Introduction

Managing hundreds of payments for employees, suppliers, or gig workers can feel overwhelming. It’s not just about ensuring accuracy and timeliness—it’s also about avoiding high costs, manual errors, and unnecessary complexity. For many businesses, this balancing act drains valuable resources and slows down operations.

Now, imagine having a tool that allows you to process all those payments in one go, with ease and precision. That’s exactly what Bulk Payouts through Open Banking offer. Whether you’re disbursing salaries, paying vendors, or issuing refunds, Bulk Payouts make the process faster, more secure, and cost-effective. This isn’t just about simplifying payments—it’s about empowering your business to focus on growth and strengthening relationships with recipients.

you’re in the perfect place If managing multiple payments feels like a challenge or adds unnecessary costs. Whether it’s employee payroll, supplier invoices, or customer refunds, this guide explores how bulk payouts with Open Banking can streamline operations, reduce expenses, and help you regain control over your financial workflow. Let’s dive in!

You will learn about:

What is Bulk Payout?

Bulk payouts refer to the process of sending multiple payments at once to a group of recipients in a single transaction. This efficient method is designed to streamline financial operations, saving businesses time and effort compared to processing payments individually. Bulk payouts are commonly used for:

- Employee Payroll: Distributing salaries, bonuses, and reimbursements efficiently to employees across departments or locations.

- Vendor and Supplier Payments: Settling multiple invoices or recurring payments for goods and services in a single batch.

- Customer Refunds: Issuing refunds for returns, cancellations, or disputes promptly and accurately.

- Gig Economy Payouts: Paying freelancers, contractors, or gig workers reliably, ensuring timely earnings disbursement.

This process is particularly valuable for businesses managing high volumes of transactions, as it eliminates the need for repetitive manual tasks and ensures accuracy and consistency in payments. Bulk payouts, especially when powered by Open Banking, offer businesses a faster, more secure, and cost-effective way to manage outgoing payments.

Challenges they Face

Industries such as e-commerce, gig platforms, corporate payrolls, and non-profits rely heavily on bulk payouts to streamline their operations.

However, traditional methods of handling bulk payments come with significant challenges:

- High Transaction Fees: Traditional banking systems or card networks often charge hefty fees for processing large volumes of payments, cutting into profit margins.

- Time-Consuming Processes: Reconciling payments manually is prone to errors and delays, eating up valuable resources.

- Slow Settlements: Payments can take several days to clear, affecting cash flow and creating uncertainty for recipients.

These inefficiencies don’t just slow down your business—they can also erode trust with employees, suppliers, and customers who depend on timely payments.

📚 Learn more about Instant Reconciliation with open banking

How Open Banking Simplifies Bulk Payouts

Open Banking introduces a smarter, more efficient way to handle bulk payouts by leveraging secure APIs that directly connect businesses with their banks. Here’s how it simplifies the process:

- Immediate Transfers: Payments are processed instantly, ensuring recipients receive funds without delays, improving cash flow management.

- Cost Savings: By eliminating card networks and using account-to-account transfers, businesses save up to 90% on transaction fees, allowing them to allocate resources more effectively.

- Automation: Bulk payouts automate payment reconciliation, reducing the need for manual intervention, minimising errors, and freeing up your team’s time for more strategic tasks.

- Enhanced Security: Advanced encryption and real-time authentication ensure every transaction is secure, lowering the risk of fraud and ensuring compliance with regulations.

By addressing the pain points of traditional payment systems, Open Banking provides businesses with a clear, reliable, and scalable solution to manage bulk payouts effortlessly.

Benefits of Bulk Payouts for Businesses

Bulk payouts via Open Banking provide significant advantages, simplifying financial operations for businesses of all sizes. Here’s how this solution can enhance the way organisations manage payments:

1. Real-Time Payments

With Open Banking’s account-to-account (A2A) infrastructure, bulk payouts are processed instantly. This means that payments are transferred directly from the payer’s bank account to the recipient’s, skipping intermediaries that typically slow down the process. Whether you are paying suppliers, employees, or contractors, the speed of Open Banking ensures that funds are disbursed quickly and reliably.

Why It Matters: Speed is critical in financial operations. Real-time payouts build trust with recipients, prevent cash flow disruptions, and allow businesses to meet payment commitments swiftly.

