With market leaders now utilising innovations like Open Banking and instant payments to improve customer experience and streamline operations, Electronic Point of Sale (EPOS) systems have emerged as the foundation of UK retail. In 2024, Open Banking payments topped 14.5 million UK transactions in a single month, a 69% year-over-year rise driven by e-commerce and high-street retailers looking to reduce costs and expedite settlement times.

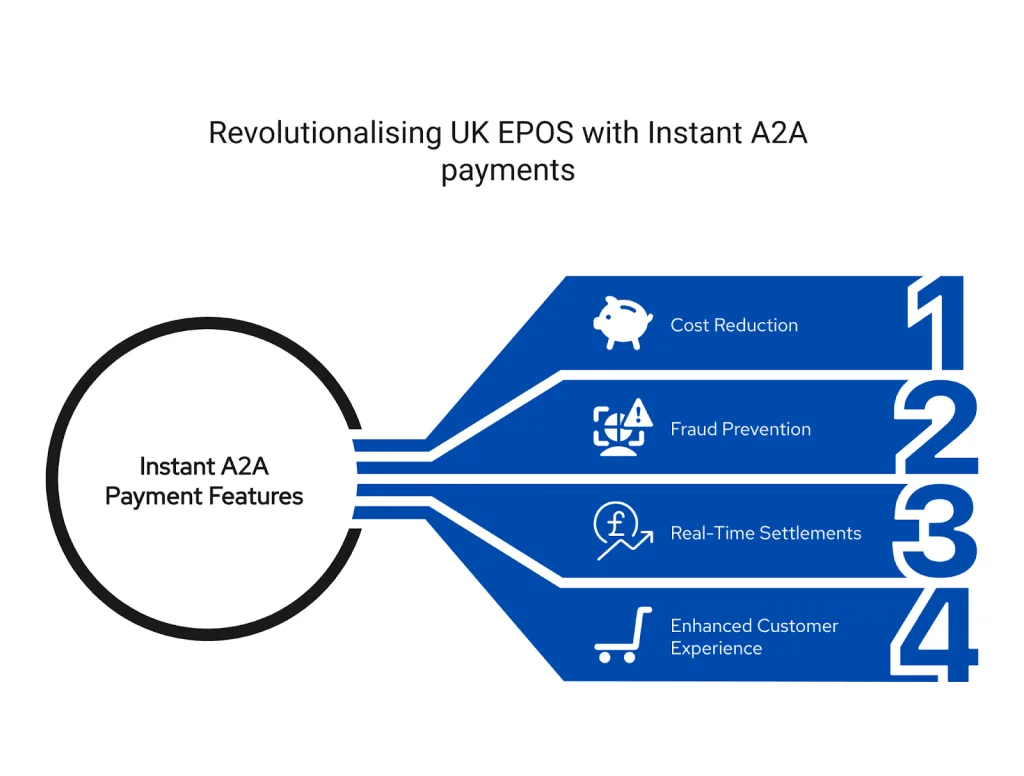

In order to avoid expensive card rails and enable real-time payment settlements and instant refunds straight to customer bank accounts, contemporary UK EPOS payment providers are implementing Pay by Bank and QR checkout features. In addition to lowering transaction costs by up to 90% when compared to conventional card payments, this also removes the possibility of fraud and chargebacks and provides safe, easy checkouts straight from the register or a customer’s device. These important features are quickly becoming standard for companies looking to preserve their margins and give customers a quick, contemporary payment experience in a market where settlement delays of two to five business days and increases in card fees are commonplace.

This guide will help you navigate the best EPOS payment providers UK 2025, from established leaders to the next generation of payment technology.

