Table of Contents

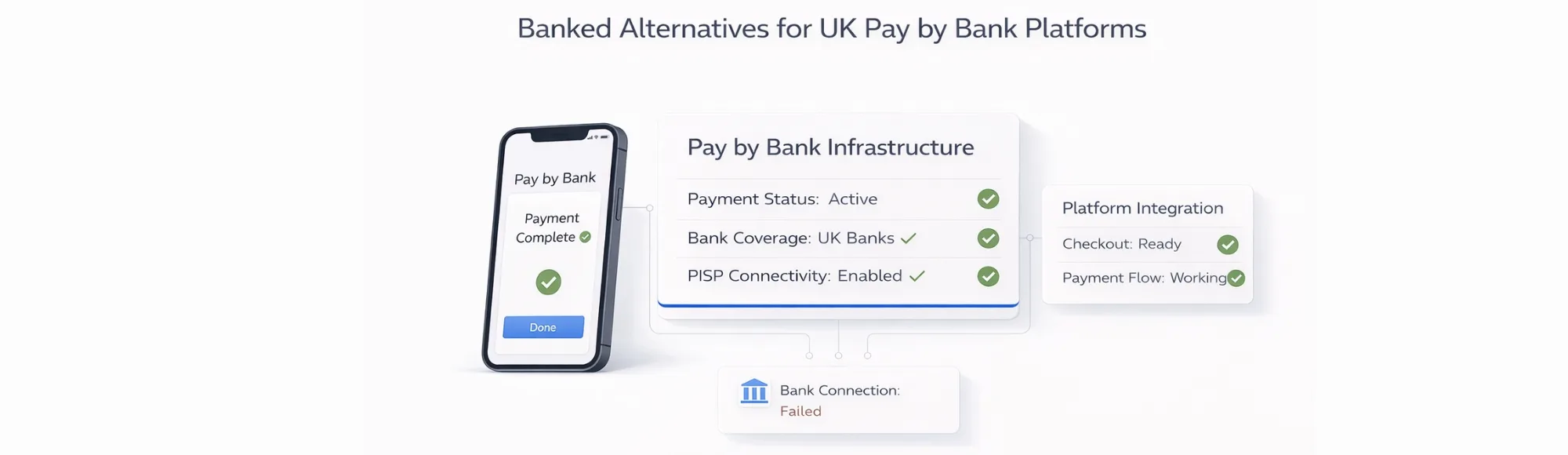

UK Platforms Need Stable Pay by Bank Infrastructure

Platforms using Banked for Pay by Bank infrastructure evaluate alternatives when stability concerns arise. Payment checkout flows cannot break. Merchant trust depends on reliable infrastructure.

UK fintech platforms, SaaS products embedding payments, and marketplaces using PISP flows need consistent bank connectivity. Infrastructure changes create operational risk.

Key Takeaways

Who needs to evaluate Banked alternatives?

UK platforms using Pay by Bank checkout. SaaS embedding PISP flows. Marketplaces dependent on stable payment infrastructure. Teams where payment disruption affects revenue.

What risks does infrastructure instability create?

Checkout disruption loses transactions. Merchant trust erodes when payments fail. Engineering teams rework integrations. Bank coverage gaps affect user experience.

What should platforms prioritize when evaluating alternatives?

FCA-authorised connectivity. UK bank coverage percentage. PISP endpoint stability. Webhook reliability. White-label capability. Transparent pricing structure.

How do Banked alternatives differ operationally?

Bank coverage depth varies. Pricing models differ significantly. Onboarding timelines range 3-12 weeks. White-label capability affects brand continuity. Technical support quality varies.

Where does Finexer fit as a Banked alternative?

UK-focused Open Banking infrastructure. 99% UK bank coverage. PISP and Pay by Bank support. Usage-based pricing. White-label flows. 3-5 weeks onboarding.

Who This Affects

UK fintech platforms: Pay by Bank checkout is core product feature requiring reliable infrastructure

SaaS embedding payments: Revenue depends on payment flows working consistently for customers

Marketplace operators: Buyer and seller transactions depend on stable PISP infrastructure

Platforms using Banked Ltd: Infrastructure changes create evaluation urgency when stability affects operations

These platforms cannot afford payment disruption. Infrastructure provider evaluation becomes a priority.

What Teams Worry About

| Concern | Business Impact |

|---|---|

| Checkout disruption | Lost transactions, revenue impact |

| Merchant trust loss | Churn when payments fail |

| Engineering rework | API migration consumes development time |

| Bank coverage gaps | Users cannot complete payments |

| Consent handling changes | User experience breaks |

| Pricing uncertainty | Budget forecasting difficulty |

When Banked infrastructure stability becomes a concern, platforms evaluate alternatives quickly. Payment flows cannot pause during migration.