2. Cost Efficiency

Open Banking eliminates the need for intermediaries like card networks or legacy banking systems, which often impose high transaction fees. Instead, payments are made directly between accounts, leading to significantly lower costs for each transaction. This reduction in fees is particularly beneficial for businesses that handle large volumes of payments, as it allows them to allocate resources more effectively.

Why It Matters: High transaction fees can erode profitability, especially for businesses managing large volumes of payments. Bulk payouts offer a cost-effective alternative without compromising on speed or security.

3. Automation of Payment Processes

Bulk payouts enable businesses to automate payment workflows entirely, from initiating transactions to reconciling them. With tools like pre-defined payment templates and data synchronisation, businesses can process large batches of payments without the need for manual intervention. This reduces the workload for finance teams, minimises the risk of human error, and allows for greater accuracy in financial operations.

Why It Matters: Manual processes are time-consuming and prone to mistakes. Automation ensures accuracy, saves time, and allows teams to focus on strategic tasks instead of operational burdens.

📚 Guide to Bulk Payments for Contractors

4. Enhanced Security

Open Banking uses advanced encryption protocols to protect sensitive payment information during every step of the process. Additionally, real-time authentication methods, such as biometric verification or secure tokens, ensure that transactions are only authorised by verified users. This reduces the risk of fraud and safeguards financial data from breaches, giving businesses confidence in the security of their payments.

Why It Matters: Security and compliance are non-negotiable in financial operations. Open Banking ensures every transaction is protected, reducing risks and meeting regulatory requirements effortlessly.

5. Improved Cash Flow Management

Real-time bulk payouts enable businesses to gain better control over their cash flow by ensuring payments are settled immediately. This prevents delays that could impact operations, helping businesses maintain a steady flow of funds. With better predictability and faster access to funds, businesses can make informed decisions about their financial strategies.

Why It Matters: Delayed payments can disrupt operations and strain relationships with recipients. Instant payouts give businesses the flexibility to plan and execute financial strategies with confidence.

Streamline Your Bulk Payouts with Finexer

Try Bulk payout with 14 days free trial. Contact us now!

6. Scalable for Growth

Open Banking-powered bulk payouts are designed to support businesses of any size. Whether a company needs to process a few dozen payments or thousands, the system can handle large volumes effortlessly. As a business grows, the infrastructure adapts, ensuring that scaling operations won’t lead to inefficiencies or delays in payment processing.

Why It Matters: Growing businesses need payment systems that can keep up. Bulk payouts provide the scalability to accommodate increasing transaction volumes without compromising on efficiency.

7. Transparency and Accountability

Bulk payout solutions via Open Banking come with robust tracking and reporting features. Businesses can monitor the status of each payment in real-time, ensuring that funds are received as expected. Additionally, detailed reconciliation reports make it easier to maintain accurate financial records and address any discrepancies promptly.

Why It Matters: Visibility into payment processes builds trust with stakeholders, improves financial oversight, and simplifies audit processes.