Top 6 EPOS payment providers in the UK

| Provider | Fees & Pricing | QR Payment Method | Payout Speed |

|---|---|---|---|

| Finexer | Usage-based pricing, no setup fees | Open Banking (Scan to Pay, API, links) | Instant |

| Stripe | 0.4% per Open Banking transaction (UK) | Open Banking via Payment Links & QR Codes | Same-day or 3–5 days |

| Square | 1.75% per QR payment | Card, Wallet, Square Pay QR | 1–2 business days |

| SumUp | 1.69% in-person, 2.5% online | Card-based QR (mobile & countertop) | 1–3 business days |

| Sumsub | Custom pricing for KYC + payments | QR for verified user payments | Custom / Variable |

1.Finexer

Using Open Banking to Pioneer Instant Payments for EPOS

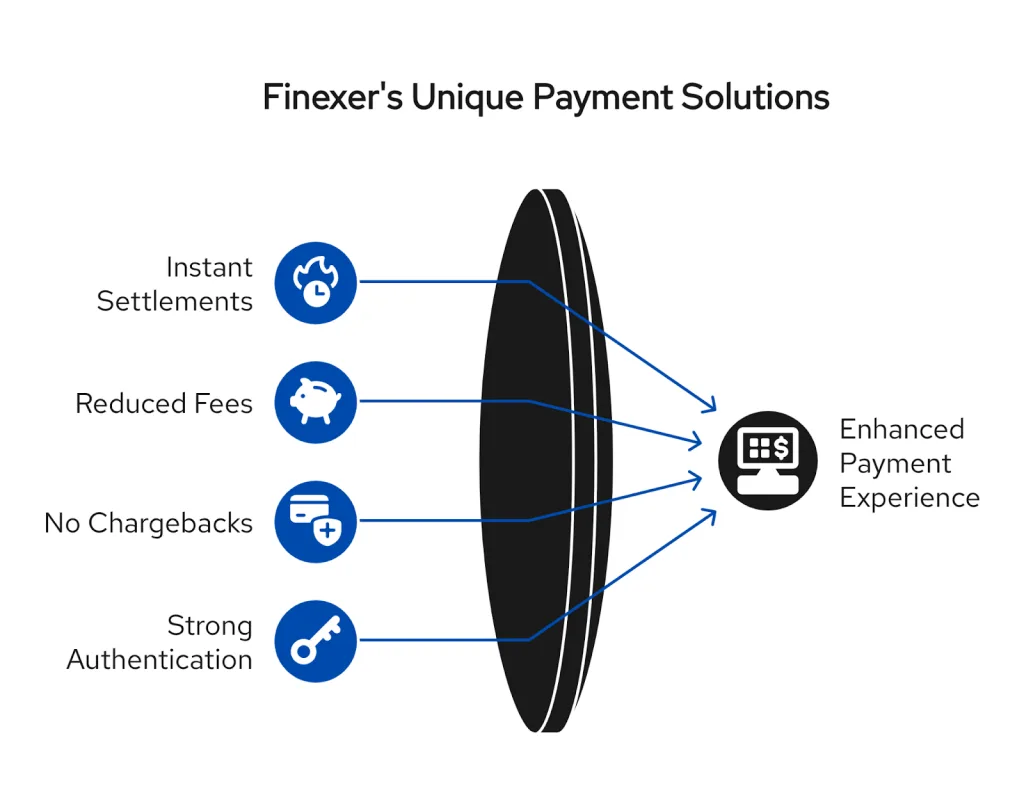

Open Banking is transforming point-of-sale transactions by facilitating instant, account-to-account payments without depending on conventional card networks, according to Finexer’s recent blog post on “How EPOS Systems Evolve with Open Banking”. Leading the way in this innovation is Finexer, which offers UK companies quick, safe, and affordable EPOS solutions.

In contrast to traditional providers, Finexer uses Open Banking technology to enable bank-to-bank transfers directly, doing away with middlemen and drastically lowering transaction costs. In addition to speeding up payments, this strategy increases security and operational effectiveness for merchants.

