Note: This guide provides a framework for understanding open banking pricing considerations and is based on market research as of december. While it offers strategic insights for startup leaders, actual pricing structures may vary and should be confirmed directly with providers.

What You Will Discover:

Introduction

The UK’s open banking sector has fundamentally changed how businesses interact with financial data and banking services. This transformation allows regulated providers to access customer bank accounts securely, but only with explicit customer permission. For startups entering the financial services market, this creates both opportunities and challenges. The ability to access and use banking data opens doors for new services, but choosing the right provider becomes crucial for long-term success.

As the open banking market matures, several major providers have established themselves, with Bud Financial emerging as a significant player. Their platform has gained attention for its data processing capabilities and enterprise-grade features. However, for startups evaluating their options, understanding Bud’s approach, pricing structure, and service model requires careful consideration beyond the surface-level features.

Want to understand how much you could save with startup-focused open banking? → Download our Complete Open Banking USP Guide for UK Startups

A Detailed Look at Bud Financial

Core Services and Capabilities

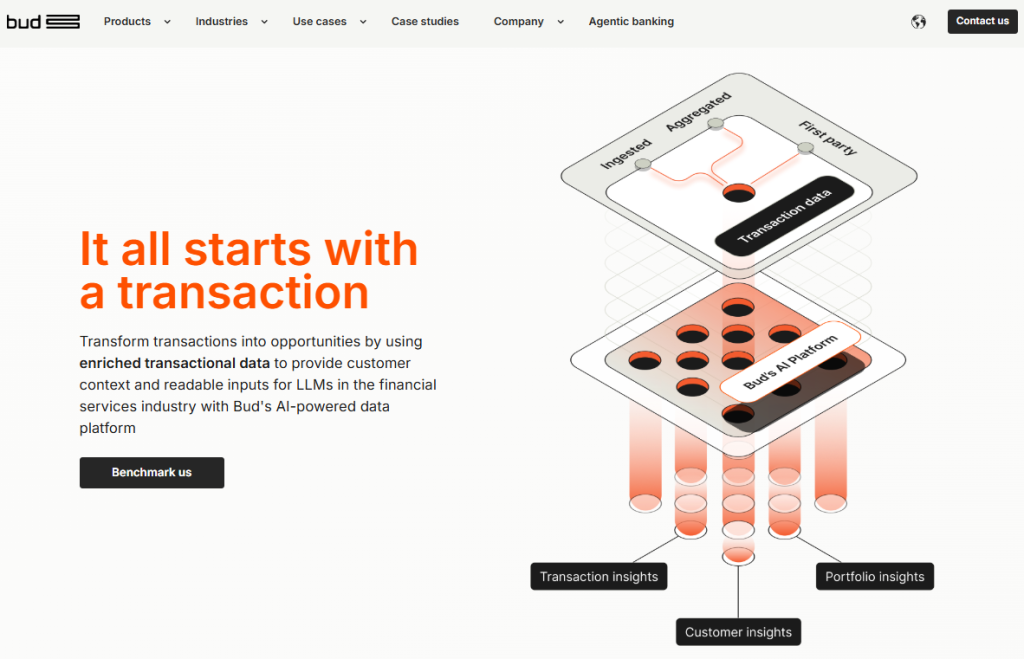

Bud Financial has built its reputation on strong data-handling capabilities, particularly in financial information processing. Their system processes over 50 billion transactions, demonstrating substantial scale and reliability. The platform emphasises data enrichment and analysis, helping businesses make sense of complex financial information. Their focus extends beyond basic data access, incorporating AI-powered categorisation and pattern recognition to provide deeper insights into financial behaviour.

Market Position and Coverage

In the competitive open banking landscape, Bud Financial has established a strong presence in both US and UK markets. Their services connect with major UK banking institutions, providing broad coverage for businesses operating in these regions. However, their limited presence in EU markets may affect companies planning for European expansion. This geographic focus shapes service delivery and technical infrastructure, with features and capabilities tailored to their primary markets.