Implementing Bulk Payouts with Open Banking

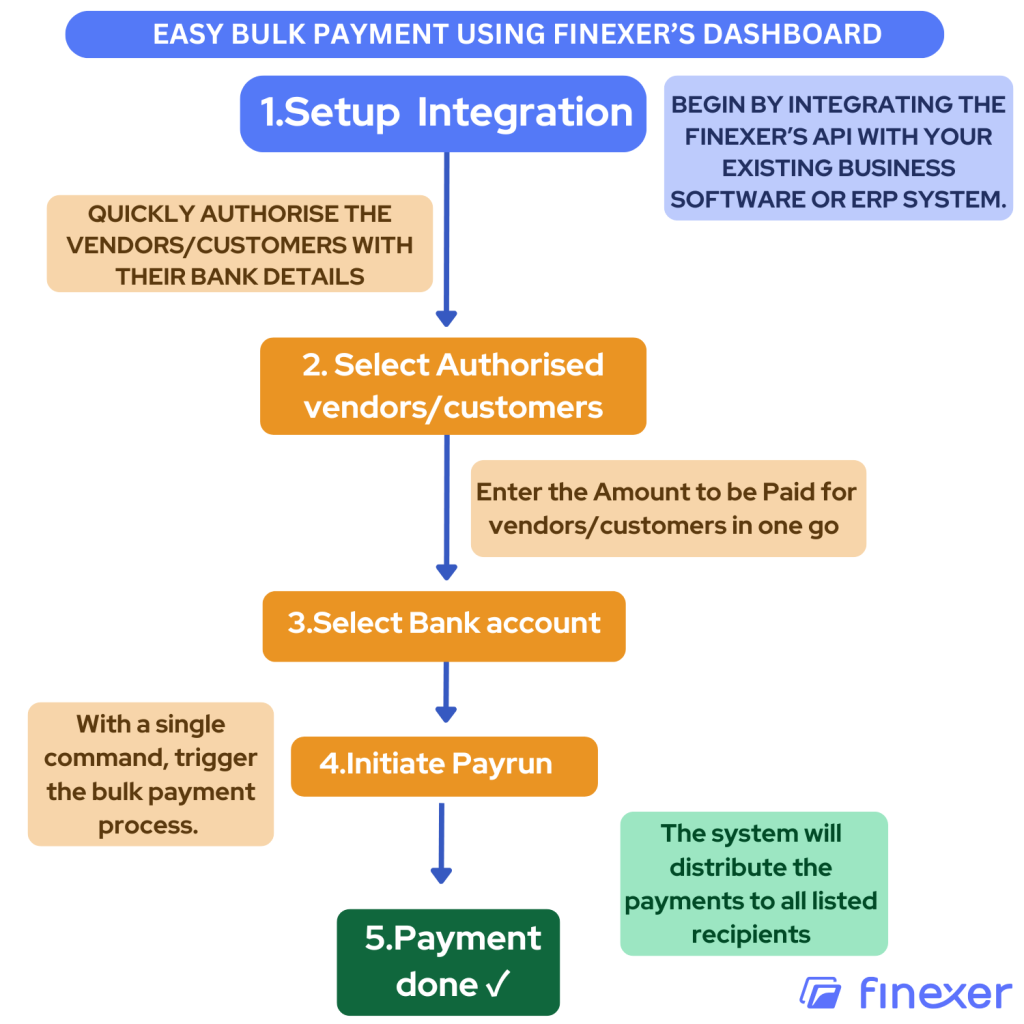

Implementing bulk payouts using Open Banking doesn’t have to be complex. With providers like Finexer, the process is straightforward, efficient, and tailored to meet your business needs. Here’s how businesses can get started:

Step 1: Choose Your Integration Option

- Dashboard-Based Payouts:

Ideal for businesses that want a quick and simple solution. Use Finexer’s dashboard to upload payment details, select recipients, and initiate payouts with a single click. - Custom API Integration:

Perfect for businesses looking to integrate bulk payouts directly into their existing systems. Finexer’s APIs provide flexibility for companies that need custom workflows and automation.

Step 2: Prepare Payment Data

- Upload a Bulk List:

Provide recipient details through a secure file upload (e.g., CSV) or sync with existing accounting or ERP software. - Add Payment Parameters:

Define payment details, such as amounts, payment types (one-off or recurring), and due dates.

Step 3: Review and Approve Payments

- Real-Time Validation:

Select your bank account and ensure all payment details are accurate and comply with security protocols. - Approval Process:

Authorise the payment batch, either through the dashboard or customised API, ensuring full control over outgoing transactions.

Step 4: Disburse Payments

- Once approved, payments are processed instantly through Open Banking’s secure account-to-account faster payments rails, ensuring recipients receive their funds without delays.

Step 5: Track and Reconcile

- Real-Time Monitoring:

Use Finexer’s tools to track payment statuses in real time, ensuring transparency and accountability. - Automated Reconciliation:

Match payments with invoices automatically, saving time and reducing errors.

Why Finexer for Bulk Payouts?

When it comes to managing bulk payouts through Open Banking, Finexer offers the ideal combination of affordability, flexibility, and expertise. Whether you’re building a Fintech product, running an ERP system, or managing an SME, Finexer is tailored to meet your needs and help your business grow.

