Table of Contents

Most Provider Lists Miss What Actually Matters

Platforms searching for open banking api providers uk find generic comparison lists ranking “top 10 tools.” These lists ignore infrastructure reliability, consent lifecycle complexity, and operational costs that emerge post-integration.

If you’re evaluating providers for UK deployment, feature lists won’t reveal what breaks in production. Coverage gaps, webhook failures, and reconciliation overhead appear after integration completes.

Key Takeaways

Why do generic provider lists mislead UK platforms?

They rank features without evaluating infrastructure reliability, consent lifecycle handling, or production support quality that affects operational costs.

What should platforms evaluate beyond feature lists?

UK bank coverage percentage, historical data depth, consent expiry handling, webhook reliability, pricing model structure, realistic deployment timelines.

What breaks when choosing providers based on features alone?

Limited bank coverage causes user drop-off. Poor consent management creates access disruptions. Batch-only updates delay reconciliation. Hidden costs emerge at scale.

How do open banking API providers differ operationally?

Regulatory authorisation type, geographic focus, bank coverage depth, pricing models, white-label capability, onboarding support quality vary significantly across providers.

Where does Finexer fit in the UK provider landscape?

FCA-authorised infrastructure focused exclusively on the UK market with 99% bank coverage, usage-based pricing, and hands-on onboarding assistance.

Who Needs This Evaluation Framework?

This checklist is for platforms if:

- You’re implementing Open Banking in UK products

- You need AIS and PIS capabilities

- You require production-grade infrastructure

- You’re comparing provider options

- You want realistic deployment expectations

If your platform depends on reliable bank connectivity, provider selection affects product roadmap directly.

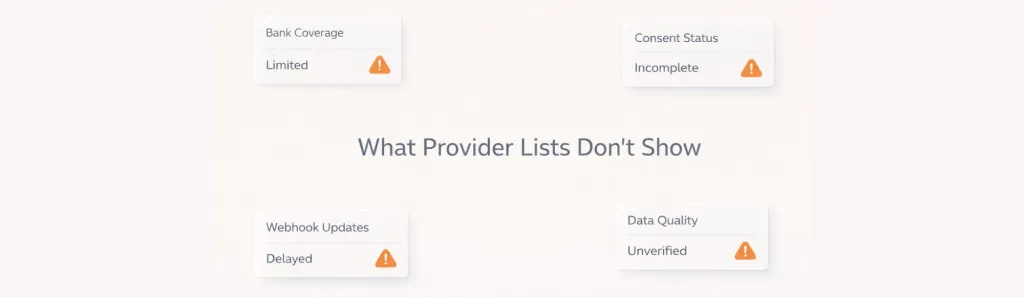

What Generic Provider Lists Don’t Tell You

Most “best open banking api providers” articles rank features without addressing operational realities:

Coverage claims without specifics: “All UK banks supported” often means major banks only. Challenger bank coverage creates user friction when missing.

Integration speed without context: “API-ready in hours” ignores webhook configuration, error handling, consent lifecycle implementation, and reconciliation logic.

Feature lists without pricing transparency: Low transaction fees hide percentage-based models that scale poorly with invoice values or high-volume accounts.

Regulatory compliance without detail: “FCA-authorised” doesn’t specify AIS vs PIS authorisation or white-label capability for brand continuity.

These omissions create expensive surprises during production deployment.

What to Evaluate in Open Banking API Providers

Before comparing specific providers, establish evaluation criteria:

UK bank coverage depth:

- Percentage of UK banks supported

- Challenger bank inclusion (Monzo, Starling, Revolut)

- Building society coverage

- Coverage verification method

Regulatory authorisation:

- FCA authorisation type (AIS, PIS, or both)

- White-label capability

- Consent flow branding options

Data capabilities:

- Historical transaction depth (up to 7 years)

- Real-time vs batch data feeds

- Transaction enrichment quality

- Webhook event coverage

Infrastructure reliability:

- Webhook delivery consistency

- Payment confirmation speed

- Consent lifecycle automation

- Status update frequency

Pricing structure:

- Usage-based vs fixed contracts

- Per-transaction vs percentage fees

- Volume commitment requirements

- Hidden integration costs

Deployment support:

- Onboarding assistance availability

- Integration timeline realism

- Sandbox environment quality

- Production support responsiveness

Without these criteria, feature comparisons provide little operational guidance.

