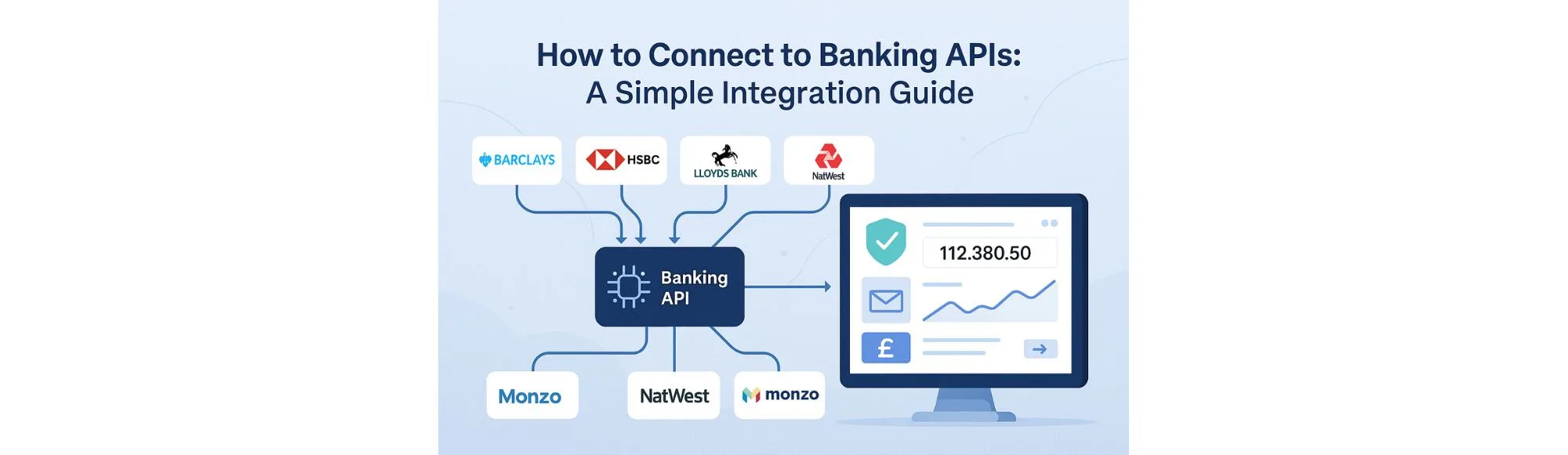

Banking APIs allow businesses to connect directly with UK banks and securely access financial data such as balances, transactions, and account ownership details — all in real time. Instead of relying on uploaded statements or spreadsheets, companies can integrate banking APIs to collect verified data straight from the source.

These APIs form the backbone of Open Banking integration, enabling regulated access to customer-permitted data and instant payments between bank accounts. Every connection runs under the UK’s Open Banking standards, ensuring encryption, customer consent, and traceability for each request.

In simple terms, banking API integration helps UK businesses reduce manual checks, automate verification, and make faster financial decisions with trusted, real-time data.

What You Can Do with Banking APIs

Modern banking APIs give businesses a secure way to access verified financial data and automate everyday finance tasks. Instead of waiting for uploaded statements, teams can work with live bank information in a single dashboard.

Here are a few practical uses:

- Account verification: Confirm a customer’s account ownership in seconds.

- Transaction access: Retrieve and categorise historic transactions for reporting or compliance.

- Balance visibility: View up-to-date balances to prevent payment delays or errors.

- Direct payments: Let customers pay straight from their bank accounts without card networks.

- Automatic reconciliation: Match incoming and outgoing payments instantly in your systems.

By using a reliable banking API integration, finance, compliance, and operations teams gain cleaner data, faster checks, and fewer manual steps.

How Banking API Integration Works

Every Open Banking connection follows a secure, consent-driven flow that protects both the business and the end user. Here’s how it typically works behind the scenes:

- User chooses their bank – Inside your platform, the customer selects their bank from a list.

- Redirect to authentication – They’re sent to the bank’s secure login page to approve access.

- Consent approval – The user confirms what data or payment permissions can be shared.