The Reasons Finexer Is Unique:

- Instant Settlements: Payments arrive in your account in a matter of minutes, enhancing cash flow and removing typical card network delays.

- Reduced Transaction Fees: Finexer provides substantial savings over the 1.5%–2.5% fees levied by UK card payment systems, with rates as low as 0.5%.

- No Chargebacks: Since the customer’s bank fully authenticates Open Banking push payments, there is no chance of expensive chargebacks or fraud.

- Strong authentication and bank-grade security are used in transactions, providing you and your clients with peace of mind regarding each payment.

Who should choose Finexer?

Finexer will help any company that wants to update its payment system, reduce expenses, and provide a high-end experience. It works especially well for expensive transactions where margins are reduced by traditional card fees. Additionally, it integrates with your current EPOS system, providing customers with additional payment options while allowing you to benefit from Open Banking technology’s efficiency.

Discover how Finexer can be customised to meet your company’s needs. Our team is prepared to demonstrate the effectiveness of direct account-to-account transfers. Get in touch with us right now.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Try Now2.Square

With its ease of use, dependability, and extensive feature set, Square continues to be one of the most popular EPOS systems in the UK, catering to small and medium-sized enterprises.

Important Features:

- EPOS software that is free: includes hardware and offers essential features without charging extra for software.

- Several payment options are available, including contactless, chip and PIN, and digital wallets like Apple Pay and Google Pay.

- Inventory and staff management: From a single dashboard, keep an eye on stock levels and employee performance in real time.

- Comprehensive sales reporting: Gain knowledge of daily, weekly, and monthly sales trends to enhance decision-making.

- Developer-friendly API: Enables businesses to easily integrate custom workflows and third-party apps.

Why should you choose Square?

Small businesses looking for a cost-effective, all-in-one solution with robust reporting, staff management, and simple integrations—as well as speedy onboarding and no hidden costs—will love Square.

3.Shopify POS

Shopify POS is a popular option for retailers who run both online and physical stores because it seamlessly integrates online and offline sales, unified retail management.

Important Features:

- To avoid overselling or stockouts, unified inventory management synchronises offline and online stock levels.

- Profiles of customers: keeps track of consumer preferences and past purchases to allow for tailored marketing.

- Advanced analytics: Offers up-to-date information on staff productivity, product performance, and revenue.

- Integrated shipping: Provides local pickups, delivery, and click-and-collect as fulfilment options.

- Numerous app integrations: Adding features like accounting or loyalty programmes requires access to Shopify’s app store.

Why should you consider Shopify POS?

Shopify POS makes omnichannel selling simple by providing a single dashboard for online and offline sales, inventory, and customer data, making it ideal for e-commerce companies branching out into physical retail.

4.Worldpay (FIS)

One of the biggest and most well-known payment companies in the UK, Worldpay is reputable due to its extensive EPOS compatibility, market dominance, and dependability. From tiny stores to massive corporations, it’s perfect for all kinds of businesses.

Important Features:

- Broad EPOS Integration: Adaptable to more than 600 EPOS systems, this feature guarantees scalability and flexibility for any type of business configuration.

- Numerous Payment Options: To accommodate a range of consumer preferences, it accepts debit/credit cards, contactless, and online payments.

- Dependable Merchant Accounts: Provides committed merchant services with established security and uptime requirements.

- Card Machines & Online Gateways: Offers omnichannel businesses online solutions as well as in-store terminals.

- Reputable Brand: An established pioneer in payment processing in the UK and around the world.

Why Worldpay?

If you require a highly dependable and extensively recognised payment processor, go with Worldpay. It works best for companies that want hundreds of EPOS integration options, stability, and excellent customer service.

5.Ayden

An all-in-one solution for online, mobile, and in-store transactions is provided by the global payment platform Adyen. Its main goal is to give enterprise-level companies a smooth omnichannel experience.

Important Features:

- Unified Commerce Platform: Provides a consistent experience by managing payments across several channels and geographical areas on a single platform.