Best Open Banking API Providers UK (Infrastructure-Focused View)

| Provider | UK Coverage | Regulatory Model | Pricing Model | Typical Deployment | Best For |

|---|---|---|---|---|---|

| Yapily | Strong UK & EU coverage | FCA-authorised AISP/PISP | Usage-based, enterprise plans | 2–8+ weeks | UK & European platforms |

| TrueLayer | Strong UK coverage | FCA-authorised AISP/PISP | Usage-based (AIS + PIS) | 2–6+ weeks | Payments-focused fintech |

| Tink | Strong EU, supports UK | PSD2 regulated provider | Enterprise contracts | 4–12+ weeks | Pan-European platforms |

| Plaid | Strong US, supports UK | Regulated via partners | Per-account pricing | Variable | US platforms expanding to UK |

| Finexer | UK-focused coverage | Uses FCA-authorised infrastructure | Usage-based, no minimums | 3–5 weeks (assisted onboarding) | UK B2B platforms |

Yapily

Infrastructure Focus:

- Pan-European coverage with strong UK presence

- AIS and PIS connectivity through single integration

- Multi-jurisdictional regulatory authorisation

UK Bank Coverage: Claims 99%+ UK bank coverage including challengers. Verification through production testing recommended.

Pricing Approach: Usage-based for mid-market. Enterprise contracts for larger deployments with volume commitments.

Deployment Complexity: Typically 4-8 weeks depending on use case. Self-service documentation with paid support tiers.

Best Suited For: Platforms requiring multi-market coverage beyond UK. Products needing European expansion capability.

Operational Considerations: European focus may affect UK-specific feature prioritisation. Enterprise pricing requires volume forecasting.

TrueLayer

Infrastructure Focus:

- Strong UK market presence

- Payment initiation capabilities emphasis

- Fintech ecosystem integrations

UK Bank Coverage: Comprehensive major bank support with challenger inclusion. Building society coverage varies.

Pricing Approach: Usage-based pricing including per-transaction fees for payments and usage-based pricing for data access.

Deployment Complexity: 3-6 weeks for standard implementations. Payment flows require additional testing cycles.

Best Suited For: Fintech products with payment collection as primary use case. Platforms prioritising PIS over AIS.

Operational Considerations: Strong payment focus may make it especially suitable for payment-led use cases.

Tink

Infrastructure Focus:

- European market leadership

- Account aggregation capabilities

- Multi-country regulatory framework

UK Bank Coverage: Strong European coverage with UK Open Banking support.

Pricing Approach: Enterprise contracts with fixed commitments. Volume-based pricing tiers.

Deployment Complexity: Deployment timelines vary depending on integration scope and compliance requirements.

Best Suited For: Pan-European products requiring unified API across markets. Platforms with European headquarters.

Operational Considerations: UK coverage gaps may affect user experience. European focus affects UK-specific feature velocity.

Plaid

Infrastructure Focus:

- US market dominance

- Consumer financial data emphasis

- Strong US presence with established UK Open Banking support.

UK Bank Coverage: Supports major UK banks with ongoing expansion.

Pricing Approach: Per-user pricing model. Scales differently than transaction-based European providers.

Deployment Complexity: Variable depending on UK-specific requirements. Deployment complexity varies based on UK-specific use case requirements.

Best Suited For: US platforms expanding to UK market. Products already using Plaid in US requiring UK extension.

Operational Considerations: US-first development affects UK feature parity. Coverage gaps in UK challenger banks.

Finexer

Infrastructure Focus:

- UK market exclusive focus

- B2B platform positioning

- Infrastructure layer emphasis

UK Bank Coverage: 99% UK banks including Lloyds, Barclays, Monzo, Starling, and building societies. UK-only focus enables deep coverage.