1. Affordable API Solutions for Fintech Startups

Finexer understands that startups often operate within tight budgets while striving to deliver innovative solutions. With Finexer’s Open Banking APIs, you can:

- Build Custom Payment Features: Integrate Finexer’s API to add bulk payout functionality directly into your Fintech app, enabling real-time disbursements for end-users.

- Keep Development Costs Low: Finexer’s APIs are competitively priced, making them accessible for startups aiming to scale without breaking the bank.

- Leverage Scalable Infrastructure: Whether you’re processing 100 or 100,000 transactions, Finexer’s platform can handle your growth, ensuring seamless operation as your user base expands.

- Comprehensive Documentation and Support: Developers can rely on detailed API documentation and a responsive support team to ensure integration is smooth and efficient.

By choosing Finexer, Fintech startups gain access to reliable bulk payout capabilities, reducing their time to market and delivering value to their customers faster.

Strategic Insight

Open Banking payments are projected to exceed $330 billion globally by 2027, indicating a significant shift towards digital financial solutions. Source

2. Transforming Accounting and ERP Sectors

For businesses in the accounting and ERP space, managing bulk payments for clients can be a time-consuming and error-prone process. Finexer helps accounting firms and ERP providers transform their financial operations with:

- Automation of Financial Workflows: Finexer’s APIs integrate seamlessly with ERP systems, enabling the automatic scheduling, initiation, and reconciliation of bulk payments. This reduces manual intervention and increases accuracy.

- Improved Payment Tracking: Accountants and ERP users can leverage Finexer’s real-time payment tracking tools to monitor transaction statuses, ensuring transparency and accountability for their clients.

- Regulatory Compliance Made Simple: Finexer’s platform adheres to UK Open Banking regulations, including GDPR and PSD2, ensuring all bulk payments meet compliance standards without extra work for users.

- Enhanced Client Offerings: ERP providers can add bulk payout capabilities to their suite of services, enabling businesses to process vendor payments, payrolls, and customer refunds efficiently—all from one platform.

Accounting firms and ERP providers using Finexer gain a competitive edge by offering their clients modern payment solutions that save time, reduce costs, and improve accuracy.

Strategic Insight

Finance teams spend up to 30% of their time on manual reconciliation tasks, highlighting the need for automated solutions. Source

3. Built for SMEs to Scale

SMEs often face significant challenges in managing cash flow, especially when processing multiple payments. Finexer provides SMEs with the tools they need to scale effectively:

- Cost-Effective Bulk Payments: By avoiding traditional banking fees and using account-to-account transfers, SMEs can save up to 90% on transaction costs.

- Streamlined Vendor Payments: SMEs can use Finexer’s dashboard or API to make vendor and supplier payments in one batch, reducing administrative workload and improving vendor relationships.

- Cash Flow Management: Real-time payouts mean SMEs no longer have to wait for funds to clear, helping them maintain better control over their finances and respond quickly to market demands.

- User-Friendly Dashboard: Finexer’s easy-to-navigate dashboard allows SMEs to initiate and manage bulk payouts without needing technical expertise.

With Finexer, SMEs can focus on growing their business rather than worrying about complex payment processes.

Strategic Insight

82% of small businesses fail due to cash flow problems, emphasising the importance of efficient financial management. Source

The Finexer Difference

Finexer isn’t just a payment provider; it’s a partner for businesses aiming to simplify their financial operations. Here’s why Finexer stands out:

- 99% UK Bank Coverage: Reach almost all banks in the UK for seamless transactions.

- Scalable Solutions: Designed to grow with your business, whether you’re a startup or an established enterprise.

- Security You Can Trust: Advanced encryption, real-time authentication, and fraud detection ensure every transaction is secure.

- Customisable Integrations: Choose between ready-to-use dashboards or API integrations tailored to your unique needs.

📚 Download Finexer’s USP for Startups in the UK

Take the First Step with Finexer

Whether you’re a Fintech startup looking to innovate, an ERP provider aiming to add value, or an SME striving to streamline payments, Finexer’s bulk payout solutions are the perfect fit. Get started today to build a payment process that’s fast, secure, and cost-effective.

Ready to experience the Finexer advantage? Contact us now and see how we can transform your bulk payouts into a seamless operation.

Try Bulk Payout today! Schedule your demo and get a 14 days free Trial by Finexer 🙂