What to Look For in a Banked Alternative

Before choosing replacement infrastructure:

FCA authorisation:

- PISP authorisation for payment initiation

- Regulatory compliance status

- White-label permissions

UK bank coverage:

- Percentage of UK banks supported

- Challenger bank inclusion (Monzo, Starling, Revolut)

- Building society access

- Coverage verification method

PISP endpoint stability:

- Payment confirmation reliability

- Status update consistency

- Error handling quality

- Downtime history

Technical capabilities:

- Webhook delivery for payment status

- QR code generation

- Payment link creation

- White-label consent flows

Pricing structure:

- Usage-based vs fixed contracts

- Per-transaction fees

- Volume commitment requirements

- Hidden integration costs

Onboarding support:

- Integration timeline realism

- Technical documentation quality

- Sandbox environment

- Production support availability

Infrastructure evaluation determines whether Pay by Bank continues working reliably.

Top 6 Banked Alternatives: UK Pay by Bank Infrastructure

1. TrueLayer

Infrastructure focus: Strong UK market presence with payment initiation emphasis.

UK bank coverage: Comprehensive major bank support. Challenger inclusion. Building society coverage varies.

PISP capabilities: Pay by Bank with instant confirmation. Payment status webhooks. Refund handling.

Pricing approach: Transaction-based fees. Volume-based pricing tiers.

Best suited for: Fintech platforms prioritizing payment features. Products where PIS is the primary use case.

Deployment: Deployment varies depending on integration complexity and internal engineering readiness.

2. Yapily

Infrastructure focus: Pan-European coverage with strong UK presence. Multi-jurisdictional capabilities.

UK bank coverage: Claims 99%+ UK bank coverage. Verification through production testing recommended.

PISP capabilities: Payment initiation via single API. Multi-currency support. Instant payment confirmation.

Pricing approach: Usage-based for mid-market. Enterprise contracts for larger deployments.

Best suited for: Platforms requiring multi-market coverage beyond the UK. European expansion capability needed.

Deployment: 4-8 weeks depending on use case complexity.

3. Finexer

Infrastructure focus: UK-exclusive Open Banking infrastructure. B2B platform positioning.

UK bank coverage: 99% UK banks including Lloyds, Barclays, Monzo, Starling, challengers, building societies.

PISP capabilities: Pay by Bank via QR codes and payment links. Real-time payment confirmation. White-label flows.

Pricing approach: Usage-based with no volume minimums. Transaction fees without percentage models.

Best suited for: UK-first B2B platforms. SaaS products requiring Pay by Bank. Marketplaces needing stable infrastructure.

Deployment: 3-5 weeks with hands-on onboarding assistance from the engineering team.

Where Finexer fits: Finexer provides FCA-authorised Open Banking infrastructure specifically for UK platforms. No European multi-market complexity. No US-centric feature gaps. Focus is infrastructure reliability for UK bank connectivity.

4. Token.io

Infrastructure focus: Payment infrastructure with Multi-region connectivity with strong European and UK support.

UK bank coverage: Historically Europe-focused, with expanding UK support.

PISP capabilities: Payment initiation with instant confirmation. Recurring payment support. Request to Pay functionality.

Pricing approach: Enterprise pricing model. Custom contracts for platform requirements.

Best suited for: Enterprise platforms. Products requiring global payment capabilities. High transaction volumes.

Deployment: 8-12 weeks typical for enterprise implementations.

5. Tink (UK)

Infrastructure focus: European market leader expanding UK presence. Account aggregation emphasis.

UK bank coverage: Growing UK coverage. European priority means UK is secondary focus.

PISP capabilities: Payment initiation available. European compliance framework.

Pricing approach: Enterprise contracts. Fixed commitments with volume tiers.

Best suited for: Pan-European products. Platforms with European headquarters requiring a unified API.

Deployment: 6-12 weeks due to multi-jurisdiction framework.

6. Plaid (UK Open Banking)

Infrastructure focus: US market dominance expanding to the UK. Consumer financial data emphasis.

UK bank coverage: Growing UK coverage. US-primary means UK feature parity developing.

PISP capabilities: Payment initiation available in the UK. Expanding functionality.

Pricing approach: Per-user pricing model. Different structure than European providers.

Best suited for: US platforms expanding to the UK. Products already using Plaid in the US.

Deployment: Variable depending on UK-specific requirements.