Pricing Approach: Usage-based with no volume minimums or fixed contracts. Transaction fees without percentage models.

Deployment Complexity: 3-5 weeks with hands-on onboarding assistance. Dedicated engineering support during integration.

Best Suited For: UK-first B2B platforms. SaaS products requiring Open Banking infrastructure. Platforms prioritising deployment speed and UK coverage depth.

Operational Considerations: UK-only coverage limits international expansion. Infrastructure focus requires product layer development.

Where Finexer Fits: Finexer provides FCA-authorised Open Banking connectivity specifically for UK platforms. No European multi-market complexity. No US-centric feature gaps.

Focus is infrastructure reliability for UK bank connectivity – not consumer-facing software or multi-jurisdiction compliance.

Common Provider Selection Mistakes

| Mistake | Why It Matters | What to Evaluate Instead |

|---|---|---|

| Choosing based on feature count | Features don’t indicate reliability | Production uptime, webhook consistency |

| Ignoring geographic focus | Multi-market providers split development | UK-specific vs pan-European priority |

| Accepting claimed coverage | “All UK banks” varies by provider | Specific bank list verification |

| Optimising for integration speed | Fast integration hides operational costs | Total cost of ownership over 12 months |

| Selecting lowest per-transaction fee | Hidden costs emerge at scale | Pricing model structure analysis |

How to Actually Evaluate Open Banking API Providers UK

Beyond provider lists, evaluation requires:

Request specific bank lists: Don’t accept “99% coverage” without verification. Ask for a complete UK bank list including challengers.

Test webhook reliability: Integration demos don’t reveal webhook consistency. Request production reliability metrics.

Calculate total cost scenarios: Model pricing across different transaction volumes and invoice values. Percentage vs fixed fees perform differently.

Verify FCA authorisation scope: Confirm AIS and PIS authorisation. Check white-label permissions for brand continuity.

Assess deployment support quality: Self-service documentation differs from hands-on engineering assistance. Clarify support model.

Review consent lifecycle handling: Consent expiry creates production issues. Evaluate automated renewal and notification systems.

Most platforms optimise for integration speed. Few evaluate operational costs that emerge post-launch.

What I Feel About UK Provider Evaluation

After observing platforms evaluate open banking api providers uk, the pattern is consistent.

- Successful platforms treat Open Banking as an infrastructure decision. They evaluate based on operational fit-UK coverage depth, consent lifecycle reliability, pricing model alignment with business model.

- Struggling platforms treat it as feature purchase. They compare API endpoint counts, integration speed claims, and initial pricing without modelling production costs.

- The “best” provider depends entirely on platform requirements. A European fintech needs pan-European coverage. A UK B2B SaaS needs deep UK bank support without European complexity.

- Geographic focus matters significantly. Providers prioritising the UK market deliver better UK-specific features than multi-market providers splitting development across regions.

- Integration speed claims mislead. Provider A integrating in 2 days without webhook configuration isn’t faster than Provider B taking 4 weeks with production-ready implementation.

- Pricing model structure affects unit economics more than per-transaction fees. Usage-based pricing without minimums scales differently than contracts with volume commitments.

What are open banking API providers?

Open banking API providers UK offer FCA-authorised infrastructure enabling platforms to access UK bank account data and initiate payments through regulated connectivity.

Which is the best open banking API provider for UK platforms?

The best open banking api providers depend on platform requirements-UK-only vs multi-market coverage, payment vs data focus, pricing model fit, deployment timeline needs.

Do all UK banks work with open banking API providers?

Coverage varies by provider. Leading open banking api providers uk support 99% of UK banks including high-street institutions, challengers, and building societies.

How long does open banking API integration take?

Integration with open banking api providers uk typically takes 3-8 weeks depending on provider, use case complexity, and onboarding support quality.

What pricing models do open banking API providers use?

Best open banking api providers offer usage-based transaction fees, per-user pricing, or enterprise contracts with volume commitments depending on provider and platform requirements.

See how Finexer’s UK-exclusive focus provides 99% bank coverage without multi-market complexity.