- Token issued – Instead of credentials, the bank returns a temporary access token.

- Data request – Your system uses that token to pull permitted account details or transactions.

- Information delivered – The data arrives in a standard format (usually JSON) for your application to process.

This regulated process ensures strong customer authentication, complete transparency, and no credential storage. It’s the foundation of every trusted Open Banking integration.

Key Technical Requirements

Before building any Open Banking connection, there are a few essentials your team needs to have in place. These ensure that your integration stays compliant, secure, and reliable across all supported UK banks.

- Regulated access: Work with an FCA-authorised provider that already holds the required permissions for data and payment access.

- Encryption and token security: Never store customer credentials. Use short-lived tokens and encrypted communication for every call.

- Consent tracking: Keep a full audit trail of when access was granted, refreshed, or revoked.

- Webhook or refresh setup: Use webhooks to stay updated when new transactions arrive, or schedule consent renewals every 90 days.

- Error handling and failover: Build retries and monitoring to handle timeouts or temporary bank outages gracefully.

These practices form the technical backbone of a compliant Open Banking environment, ensuring that data stays protected and systems run smoothly.

Common Mistakes to Avoid

Even well-prepared teams can run into issues when setting up Open Banking connections. Here are some common pitfalls to watch out for:

- Treating live data like static files: Once connected, the data updates continuously. Avoid downloading and storing it like traditional bank statements.

- Ignoring consent expiry: In the UK, user consent typically lasts 90 days. Always include a simple re-authorisation flow.

- Pulling excessive information: Request only what’s necessary for your use case to stay compliant and minimise processing load.

- Skipping data standardisation: Transaction descriptions vary across banks. Normalising and categorising them early saves time later.

- Overlooking payments: Many teams focus only on data access, missing the opportunity to enable instant Pay by Bank transfers within the same API stack.

Addressing these issues early helps maintain smooth performance, consistent compliance, and better customer experience throughout your integration.

Who Should Use Banking APIs

Open Banking technology benefits a wide range of UK businesses that depend on verified financial data or direct account-to-account transfers. Whether you handle payments, compliance, or reporting, integrating these APIs can remove repetitive manual steps.

Here are some of the most common use cases:

- Lenders: For income verification and affordability assessments before approving loans.

- Accountants: To import live transaction data for instant reconciliation and reporting.

- Law firms: For conducting source-of-funds checks during client onboarding.

- Utilities and telecoms: To automate bill payments and manage recurring collections.

- Payroll providers: To handle salary payouts or contractor disbursements directly through bank accounts.

Any business that manages large volumes of financial data can gain faster insight, stronger accuracy, and full transparency with Open Banking integration.

Finexer: Trusted Banking API Provider for UK Businesses

Finexer offers a single banking API that lets UK businesses access live financial data and process instant payments in a secure, compliant way. Designed for easy deployment, it removes common limits on transaction history and data fetches giving teams full visibility and control through one reliable connection.

Best for:

Accounting, payroll, legal, fintech, and utility teams that need fast, compliant access to verified UK bank data.

Key Benefits:

- Unified API for both data access and payments.

- Extended transaction history (up to seven years where consent is granted).

- No data-fetch restrictions or capped limits.

- Usage-based pricing with transparent, predictable costs.

- Fully white-labelled for branded customer experiences.

- Deploys 2–3x faster than typical market timelines, supported by an onboarding team.

With Finexer, businesses can integrate Open Banking APIs quickly, access verified data instantly, and manage payments without complex setup or compliance hurdles.

What is a banking API?

A banking API securely connects apps to bank accounts, allowing access to balances, transactions, and payments with customer consent under Open Banking regulations.

How does banking API integration work?

Users log in through their bank, approve access, and the system retrieves verified financial data using encrypted, regulated Open Banking connections.

What data can I access through a banking API?

You can access account details, balances, and transaction history. Some APIs also support initiating secure Pay by Bank payments.

Is it secure to use banking APIs?

Yes. All data access follows Open Banking standards with encryption, token-based authentication, and customer consent to keep information safe.

Start your Open Banking journey today and see how Finexer can help you connect, verify, and pay faster and with less effort.