Table of Contents

Bookkeeping Automation Breaks When Bank Feeds Fail

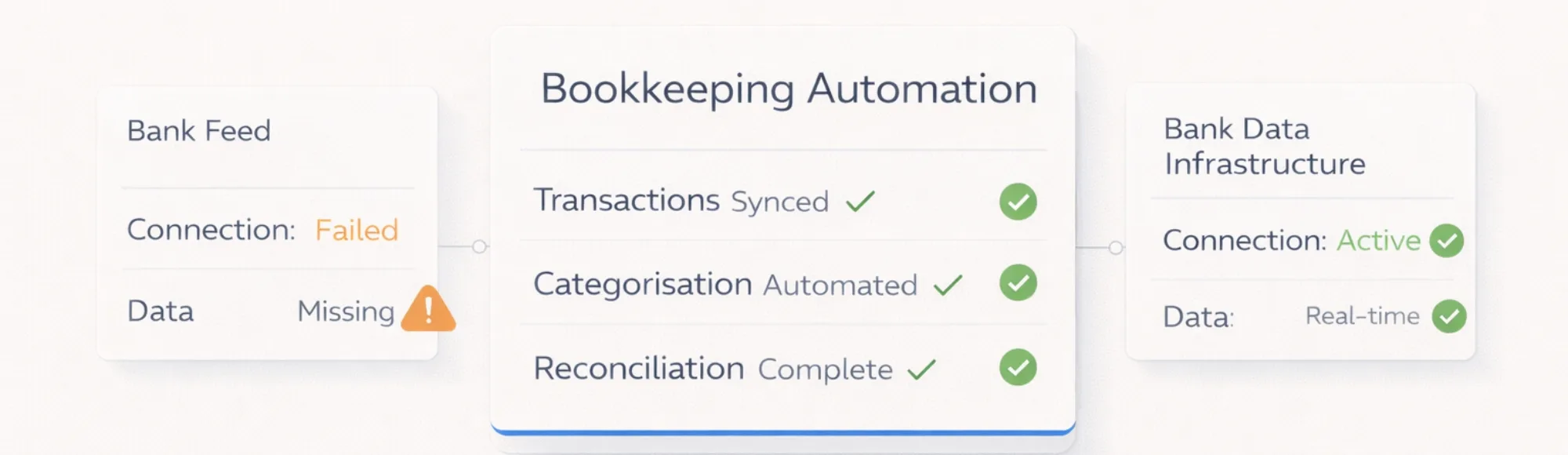

Bookkeeping automation software promises to eliminate manual data entry. But automation fails when bank transaction feeds break or arrive too late.

Accounting firms and platforms discover the bottleneck is not the software interface. It is bank data access underneath.

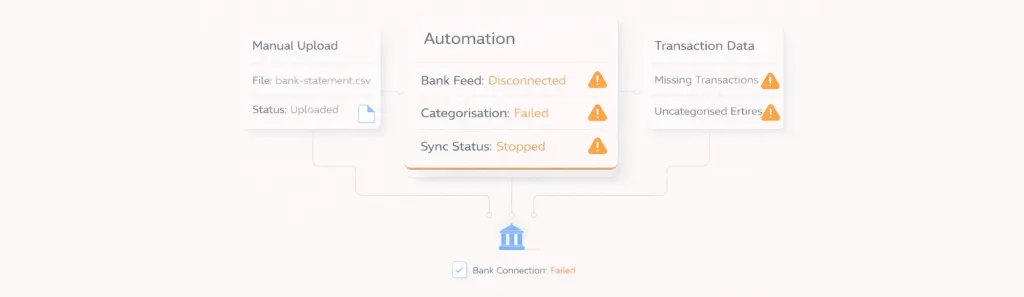

When bank feeds stop working, bookkeepers return to manual CSV uploads. Automation features become unusable.

Key Takeaways

Why does bookkeeping automation software fail without reliable bank feeds?