Technical Infrastructure and Compliance

Bud’s technical foundation rests on PSD2-compliant infrastructure, ensuring adherence to current banking regulations. Their system maintains a 99.99% uptime SLA and achieves a 98.2% first-connection success rate, indicating robust technical performance. The platform includes real-time balance updates and webhook notifications, allowing businesses to promptly monitor and respond to account changes. Their white-label API options let companies integrate these features into their existing systems while maintaining their brand identity.

Service Limitations

While Bud excels in data services, some limitations affect its suitability for certain business models. The platform currently doesn’t support bulk payment processing or variable recurring payments, which may impact businesses requiring these features. Their stronger focus on data services over payment capabilities means companies primarily needing payment processing might need to evaluate additional solutions or alternative providers.

Pricing Structure

Bud Financial’s pricing approach includes several key elements:

- Free sandbox access for testing and development, allowing businesses to explore the platform’s capabilities and assess integration requirements without financial commitment or time pressure.

- Production environment pricing is based on a per-user model means costs scale with actual usage rather than fixed monthly fees, though specific rates require direct consultation with their sales team.

- Enterprise-level customisation options for larger implementations, with pricing tailored to specific business needs and usage patterns, though these typically involve longer-term commitments.

- Additional services and support packages are available based on business requirements, with pricing details provided during consultation phases.

Hidden Costs of Bud Financial for Startups

Beyond the Basic Pricing Structure

When evaluating Bud Financial for your startup, the published pricing structure tells only part of the story. The per-user pricing model appears simple, but implementation and maintenance involve additional considerations that affect your total investment. These factors become particularly important for startups operating with limited resources and tight budgets.

Technical Integration Requirements

The technical demands of implementing Bud Financial’s system require careful consideration. While the platform offers comprehensive documentation and API access, the integration process needs dedicated developer time and expertise. Most startups find they need to allocate significant development resources for initial setup, testing, and ongoing maintenance. This commitment extends beyond the initial integration phase, as updates and system modifications often require additional technical attention.

Ready to see how simple open banking integration can be? → schedule a quick demonstration with our technical team

Security and Compliance Investments

Banking data security demands substantial attention and resources. Your startup must maintain appropriate security measures and certifications to handle sensitive financial information when using Bud Financial. This includes regular security audits, ongoing compliance monitoring, and potential updates to match changing regulations. While Bud provides the basic infrastructure, your team needs to ensure proper implementation and maintenance of security protocols within your application.

Support and Maintenance Considerations

Reliable support systems are essential for the day-to-day operation of open banking services. While Bud Financial offers basic support, growing startups often need enhanced support levels as their user base expands. This might mean investing in additional internal support staff or paying for upgraded support packages. Quick issue resolution becomes critical as your service grows, potentially requiring investments in monitoring tools and support personnel.

Impact on Startup Operations

Resource Allocation Challenges

For many startups, implementing Bud Financial affects team structure and resource distribution. The need for dedicated technical personnel to manage the integration can strain small development teams. This often requires either hiring additional staff or redirecting existing resources from other projects, affecting overall development timelines and capabilities.

Scaling Considerations

As your startup grows, the relationship between costs and revenue requires careful management. The per-user pricing model means expenses increase with each new customer, potentially affecting your profit margins during rapid growth phases. This scaling pattern demands careful financial planning to ensure your pricing strategy accommodates these increasing costs while maintaining profitability.

Technical Debt and Future Planning

The initial implementation decisions made with Bud Financial can create long-term technical commitments. Changes to your integration or switching to different providers become more complex as your user base grows. This potential technical debt needs consideration in your long-term planning, particularly if your startup’s needs evolve beyond Bud’s current feature set.

