Most businesses today already use accounting software like Xero, QuickBooks, or NetSuite. These tools are great for tracking revenue, expenses, and generating reports. But when it comes to cash flow monitoring, there’s a major gap in timing.

These systems typically rely on synced data from your bank account, but the feeds aren’t always real-time. Some updates once a day. Others pull in transactions after delays. That means your cash balance may look fine on paper, but in reality, you could be hours away from running into a problem, like an overdraft, bounced payroll, or missed vendor payment.

This is why relying only on traditional software is risky. It doesn’t tell you:

- When a large outgoing payment is about to drop your balance

- If a client failed to pay on time

- Or if your available cash falls below a critical threshold

That’s where real-time cash flow monitoring makes the difference. Instead of waiting for issues to show up in your reports, you can set up a system that notifies you before your cash balance hits a danger zone.

The good news? You don’t need to build a complex system from scratch. With tools like Finexer, it’s now possible to set up real-time financial alerts using live bank data even if you don’t have a tech team.

How a Real-Time Cash Alert System Works (And How to Build One)

A real-time cash flow monitoring system is easier to set up than most people think. It only needs three basic parts:

- A live bank feed that shows your actual cash balance

- A set of rules to watch for possible risks

- A way to send alerts when one of those rules is triggered

Below is a step-by-step guide to build it, even if your team does not have technical experience.

Step 1: Connect Your Live Bank Feed

To begin, you need access to real-time bank data. This means seeing your current balance and transactions as they happen, not hours later. With Finexer, you get direct access to almost every UK bank. The data updates live, so you always know where your cash stands.

This helps you avoid relying on outdated bank feeds or daily syncs from your accounting system.

Step 2: Set Your Cash Balance Rules

Once your data is live, the next step is setting simple rules. These rules tell your system when to send a warning. Some examples include:

- Alert if balance falls below £10,000

- Notify if more than £30,000 is due to leave the account today

- Flag if a customer payment is overdue by more than 7 days

These rules help you turn your financial alert system into something useful. Instead of finding problems after they happen, you get early warnings while there is still time to act.

Step 3: Send Alerts Using Webhooks

Webhooks let you send messages between systems as soon as something changes. For example, when a rule is triggered, you can set Finexer to:

- Send a message in Slack

- Email your finance lead

- Push a notification to another platform, like your ERP or risk dashboard

There is no delay. You do not need to log in or refresh anything. The alert is sent right away so the right person can take action.

Step 4: Test and Fine-Tune

After setup, run a few tests. Try simulating a low balance or a late payment. Check that the alerts are going to the right person. If needed, adjust your thresholds or who receives each alert.

The goal is to build a system that works in the background and only reaches out when something important happens.

📚 Top 6 Cashflow Forecasting Platforms

How Finexer Makes This Easier

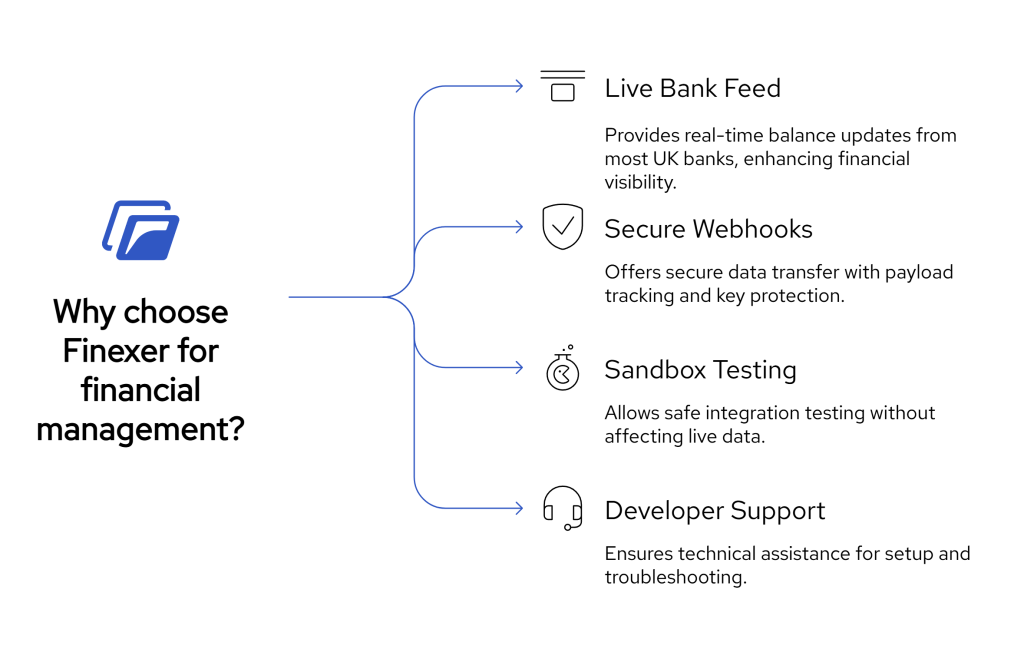

Setting up a real-time cash alert system might sound technical, but with Finexer, it is simple. You do not need a developer or any custom infrastructure to get started.

Finexer gives you live access to bank data from almost every UK bank. This means your team sees the actual account balance and transactions as they happen, without delays. It is a more accurate and timely way to manage cash flow monitoring.

You can create basic rules such as:

- Alert when your account drops below a certain amount

- Notify the team when expected payments are late

- Send a message if large outgoing payments are detected

When these rules are triggered, Finexer uses webhooks to deliver alerts in real time. The webhook system supports multiple endpoints, secure access keys, and payload verification. You can also track each webhook’s delivery status to ensure alerts are sent and received correctly.

Finexer also offers free sandbox accounts, so your team can test the full setup before going live. You can experiment with thresholds, alerts, and data flows without affecting your live environment.

If your setup gets more advanced, Finexer also provides developer support. Whether it’s a technical issue or a bank-side query, their team is available to help you work through it.

In short, Finexer gives you everything you need to run a working financial alert system, with or without in-house engineering help.

Get Started

Connect today and see why businesses trust Finexer for secure, compliant, and tailored open banking solutions.

Wrapping Up

Most accounting software helps you track what has already happened. But when you manage cash closely, you need to know what is happening right now. That is where real-time cash flow monitoring becomes essential.

By setting up a simple alert system using live bank data, clear thresholds, and instant notifications, you can avoid surprises. You do not need to build a complex tool from scratch or hire a development team. With Finexer, you can connect to your bank accounts, set your rules, and start receiving real-time alerts in just a few steps.

This type of setup is already used by larger firms to prevent overdrafts, missed payments, and shortfalls. Now, it is accessible to small and medium businesses too.

If your team has ever had to react late to a cash problem, this system will help you act earlier next time.

How can a financial alert system help prevent overdrafts?

A financial alert system sends real-time warnings when your cash balance reaches a critical point. For example, it can alert you before your account drops below a set threshold. This gives you time to act and avoid overdraft fees or missed payments.

What is cash balance monitoring?

Cash balance monitoring involves keeping a constant check on the actual balance in your business bank account. When paired with live bank feeds, this lets you know exactly how much cash is available at any moment, rather than relying on delayed reports.

Can I set up real-time alerts without a developer?

Yes. With platforms like Finexer, you can set up real-time cash flow alerts using pre-built tools and webhooks. No coding is needed. You can connect to your bank accounts, define alert rules, and route notifications to Slack, email, or other systems.

Ready to act before your balance runs low? Monitor your cash in real time with Finexer’s live bank feed tools.