Software cannot categorize transactions it cannot access. Manual CSV uploads replace automation. Real-time features become impossible when data arrives in batches.

What impact does broken bank connectivity have on accounting firms?

Bookkeepers revert to manual data entry. Client onboarding delays when bank connections fail. Month-end close extends because transaction data is incomplete.

What does real accounting process automation require?

Direct bank connectivity via Open Banking. Consistent transaction data format across all banks. Real-time feeds instead of batch downloads. Historical data for complete records.

How does Finexer power bookkeeping automation?

Finexer provides bank transaction data infrastructure. Accounting platforms receive consistent feeds from UK banks. Software can then automate categorization and reconciliation.

What happens when platforms use Finexer infrastructure?

Bank feeds work reliably. Transaction data arrives in a consistent format. Real-time updates enable automation. Platforms focus on software features, not bank connectivity.

Who Faces This Problem?

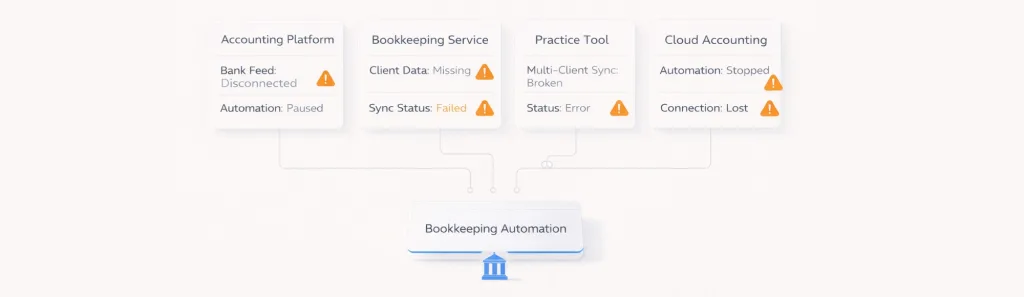

- Accounting software platforms: Users complain when bank feeds stop working or require manual reconnection

- Bookkeeping service providers: Automation fails when client bank data cannot be accessed automatically

- Practice management tools: Multi-client workflows break when bank connections need manual fixing

- Cloud accounting platforms: Users cancel subscriptions when automation features stop working due to data access issues

These platforms built bookkeeping automation software. But bank data access determines whether automation actually works.

The Problem: Bank Feeds Break Automation

| Bank Feed Problem | Impact on Automation |

|---|---|

| Connection breaks after bank update | Software cannot access new transactions |

| Manual reconnection required | Automation pauses until user fixes |

| Different format per bank | Categorization rules break |

| Batch downloads only | Real-time features impossible |

| Historical data gaps | Incomplete records for analysis |

A bookkeeping platform with strong categorization algorithms cannot function when bank transaction data is unavailable.

Users expect automation. When bank feeds fail, users blame the software. But the problem is the data access infrastructure underneath.

The Impact: Automation Features Become Unusable

When bank connectivity breaks:

Bookkeepers return to manual work:

- Download bank CSVs manually

- Upload files to software

- Fix categorization errors

- Chase missing transactions

Accounting firms lose client trust:

- Promised automation does not work

- Manual intervention required constantly

- Real-time reporting becomes impossible

- Clients question software value

Platform reputation suffers:

- User reviews mention “bank feeds always break”

- Support tickets increase for connectivity issues

- Churn increases when automation fails

- Feature development stalls fixing data issues

The problem is not the bookkeeping automation software. The problem is unreliable bank data access underneath.

Understanding automated bookkeeping with Open Banking shows why data infrastructure matters more than software features.