Growth-Related Adjustments

As transaction volumes increase, your startup may need to adjust its technical infrastructure to maintain performance. This might include upgrading servers, improving monitoring systems, or enhancing security measures. These growth-related modifications add to the total cost of using the platform and require effective implementation planning.

Discover how your startup can implement open banking 3x faster with direct connections to 99% of UK banks → Book a free consultation with our open banking specialists

Finexer: The Right Choice for UK Startups

A Fresh Approach to Open Banking

While traditional providers focus on serving large enterprises, Finexer has built its platform for growing businesses and startups. This focused approach means that every aspect of the service, from pricing to technical support, addresses the real needs of early-stage companies in the UK market.

Strategic Insight

Startups using Finexer save up to 90% on transaction costs compared to traditional banking solutions.

Making Open Banking Work for Small Companies

Finexer’s platform stands out by providing direct connections to 99% of UK banks through a single integration process. This comprehensive coverage allows new businesses to immediately serve their target market without managing multiple technical implementations or complex connection types. The straightforward integration process typically completes in one-third of the usual time, helping startups begin serving customers and generating revenue more quickly.

Cost Structure That Makes Sense

Independent analysis demonstrates that UK startups save up to 90% on transaction costs when choosing Finexer compared to traditional providers. This substantial reduction comes from a consumption-based pricing model that removes large upfront fees and minimum commitments. Companies pay only for their actual usage, directly linking costs and revenue generation. As transaction volumes increase, the pricing scales proportionally, keeping costs predictable even during rapid growth phases.

Technical Excellence Without Complexity

Finexer’s infrastructure maintains 98% uptime while handling anywhere from 100 to 100,000 transactions without requiring additional technical investment. This scalability means startups can focus on growing their business without concerns about outgrowing their open banking solution or facing unexpected technical hurdles. The platform’s design ensures companies can scale their operations smoothly without modifying their core infrastructure.

Complete Support from Day One

Finexer clients receive dedicated technical assistance and strategic guidance regardless of size or transaction volume. The support team combines deep fintech expertise with practical startup experience, offering insights beyond basic technical help. This includes assistance with integration planning, growth strategy development, and ongoing platform improvements. Unlike traditional providers that reserve premium support for enterprise clients, Finexer ensures all businesses receive the attention needed for success.

Built-In Security and Compliance

Managing regulatory requirements presents a significant challenge for growing businesses. Finexer’s FCA-authorised infrastructure handles compliance requirements automatically, removing this operational burden from startup teams. This built-in compliance support includes regular updates to match changing regulations, ensuring businesses maintain their regulatory standing without dedicating extensive internal resources.

📚 Learn more about Security & PSD2 Compliance

Getting Started with Finexer

The transition to Finexer begins with a straightforward process designed specifically for startups. The platform offers a 14-day free trial with unlimited sandbox access, allowing your team to thoroughly explore all features and capabilities without any commitment. This hands-on experience helps ensure the platform meets your requirements before making decisions.

The journey starts with a no-obligation consultation with fintech specialists who understand the unique challenges of growing businesses. You’ll receive a customized implementation plan tailored to your specific needs and goals during this consultation. This planning phase helps you make the most of your free trial period and eventual transition to the platform.

Following the initial consultation, you’ll participate in a live demonstration of the platform, seeing exactly how it will work with your business model. This demonstration helps you understand the practical benefits and ensures the solution meets your requirements. After the demo, you’ll receive a clear cost projection based on your expected usage, helping you plan your budget effectively after your trial period.

Take the Next Step

For startups looking to implement open banking capabilities, Finexer provides a solution that balances sophisticated features with practical usability. The platform offers the tools and support needed to compete effectively in the UK financial services market while maintaining costs that work for growing businesses.

Begin your 14-day free trial today and discover how Finexer can help your startup implement open banking at a price that makes sense for your business stage and growth plans. Schedule your consultation to start your journey toward better open banking.

Turn your open banking vision into reality today! Schedule your no-obligation consultation and platform demo 🙂