seven days later, and a final notice at the two-week mark. Automated reminders keep the tone neutral and professional.

Can I charge interest on late B2B payments in the UK?

Yes. UK law allows you to charge statutory interest—the Bank of England base rate plus 8 percent—if the terms were agreed in advance. Always state this clearly on your invoice.

What is a Request-to-Pay and how does it help collect B2B payments?

A Request-to-Pay is a secure message that lands in the client’s banking app or email, showing invoice details and a Pay-by-Link. It reduces missed emails and speeds up settlement.

See how quickly you can start collecting B2B payments on time. Book a short demo and go live in days !