The Process Fix: Reliable Bank Data Infrastructure

Real accounting process automation requires infrastructure that:

Provides consistent bank connectivity:

- Open Banking access to UK banks

- No screen-scraping that breaks during updates

- FCA-authorised connections

- Reliable authentication flow

Delivers structured transaction data:

- Same format across all banks

- Consistent field naming

- Complete transaction details

- No parsing required

Enables real-time updates:

- Webhook notifications for new transactions

- No batch processing delays

- Immediate data availability

- Automation works continuously

Includes historical data:

- Access past transactions

- Complete records for analysis

- No data gaps

- Full account history

When bank data infrastructure works reliably, bookkeeping automation software can deliver on automation promises.

Platforms building accounting and ERP solutions need this infrastructure layer before automation features work properly.

Where Finexer Fits

Finexer provides the bank data infrastructure that powers bookkeeping automation software.

We handle UK bank connectivity. Accounting platforms focus on automation features users see.

How Finexer powers bookkeeping automation:

Problem: Bank feeds break after updates Finexer provides: FCA-authorised Open Banking connectivity that does not break during bank updates Platform result: Bank feeds work reliably, automation continues

Problem: Different data format per bank Finexer provides: Consistent transaction data structure across all UK banks Platform result: Categorization rules work for all banks, no custom parsing

Problem: Batch-only data delays automation Finexer provides: Real-time transaction feeds via webhooks Platform result: Real-time categorization and reporting features work

Problem: Historical data gaps Finexer provides: Access to transaction history up to 7 years Platform result: Complete records for client onboarding and analysis

Infrastructure specifics:

- FCA-authorised Open Banking access

- Connection to UK banks

- Structured transaction data

- Real-time webhook delivery

- Historical data retrieval

- 3-5 weeks integration support

- Usage-based pricing

This infrastructure enables automation. Platforms build the categorization, reconciliation, and reporting features users see.

What Powers Real Accounting Process Automation

| Automation Need | Infrastructure Layer (Finexer) | Software Layer (Platform) |

|---|---|---|

| Bank data access | Open Banking connectivity | User interface |

| Data consistency | Structured format across banks | Categorization rules |

| Real-time updates | Webhook delivery | Dashboard updates |

| Historical records | Transaction retrieval | Analysis features |

| Reliable connection | FCA-authorised access | Automation workflows |

Accounting process automation requires both layers. Infrastructure provides data. Software provides features.

When infrastructure fails, software cannot deliver automation. When infrastructure works, software can focus on user experience.

Various Open Banking use cases demonstrate how infrastructure enables different automation scenarios.

Real Example: When Infrastructure Powers Automation

Bookkeeping platform problem: Users report bank feeds breaking weekly. Manual CSV upload becomes the workaround. Categorization automation fails because data format varies. The support team spends hours troubleshooting connections.

What Finexer provides: Reliable Open Banking connectivity to UK banks. Consistent transaction data format. Real-time webhooks when new transactions appear. No screen-scraping that breaks.

What platform builds on top: Automatic transaction import that works continuously. Categorization rules that work across all banks. Real-time dashboard updates. Exception flagging for manual review.

Result for users: Bank feeds work reliably. Transactions appear automatically. Categorization happens in real-time. Manual work reduces to exception handling only.

What Finexer did: Provided infrastructure for bank data access. Handled connectivity reliability. Delivered consistent data format.

What Finexer did NOT do: Did not build categorization logic. Did not create user interface. Did not design automation workflows.

Platform built automation features. Finexer provided infrastructure those features depend on.

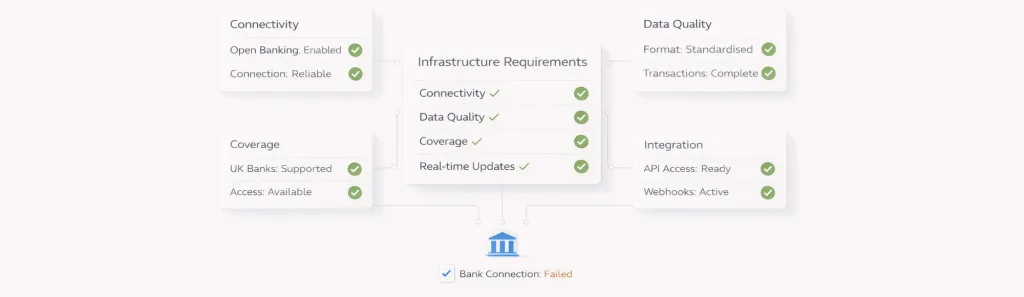

Vendor Evaluation: Infrastructure Requirements

Before choosing infrastructure for bookkeeping automation software:

Connectivity reliability:

- Open Banking vs screen-scraping approach

- FCA authorisation status

- Bank update handling process

Data quality:

- Format consistency across banks

- Transaction detail completeness

- Field naming standards

Update timing:

- Real-time webhooks vs batch processing

- Notification delivery reliability

- Data availability delays

Coverage:

- UK bank percentage supported

- Challenger bank inclusion

- Building society access

Integration:

- API documentation clarity

- Sandbox environment quality

- Technical support availability

Pricing:

- Usage-based vs fixed contracts

- Per-transaction costs

- Volume commitment requirements

Infrastructure determines whether automation works. Software features determine what automation does.

Common Infrastructure Mistakes

| Mistake | Why It Breaks | What to Choose |

|---|---|---|

| Screen-scraping providers | Breaks during bank updates | FCA-authorised Open Banking |

| Batch-only data feeds | Real-time features impossible | Webhook-based updates |

| Inconsistent formats | Categorization rules break | Standardized data structure |

| Limited bank coverage | User connections fail | UK bank coverage |

| No historical access | Onboarding requires manual data | Historical data retrieval |

Platforms often optimize for quick integration. Then spend months fixing reliability issues that infrastructure should handle.

What I Feel About Bookkeeping Automation Infrastructure

After working with accounting platforms, the pattern is consistent.

Successful platforms separate infrastructure from features. They use reliable bank connectivity infrastructure. Then focus engineering on categorization algorithms, user experience, and reporting.

Struggling platforms treat bank connectivity as feature work. They build connections themselves. Then maintain them constantly. Bank updates break connections. Engineering capacity goes to infrastructure instead of features.

Users do not care about infrastructure. They care whether automation works. But automation only works when infrastructure is reliable.

Many platforms assume “bank feed integration” is one-time work. It is not. Banks update authentication. APIs change. Coverage gaps appear. Infrastructure requires constant maintenance.

Bookkeeping automation software without reliable infrastructure is just manual bookkeeping with a nice interface. Infrastructure determines whether automation actually works.

Real-time data reveals issues batch processing hides. When transactions appear same-day instead of next-day, bookkeepers spot problems faster. Automation works better with current data.

What is bookkeeping automation software?

Bookkeeping automation software automatically categorizes transactions, reconciles accounts, and generates reports. Automation requires reliable bank transaction data access to function.

Why does bookkeeping automation fail?

Automation fails when bank connectivity breaks or data arrives inconsistently. Software cannot automate without reliable transaction data access from banks.

What does accounting process automation require?

Accounting process automation requires bank data infrastructure providing consistent transaction feeds. Software builds automation features on top of reliable data access.

How does Finexer power bookkeeping automation?

Finexer provides bank connectivity infrastructure. Accounting platforms receive reliable transaction data from UK banks. Platforms then build automation features users see.

What is the difference between infrastructure and software?

Infrastructure provides bank data access. Software provides automation features users interact with. Both layers are required for working automation.

Is it possible to automate bookkeeping?

Yes, bookkeeping can be automated when reliable bank data infrastructure exists. Platforms access transaction data via Open Banking. Then build categorization and reconciliation automation on top.

Which accounting automation software is best?

The best accounting process automation software depends on reliable bank data infrastructure underneath. Software with strong features cannot automate without consistent transaction data access.

If your platform’s automation breaks when bank feeds fail, see how Finexer’s infrastructure solves this