Infrastructure Comparison Table

| Provider | UK Coverage | PISP Support | White Label | Pricing Model | Best For |

|---|---|---|---|---|---|

| TrueLayer | High | Strong | Yes | Transaction-based | Payment-focused fintech platforms |

| Yapily | 99%+ claimed | Yes | Yes | Usage + enterprise | Multi-market platforms |

| Finexer | Extensive UK bank coverage | Yes | Yes | Usage-based, no minimums | UK-first B2B platforms |

| Token.io | Strong major banks | Yes | Yes | Enterprise contracts | Enterprise and global platforms |

| Tink | Growing | Yes | Limited | Enterprise | Pan-European platforms |

| Plaid | Expanding | Yes | Limited | Per-user | US platforms entering UK |

Common Mistakes When Replacing Banked

| Mistake | Why It Matters | What to Verify |

|---|---|---|

| Assuming API parity | Each provider’s API differs | Review API documentation before commitment |

| Ignoring consent flow changes | User experience breaks | Test consent flows in sandbox |

| Underestimating bank coverage | Transaction failure rates increase | Verify specific bank list |

| Skipping webhook testing | Status updates fail | Validate webhook delivery |

| Accepting vague timelines | Migration delays affect revenue | Demand realistic deployment schedule |

Platforms often optimize for quick replacement. Then discovering API differences requires significant rework.

What We See in Practice

After working with platforms evaluating banked alternative options, patterns emerge consistently.

Platforms underestimate consent flow differences. Each provider implements Open Banking consent differently. User experience testing reveals friction points after commitment.

API logic varies significantly. Payment confirmation workflows differ between providers. Engineering teams discover this during integration, not evaluation.

Bank coverage claims require verification. “99% coverage” varies by provider. Platforms test with actual user banks before finalizing.

Checkout UX changes affect conversion. Payment flow differences impact user experience. A/B testing reveals conversion impacts post-migration.

White-label capability affects brands. Redirects to provider-branded pages during payment hurt user trust. Evaluating white-label quality matters.

The infrastructure decision compounds over time. Platforms choosing based on initial integration speed discover operational differences later.

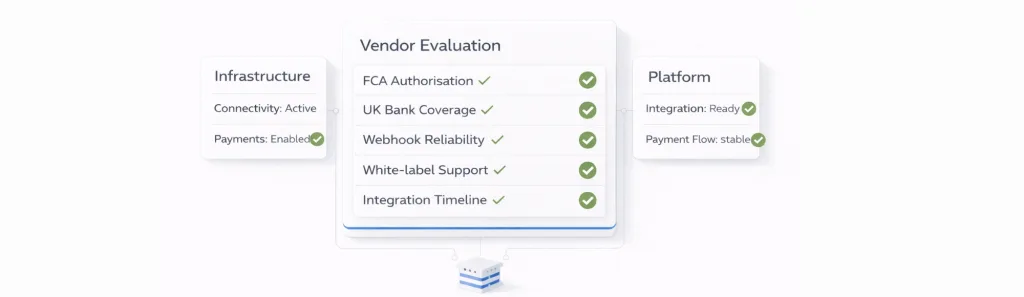

Vendor Evaluation: Key Questions

When comparing banked alternatives:

- Does the provider hold FCA PISP authorisation?

- What percentage of UK banks are actually supported?

- How do payment confirmation webhooks work?

- Is white-label consent flow available?

- What is a realistic integration timeline with support?

- How does pricing scale with transaction volume?

- What production support is available?

Infrastructure provider evaluation determines whether Pay by Bank continues working reliably.

What I Feel About Infrastructure Migration

After observing platforms migrate from Banked Ltd infrastructure, the successful ones approach it systematically.

They evaluate not just features but operational reliability. They test API differences in sandbox before committing. They verify bank coverage with actual user accounts, not marketing claims.

Struggling platforms rush replacement due to urgency. They assume APIs work similarly. Then spend weeks adapting to provider differences.

Infrastructure migration is not feature comparison. It is operational risk management. Payment flows affect revenue directly. Evaluation must account for migration complexity.

The cheapest option often becomes expensive. Hidden integration costs, extended timelines, and operational issues emerge after commitment.

Platforms succeeding with migration treat infrastructure as a long-term decision. They evaluate based on reliability, not initial pricing.

Why do platforms look for Banked alternatives?

Platforms evaluate banked alternative options when infrastructure stability concerns arise or when exploring different pricing models, bank coverage, or technical capabilities.

What should platforms prioritize when replacing Banked?

Platforms should prioritize FCA authorisation, UK bank coverage verification, PISP endpoint stability, webhook reliability, white-label capability, and realistic integration timelines.

How long does migration to a Banked alternative take?

Migration timeline varies 3-12 weeks depending on provider, technical complexity, and support availability. Testing and validation extend the timeline beyond initial integration.

Do all Banked alternatives support UK banks?

Coverage varies significantly. Some providers focus on major banks. Others include challengers and building societies. Verification of specific bank support is essential.

What is the best Banked alternative for UK platforms?

Best banked alternative depends on platform requirements-UK-only vs multi-market, payment focus, pricing model fit, and deployment timeline needs.

Review your Pay by Bank infrastructure options with our team. See how Finexer’s UK-focused infrastructure compares.