- Enterprise-Level Solution: Made for big or international retailers who require sophisticated payment infrastructure and scalability.

- EPOS Integration: Gives companies a comprehensive view of transactions and customer data by integrating with top EPOS systems.

- Advanced Analytics & Insights: Provides data-driven insights and real-time reporting to maximise business performance.

- Multiple Payment Methods: Provides flexibility for international businesses by supporting digital wallets, cards, and local payment methods.

Why should you use Ayden?

Adyen is designed for enterprise-level or large businesses that sell globally. Global online, in-store, and mobile payments are managed by its single, unified platform, which guarantees uniform reporting and compliance everywhere.

6.Zettle by PayPal

With the support of the reliable PayPal ecosystem, Zettle is one of the top EPOS and payment systems in the UK. For companies that want to seamlessly integrate online and in-store sales, it’s a great option. Zettle has emerged as a popular choice for small and medium-sized enterprises due to its user-friendly design and reasonably priced hardware.

Important Features:

- Retail & Hospitality Ready: Designed to provide a seamless checkout process for small stores, boutiques, cafes, and quick-service restaurants.

- PayPal Integration: Straightforward access to funds and simple cash flow management are made possible by this direct connection to PayPal.

- Dependable Hardware: Provides small, wireless card readers that support contactless, Chip & PIN, and mobile wallets (Apple Pay, Google Pay).

- Inventory management: Offers barcode scanning capabilities, product organisation, and basic stock tracking for effective operations.

How can Zettle by PayPal help you?

Zettle is the best option if you’re looking for an affordable EPOS system that works well with PayPal. Small businesses and cafes that require easy payment processing with PayPal trust, dependable hardware, and speedy setup will find it ideal.

So how do you choose the right one?

For many, well-known companies like Square and Zettle provide an amazing combination of dependable performance and easy-to-use software, making them great all-rounders. Experts like Shopify for multi-channel retail and Lightspeed for hospitality offer strong, customised solutions that simplify intricate processes for companies with particular requirements.

But the terrain is changing. Businesses in 2025 will be most affected by the transition from a total reliance on traditional card networks to more effective, contemporary alternatives. Herein lies the obvious future of open banking solutions such as Finexer. They address the fundamental issues of exorbitant fees and protracted settlement times that merchants have been dealing with for years by facilitating safe, direct bank-to-bank transactions.

Your priorities will ultimately determine your choice. The traditional providers are still good options if you value tested systems with many integrated features. However, investigating an Open Banking provider is no longer merely a choice; it is now a strategic advantage for a competitive edge if your objective is to maximise profitability, greatly improve your cash flow with immediate access to your funds, and adopt a more secure payment technology.

What is the difference between an EPOS provider and a payment provider?

An EPOS provider typically sells an all-in-one package that includes the software, hardware, and their own integrated payment processing. A payment provider (like Worldpay, Stripe, or Finexer) is a specialist service that handles the financial transaction. They can be integrated into various third-party EPOS systems, giving you more flexibility.

What are the main benefits of Open Banking for EPOS payments?

Open Banking EPOS providers use direct bank transfers to give your business significantly lower fees, instant cash settlements, and complete protection from the risk and cost of fraudulent chargebacks.

Do I need a long-term contract for an EPOS payment provider?

Not anymore. Most modern providers operate on a flexible, pay-as-you-go model with no long-term contracts or cancellation fees. However, some traditional merchant account providers may still require a minimum contract term, so it’s important to always check the terms and conditions.

How long does it take to get money from an EPOS transaction?

With traditional card payments (from providers like Square, Worldpay, etc.), it typically takes 2-3 business days for the money to settle in your account. With Open Banking payments (from a provider like Finexer), the settlement is nearly instant, usually taking only a few seconds.

Integrate Finexer with your EPOS System and get instant settlement directly into your bank account at no extra setup fees