Cash flow automation is changing the way finance teams approach forecasting. While Excel has long been the default tool for managing company finances, it quickly falls short when real-time accuracy and responsiveness are needed. Teams often spend hours downloading bank statements, updating formulas, and reconciling tabs, only to end up with forecasts that are outdated before they’re even shared.

The issue isn’t with Excel itself. It’s that manual processes simply can’t keep pace with the speed of today’s financial operations. Cash positions change daily. Unexpected inflows and outflows happen without warning. When your forecasting model depends on static exports from disconnected systems, you’re always one step behind.

This disconnect between data and decisions leads to missed opportunities and short-term fixes. Spreadsheets lack real-time visibility, offer no automated alerts, and fail to provide a reliable single source of truth. The outcome is a constant cycle of reactivity instead of proactive planning.

Even the most experienced spreadsheet user can’t match the accuracy, speed, or control offered by cash flow automation. When forecasts are powered by real-time financial data pulled directly from bank accounts and accounting tools, they shift from guesswork to actionable insight.

It’s no surprise that more finance teams are now searching for Excel forecast alternatives that are built to handle live data, multiple accounts, and constant change.

📚 Open Banking Use Cases for Accounting Firm

What Is Cash Flow Automation and Why It Matters

Cash flow automation refers to the process of generating real-time forecasts and insights using live data from your bank accounts, accounting software, and payment platforms, without any manual input. Instead of downloading CSV files or updating formulas in spreadsheets, automated systems pull data continuously through secure integrations and APIs.

With tools like Open Banking platforms, you can access real-time financial data that reflects your current cash position across all accounts. This ensures you’re not relying on outdated figures when making important decisions.

For finance professionals, the shift to automation is more than a time-saver. It’s a way to gain control over forecasting. Automated pipelines reduce the risk of human error, eliminate data duplication, and create a single, trusted view of your finances. You save hours each week and also gain the confidence to act on accurate, up-to-date numbers.

In short, cash flow automation turns forecasting into a live operational tool. Whether you’re managing runway, planning investments, or preparing for a board meeting, having financial data automation in place gives you the clarity to move forward with confidence.

Comparison: Excel Forecasting vs Modern Alternatives

If you’re considering replacing your manual process, this table outlines how traditional spreadsheets compare to three major Excel forecast alternatives: prebuilt cash-flow tools, custom dashboards with APIs, and Open Banking integrations like Finexer.

| Feature | Excel Spreadsheets | Prebuilt Cash Flow Tools | Custom Dashboards (API-based) | Open Banking Integrations (e.g., Finexer) |

|---|---|---|---|---|

| Data Freshness | Manual & outdated | Daily syncs or batch updates | Near real-time (depends on setup) | Real-time financial data |

| Setup Time | None (manual process) | Moderate | High | Low |

| Bank Data Connectivity | Manual exports | Limited to major banks | Requires custom build | 99% of UK banks via secure APIs |

| Error Risk | High (manual entry) | Moderate | Low (if built well) | Low (automated source) |

| Multi-Account Visibility | Requires manual consolidation | Available in some tools | Custom setup needed | Unified dashboard across accounts |

| Forecasting Logic | User-defined formulas | Prebuilt logic (limited control) | Fully flexible | Fully flexible |

| Scalability for Growth | Poor | Moderate | High | High |

| Ideal For | Solo or early-stage teams | SMEs with simple cash flow needs | Mid-sized to large finance teams | Finance professionals seeking automation |

Implementation Roadmap: Move from Spreadsheets to Cash Flow Automation

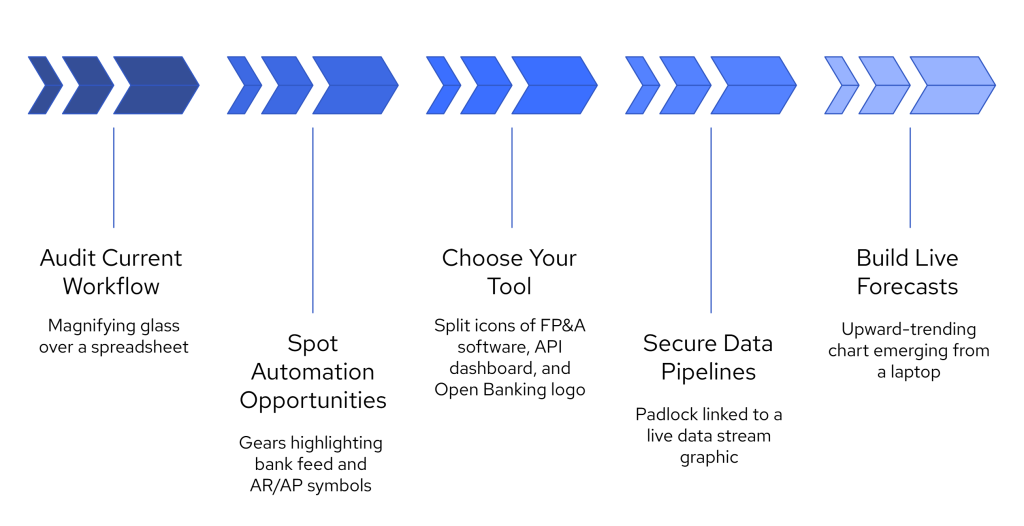

Switching from Excel models to automated forecasting may sound complex, but it doesn’t have to be. Below is a simple 5-step roadmap that walks finance teams through the process, from identifying current gaps to using tools like Finexer to unlock real-time financial data.

Step 1: Audit Your Current Forecasting Workflow

Start by mapping out how your cash flow forecasts are created today.

- Where does your data come from?

- How frequently is it updated?

- Who manages the spreadsheets?

Look for bottlenecks, data delays, or errors that result from manual input. This forms your baseline for improvement.

Step 2: Identify Automation Opportunities

Pinpoint areas where you can automate:

- Bank statement imports

- Accounts receivable/payable tracking

- Consolidation of multi-account or multi-entity data

Most teams begin by integrating bank data feeds or automating reconciliation tasks.

Step 3: Choose the Right Automation Tool

Now evaluate the best Excel forecast alternatives. Your options include:

- FP&A software with cash flow modules

- Custom dashboards powered by APIs

- Open Banking integrations like Finexer, which fetch real-time financial data from 99% of UK banks

Choose a solution that matches your technical capacity and forecast complexity.

Step 4: Set Up Secure Data Pipelines

Once you’ve chosen a tool, establish secure, permissioned data access:

- Connect your accounting software and bank accounts

- Test data flow accuracy and stability

- Ensure finance has visibility without relying on dev teams

With financial data automation, your system should auto-refresh forecasts without manual imports.

Step 5: Build Forecasting Models Around Live Data

With live data connected, rebuild your forecasting logic:

- Use historical transaction trends

- Factor in payment schedules and inflow timings

- Create scenario models using always-updated cash positions

This gives you cash flow visibility that adapts in real time.

How Finexer Helps You Automate Cash Flow Forecasting

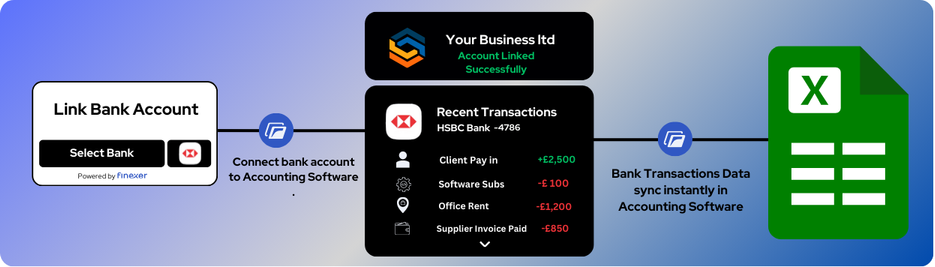

Finexer is designed for finance teams that are ready to replace spreadsheets with real-time financial data, without relying on developers or waiting months for custom builds.

Using secure Open Banking integrations, Finexer connects directly to 99% of UK banks, enabling your team to automate the flow of balance and transaction data into your forecasting models. You can always create fresh reports powered by live cash positions across all accounts, all in one place.

Here’s how Finexer fits into your cash flow automation journey:

- Live Bank Feed Integration: Real-time syncing of transactions and balances, so your forecasts are never out of date.

- No-Code Setup: Finance teams can connect accounts and start receiving live data without writing a single line of code.

- Multi-Account Dashboards: Gain full cash flow visibility across subsidiaries, entities, or departments.

- Secure & FCA-Authorised: All data connections are fully compliant with UK Open Banking regulations.

Whether you’re building a custom dashboard or plugging data into FP&A tools, Finexer provides the reliable foundation for financial data automation at scale.

Wrapping Up:

Manual spreadsheets may have worked in the past, but today’s finance teams need agility, accuracy, and real-time insight to make confident decisions. If you’re spending hours every week updating Excel tabs, it’s time to rethink your approach.

By adopting cash flow automation, you eliminate human error, reduce time spent on repetitive tasks, and gain a clearer view of your company’s financial health. Whether you start with simple bank data feeds or adopt a full-scale automation platform, the key is to act now, not after the next cash shortfall.

Tools like Finexer offer finance professionals a fast, secure way to connect with real-time financial data, automate forecasting inputs, and finally move beyond static spreadsheets. The result? More visibility, fewer surprises, and a forecasting process you can trust.

What is cash flow automation and how does it work?

Cash flow automation uses live bank and accounting data to update forecasts automatically, reducing manual work and improving accuracy.

How does Finexer support cash flow automation?

Finexer connects to 99% of UK banks, automating live data feeds for forecasting without developer setup or spreadsheet work.

Is cash flow automation suitable for small businesses?

Yes. Small teams can benefit from fast setup, real-time data, and reduced manual effort using cash flow automation tools like Finexer.

Get real-time financial data from 99% of UK banks and replace Manual spreadsheet tasks in days, not months.